Be1st Smart Rabbit LINE Pay

- Make withdrawals, transfers, and payments securely with CHIP & 6-digit PIN technology at all ATMs nationwide and worldwide that accept chip cards and display

- Make purchases online and at stores that accept chip cards and display the symbol

or

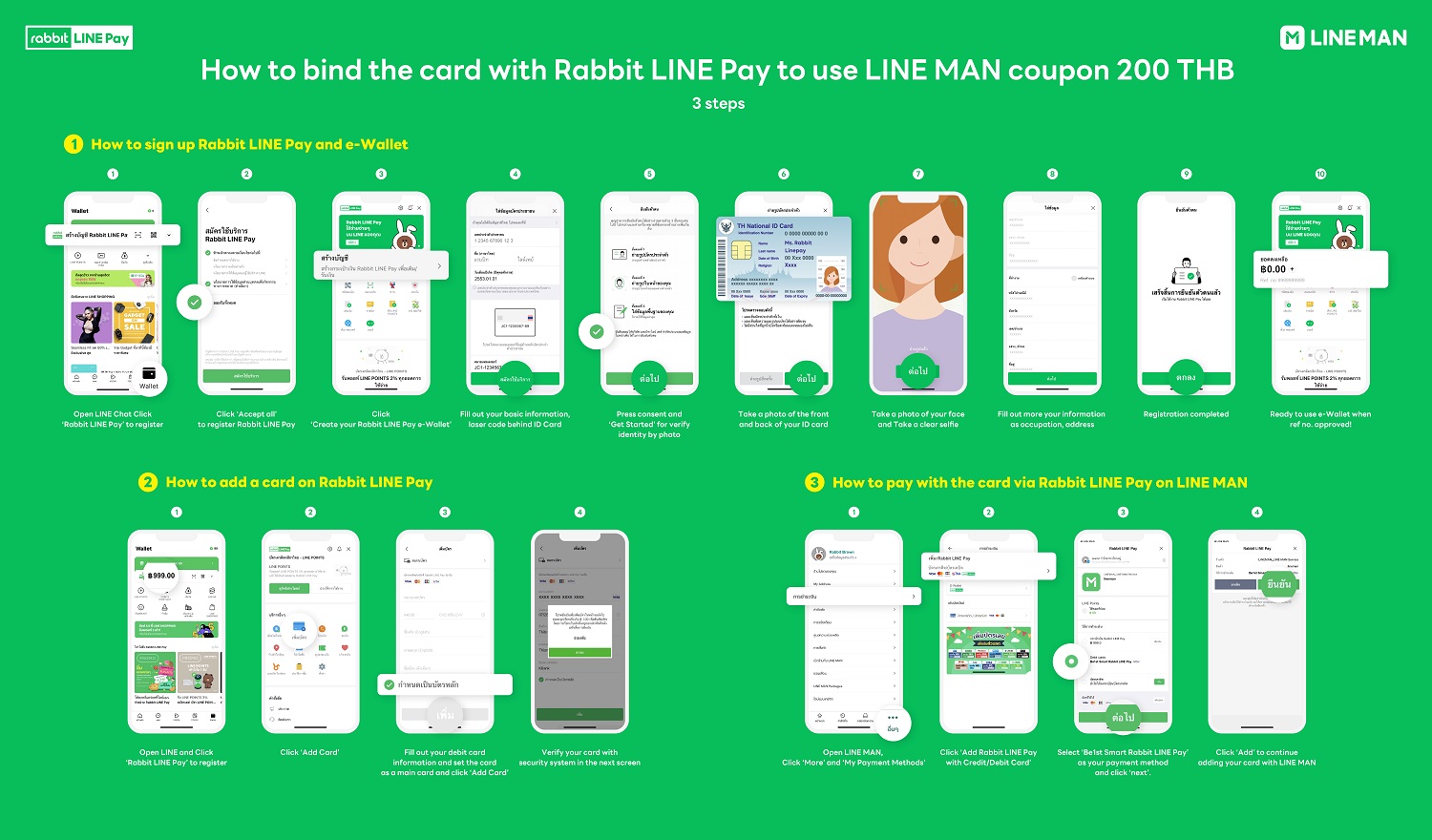

or - Make quick payments through Rabbit LINE Pay and receive special discounts and benefits

- Shop conveniently with

on your card and enjoy contactless payments. Simply wave your card to pay at any store with the

on your card and enjoy contactless payments. Simply wave your card to pay at any store with the  anywhere in the world.

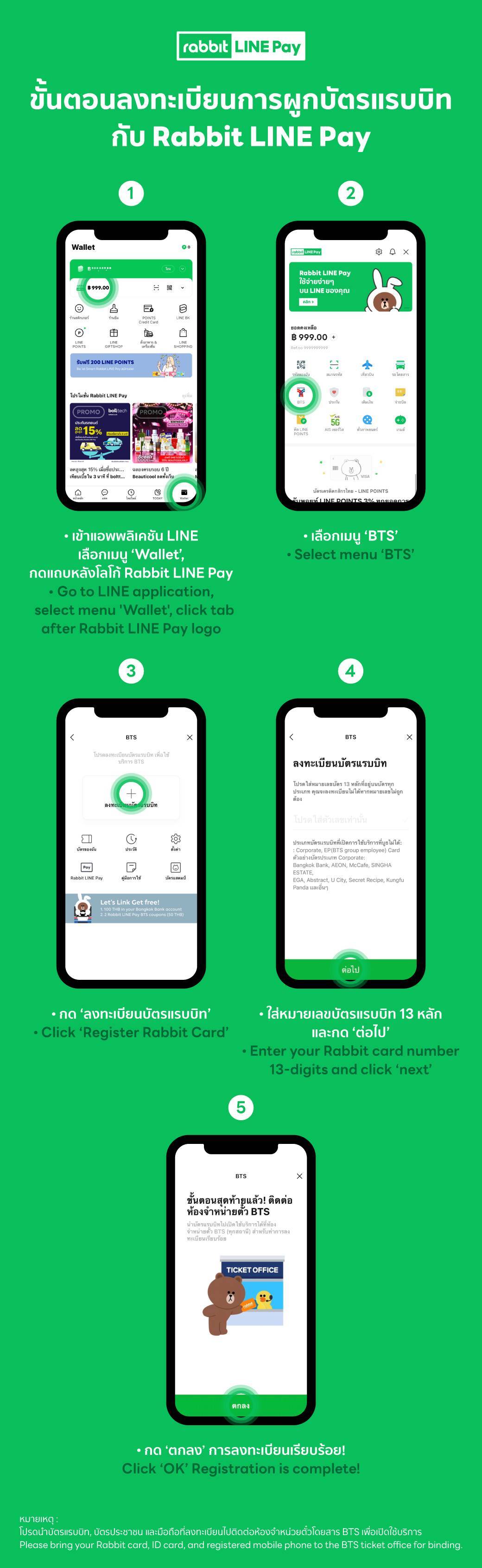

anywhere in the world. - Travel conveniently on the BTS (available for card with the Rabbit logo) and enjoy privileges from Rabbit.

Be1st Digital Rabbit LINE Pay

A Be1st Digital debit card is available in two formats; virtual card and physical card to serve a variety of transactions and payments which are easy, convenient and fast.

- Make online purchases with confidence. The card number, expiry date and CVC/CVN will be only shown on Bangkok Bank Mobile Banking. You can lock or unlock the card 24 hours a day via the app.

- Control the purchase limit, enable or disable and suspend or cancel your card 24 hours a day via Bangkok Bank Mobile Banking.

Be1st Digital Rabbit LINE Pay virtual debit card

- Apply for the virtual card easily using Bangkok Bank Mobile Banking and activate it on the app for immediate use.

- Shop anywhere anytime at online stores accepting

or

or - Be secure and confident with every online purchase - you can change the purchase limit by yourself on Bangkok Bank Mobile Banking.

Be1st Digital Rabbit LINE Pay physical debit card

- If you opt to get a physical debit card, you can make a full range of transactions such as withdrawals, transfers, and payments securely and confidently with CHIP & 6-digit PIN.

- Shop conveniently and confidently at physical stores or online stores that accept chip cards and display the symbol

or

or - Shop conveniently with your

card and enjoy contactless payments. Simply wave your card to pay at any store with the

card and enjoy contactless payments. Simply wave your card to pay at any store with the  anywhere in the world.

anywhere in the world. - Travel conveniently on the BTS (available for card with the Rabbit logo) and enjoy privileges from Rabbit.