- Strategies

- Stakeholder Engagement

- Materiality Issues

- Sustainable Development Goals

- Engagement for Driving Sustainability

- Policies

Guidelines for Sustainable Business

Uncertain and fast-changing situations related to environmental, social and governance (ESG) aspects present both opportunities and challenges for businesses today. Businesses that are able to

successfully adapt to and embrace changes can gain a competitive advantage over their peers. Additionally, companies that integrate ESG factors into their business will have a broader perspective and should be better able to identify opportunities and risks. This should enable them to properly formulate strategies and set forth measures to expand business opportunities and reduce ESG risks.

We recognize the expectations of all stakeholder groups when considering our sustainability or ESG practices, as well as the policy directions from regulators that require businesses to take tangible actions in terms of social and environmental responsibility, particularly supporting the country to achieve carbon neutrality in 2050 and net zero carbon emissions in 2065. Therefore, the Bank has developed a sustainability policy and a systematic sustainability framework including setting sustainability strategies that are aligned with our business and the interests of our stakeholders. We have also incorporated materiality issues derived from the double materiality assessment that require stakeholder engagement as a foundation for formulating our strategy while identifying commitments, key performance indicators, short-term and long-term targets for each materiality issue. This is to demonstrate our sustainability commitment and performance. Our sustainability policy and strategies have been agreed by senior executives and approved by the Board of Directors.

Sustainability Policy

We have founded our sustainability policy on four key pillars as follows:

- Prudent and Comprehensive Risk Management covering significant issues in both the short and long term while keeping abreast of situations and assessing business opportunities resulting from changing economic, social and environmental conditions.

- Human Resource Management including treating employees equally and fairly without discrimination, providing them with occupational health, safety and wellbeing, and continually developing their knowledge and skills.

- Good Corporate Governance.

- Creating Sustainable Value for Society and Environment including promoting financial literacy and financial inclusion, participating in corporate social responsibility activities, and encouraging suppliers to conduct their businesses in a sustainable manner.

In addition, we place importance on sustainability governance, stakeholder engagement and communication, and capability building for directors, executives and employees at all levels to ensure effective policy implementation.

Stakeholder engagement is the foundation of sustainable business conduct as it promotes mutual understanding and builds good relationships, leading to shared benefits between the Bank and all stakeholders. The Bank has always placed great importance on the stakeholder engagement process to ensure participation from and communication with stakeholders to enable understanding of the expectations, needs, and impacts of the Bank’s business operations, both positive and negative and across every dimension, whether economic, social or environment, on all groups of stakeholders. The Bank adheres to principles of the AA1000 AccountAbility Principles (2018) which covers four aspects: 1. Inclusivity; 2. Materiality; 3. Responsiveness; and 4. Impact, with the intention to ensure that the Bank’s stakeholder engagement process will be beneficial to all parties involved. Note that the Bank requires the results of stakeholder engagement to be reported to the Corporate Governance Committee on a yearly basis.

Stakeholder Analysis Process

- Identification of stakeholders: Identification of stakeholder groups by considering the relationship with stakeholders, such as responsibilities, influence, relationships, dependencies, and impacts of the Bank's business on the stakeholders.

- Assessment of the level of impact from the Bank's activities on stakeholders: Assessment and ranking of both positive and negative impacts of the Bank's business activities, covering economic, environmental and social aspects, including human rights, on stakeholder groups.

- Assessment of the level of influence of stakeholders on the Bank: Assessment of the influence level of stakeholders on the Bank, covering finance, operations, regulations, reputation, risks and strategy.

- Prioritization of stakeholders: The Bank's stakeholders are divided into four groups according to the level of impact on them from the Bank's operations and the level of influence that the stakeholders have on the Bank which are 1. High Impact; High Influence; 2. High Impact, Low Influence; 3.Low Impact, High Influence; and 4. Low Impact, Low Influence.

Building Stakeholder Engagement

To understand the impacts, needs and expectations of all stakeholders, the Bank provides opportunities for them to express their opinions through various channels. The Bank will use information and opinions to determine operational guidelines to appropriately respond to each stakeholder group as well as seeking cooperation for the benefit of all stakeholders. We have classified our stakeholders into seven groups as follows: 1. Shareholders and Investors; 2. Customers (Businesses and Individuals); 3. Employees; 4. Suppliers (Vendors, External Service Providers and Contractors); 5. Creditors; 6. Other Financial Institutions; and 7. Community, Society and Environment (including Regulatory Authorities, Public Sector and Mass Media). Each stakeholder group prioritizes different issues and they can engage with the Bank through the following formats and channels.

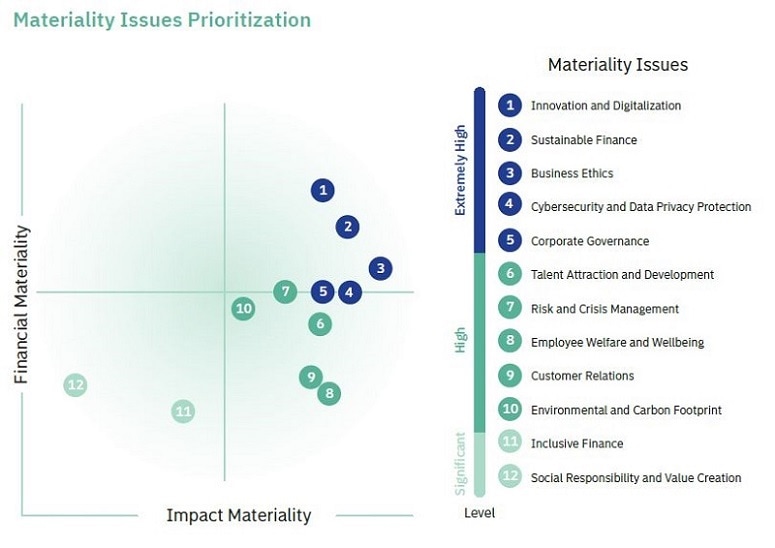

We conduct a materiality assessment every two years. In 2023, the Bank revised its materiality assessment by adopting a Double Materiality Approach which complies with the Global Reporting Initiative (GRI) standards 2021. This approach includes an assessment of how the Bank’s business activities that are related to materiality issues have a significant impact on the economy, society and environment (Impact Materiality) which require engagement from stakeholders. Then we determine how the materiality issues may financially or reputationally impact the Bank’s business operations and performance (Financial Materiality). The outcome of aggregate assessments will be further used to identify and prioritize the Bank’s materiality issues.

Steps of Materiality Issues Assessment

- Understanding the Organization’s Sustainability Context

- Identifying and Assessing Impacts

- Prioritizing the Materiality Issues

- Verifying and Reviewing

Materiality Issues Prioritization 2023-2025

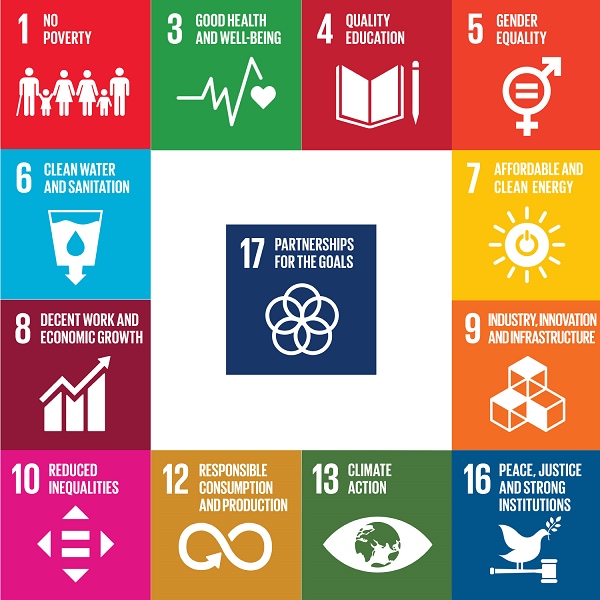

The Bank implements sustainability policies, guidelines and activities that promote the UN Sustainable Development Goals (UNSDGs). The Bank established five sustainability guidelines that are aligned with 12 materiality issues, each of which has been incorporated as a part of the Bank’s strategy to meet the expectations of all stakeholders and to jointly create value for the economy, society and the environment and to support the sustainable growth of the Bank.

Achieving the country’s sustainable development goals requires cooperation from all sectors. Thus, we are committed to developing our operations to be consistent with the criteria, standards, and initiatives related to sustainability, at the national and international levels. We also continually supported and worked closely with other parties in driving sustainability efforts throughout the year. In 2023, we signed the Bangkok Goals on BCG Economy pledge that had been endorsed by the APEC Leaders’ Summit in 2022 and announced zero waste to landfill for our Rama III Building within 2025. Furthermore, the Bank, as a member of the Thai Bankers’ Association (TBA), participated in developing the Industry Handbook on Internalizing Environmental and Climate Change Aspects into Financial Institution Business for Banks in response to the Bank of Thailand’s policy guidelines requiring financial institutions to be able to assess the opportunities and risks related to environmental and climate change, formulate relevant strategies properly and develop sustainable finance products. In addition, we joined forces with other members of the TBA to determine sustainability targets and indicators for the banking sector to support sustainability efforts in a tangible manner after the ESG declaration was jointly organized in 2022.

Participation as a Member of Organizations and Networks

The Bank prioritizes support and collaboration with different sectors to support the country’s sustainable growth as well to attain Thailand’s greenhouse gas reduction targets and goals according to the Paris Agreement by participating as a member of various organizations and by sending our executives to serve as directors in committees or as members of working groups in business networks or associations to provide policy recommendations to government agencies on climate change mitigation and energy transition toward renewable energy and clean energy. We also promote and support various sectors to transform to a low-carbon economy according to Thailand’s goals through various initiatives, knowledge-sharing activities and public relations. Note that participation in the aforementioned committees or working groups of our executives must be approved by the Management and participation as a member of business networks or associations must be approved by the Board of Directors through a consideration of objectives and activities of business networks or associations to be in alignment with the Bank’s goals, policies and business conduct including benefits for the society at large from the membership.

- Corporate Governance Policy

- Board Diversity Policy

- Code of Conduct and Business Ethics

- Supplier Code of Conduct

- Tax Policy

- Anti-Corruption Policy

- Anti-Money Laundering and Counter Terrorism Financing (AML/CFT) Policy

- Whistle Blowing Policy

- Corporate Social Responsibility Policy

- Human Rights Policy

- Sustainability Policy

- Responsible Lending Policy

- Environmental and Energy Conservation Policy

- Non-discrimination and Anti-harassment Policy

- Occupational Health and Safety Policy