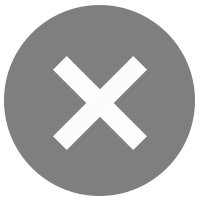

1.

Go to “More” and select “NDID service”

2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

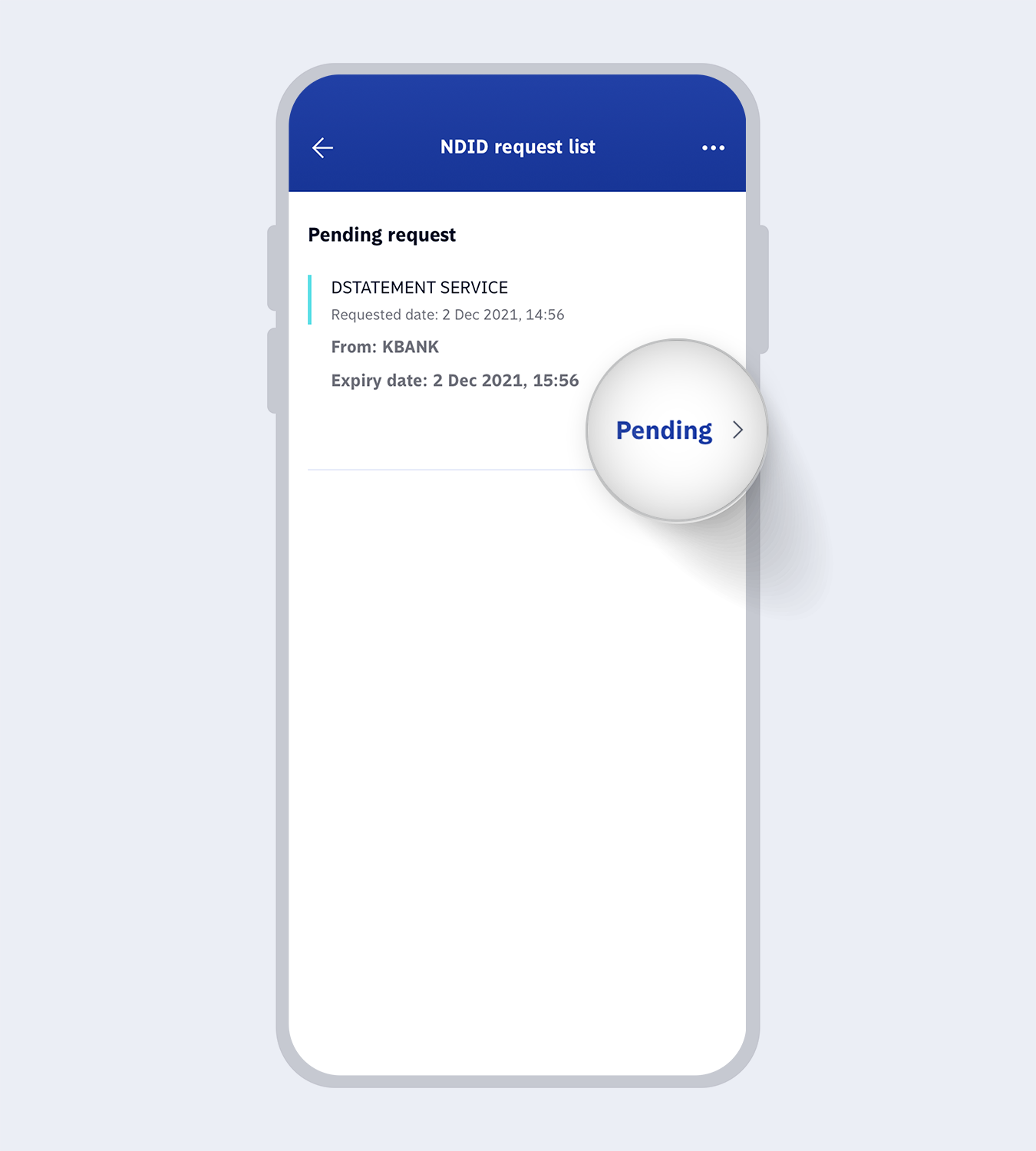

3.

The system will display the pending request for dStatement service then select “Pending” to view details

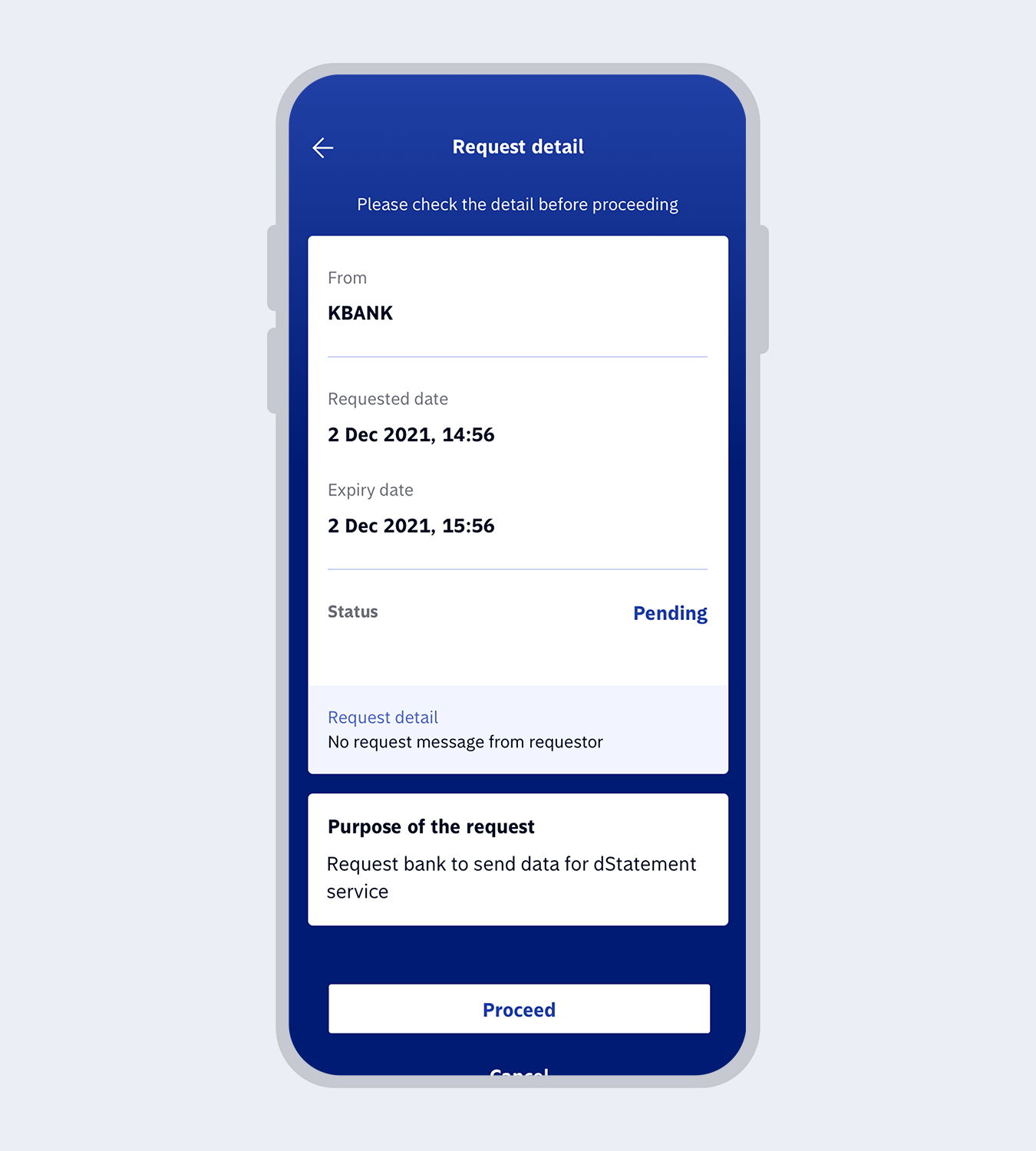

4.

Review the request details then select “Proceed”

5.

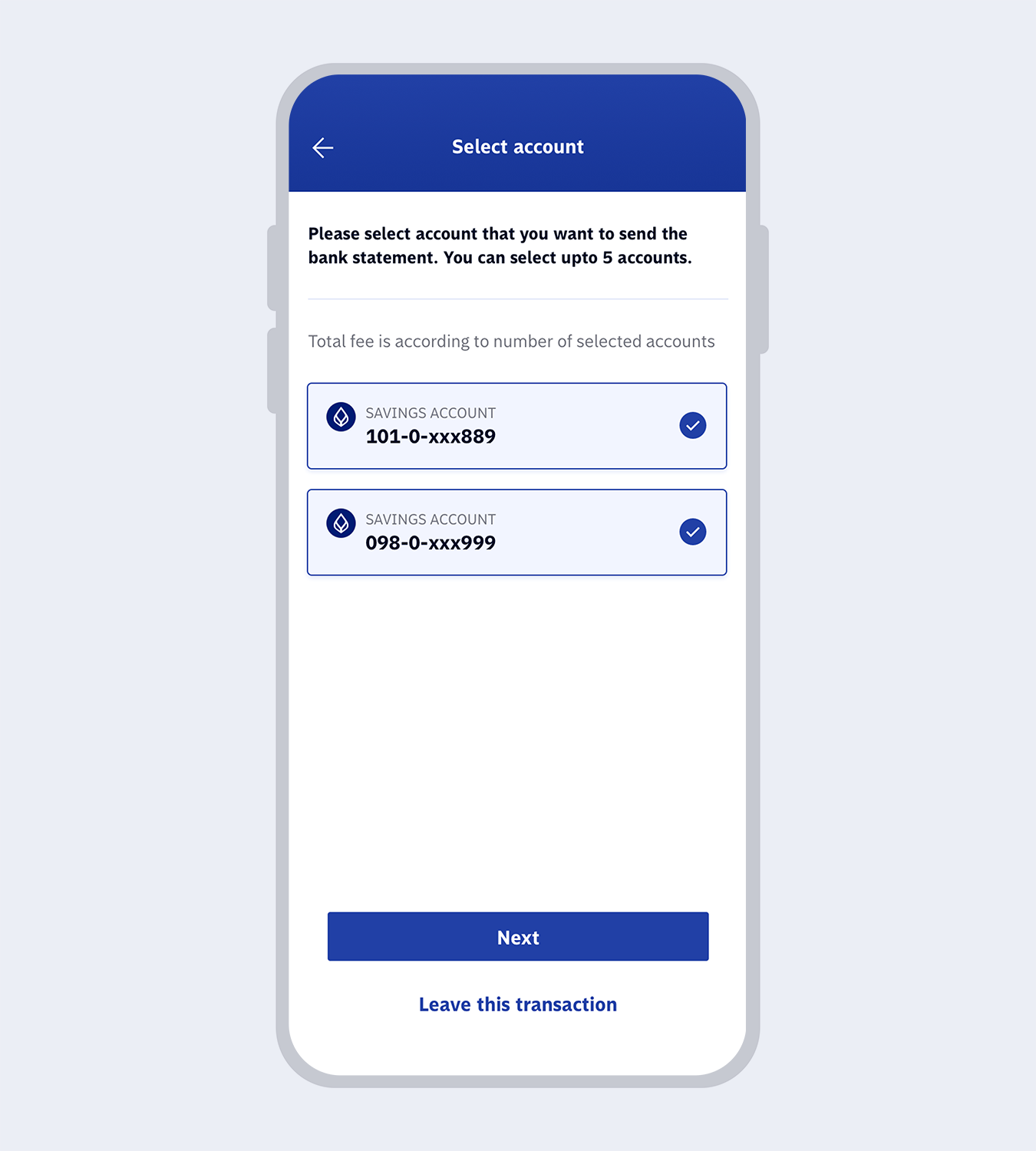

Select accounts for which you want a bank statement (Maximum 5 accounts per one request) then click “Next”

6.

Review the information then select your account for fee payment and click “Next”

7.

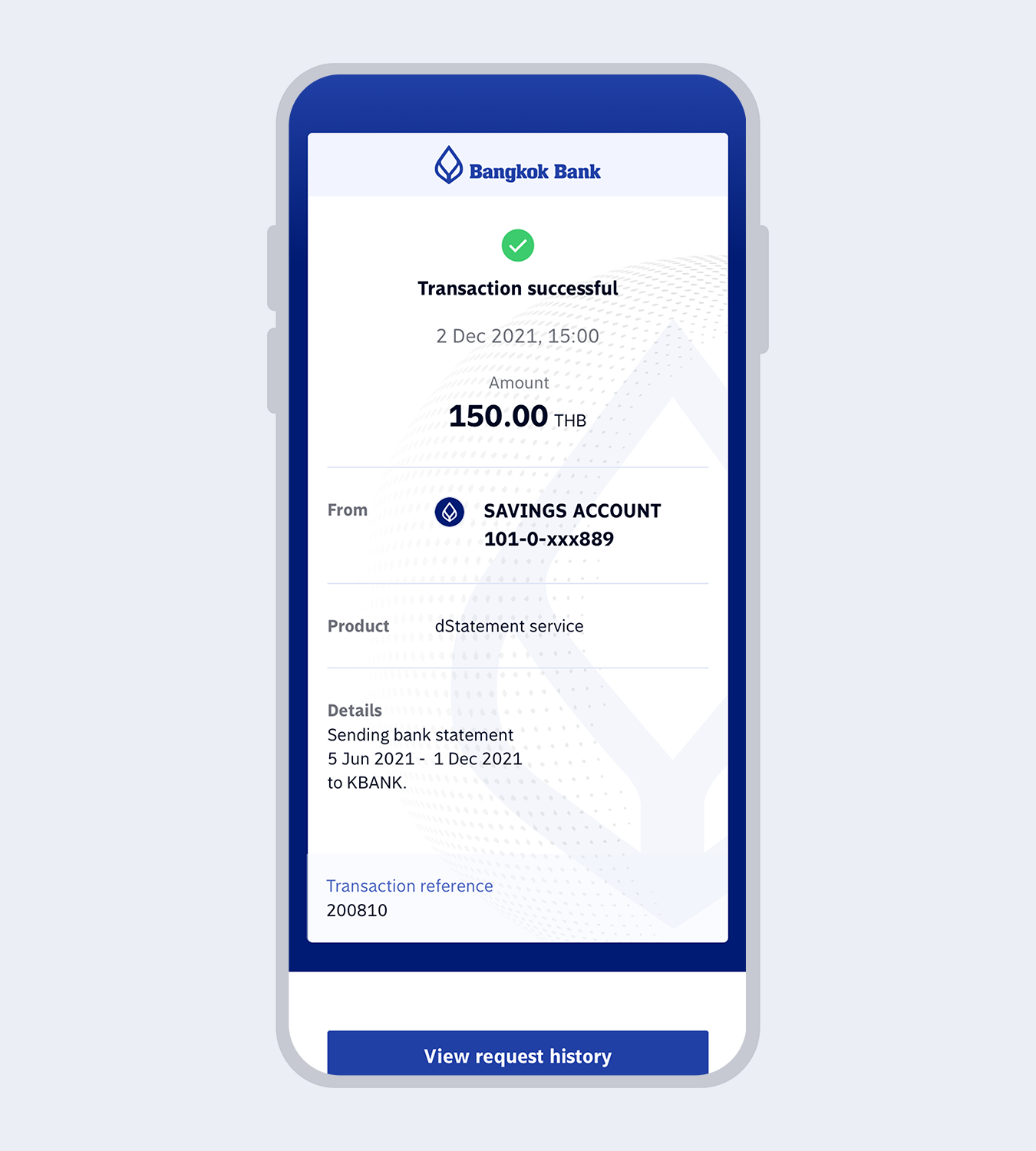

Once the transaction is completed, you will receive the transaction e-slip and the system will send the bank statement directly to the requesting bank.