To monitor performance, the Bank has assigned the Service Quality Team to carry out activities designed to assess and monitor the service quality of branch employees on an annual basis to ensure that the services provided at each branch can meet customer expectations and comply with the service standards set by the Bank, as follows:

- Mystery Shopping is a quality assessment method to evaluate branches throughout the country in terms of service provision, readiness of the branch premises, and whether the product sales process meets market conduct requirements. In 2024, there were 2,400 rounds of service quality assessments conducted through mystery shopping.

- Service and Sales Quality Roleplay (SQR) aims to educate and evaluate employees in all branches nationwide for the process of presenting investment products, funds, insurance, savings account products, debit cards, credit cards, accident insurance, personal loans and home loans using a role play to test employees’ knowledge and understanding. During 2024 a total of 1,691 activities were conducted on SQR covering all branches.

The Service Quality Team gathers information from service quality assessments, customer satisfaction surveys and customers’ complaints to communicate with branch employees on Knowledge Days which are held on a weekly basis and at the monthly meeting with branch managers. These activities help encourage our branch employees to work together to improve service quality and prevent recurrence of similar mistakes. Moreover, to boost morale and recognize outstanding performance, the Service Quality Team hosts the Best Employer of the Year recognition event at both district and regional levels and an annual Quality Sales Quality Services recognition event for the top performing branches to set a good example for other branches to learn from and follow.

Customer Satisfaction Survey

Every customer’s “voice” counts as their feedback is valuable and meaningful to the Bank and helps the Bank understand customer needs, expectations and issues regarding the use of our products and services. As a method to listen to the voice of customers, we conduct our customer satisfaction survey to collect opinions and suggestions related to the Bank’s services via the following service channels: Customer Satisfaction Survey for Branch Services

The customer satisfaction survey for branch services is conducted for every branch with more than 75,000 branch customers per year. Survey results are communicated to all branch managers so that they can use the insights to make plans with their staff to improve the service quality standards of their branches. Note that if there are customer complaints during the survey, the complaints will be reported to branch managers promptly so that appropriate actions can be taken according to the Bank’s complaint handling procedures.

Customer Satisfaction Survey Results for Branch Services

Customer Satisfaction Survey for Bangkok Bank Mobile Banking

We run an online customer satisfaction survey for mobile banking services regularly to understand their level of satisfaction and hear their opinions on various assessment topics such as speed, user friendliness, and functionalities that address needs of customers. Feedback is used to develop new features for Bangkok Bank Mobile Banking to better meet the needs of customers in the future.

The results of the survey on Bangkok Bank Mobile Banking show that customers want services to be easy-to-use and secure, as well as supporting a wide variety of transactions. Therefore, we have applied these findings to make several improvements to our Bangkok Bank Mobile Banking application to address the indicated needs, for instance, improving the application process and easier access to the app, adding more features to ensure secured transactions, and creating shortcuts for payment scans. Such improvements reflect our commitment to developing Bangkok Bank Mobile Banking truly based on our customers’ needs.

Customer Satisfaction Survey Results for Bangkok Bank Mobile Banking

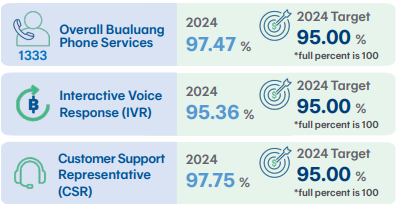

Customer Satisfaction Survey for Bualuang Phone

We collect data related to service usage of Bualuang Phone 1333 while customers can rate their experience and leave a voice message to provide feedback and suggestions right after a call with Bualuang Phone 1333 through both interactive voice response (IVR) and customer support representatives (CSR). The Bank utilizes results from the survey, as well as other information such as dropout rate, volume of calls over a period of time and voice records to improve and elevate service quality.

The survey results in 2024 show that customers were very satisfied. We found that customers who used the service through the call center officers received convenient, fast and responsive services and were impressed with the services. Meanwhile, customers who used the service through the automated system were able to use the services conveniently and easily. This is a result of the Bank’s commitment to seriously and continuously develop the Bualuang Phone service.

Customer Satisfaction Survey Results for Bualuang Phone Services

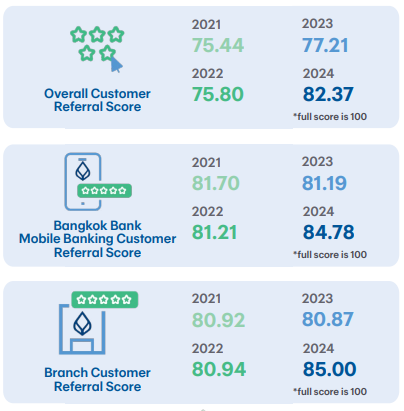

Customer Recommendation Survey

Our Consumer Research and Analytics Team holds an online customer referral survey on a regular basis, covering 1,000 customers nationwide for each survey. Moreover, we monitor comments about the Bank and its competitors through online research and the use of social listening tools to gather both positive and negative feedback of customers and the general public. The positive feedback received is expected to lead to referrals of our services while the negative ones will help us to target improvements and solutions to prevent customers from discontinuing using our services.

Customer Recommendation Survey Results

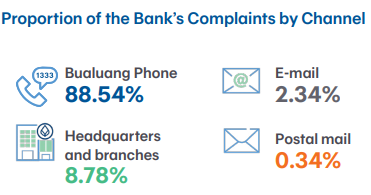

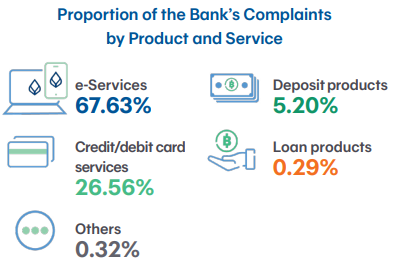

Customer Complaint Handling

We provide a variety of convenient channels for customers and other stakeholders to file complaints about the Bank’s products and services, including email, official website, Bualuang Phone, the head office and bank branches. When officers in charge receive complaints from customers, they input the details into the system to be passed to relevant units for investigation, solution and restitution for any damage caused. We have clearly defined complaint handling guidelines and relevant service level agreements (SLA) to ensure systematic complaint handling and timely remediation to customers. Our service quality information is disclosed on a quarterly basis on the Bank’s website.

With regard to complaints about services provided by branch staff, we have established a process and guidelines such that branch managers are promptly notified of the complaints and are required to contact customers to assist them or resolve the issues within two working days. The Service Quality Team will follow up on the progress as to how branches are handling each case to ensure that complaints are handled quickly and resolved properly. During 2024, 90 percent of complaints were resolved successfully within the specified timeline while unsettled ones were escalated to senior executives for further action. Note that all complaints and comments the Bank receives from every channel will be communicated with related parties to improve the quality of services and find appropriate measures to prevent similar mistakes in the future.

Besides, we adopt social listening tools to collect customers’ opinions, suggestions and complaints through social media channels. At the same time, the Bank has established a team to track customers’ opinions on the use of Bangkok Bank Mobile Banking in the App Store and Google Play so as to answer queries, provide advice and solve technical issues in a timely manner.