1 Mar 2026 until 30 Jun 2026

1 Apr 2025 until 31 May 2026

1 Jan 2026 untill 30 Dec 2026

1 Dec 2025 until 30 Nov 2026

1 Mar 2026 until 30 Apr 2026

1 Jan 2026 until 31 Dec 2026

1 Feb 2026 untill 30 Apr 2026

1 Apr 2025 until 31 May 2026

1 Jan 2026 untill 30 Dec 2026

5 Mar 2026 until 30 Jun 2026

1 Mar 2026 until 28 Feb 2027

1 Mar 2026 until 28 Feb 2027

1 Mar 2026 until 28 Feb 2027

1 Mar 2026 until 30 Jun 2026

1 Feb 2026 until 15 Jun 2026

1 Feb 2026 until 31 Jan 2027

1 Feb 2026 until 31 Jan 2027

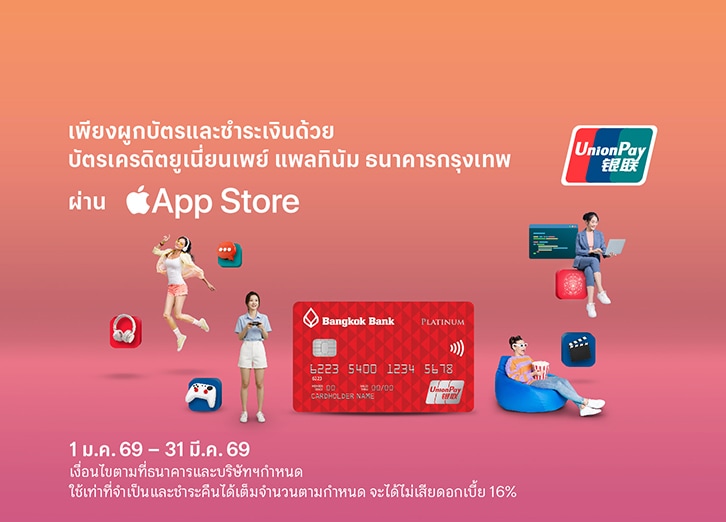

1 Jan 2026 until 31 Mar 2026

Special privileges on medical expenses and certain health check programs at participating hospitals.

1 Jan 2026 until 31 Dec 2026

Special privileges on medical expenses and certain health check programs at participating hospitals.

1 Jan 2026 until 31 Dec 2026

1 Jan 2026 until 31 Dec 2026

1 Dec 2025 until 30 Nov 2026

1 Oct 2025 until 31 Mar 2026

1 Apr 2025 until 31 Mar 2026

1 Dec 2025 until 30 Apr 2026

16 May 2025 until 30 Apr 2026

1 May 2025 until 30 Apr 2026

1 May 2025 until 30 Apr 2026

1 Feb 2026 until 30 Sep 2026

1 Nov 2025 until 31 Dec 2026

1 Sep 2025 until 31 Aug 2026

16 Aug 2025 until 31 Dec 2026

16 Jul 2025 until 15 Jul 2026

1 Jan 2026 until 31 Mar 2026

1 Jan 2026 until 31 Mar 2026

1 Jan 2026 until 31 Mar 2026

1 Jan 2026 until 31 Dec 2026

5 Mar 2026 until 28 Apr 2026

1 Mar 2026 until 20 May 2026

26 Feb 26 until 31 May 2026

26 Feb 26 until 31 May 2026