We recognize the importance of managing environmental, social, and governance (ESG) risks arising from the operations of our suppliers and have established a Supplier Code of Conduct that addresses ESG issues, including respect for human rights, labor rights and community rights. The Supplier Code of Conduct has been shared with all suppliers to communicate our expectations with regard to their operations. We actively seek to encourage and motivate them to conduct their business responsibly in accordance with the Supplier Code of Conduct. Furthermore, we promote the procurement of environmentally-friendly products and organize annual ESG knowledge-sharing activities for our suppliers to collaboratively build an environmentally-sustainable supply chain that benefits society.

Suppliers in the Bank's supply chain are classified into three types: 1. Suppliers who are those who are suppliers of supplies and equipment used in business operations under the responsibility of the Bank’s procurement section, 2. Contractors who are those who provide services such as repairs, renovations and maintenance of the Bank’s equipment and office buildings, and 3. External service providers who are those contracted by the Bank for specific tasks. In 2024, the Bank had a total of 2,756 suppliers registered with the Bank, comprising 2,357 domestic suppliers and 399 overseas suppliers. Of the total, 35 were new suppliers. We entered into procurement contracts with 1,398 suppliers.

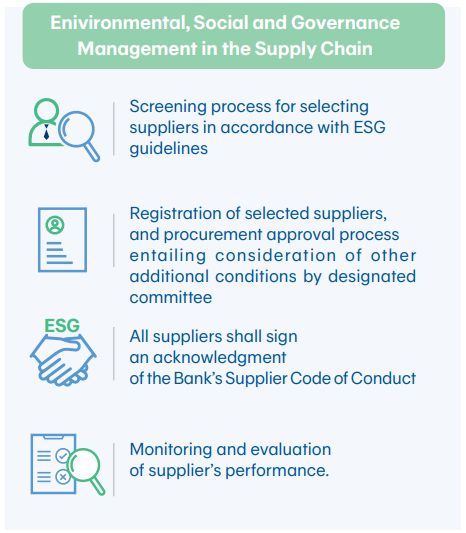

Environmental, Social and Governance Management in the Supply Chain

ESG management in the Bank’s supply chain includes the following elements: screening new suppliers by considering important ESG issues as part of the evaluation, regularly assessing ESG risks associated with critical suppliers, managing risks at an acceptable level, communicating the Supplier Code of Conduct to all suppliers, and establishing a process for monitoring suppliers’ compliance with the Supplier Code of Conduct. We encourage all suppliers to fully comply with the Supplier Code of Conduct. In addition, we also encourage the Bank’s suppliers and business partners to increase their anti-corruption efforts and invite them to join the Thai Private Sector Collective Action Against Corruption.

We established a policy outlining guidelines for using external service providers covering criteria for selecting service providers, risk management, internal controls, data security and confidentiality, as well as labor practices. The Screening Committee for External Service Providers is responsible for overseeing the use of external services. Business units using outsourced services are responsible for considering and proposing the work requiring outsourced services and suitable external service providers to the designated screening committee; as well as overseeing compliance with contracts, monitoring, auditing and evaluating the performance of suppliers. This also includes monitoring information and news related to non-compliance with laws and the Bank’s Supplier Code of Conduct. Such information and news will be used as part of the consideration when reviewing the supplier registry in the following year or once the contract is due for renewal. Furthermore, the Bank has adopted the Three Lines of Defense principle to manage risks within its supply chain. The Compliance Unit is responsible for ensuring that procurement activities comply with the Bank’s regulations as well as applicable laws and regulations. The Audit and Control Division is tasked with reviewing operations related to procurement activities. If any stakeholders are negatively impacted by the operations or activities of the Bank’s contracted supplier, they may file complaints through the Bank’s complaint filing channels.

Supplier Screening

In the supplier screening process, we follow a comprehensive screening approach that thoroughly addresses material issues such as the quality of products and services, stability and trustworthiness, production capabilities and the supplier’s ESG practices. All suppliers, both new and existing, are required to complete an ESG self-assessment covering critical areas including environmental impact management, adherence to international human rights principles and standards, respect for fundamental workplace rights in accordance with the core labor rights conventions of the International Labour Organization (ILO), the illegal use of child labor and forced labor, protection of personal data, anti-corruption measures, and handling of complaints. Suppliers are required to meet the Bank’s evaluation criteria before they can be registered and enter into a procurement contract with the Bank. Once the supplier screening process is complete, the Bank will invite the potential supplier to present information on their products and services for our consideration and also to In the supplier screening process, we follow a comprehensive screening approach that thoroughly addresses material issues such as the quality of products and services, stability and trustworthiness, production capabilities and the supplier’s ESG practices. All suppliers, both new and existing, are required to complete an ESG self-assessment covering critical areas including environmental impact management, adherence to international human rights principles and standards, respect for fundamental workplace rights in accordance with the core labor rights conventions of the International Labour Organization (ILO), the illegal use of child labor and forced labor, protection of personal data, anti-corruption measures, and handling of complaints. Suppliers are required to meet the Bank’s evaluation criteria before they can be registered and enter into a procurement contract with the Bank. Once the supplier screening process is complete, the Bank will invite the potential supplier to present information on their products and services for our consideration and also to acknowledge the Bank’s Supplier Code of Conduct. Moreover, the Bank may assess the supplier’s qualifications based on service capability and reliability criteria and may conduct site visits to the supplier’s business for further inspection and assessment as appropriate.

Assessment of ESG Risks in the Supply Chain

The Bank regularly assesses the ESG risks of its suppliers by focusing on critical suppliers. These are the providers of products and services with high spending value, suppliers of critical components that produce essential goods and services for the Bank, and non-substitutable suppliers that produce products and provide services that cannot be easily replaced by other sources. The Bank has identified materiality risk issues by considering the likelihood and severity of the impact as follows:

- Environmental: 1. Greenhouse gas emissions, 2. Energy management, and 3. Waste and hazardous material management.

- Social: 1. Human rights, 2. Labor practices, and 3. Occupational health and safety at the workplace.

- Governance: 1. Corruption, 2. Privacy protection, and 3. Fraud.

In cases where the risk level is found to be higher than the Bank’s acceptable threshold, we will consider implementing additional or more stringent risk mitigation measures as necessary. In 2024, the ESG risks associated with the Bank’s suppliers were deemed to be within acceptable levels, and the economic risks posed by suppliers were insignificant to the Bank’s operations and performance.

Transparent and Environmentally-friendly Procurement

We have implemented an online auction (e-Auction) system for procurement to foster transparency and fair competition. Moreover, we promote the use of environmentally-friendly or low-carbon products and materials. We have procured a range of environmentally-conscious products, including photocopy paper made from environmentally-friendly pulp, document forms made from recycled paper, printing toner certified to meet international environmental standards, employee uniforms bearing the Cool Mode label, nonCFC water-mist fire extinguishers, products manufactured through recycling and upcycling processes, bottled water packaging made from rPET (recycled PET) instead of PET, water-saving sanitary fixtures, office supplies certified by Leadership in Energy and Environmental Design (LEED), and office furniture certified for compliance with international environmental standards.