-

Strategies

-

Stakeholder Engagement

-

Materiality Issues

-

Sustainable Development Goals

-

Engagement for Driving Sustainability

-

Policies

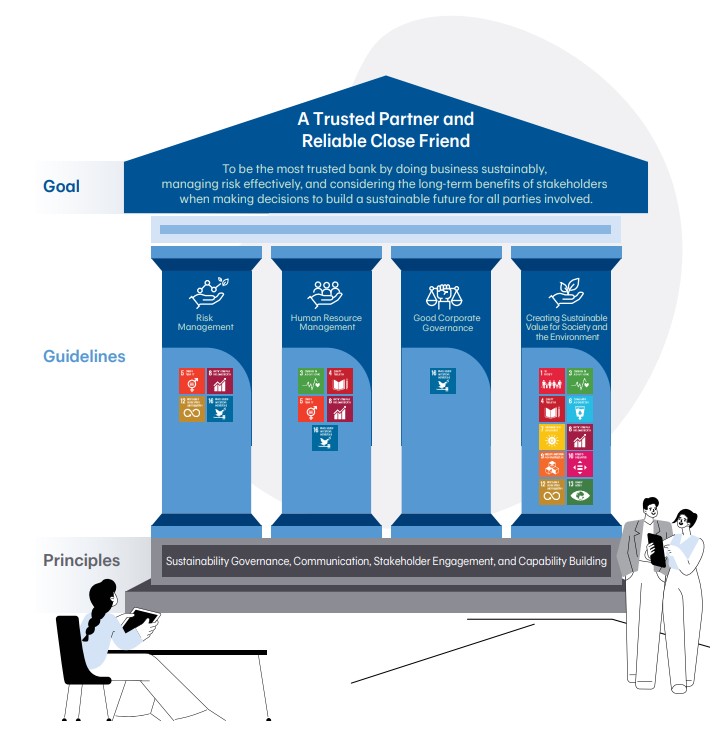

Guidelines for Sustainable Business

Uncertain and fast-changing situations related to environmental, social and governance (ESG) aspects present both opportunities and challenges for businesses today. Businesses that are able to

successfully adapt to and embrace changes can gain a competitive advantage over their peers. Additionally, companies that integrate ESG factors into their business will have a broader perspective and should be better able to identify opportunities and risks. This should enable them to properly formulate strategies and set forth measures to expand business opportunities and reduce ESG risks.

We recognize the expectations of all stakeholder groups when considering our sustainability or ESG practices, as well as the policy directions from regulators that require businesses to take tangible actions in terms of social and environmental responsibility, particularly supporting the country to achieve carbon neutrality in 2050 and net zero carbon emissions in 2065. Therefore, the Bank has developed a sustainability policy and a systematic sustainability framework including setting sustainability strategies that are aligned with our business and the interests of our stakeholders. We have also incorporated materiality issues derived from the double materiality assessment that require stakeholder engagement as a foundation for formulating our strategy while identifying commitments, key performance indicators, short-term and long-term targets for each materiality issue. This is to demonstrate our sustainability commitment and performance. Our sustainability policy and strategies have been agreed by senior executives and approved by the Board of Directors.

Sustainability Policy

We have founded our sustainability policy on four key pillars as follows:

- Prudent and Comprehensive Risk Management covering significant issues in both the short and long term while keeping abreast of situations and assessing business opportunities resulting from changing economic, social and environmental conditions.

- Human Resource Management including treating employees equally and fairly without discrimination, providing them with occupational health, safety and wellbeing, and continually developing their knowledge and skills.

- Good Corporate Governance.

- Creating Sustainable Value for Society and Environment including promoting financial literacy and financial inclusion, participating in corporate social responsibility activities, and encouraging suppliers to conduct their businesses in a sustainable manner.

In addition, we place importance on sustainability governance, stakeholder engagement and communication, and capability building for directors, executives and employees at all levels to ensure effective policy implementation.

Stakeholder engagement is the foundation of sustainable business conduct as it promotes mutual understanding and builds good relationships, leading to shared benefits between the Bank and all stakeholders. The Bank has always placed great importance on the stakeholder engagement process to ensure participation from and communication with stakeholders to enable understanding of the expectations, needs, and impacts of the Bank’s business operations, both positive and negative and across every dimension, whether economic, social or environment, on all groups of stakeholders. The Bank adheres to principles of the AA1000 AccountAbility Principles (2018) which covers four aspects: 1. Inclusivity; 2. Materiality; 3. Responsiveness; and 4. Impact. The Bank also requires the results of stakeholder engagement to be reported to the Corporate Governance Committee on a yearly basis.

Stakeholder Analysis Process

- Identification of stakeholders: Identification of stakeholder groups by considering responsibilities, influence, relationships, dependencies, and impacts on the stakeholders from the Bank’s business activities.

- Assessment of the level of impact from the Bank's activities on stakeholders: Assessment of both positive and negative impacts of the Bank’s business activities, covering economic, environmental and social aspects, including human rights, on stakeholder groups.

- Assessment of the level of influence of stakeholders on the Bank: Assessment of the influence level of stakeholders on the Bank, covering finance, operations, regulations, reputation, risks and strategy.

- Prioritization of stakeholders: The Bank's stakeholders are divided into four groups according to the level of impact on them from the Bank's operations and the level of influence that the stakeholders have on the Bank which are 1. High Impact; High Influence; 2. High Impact, Low Influence; 3.Low Impact, High Influence; and 4. Low Impact, Low Influence.

Building Stakeholder Engagement

To understand the impacts, needs and expectations of all stakeholders, we provide opportunities for stakeholders to express their opinions through various channels. We use the information and opinions we gather to determine operational guidelines for appropriately responding to each stakeholder group as well as seeking cooperation for the benefit of all stakeholders. We have classified our stakeholders into seven groups as follows: 1. Shareholders and Investors; 2. Customers (Businesses and Individuals); 3. Employees; 4. Suppliers (Vendors, External Service Providers and Contractors); 5. Creditors; 6. Other Financial Institutions; and 7. Community, Society and Environment (including Regulatory Authorities, Public Sector and Mass Media).

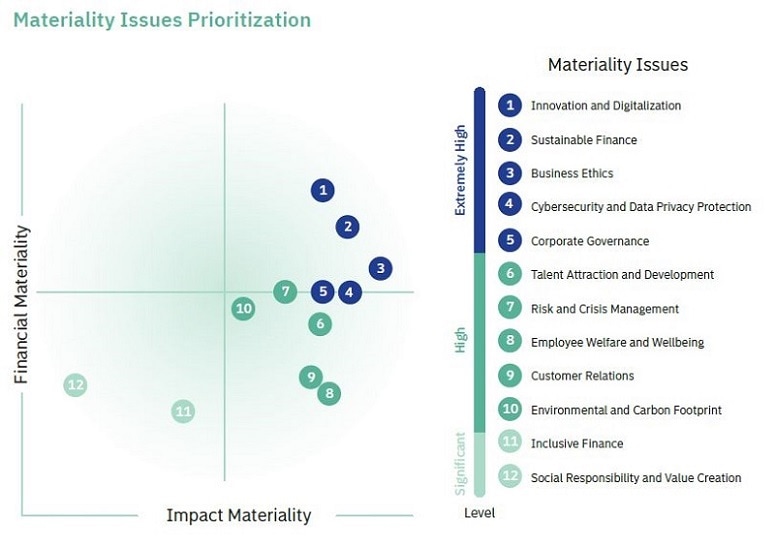

We conducted a double materiality assessment, considering the impacts from the Bank’s business activities under each materiality issue on the economy, society, environment, and human rights (Impact Materiality), which requires engagement from stakeholders. We determined how the materiality issues may financially or reputationally impact the Bank’s business operations and performance (Financial Materiality). The outcome of the aggregate assessments is used to further identify and prioritize the Bank’s materiality issues. We review the materiality issues annually to ensure their relevance in the light of changing circumstances.

Impact Materiality

The level of impact on the economy, society and environment, including human rights, considered by the Bank’s stakeholders and the Sustainability team

Financial Materiality

The level of impact on business operations and performance considered by the Enterprise Risk Management Division and the Sustainability team

Materiality Assessment Procedure

- Understanding the Organization’s Sustainability Context

- Identifying and Assessing Impacts

- Prioritizing the Materiality Issues

- Verifying and Reviewing

Materiality Issues Prioritization 2023-2025

The Bank implements sustainability policies, guidelines and activities that promote the UN Sustainable Development Goals (UNSDGs). The Bank established five sustainability guidelines that are aligned with 12 materiality issues, each of which has been incorporated as a part of the Bank’s strategy to meet the expectations of all stakeholders and to jointly create value for the economy, society and the environment and to support the sustainable growth of the Bank.

Participation from all sectors is a key factor in driving Thailand toward achieving sustainable development goals. We have continually supported and collaborated with various external agencies to drive sustainability progress. In 2024, we were a major sponsor of The Economist Impact Asia Sustainability Week, organized by The Economist magazine, to present information on the transition to sustainability, the role of the private sector in supporting the Net Zero target and mitigating climate change. Our executives also participated in a seminar on ASEAN’s Sustainability Transition: Identifying Opportunities, Managing Challenges. In addition, we established a booth to tell the story of the Bank’s financial services on the occasion of Bangkok Bank’s 80th anniversary, as well as presenting various sustainability efforts at TMA 60 Years of Excellence and Sustainability Expo 2024.

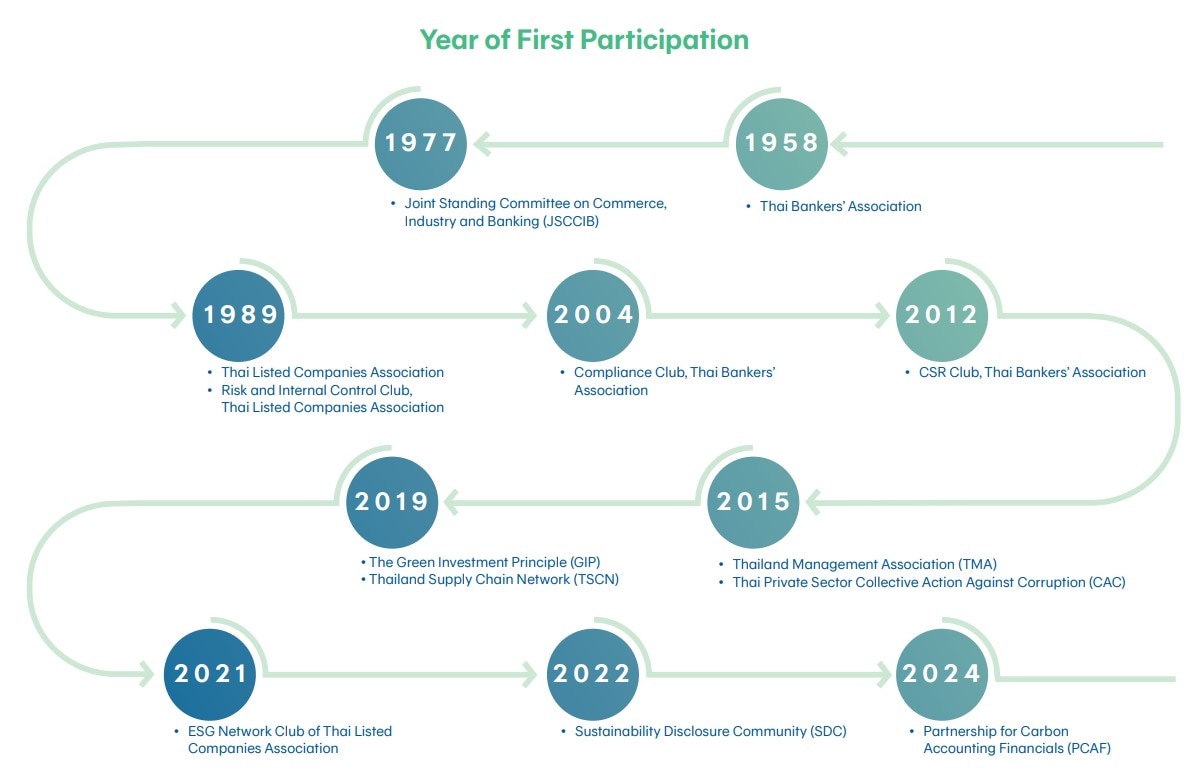

Participation as a Member of Organizations and Networks

We have joined various organizations and associations to improve the financial institution system, create collaboration networks within the business sector, exchange knowledge and good business practices, and support the achievement of sustainable development goals and greenhouse gas reduction targets at both the corporate and national levels. Most recently, in 2024, we joined the Partnership for Carbon Accounting Financials (PCAF), an international cooperation organization that establishes standards for measuring and disclosing greenhouse gas emissions from the Bank’s loans and investments. We are also a founding member of the Thailand Supply Chain Network (TSCN), and we send Bank executives to share knowledge on loan products to support greenhouse gas reduction and climate change adaptation to the network’s partners.

Contributions to External Organization

The Bank has consistently promoted partnerships with various organizations and networks through financial support in the form of membership fees and donations for activities that help strengthen the economy and society and to support the development of the financial and business sectors. The Bank refrains from supporting political activities, political parties or lobbyists.

|

Activities |

Amount (Million Baht) |

|||

|

2021 |

2022 |

2023 |

2024 |

|

|

Lobbying, interest representation or similar |

0 |

0 |

0 |

0 |

|

Local, regional or national political campaigns / organizations / candidates |

0 |

0 |

0 |

0 |

|

Trade associations or tax-exempt groups |

26.51 |

50.10 |

47.54 |

56.22 |

|

Other (e.g. spending related to ballot measures or referendums) |

0 |

0 |

0 |

0 |

|

Total contributions and other spending |

26.51 |

50.10 |

47.54 |

56.22 |

- Corporate Governance Policy

- Board Diversity Policy

- Code of Conduct and Business Ethics

- Supplier Code of Conduct

- Tax Policy

- Anti-Corruption Policy

- Anti-Money Laundering and Counter Terrorism Financing (AML/CFT) Policy

- Whistle Blowing Policy

- Corporate Social Responsibility Policy

- Human Rights Policy

- Sustainability Policy

- Responsible Lending Policy

- Environmental and Energy Conservation Policy

- Non-discrimination and Anti-harassment Policy

- Occupational Health and Safety Policy