1.

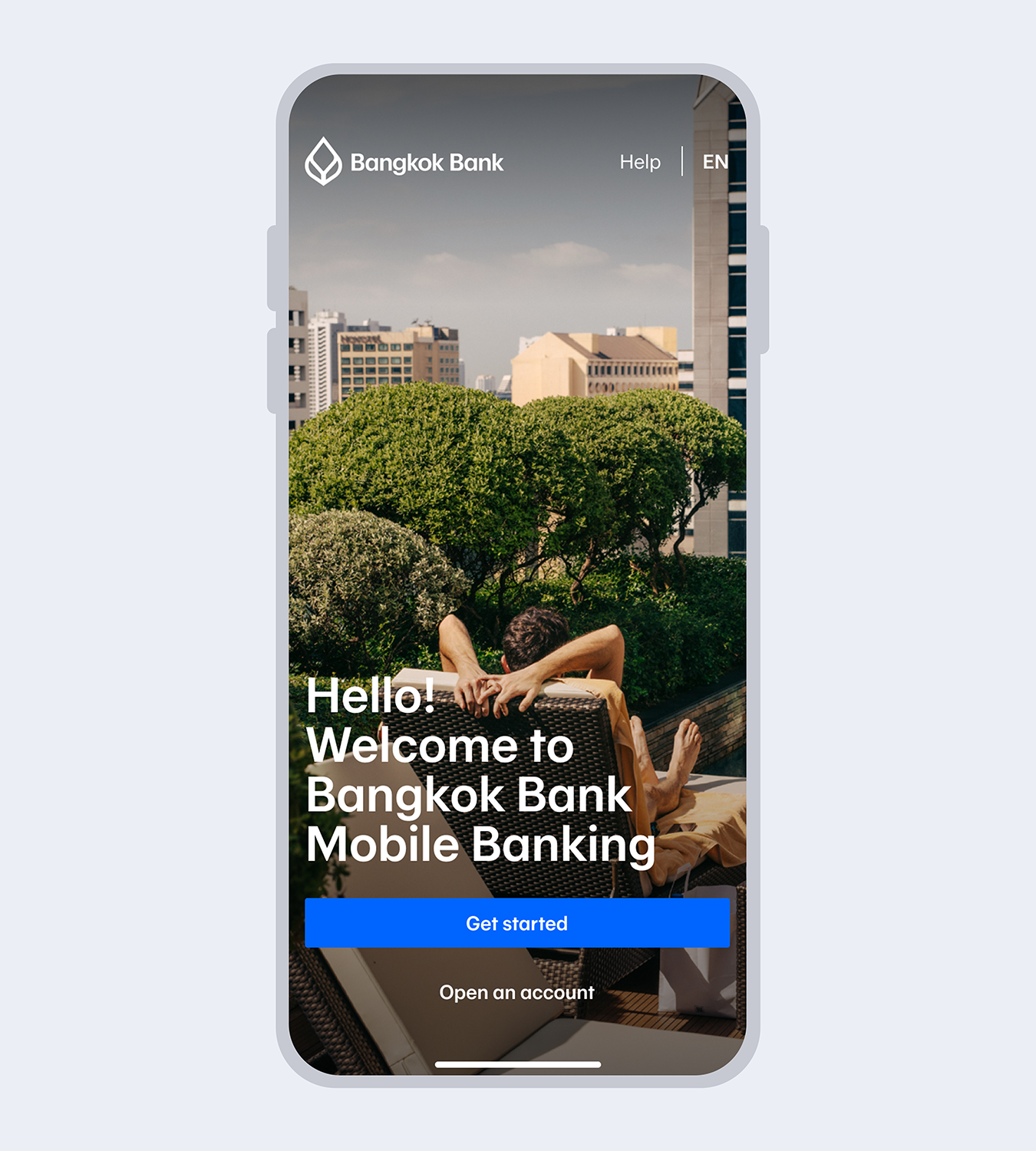

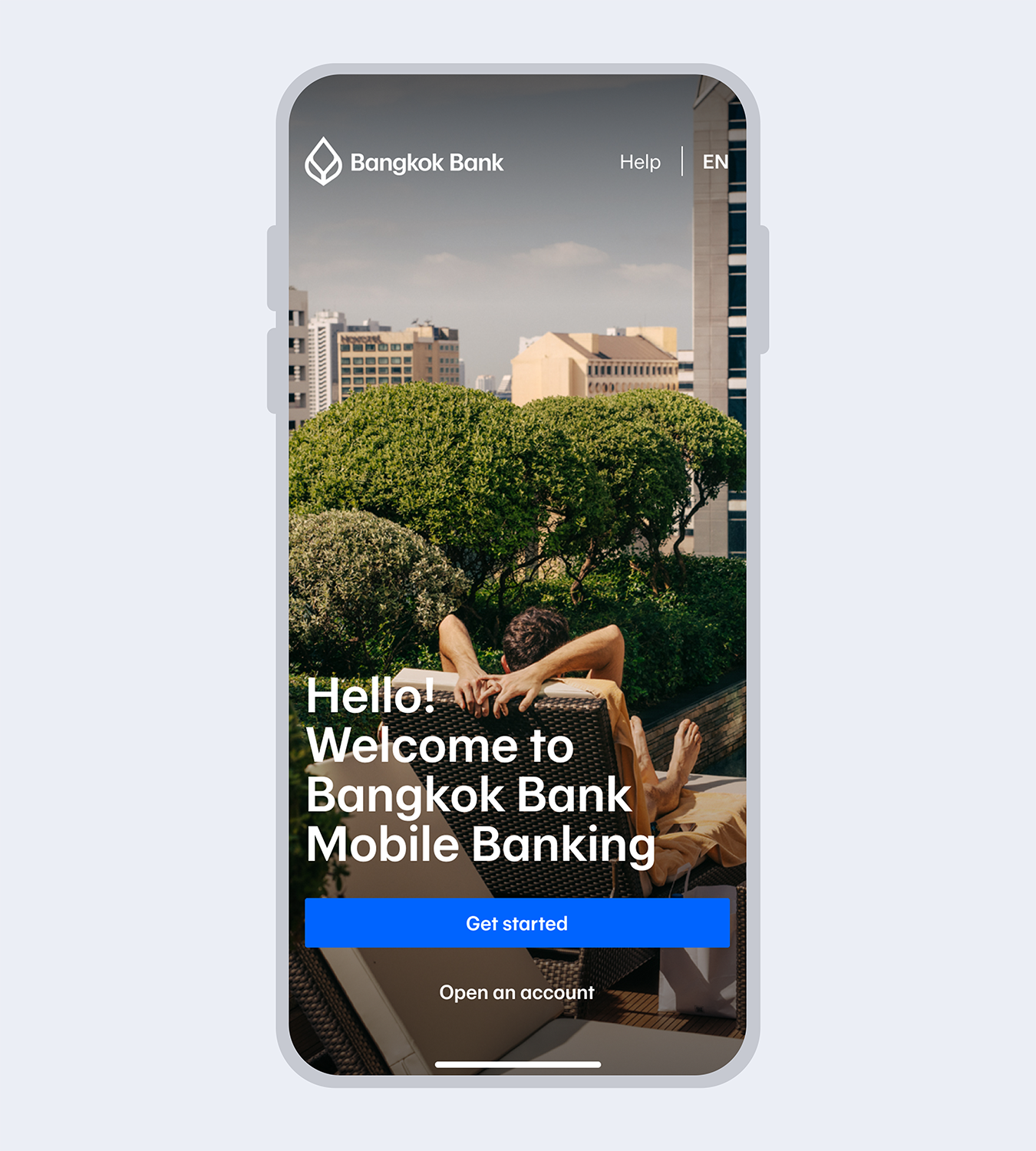

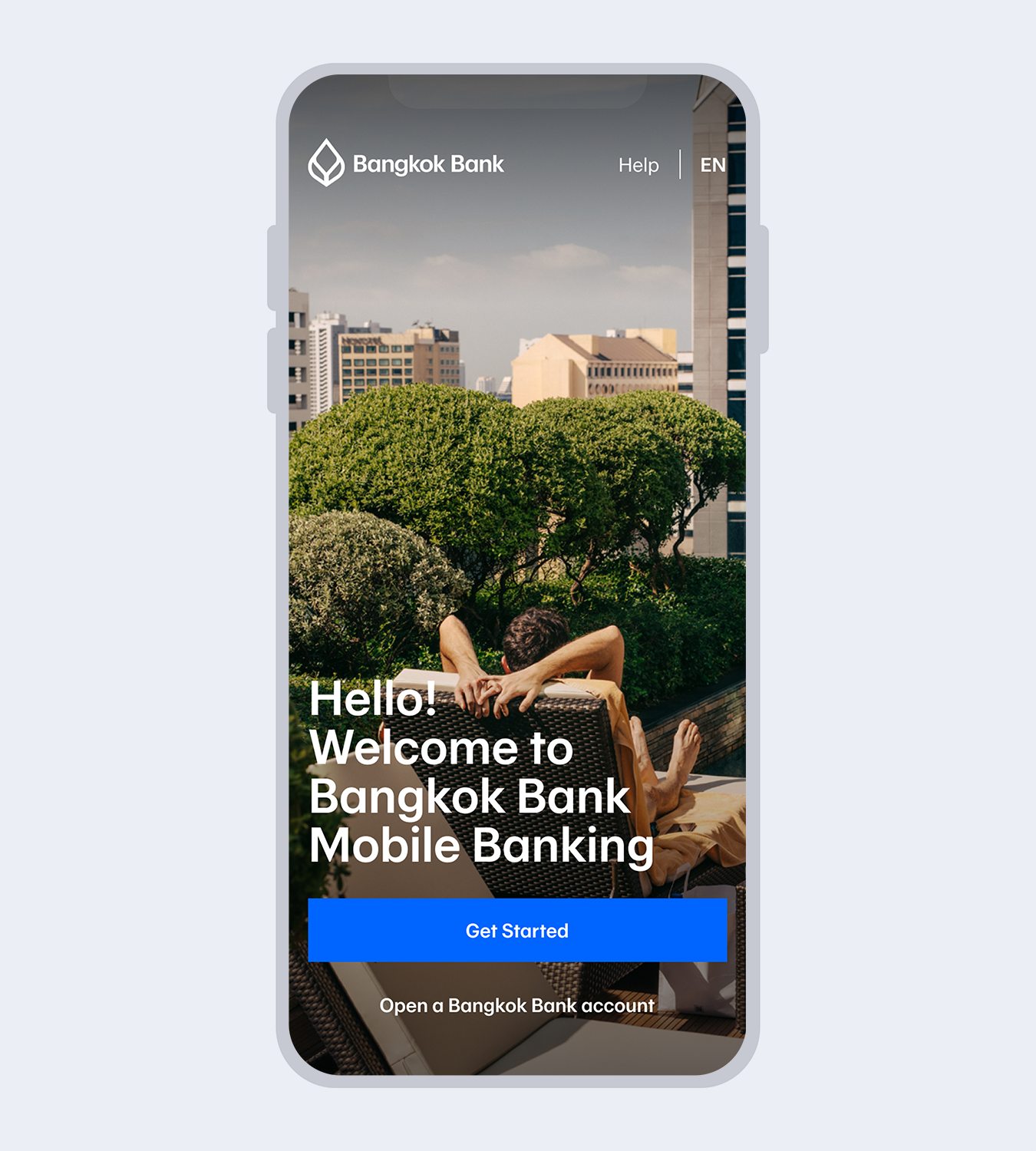

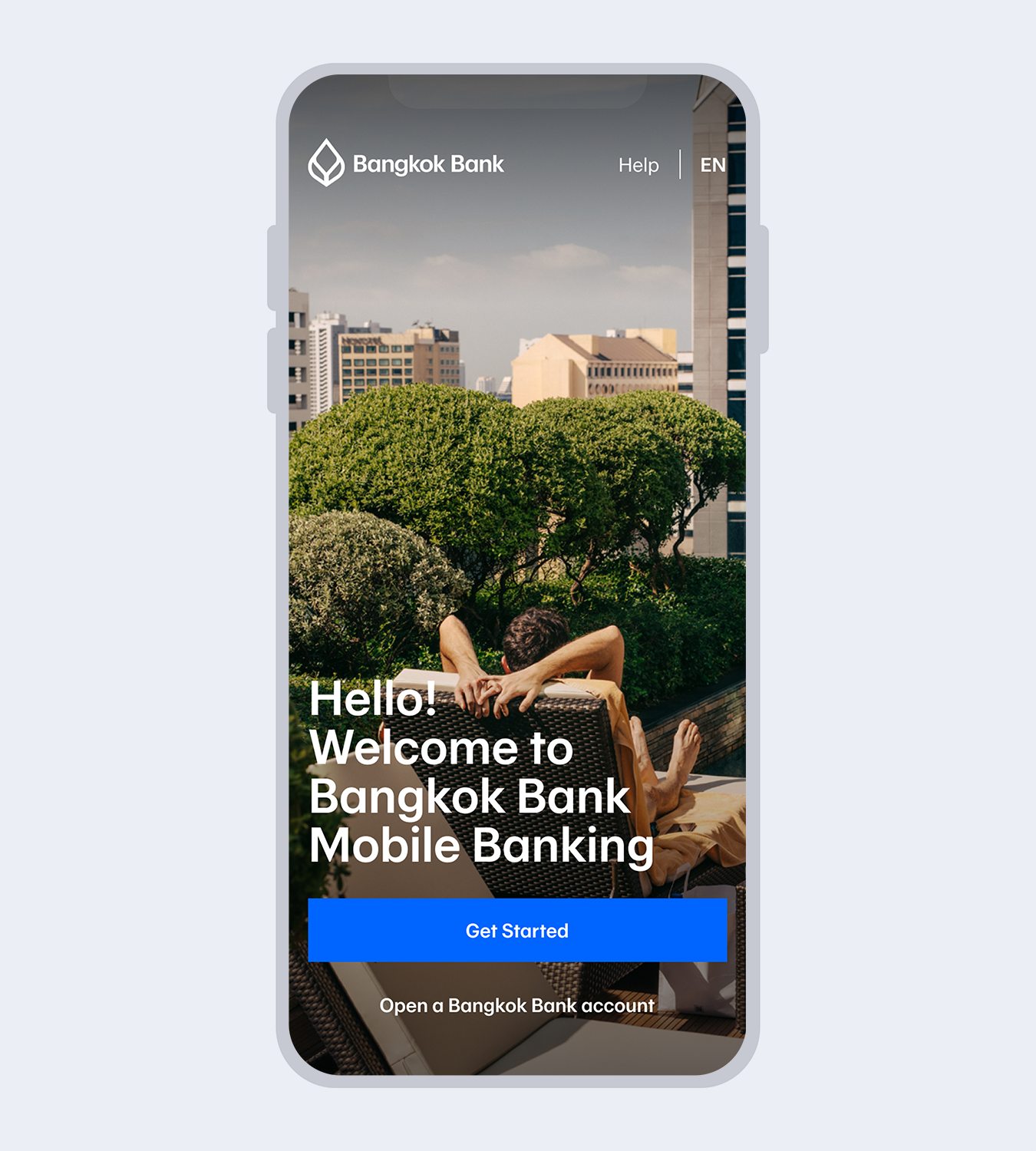

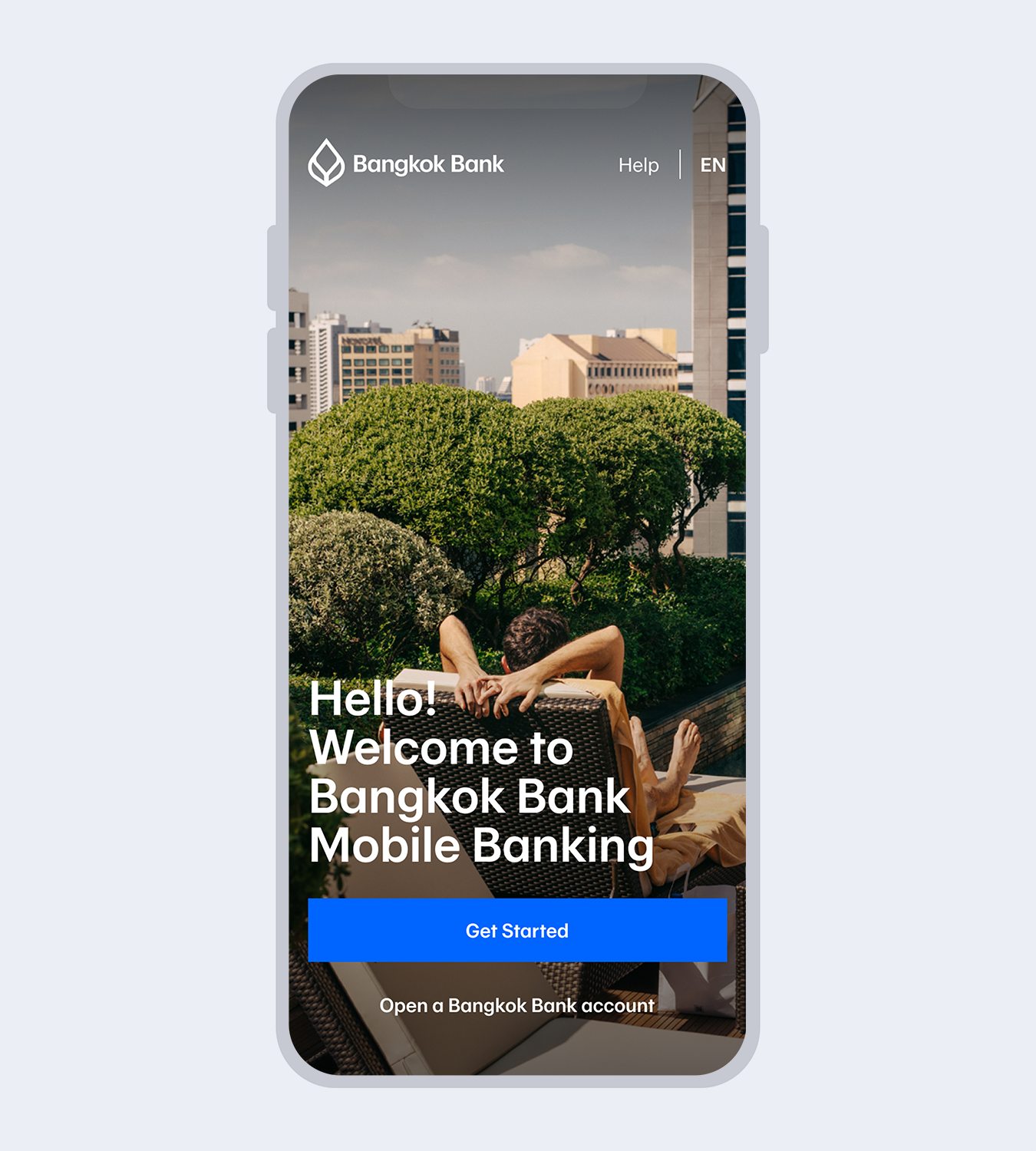

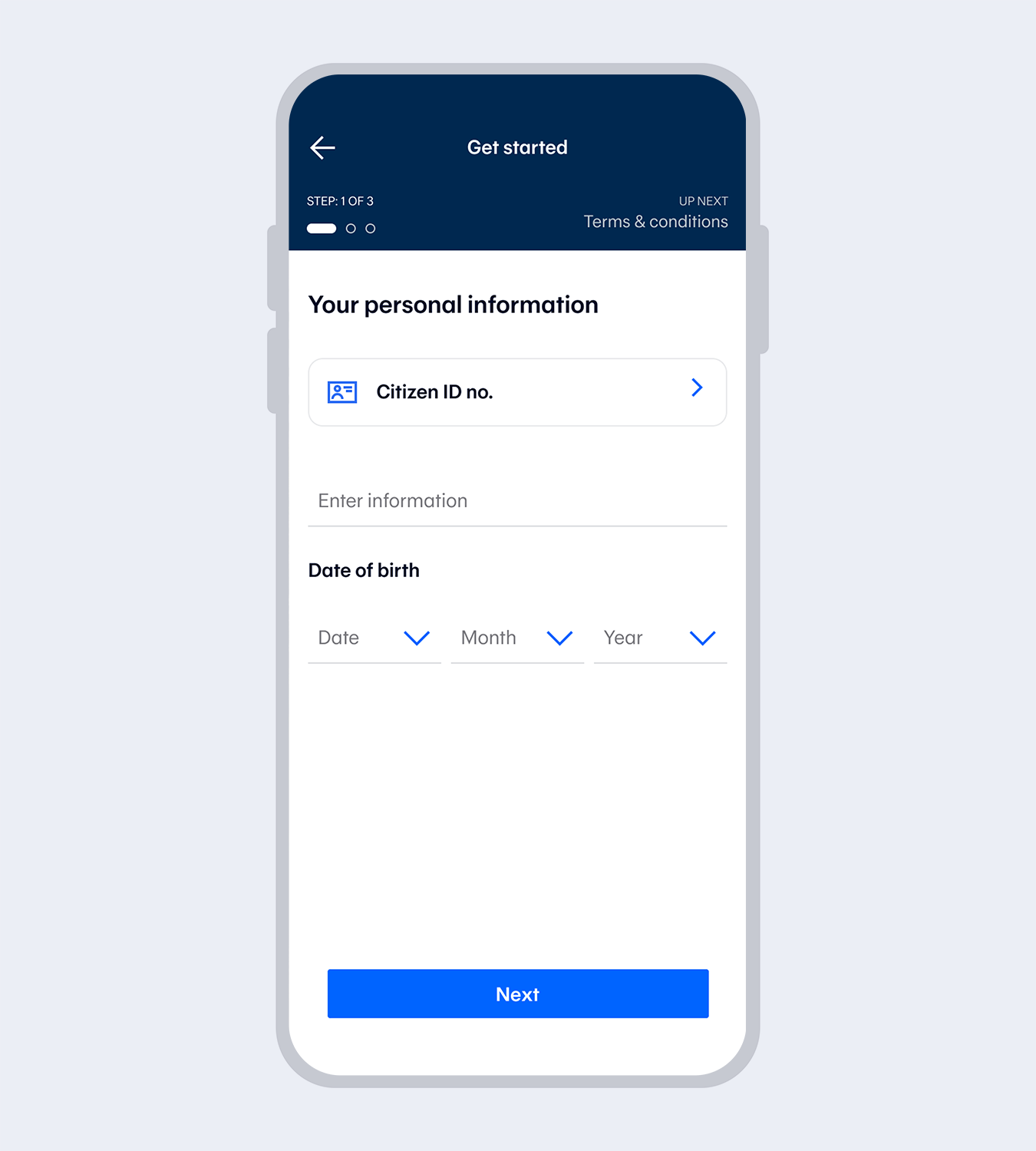

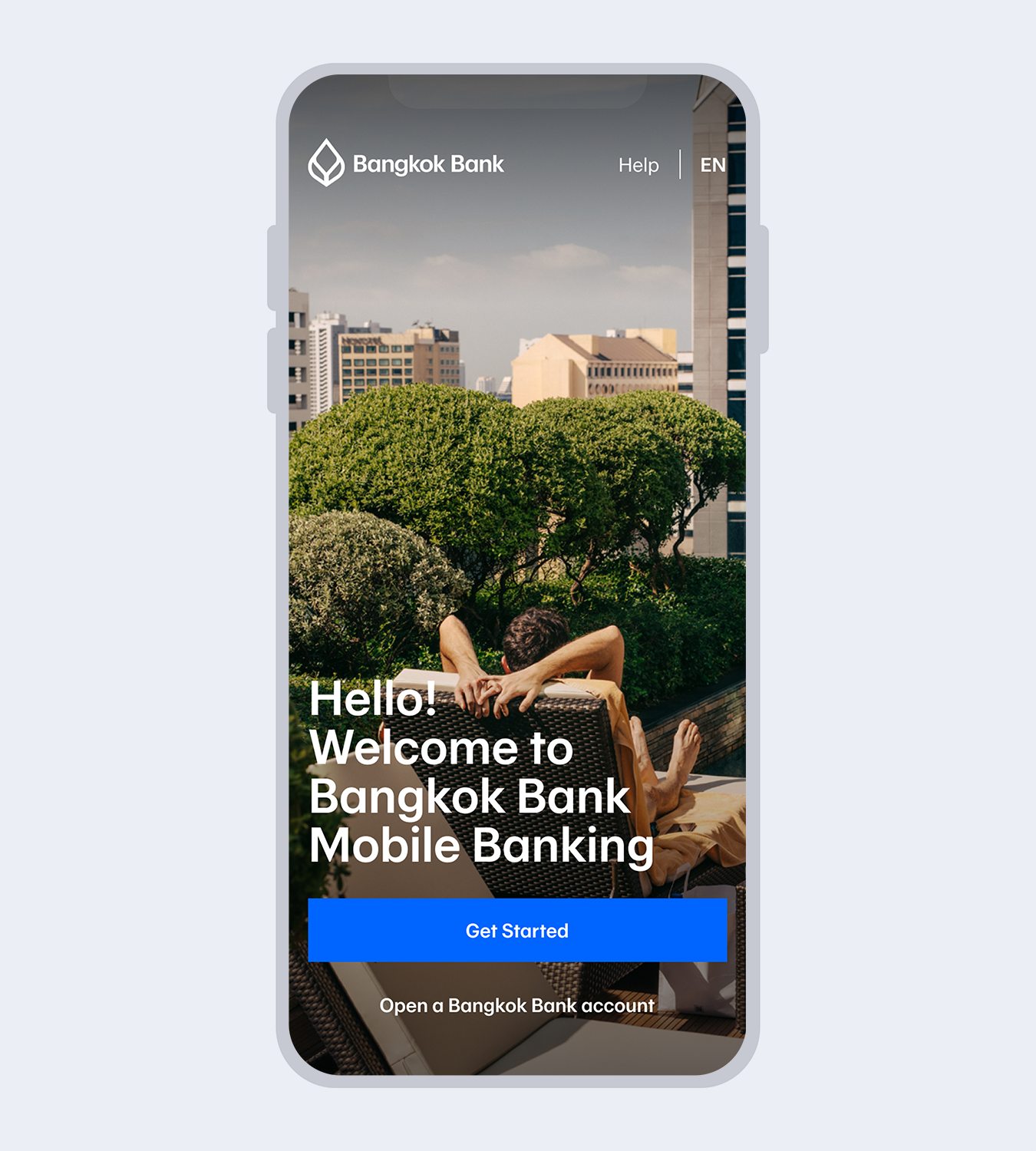

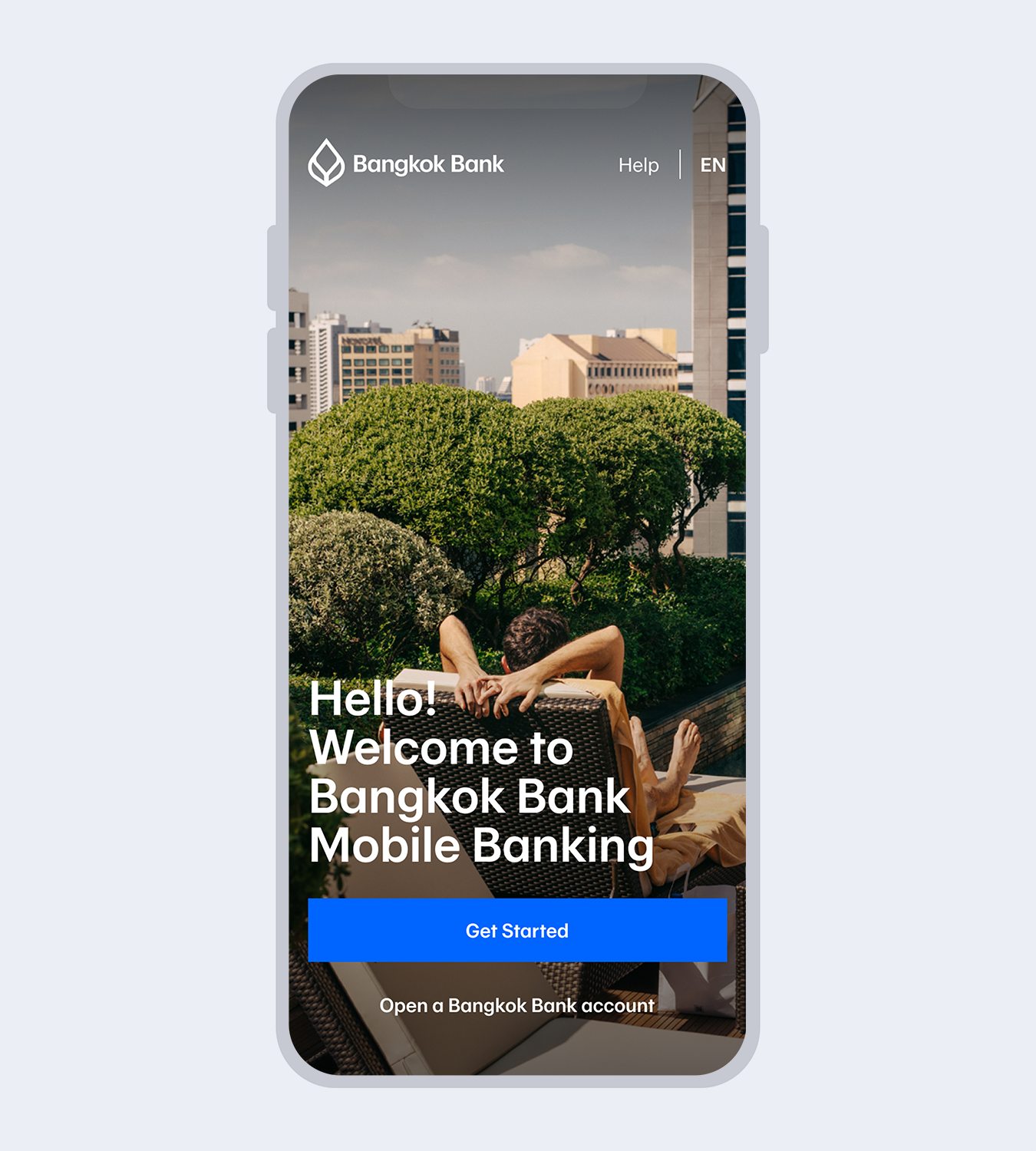

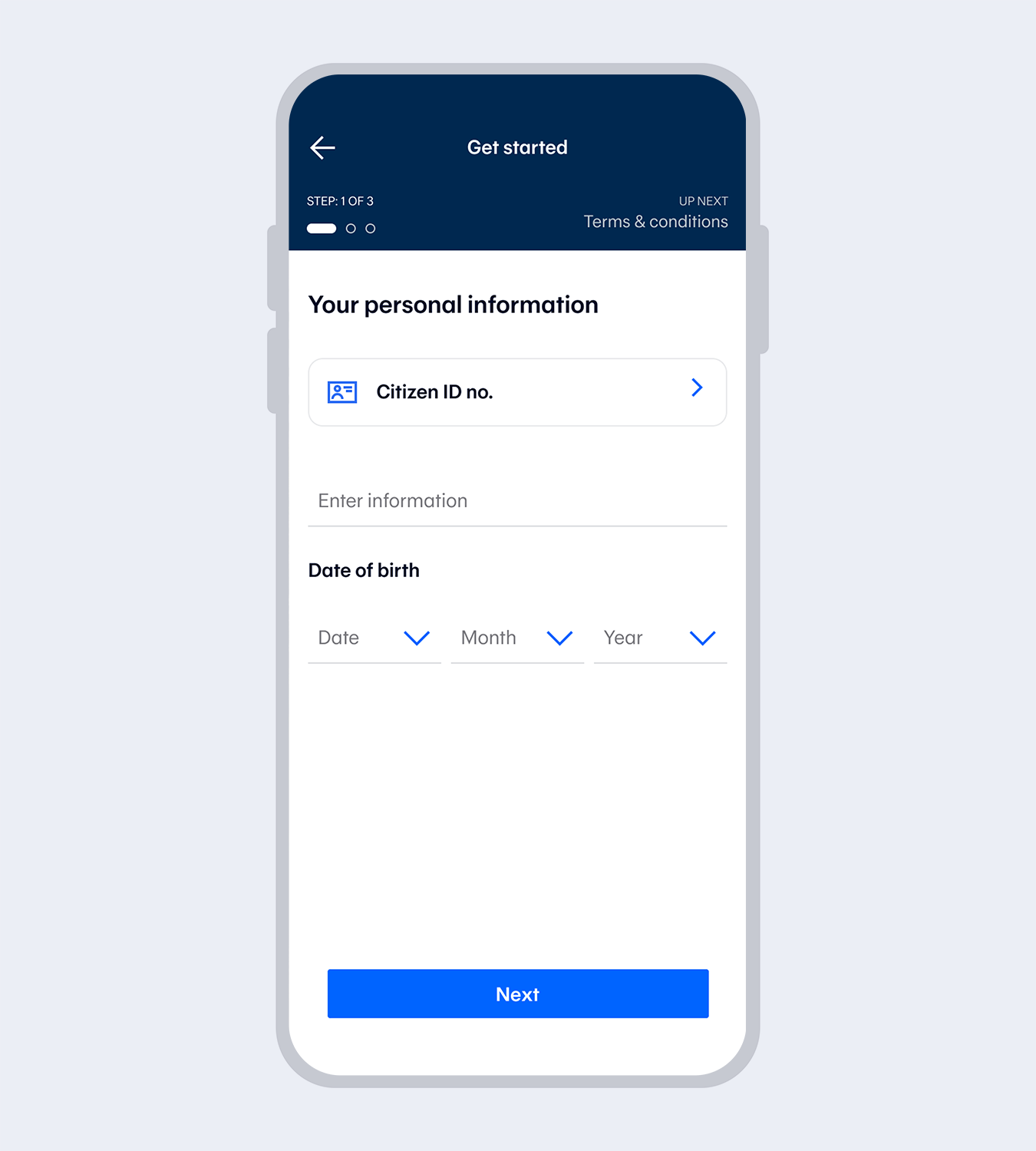

Download Bangkok Bank Mobile Banking.Select “Get started” if you have a Bangkok Bank account.

2.

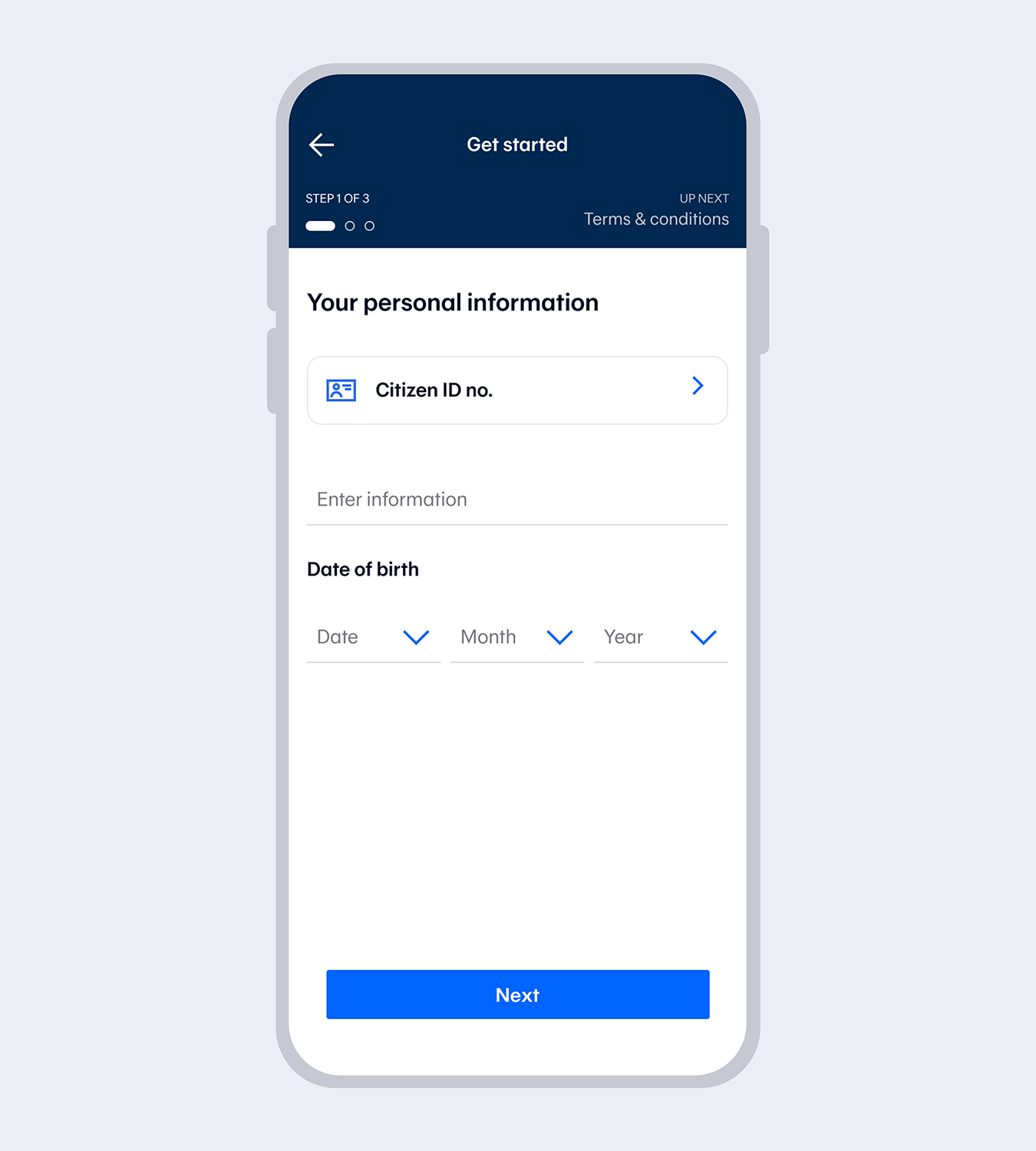

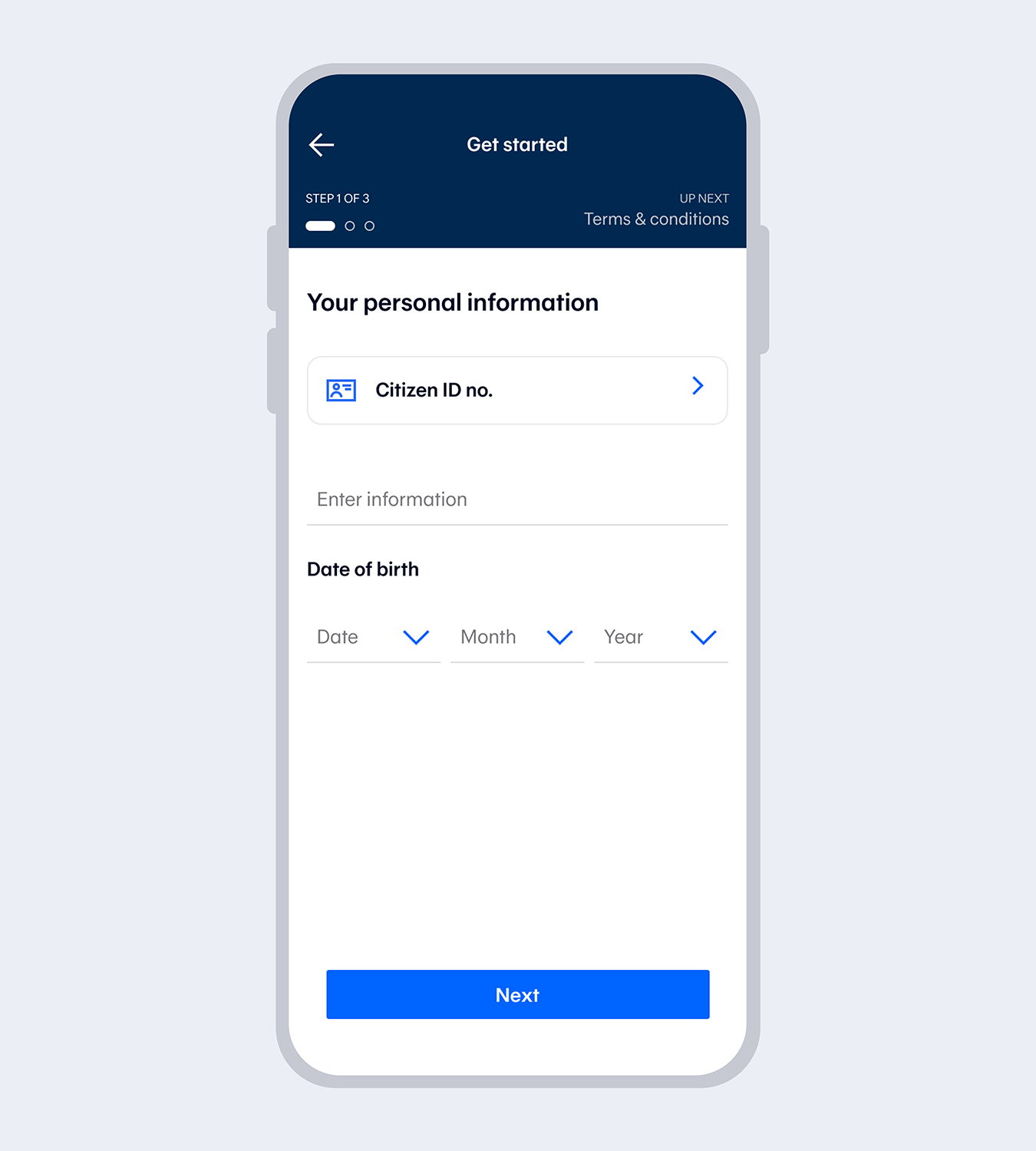

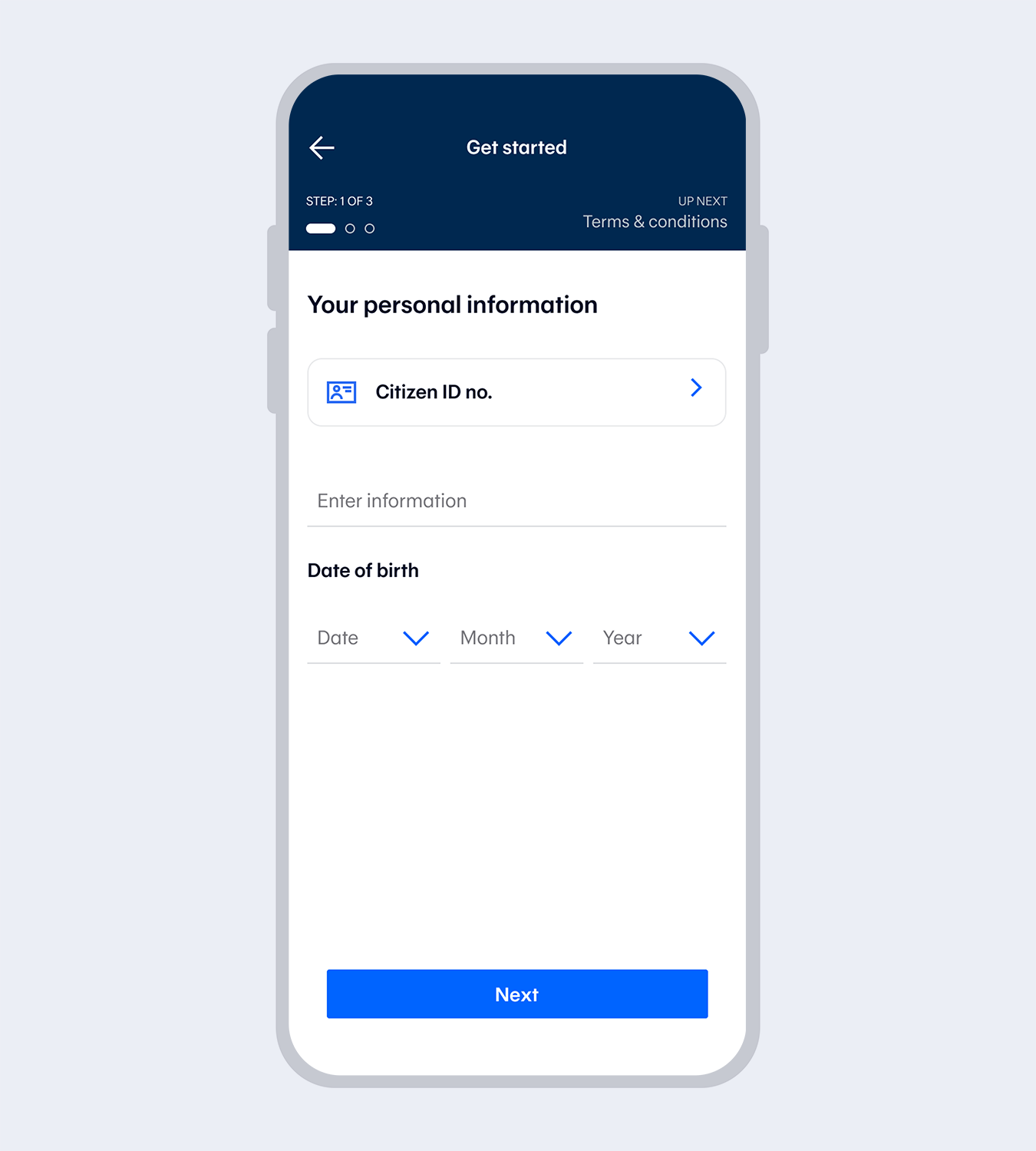

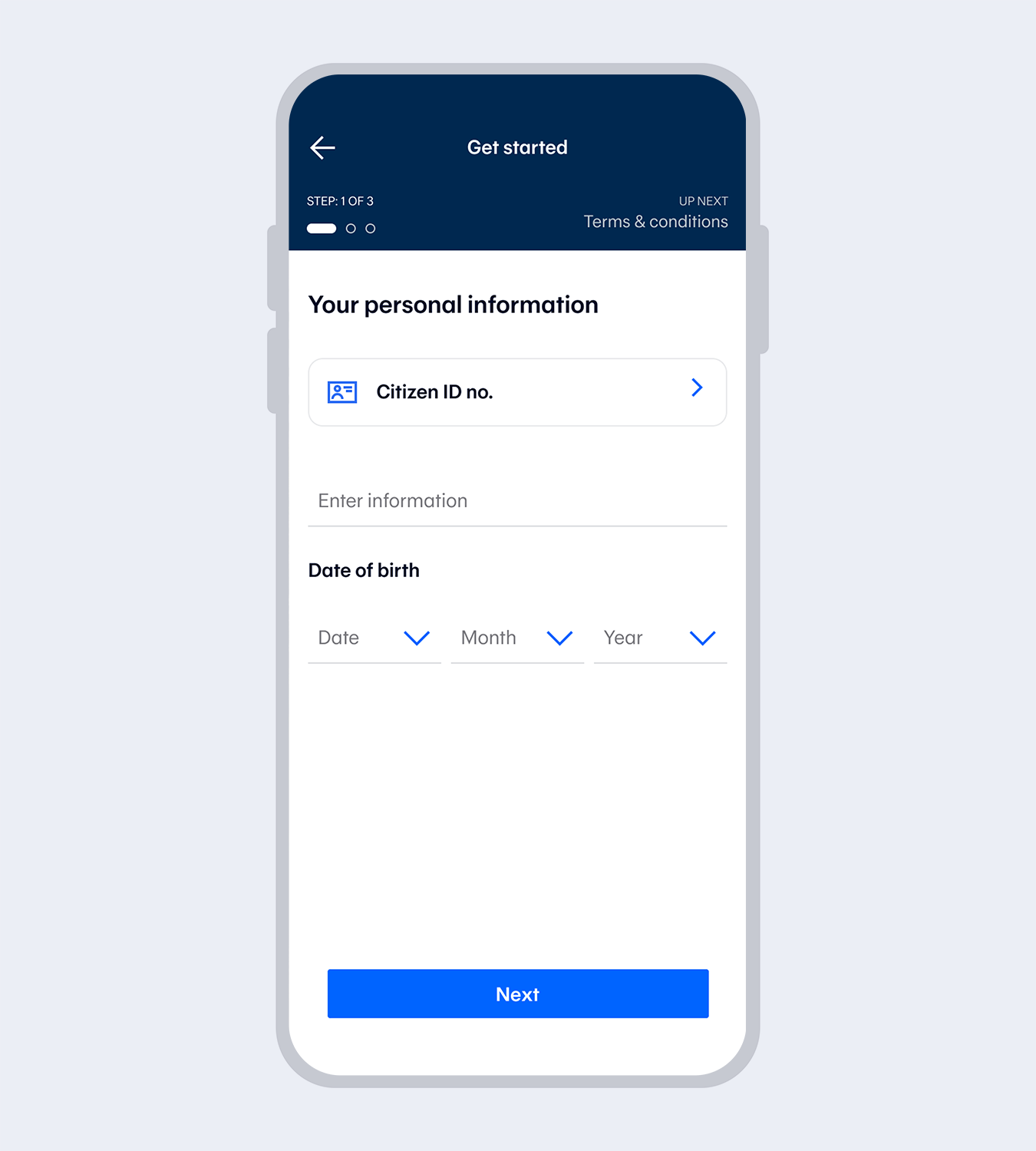

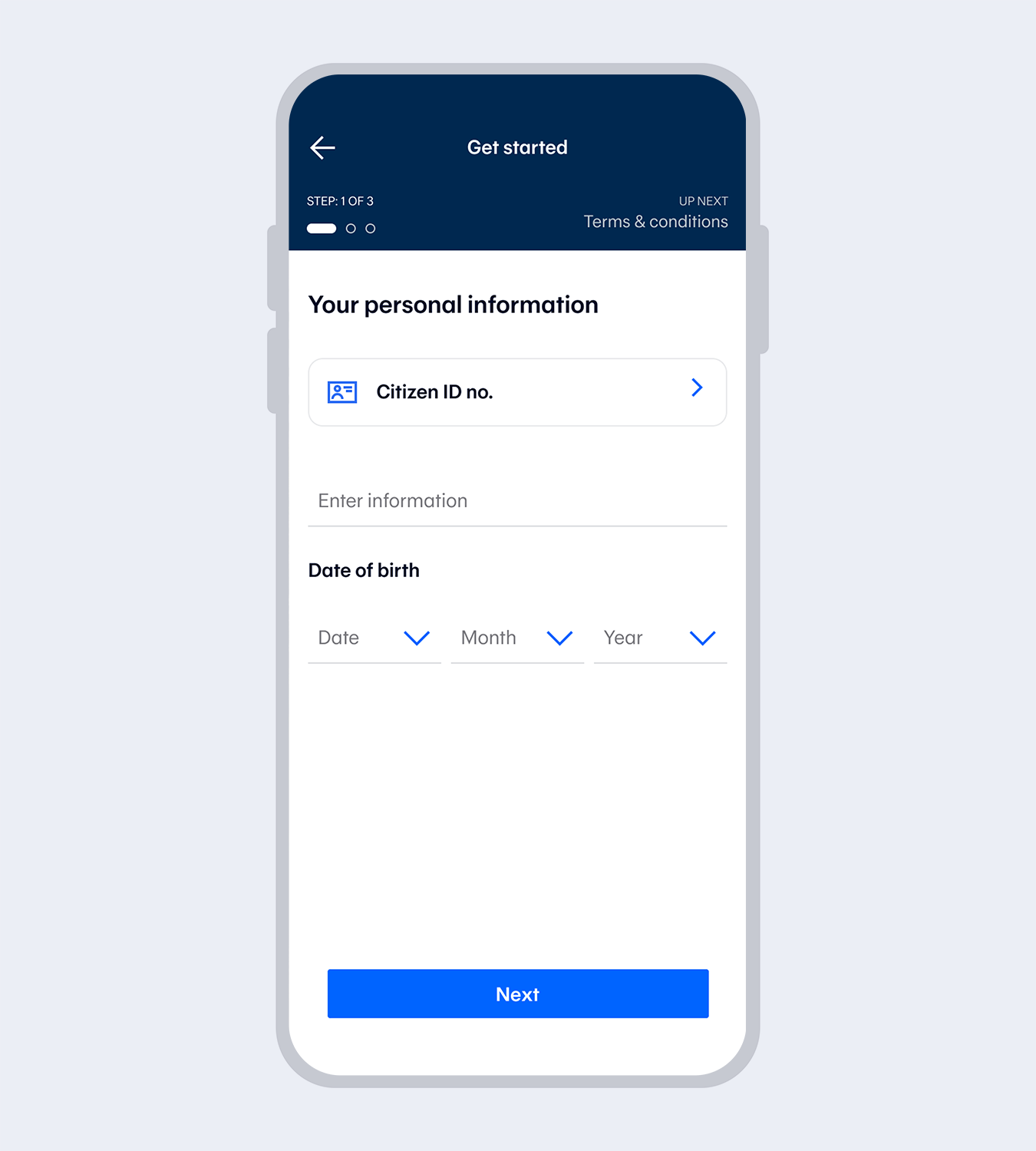

Enter your Citizen ID no. and date of birth.*for Thai citizens only.

3.

Read and accept the terms and conditions.

4.

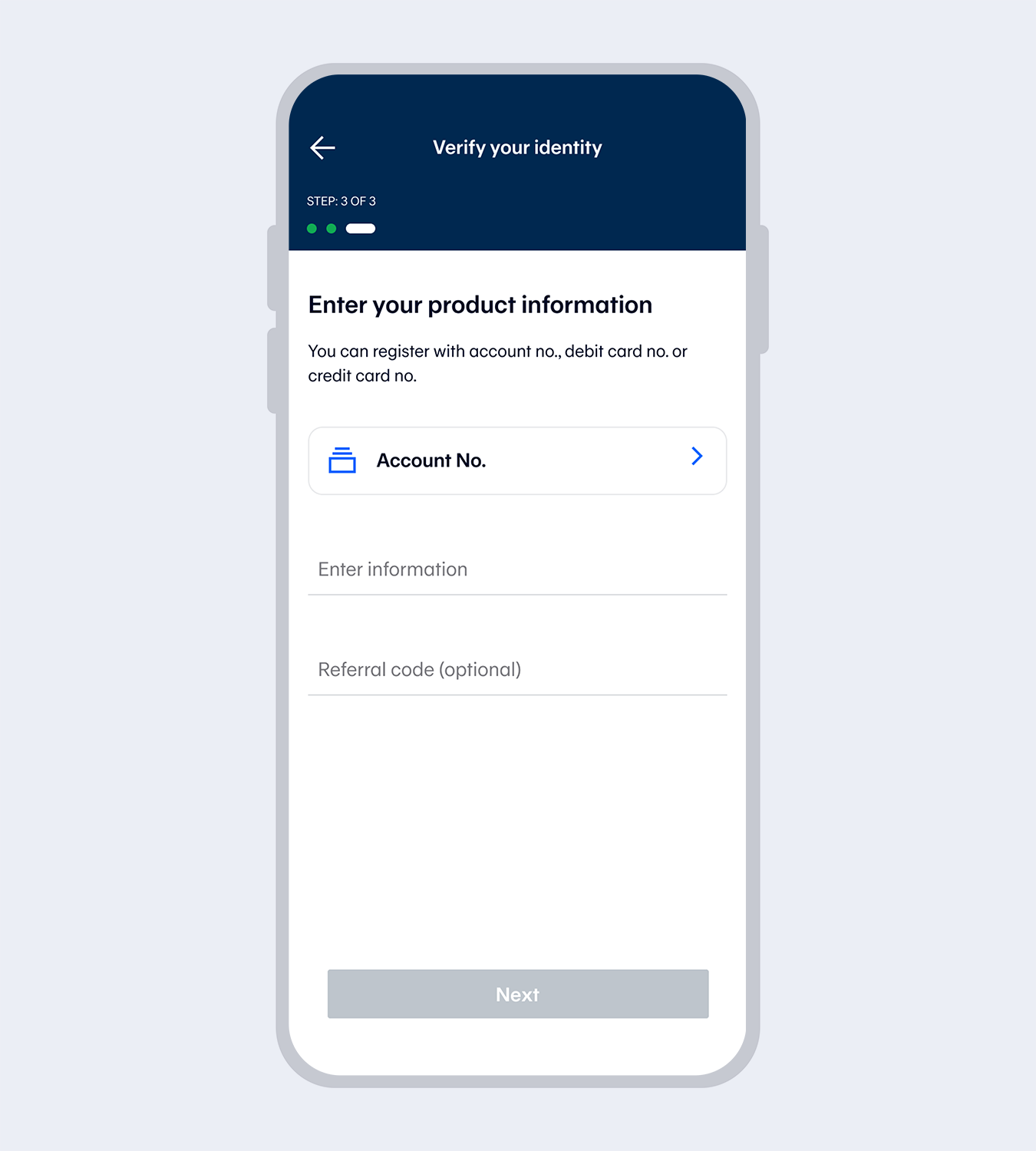

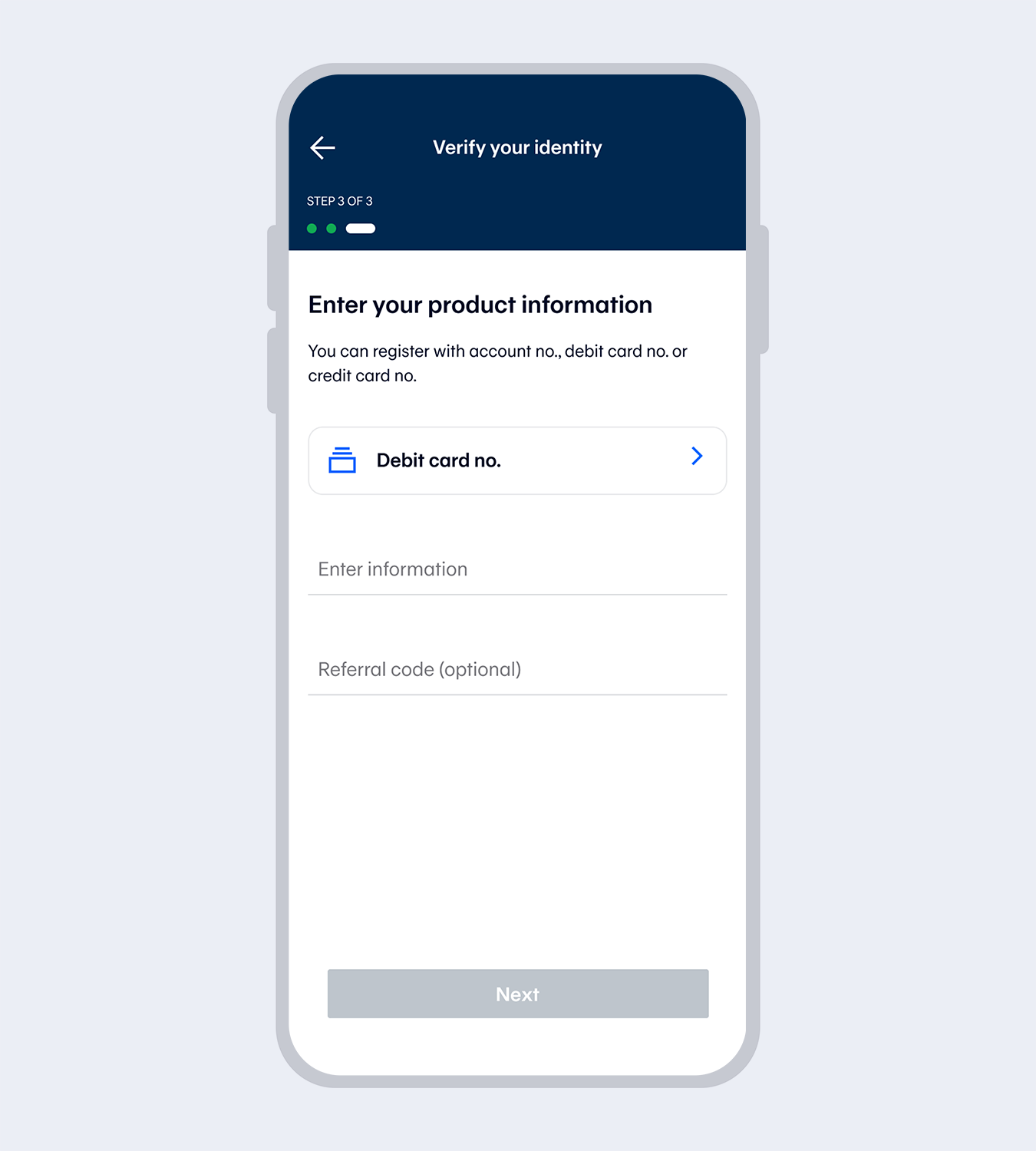

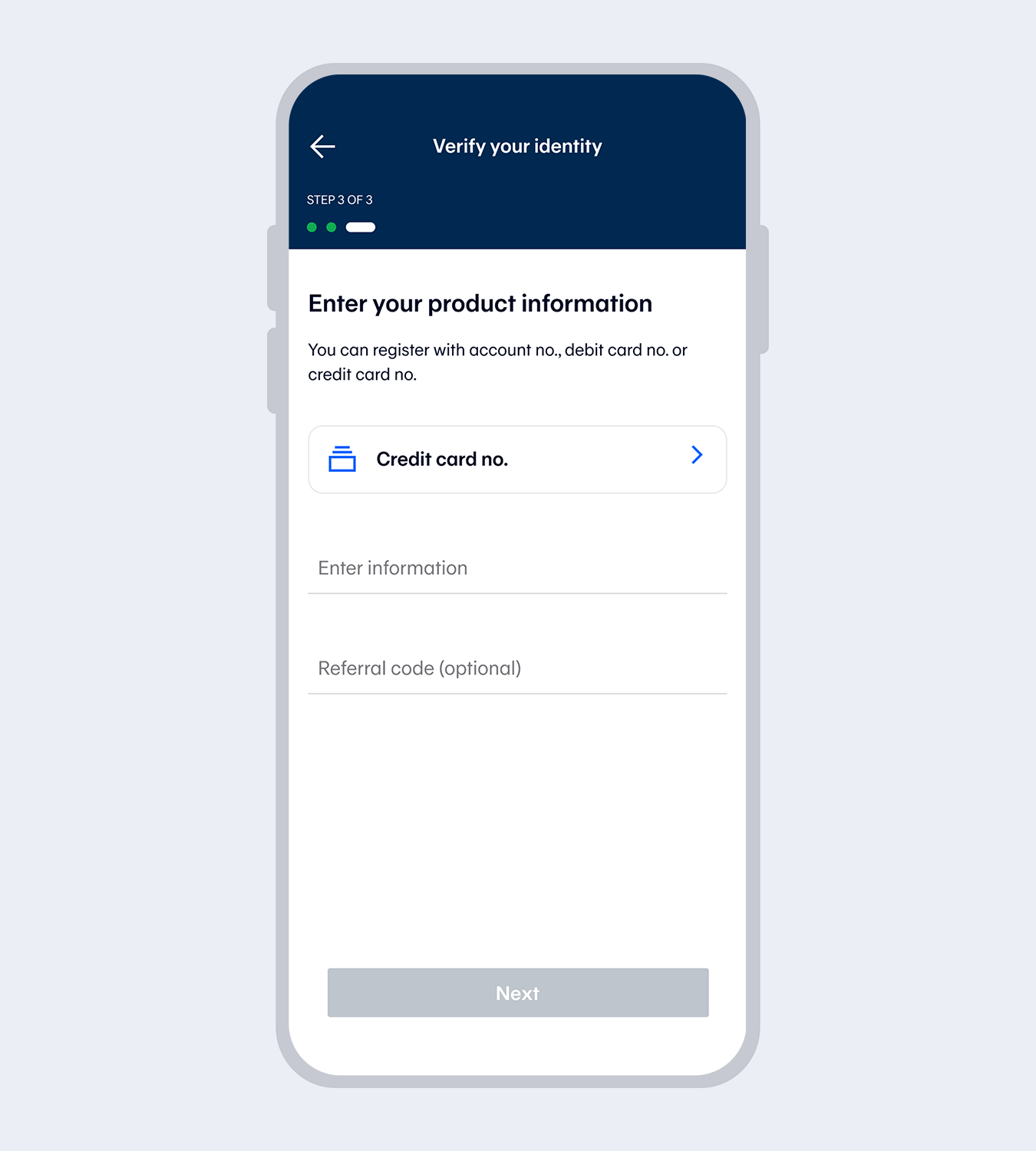

Select "Account no."Enter the account number and referral code (if any).

5.

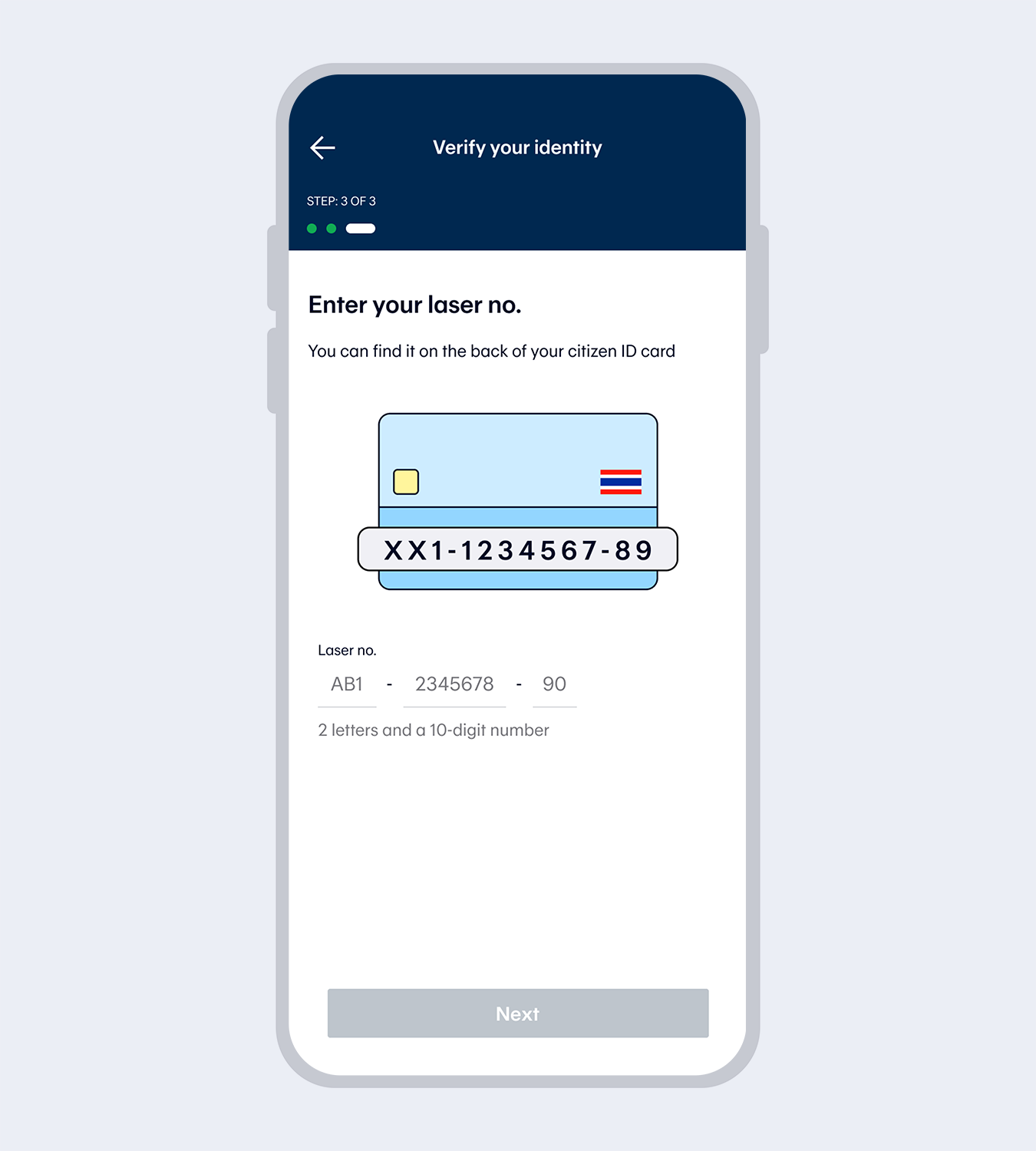

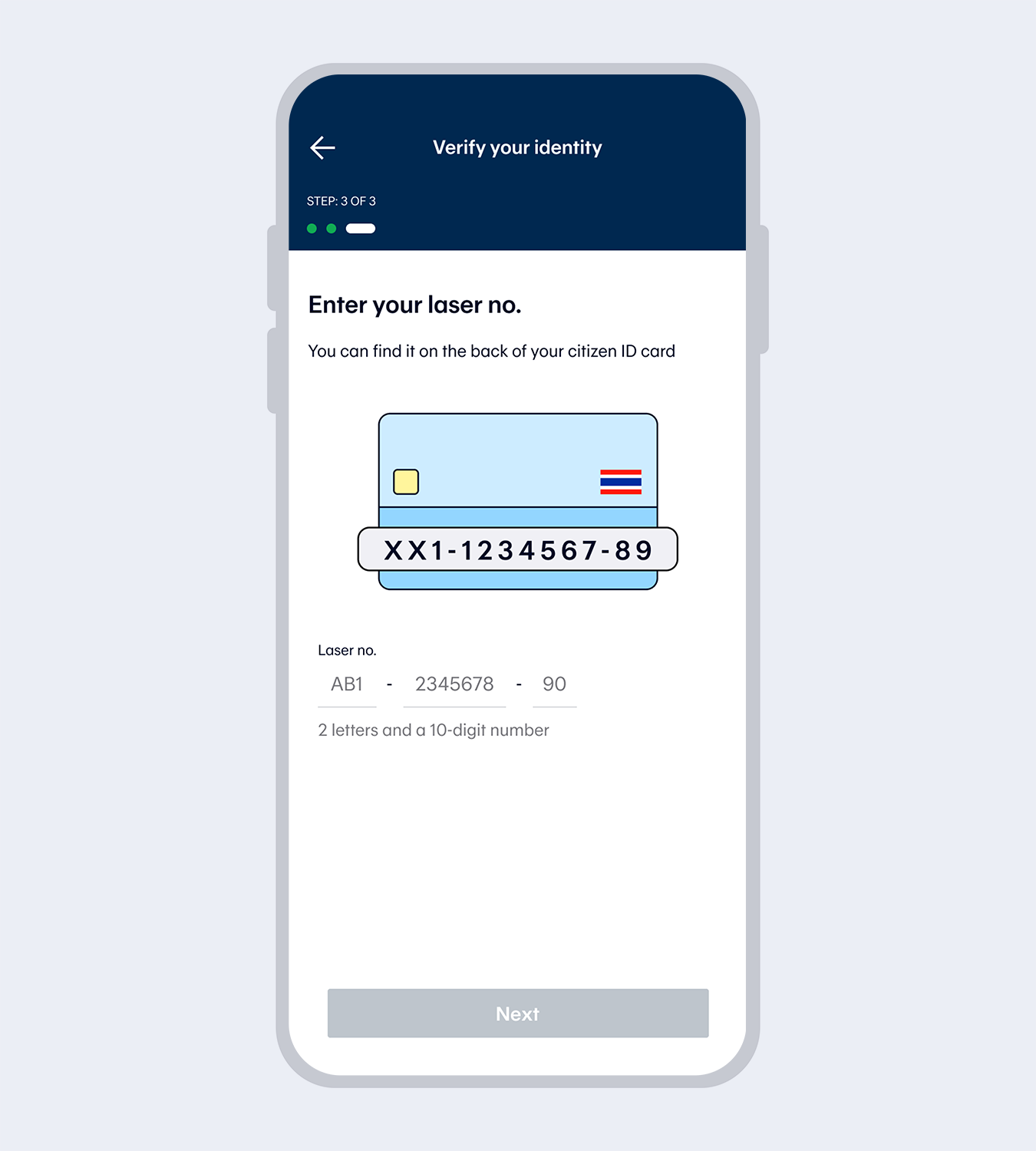

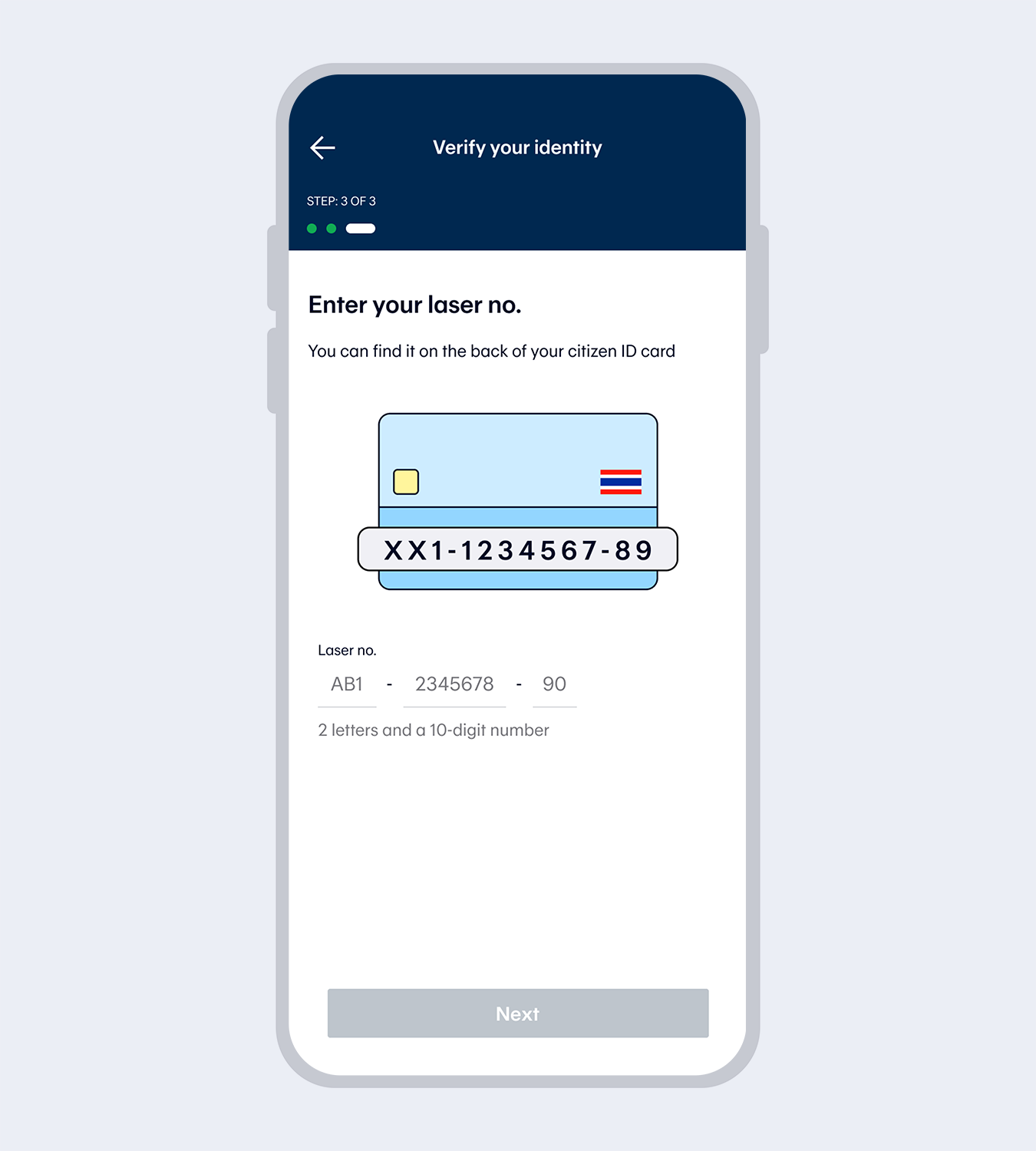

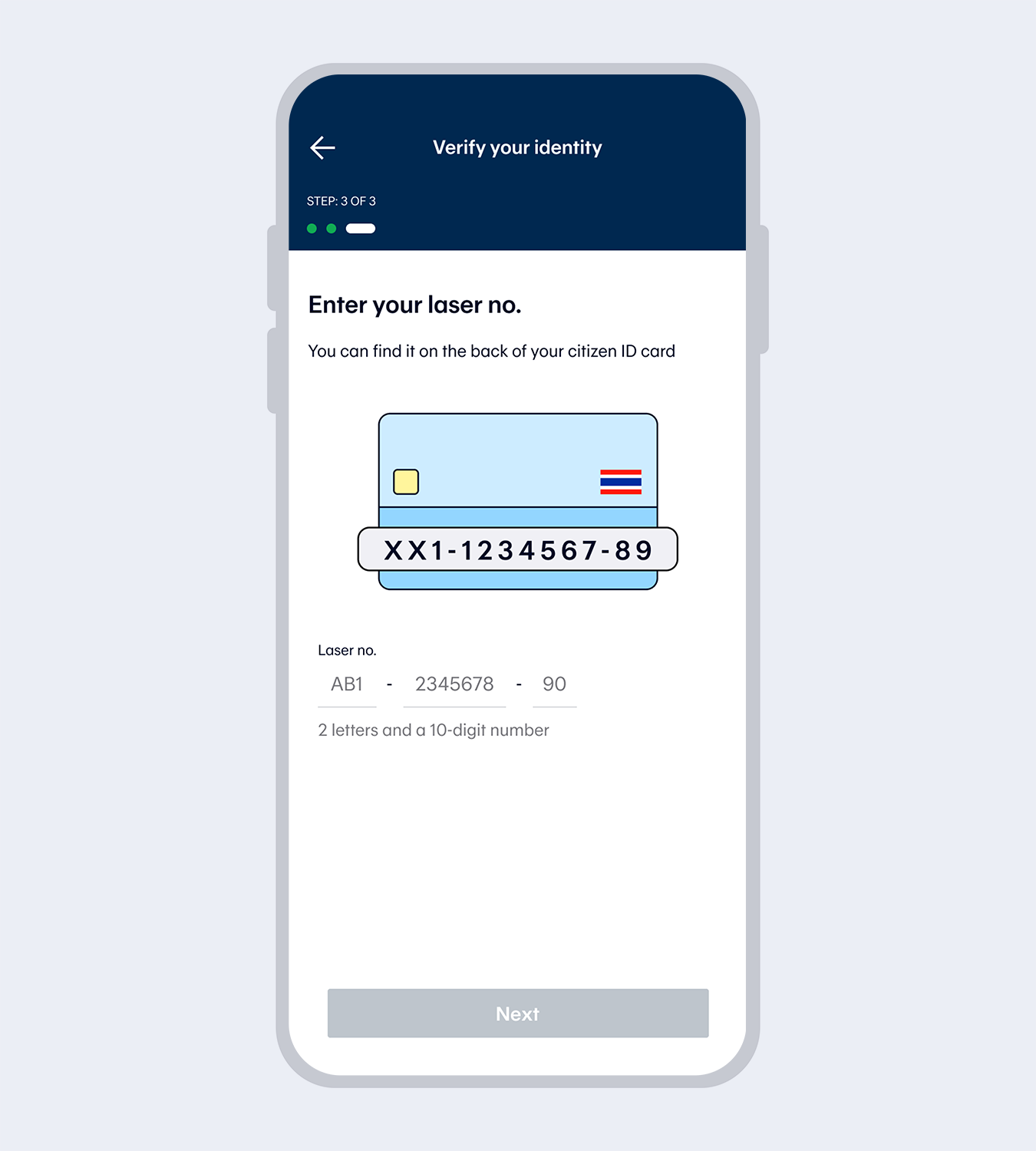

Enter your laser no.

6.

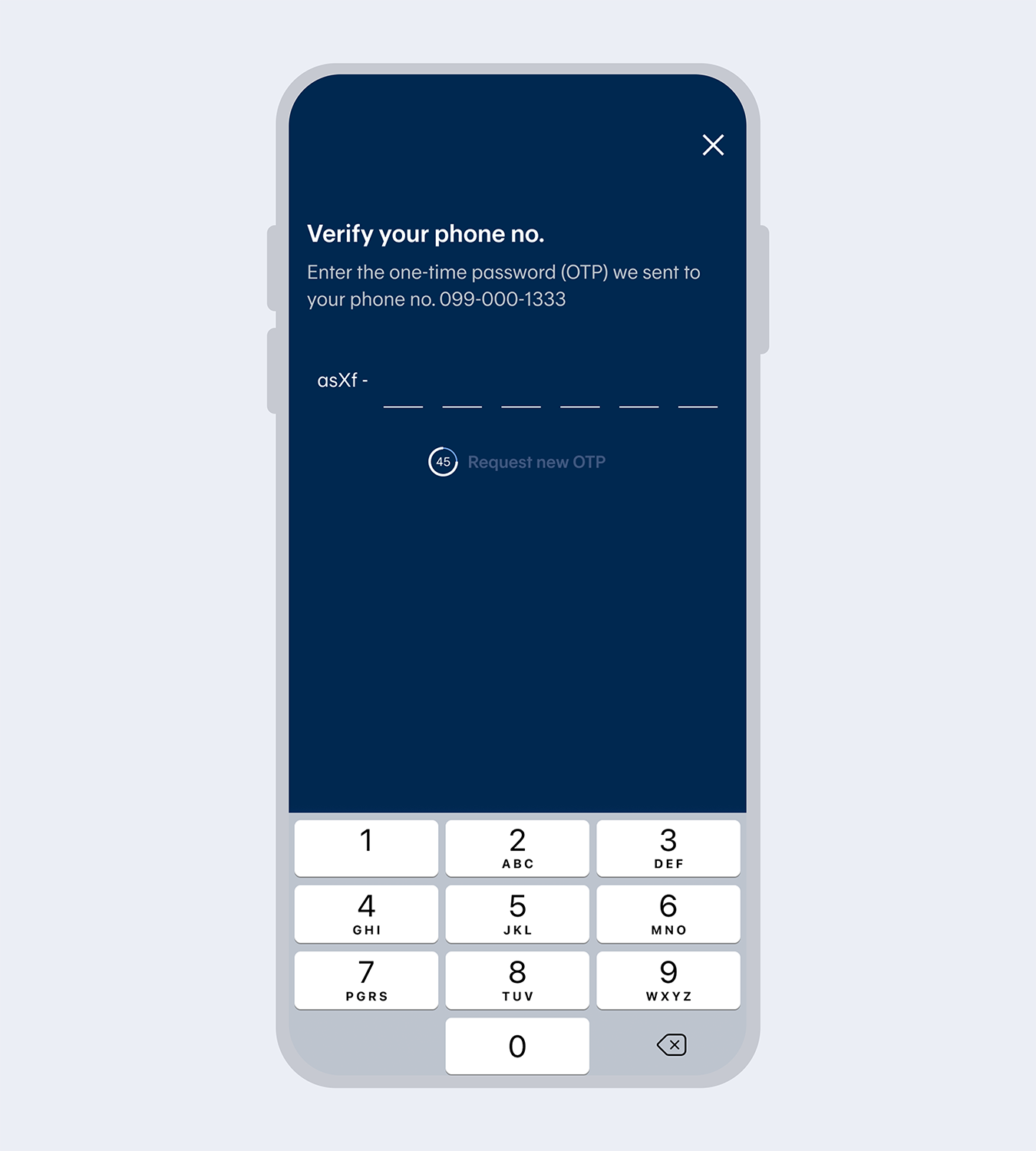

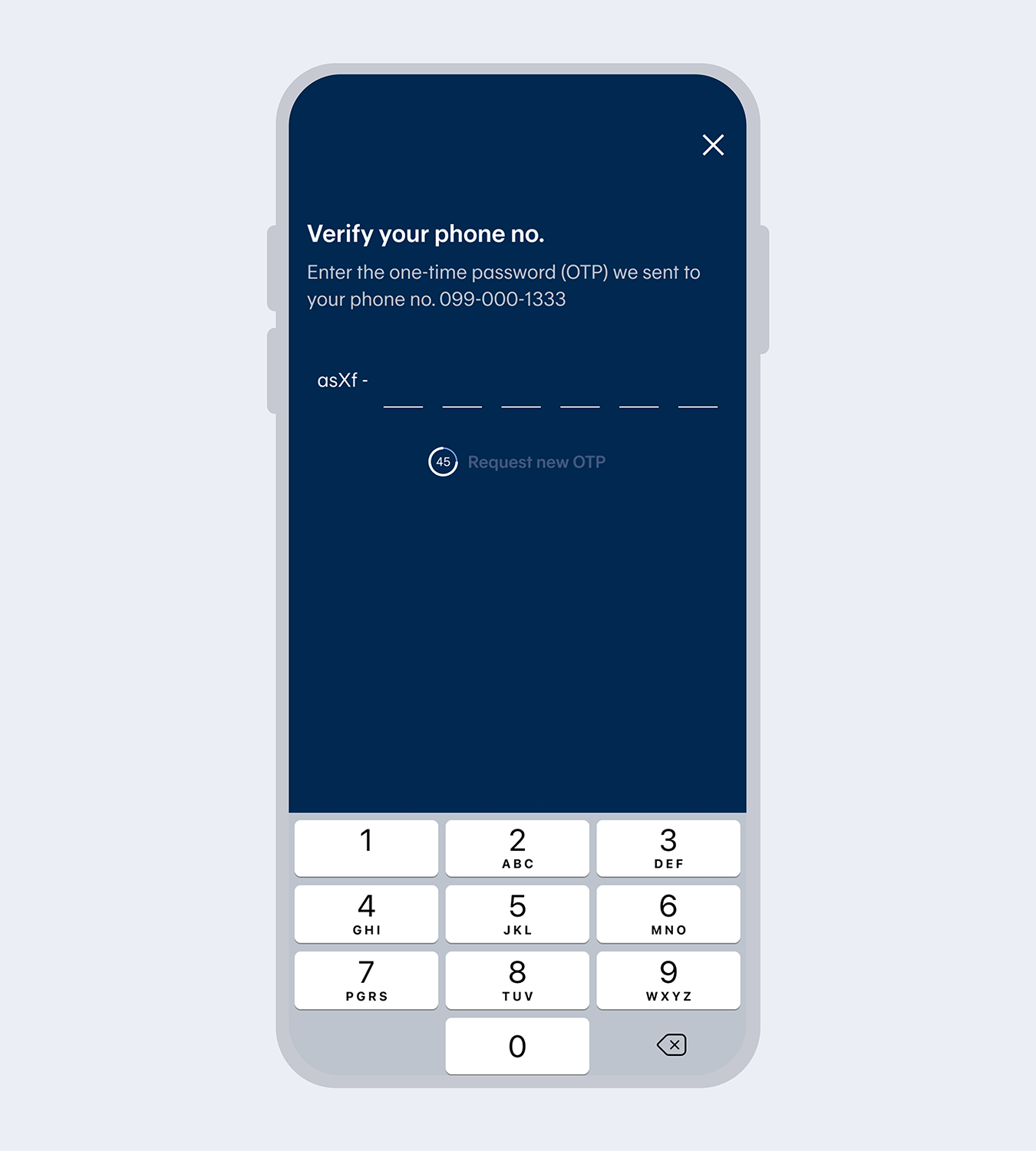

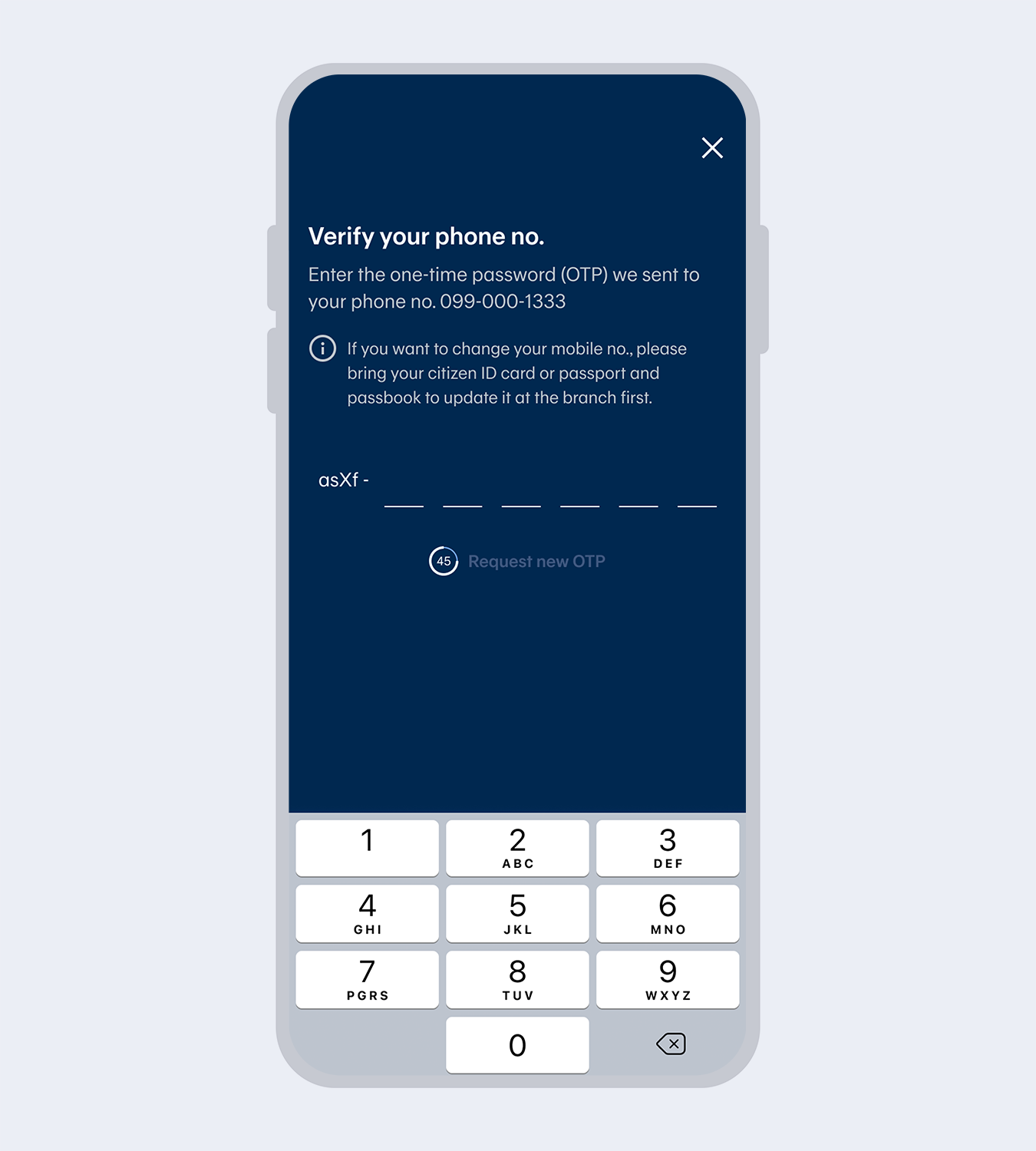

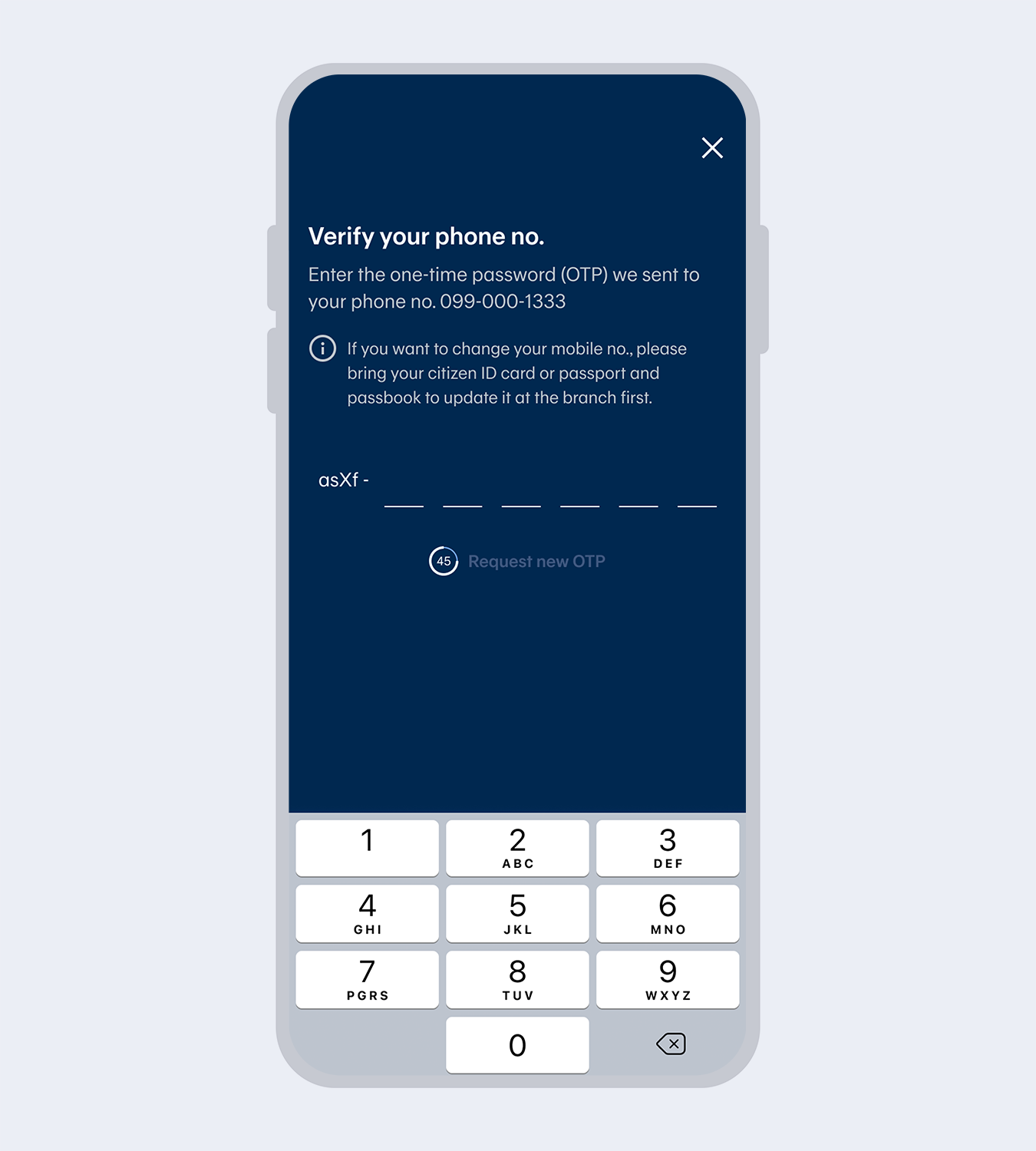

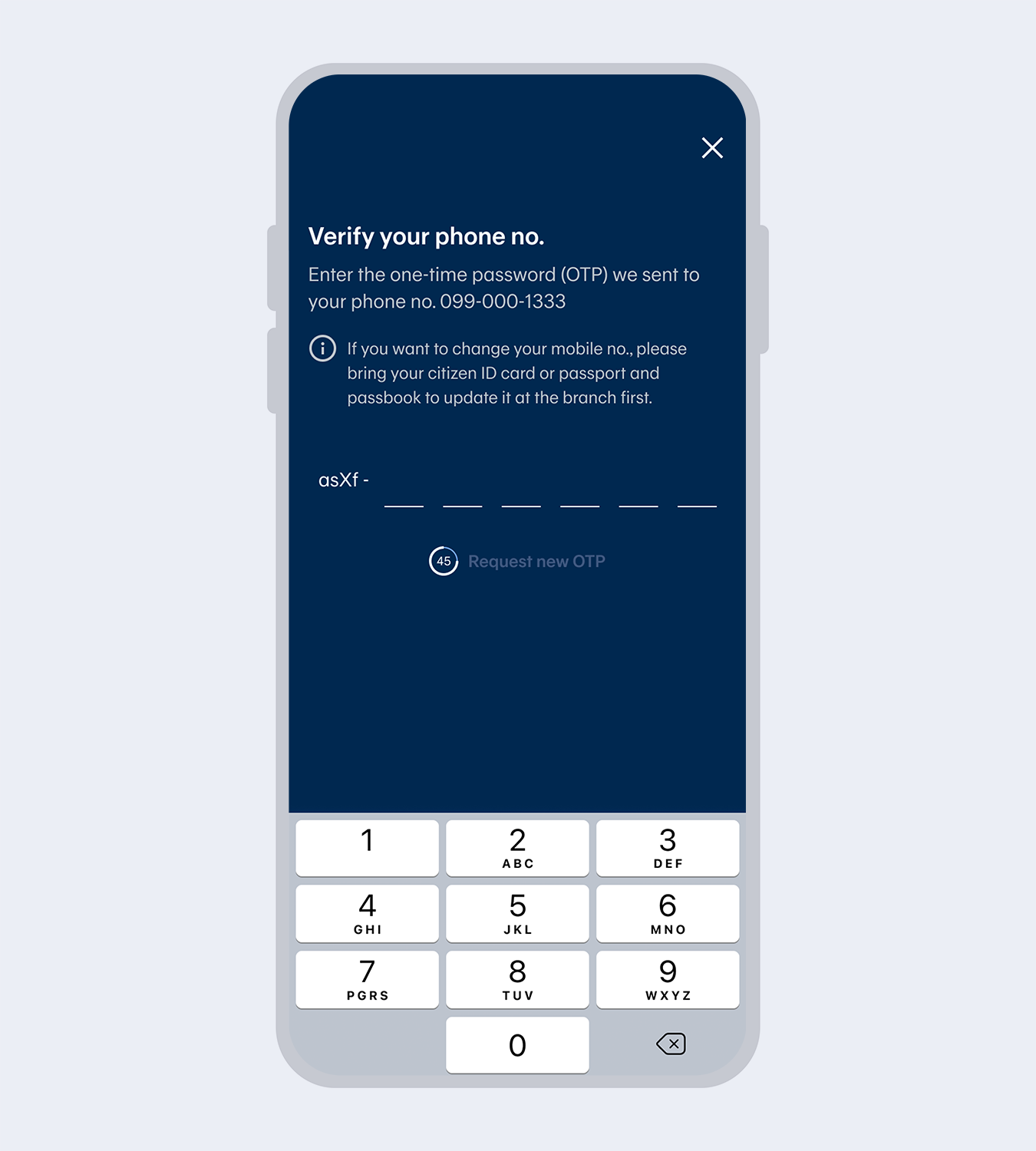

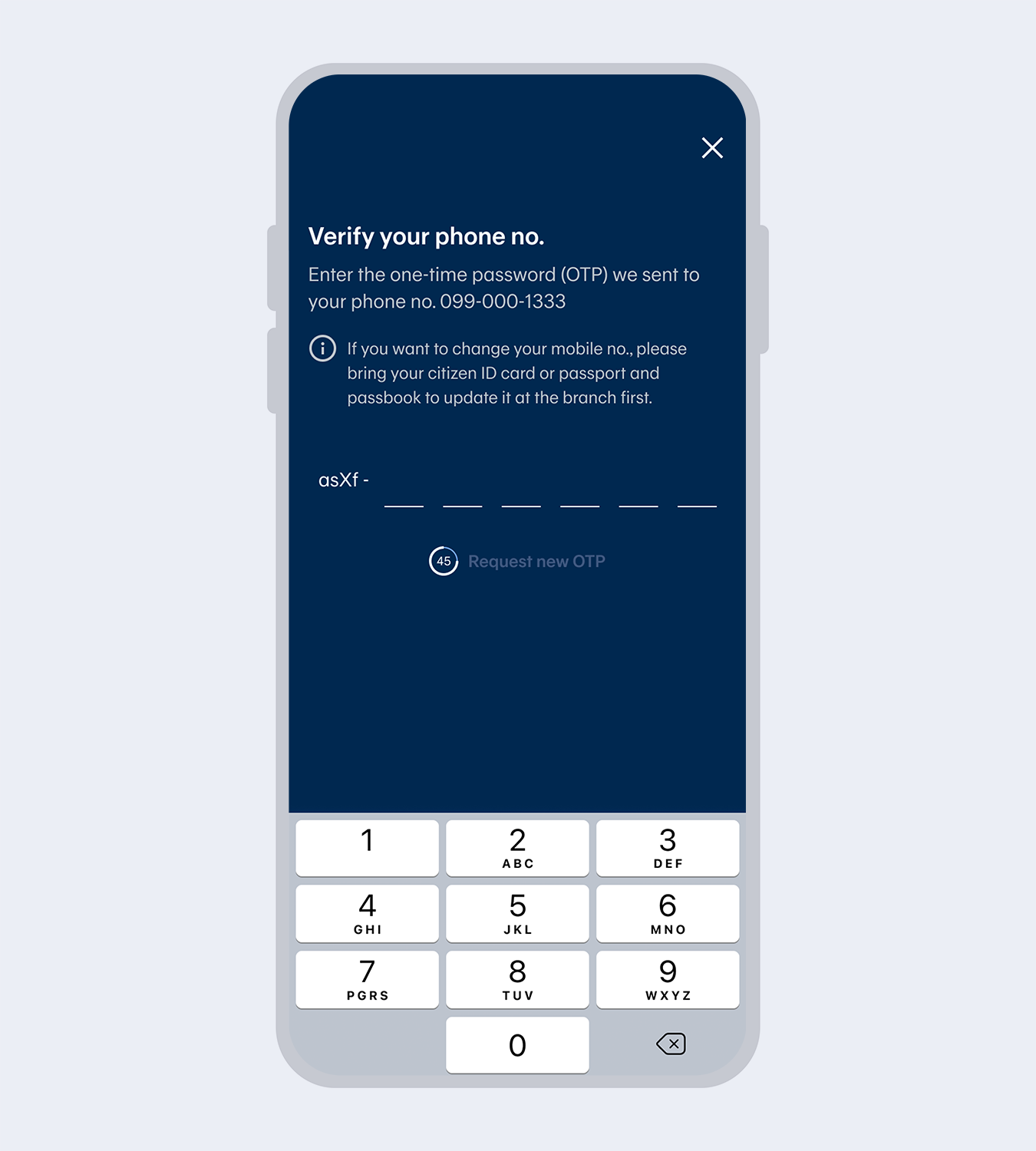

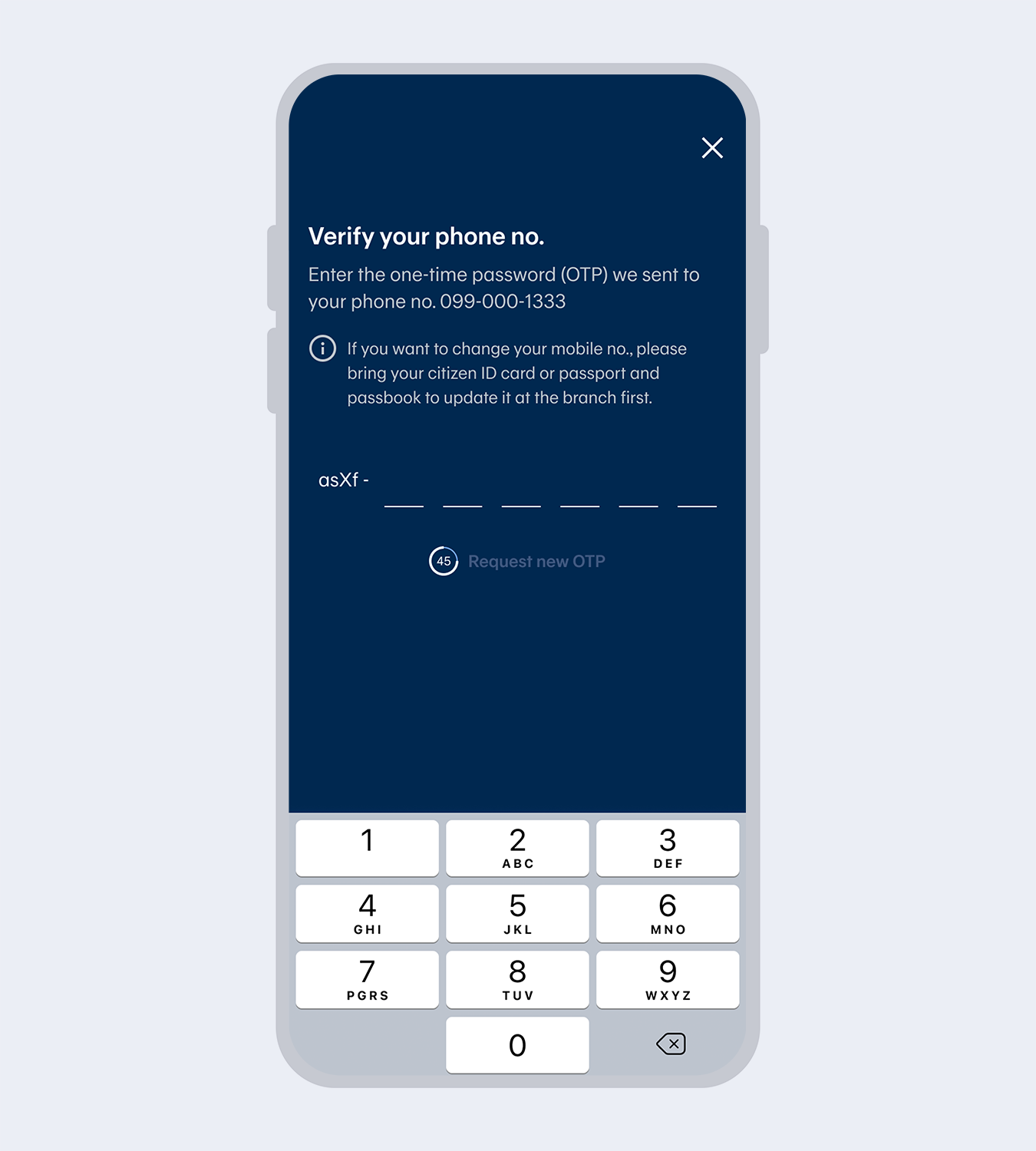

Enter the One Time Password (OTP) from the SMS to verify your mobile no.Note: The mobile number will be drawn automatically from the SIM card for service registration purposes.

The mobile number must match the one you have provided to the Bank.

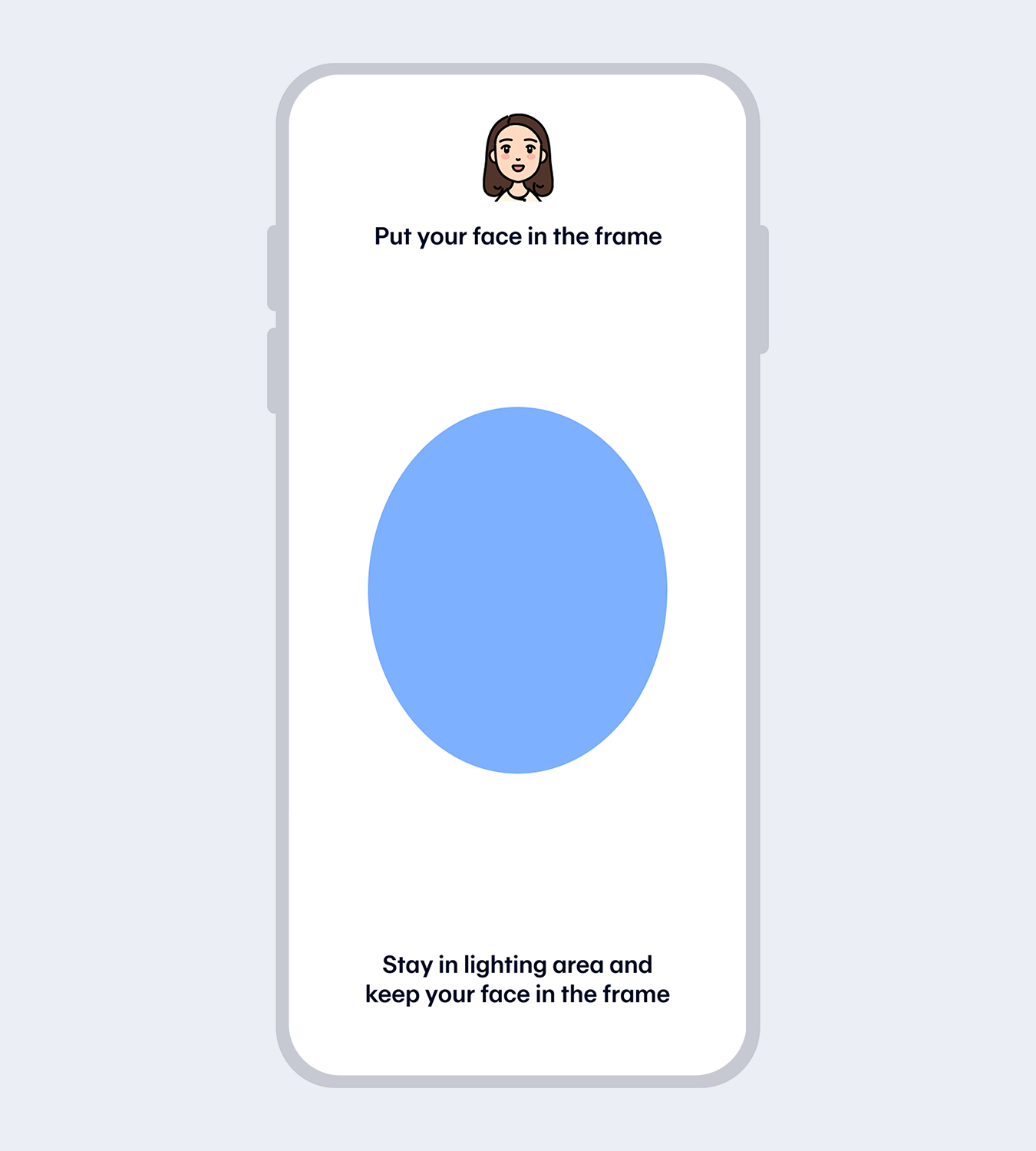

7.

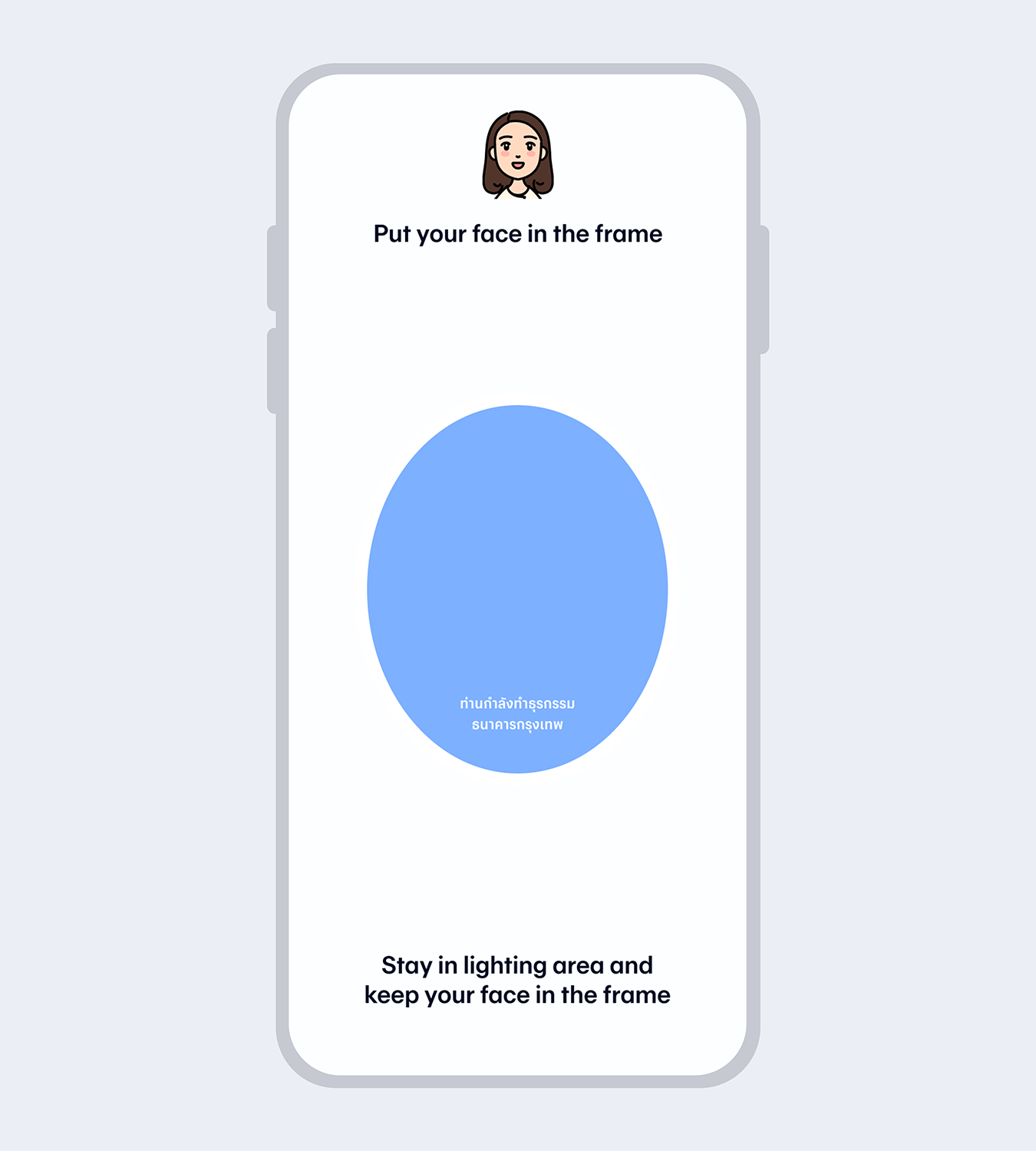

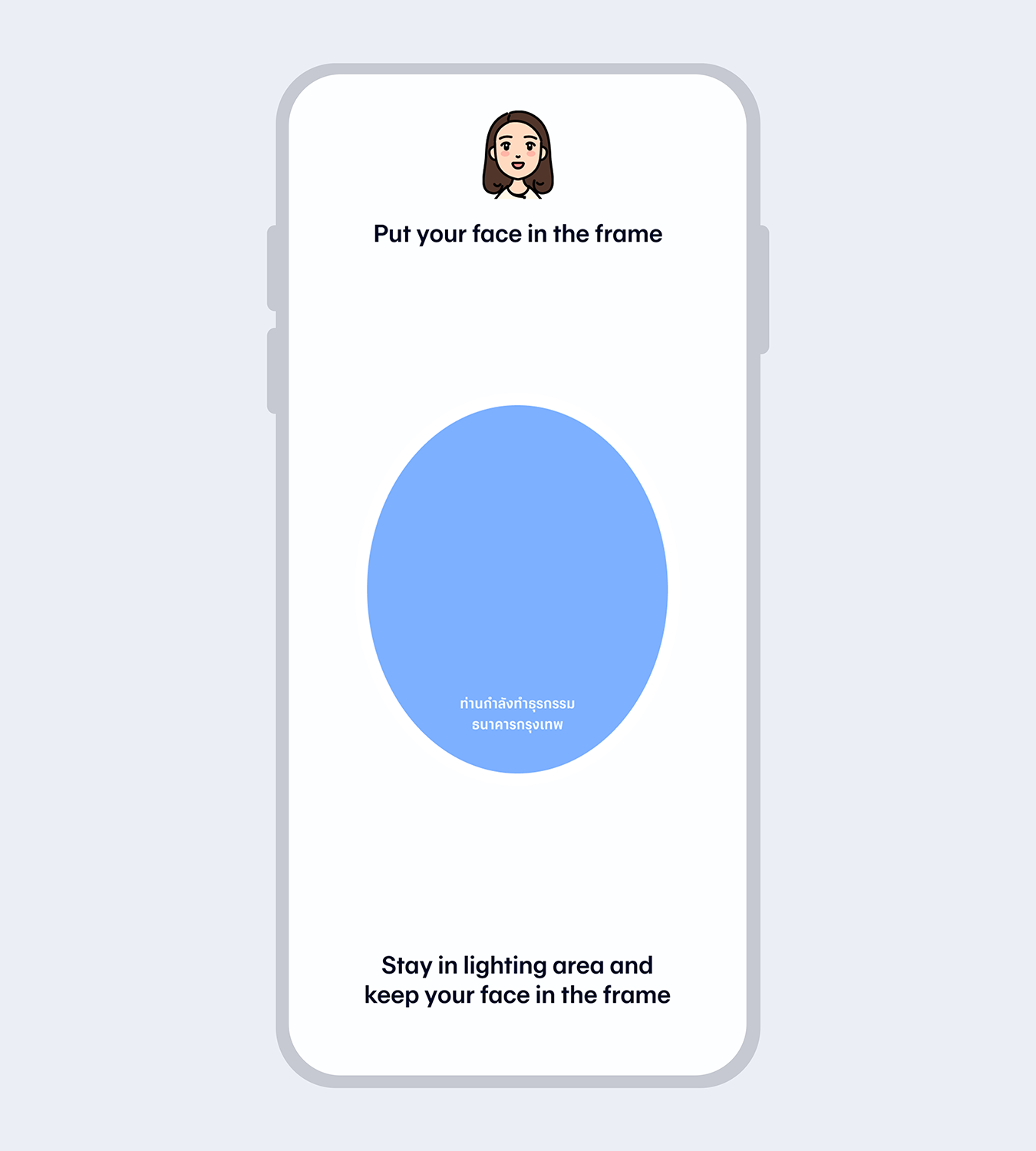

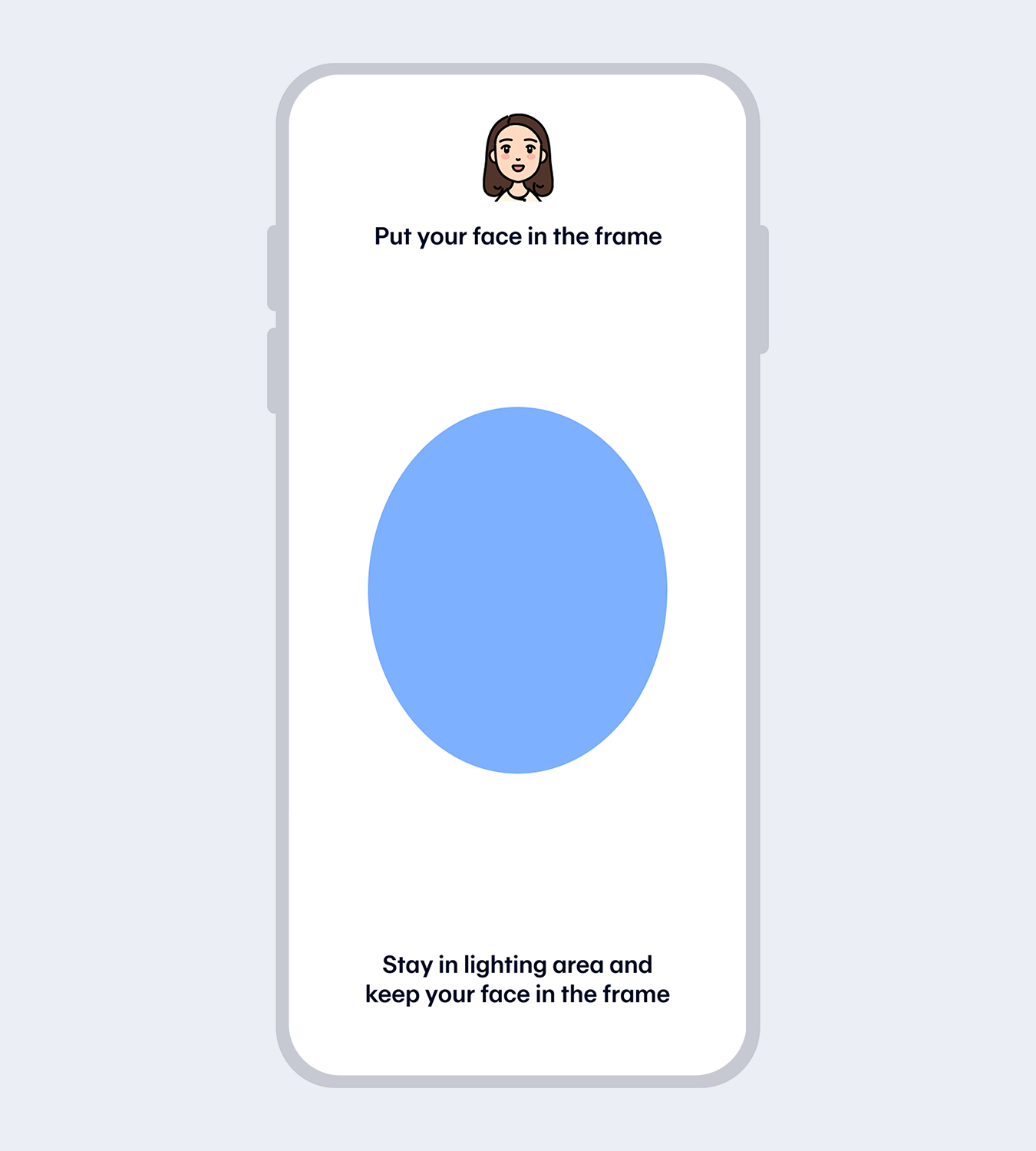

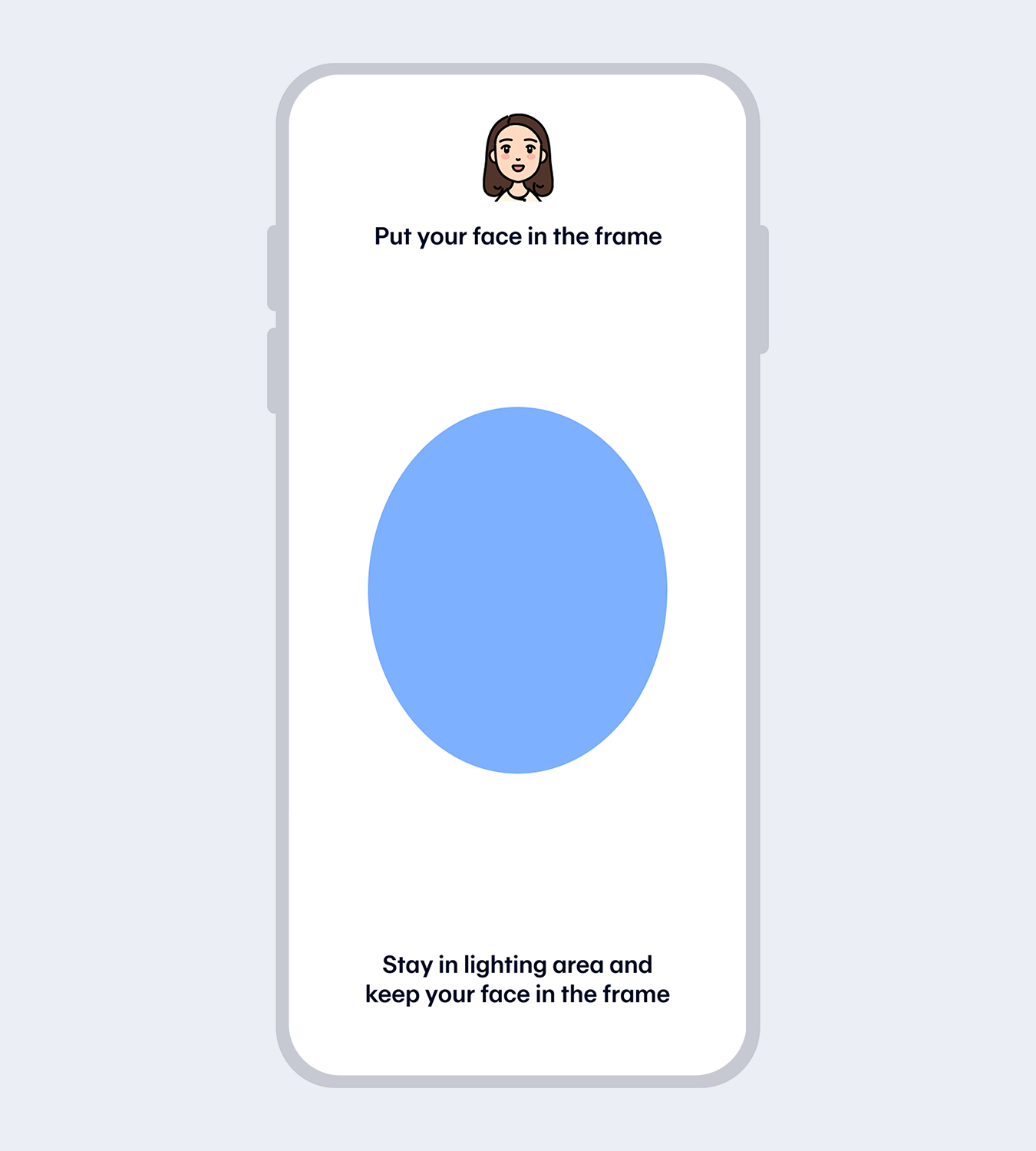

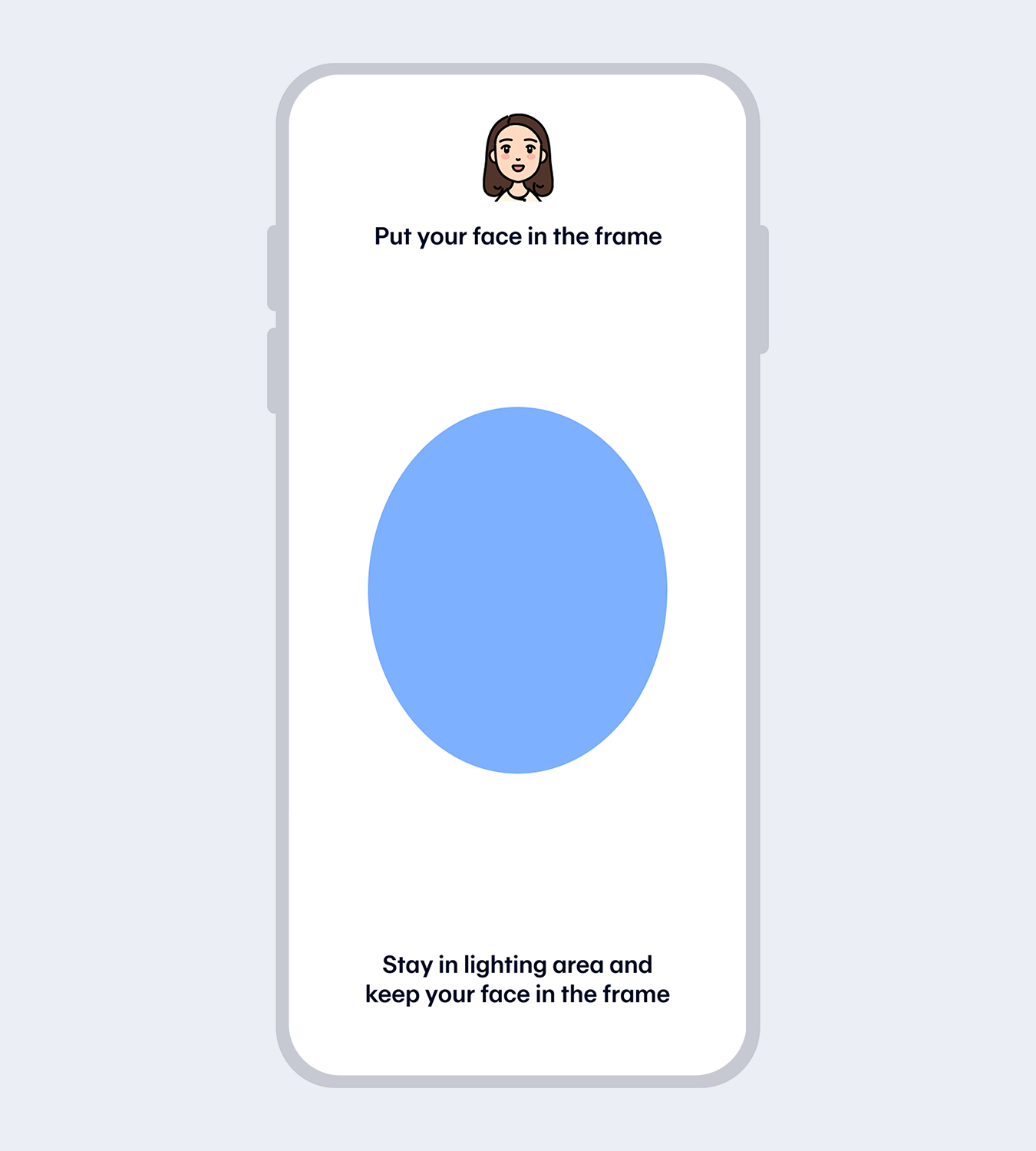

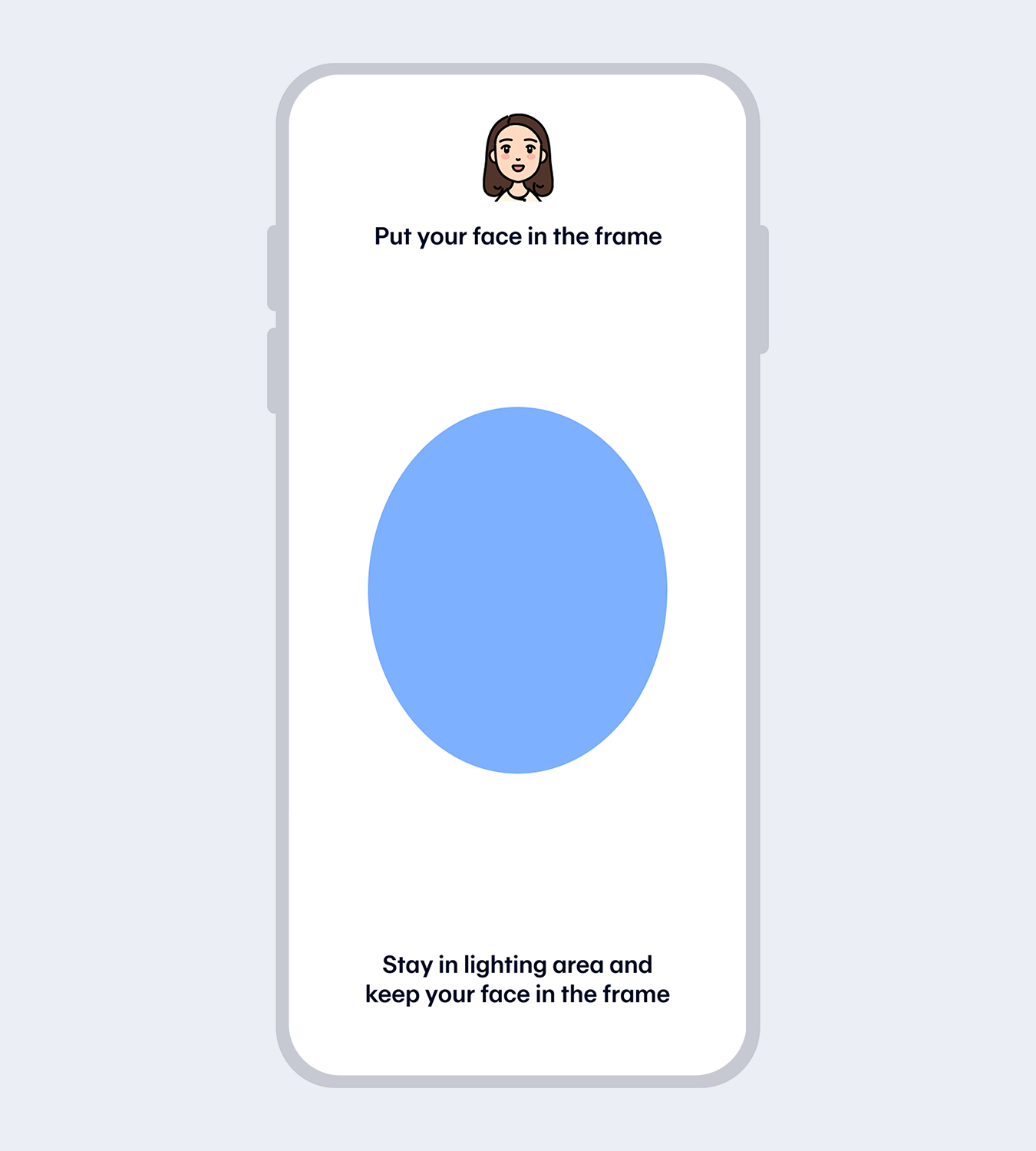

Verify your identity with facial recognition.

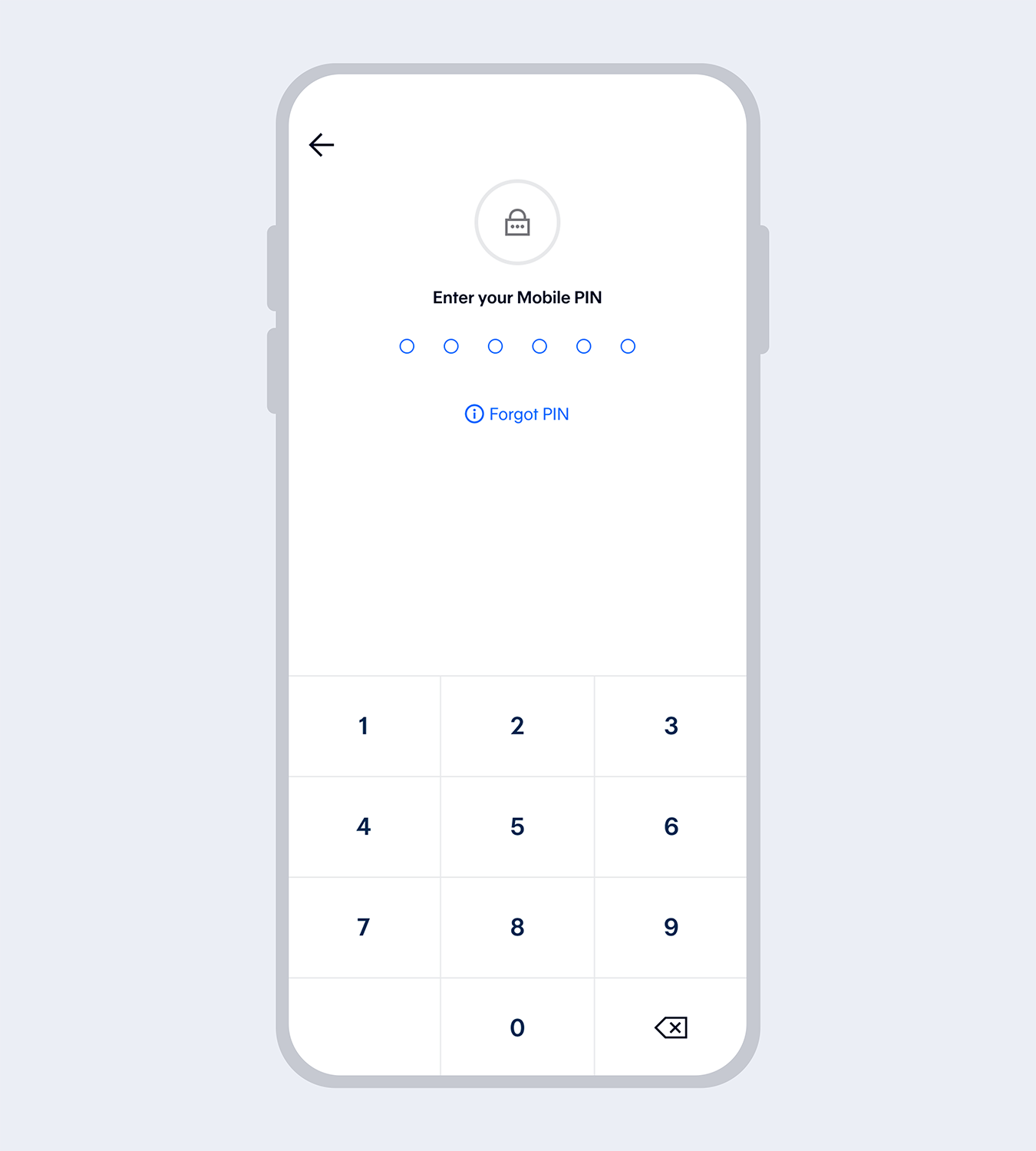

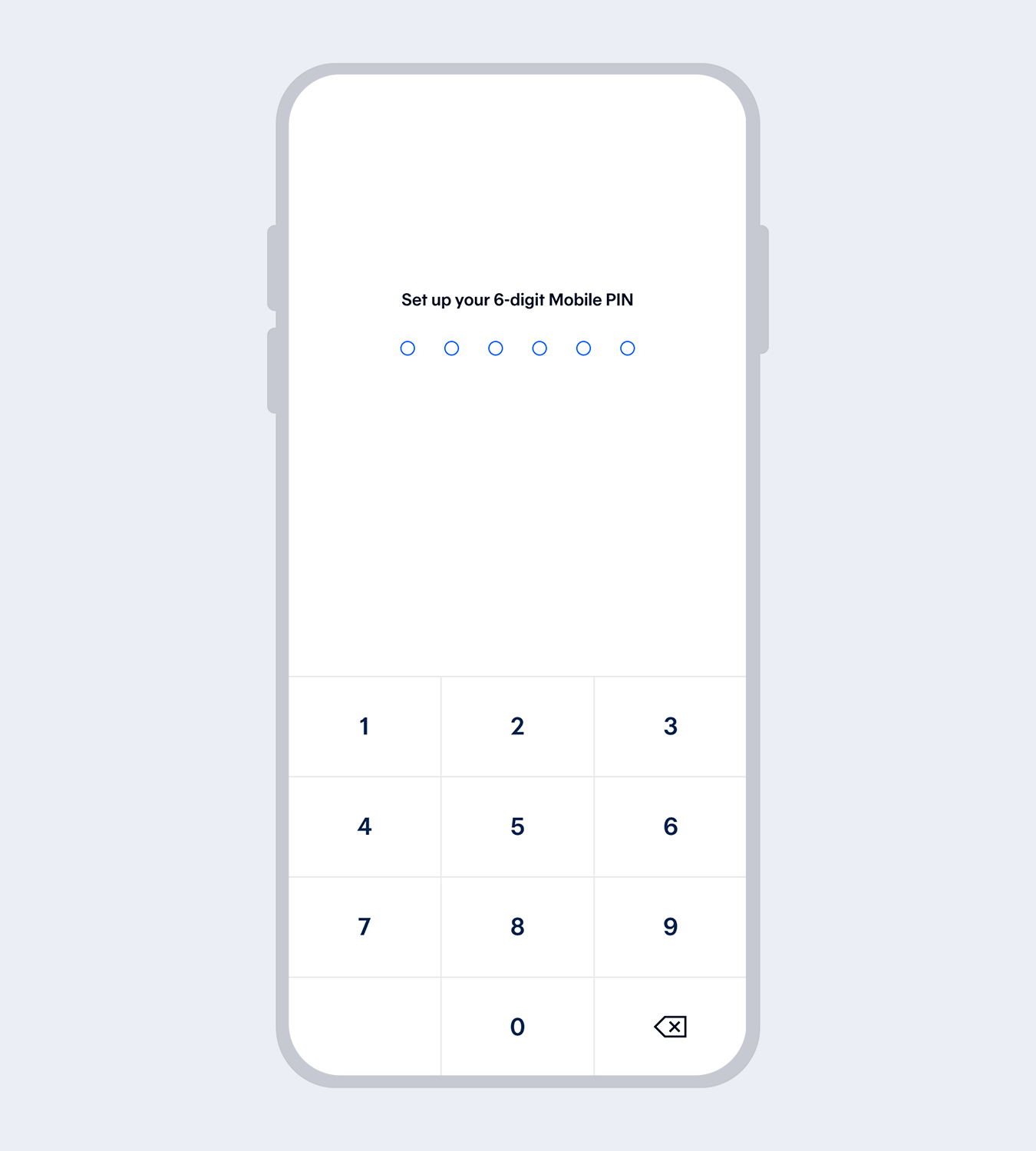

8.

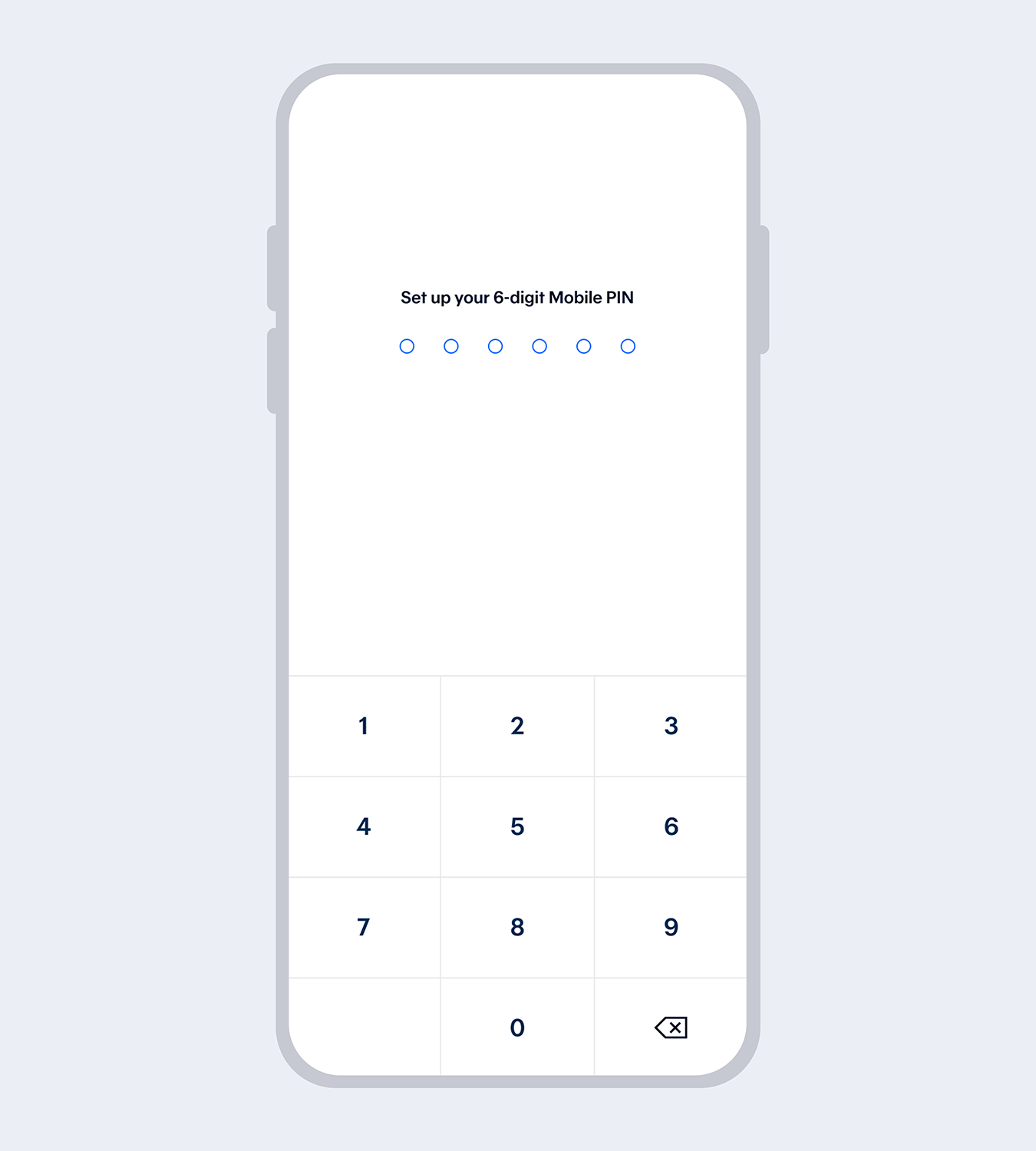

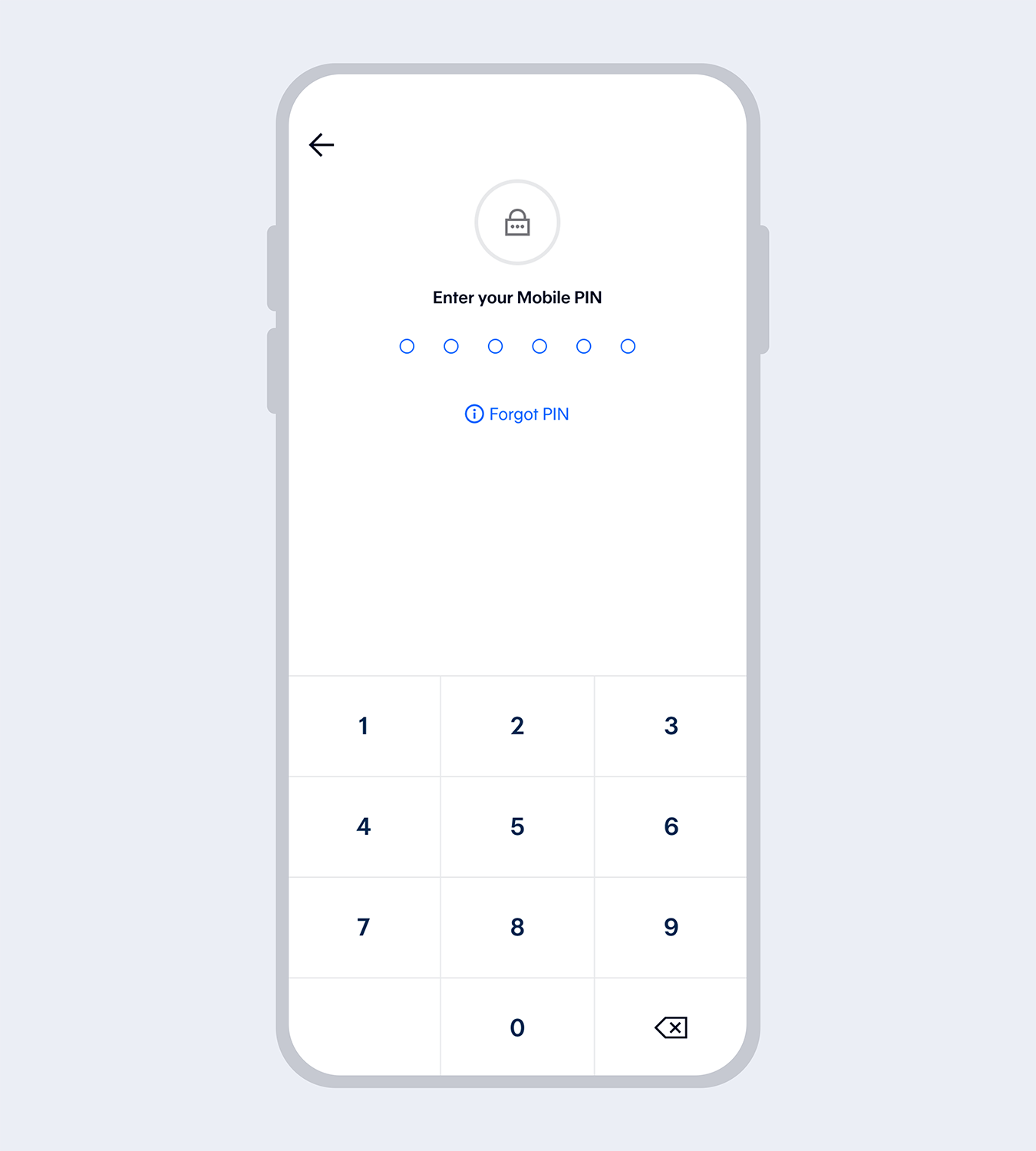

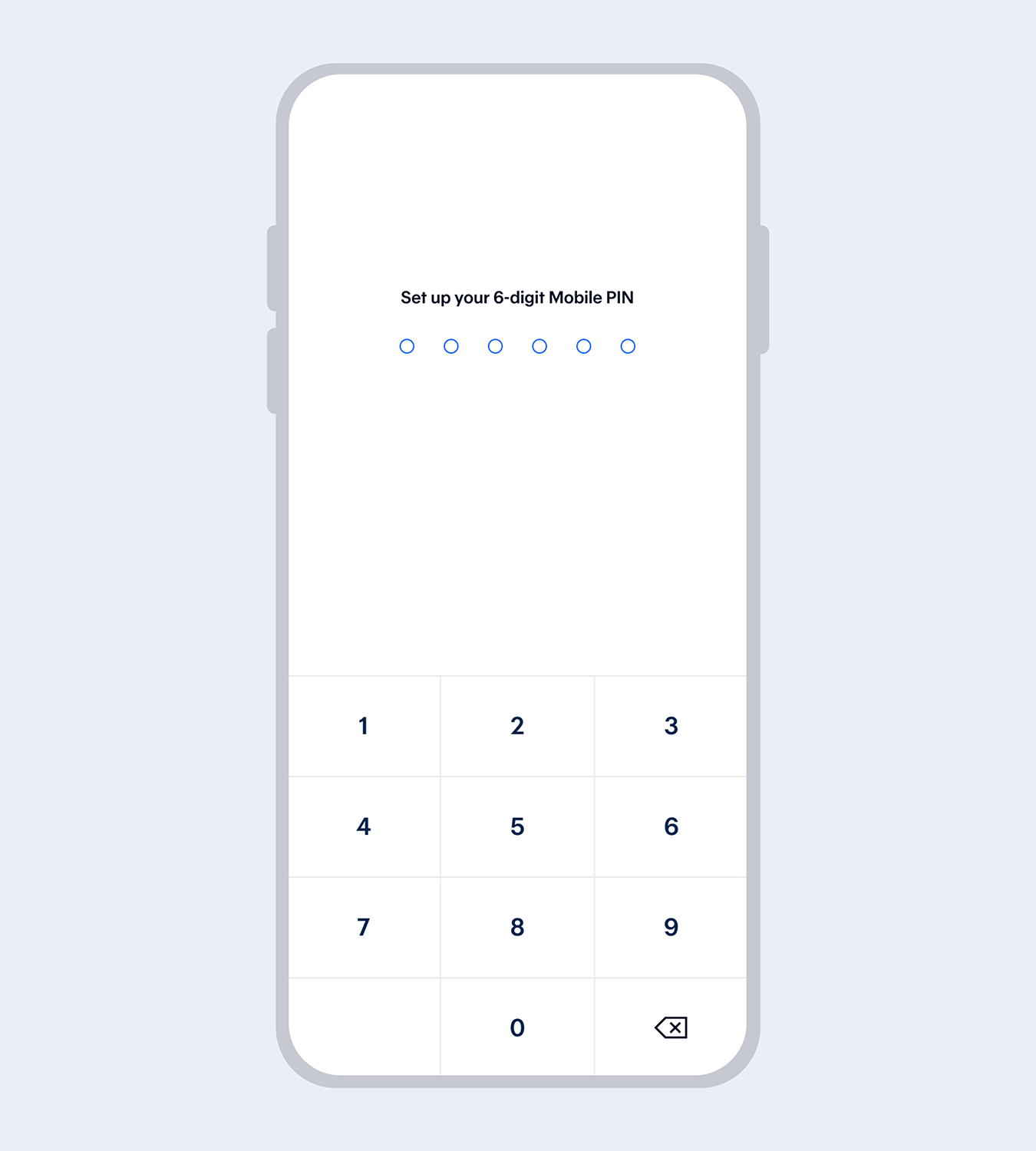

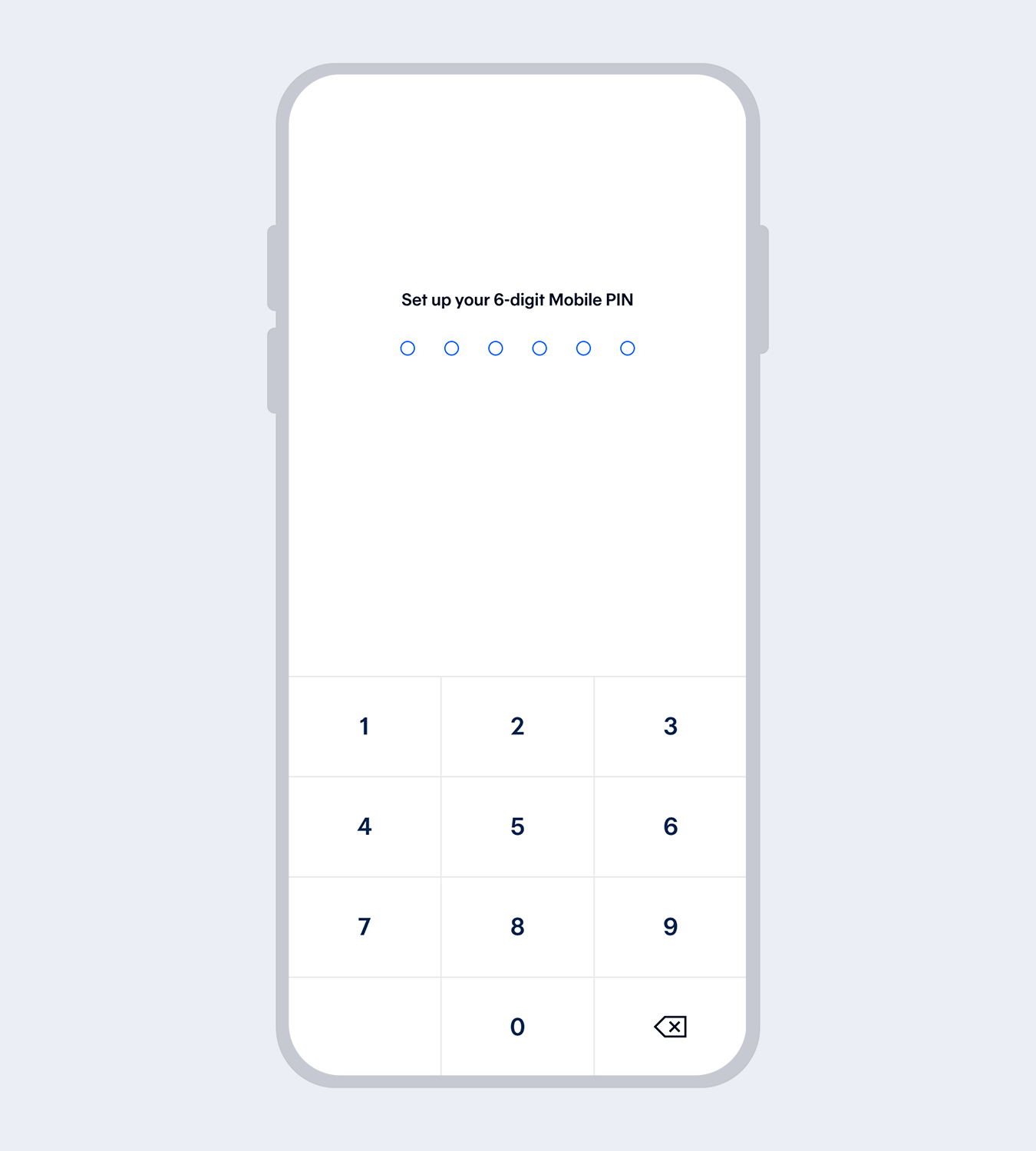

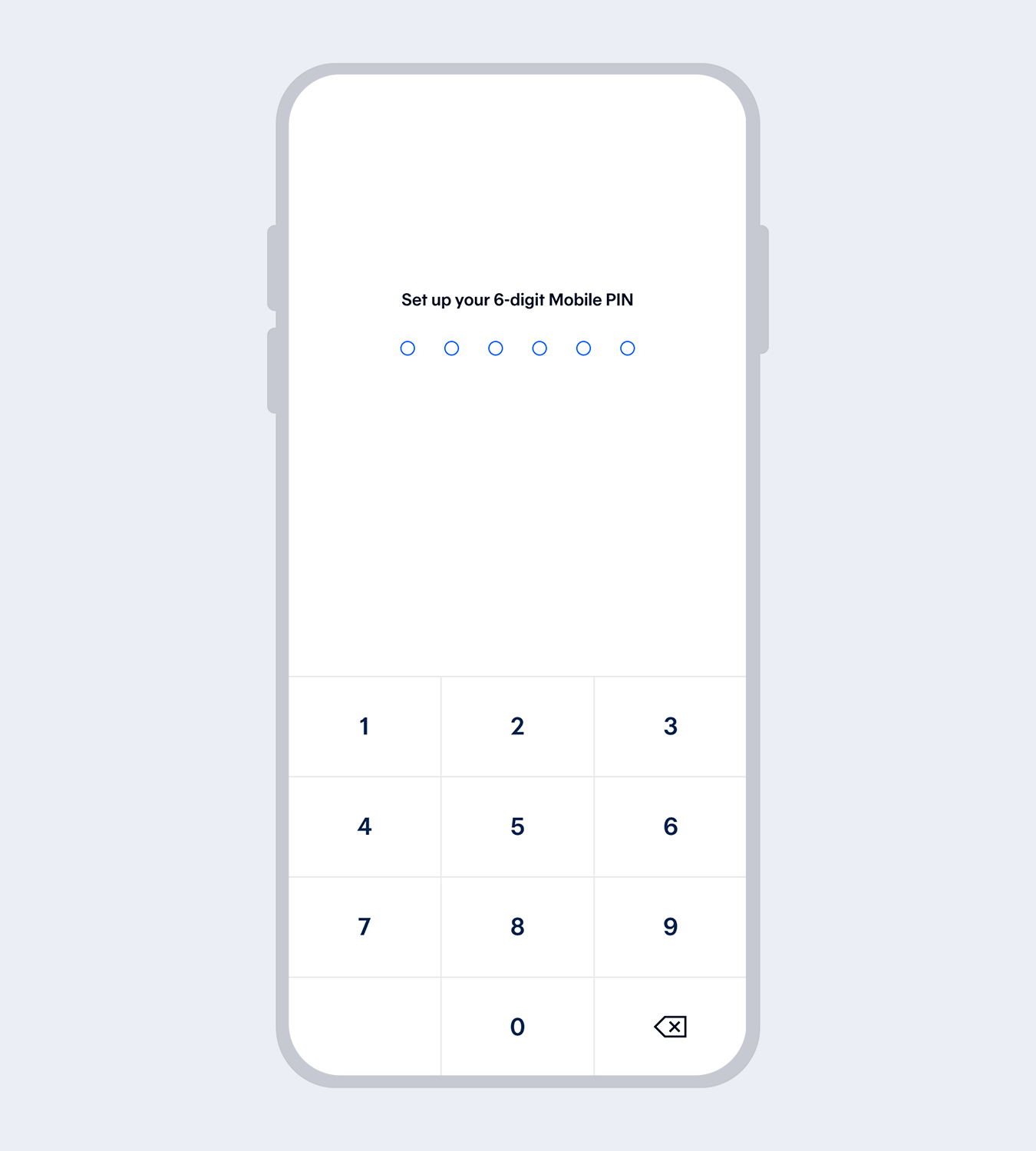

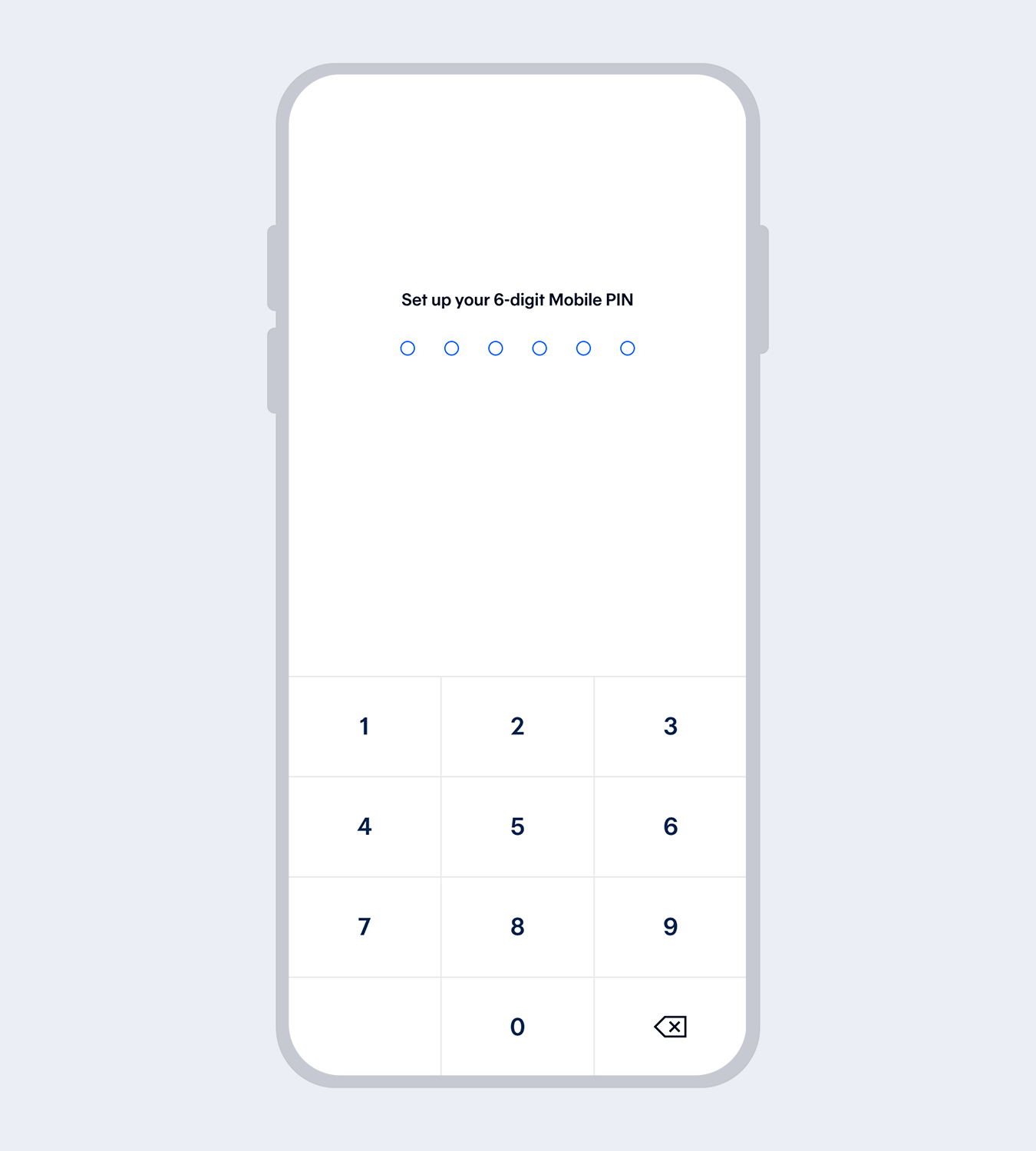

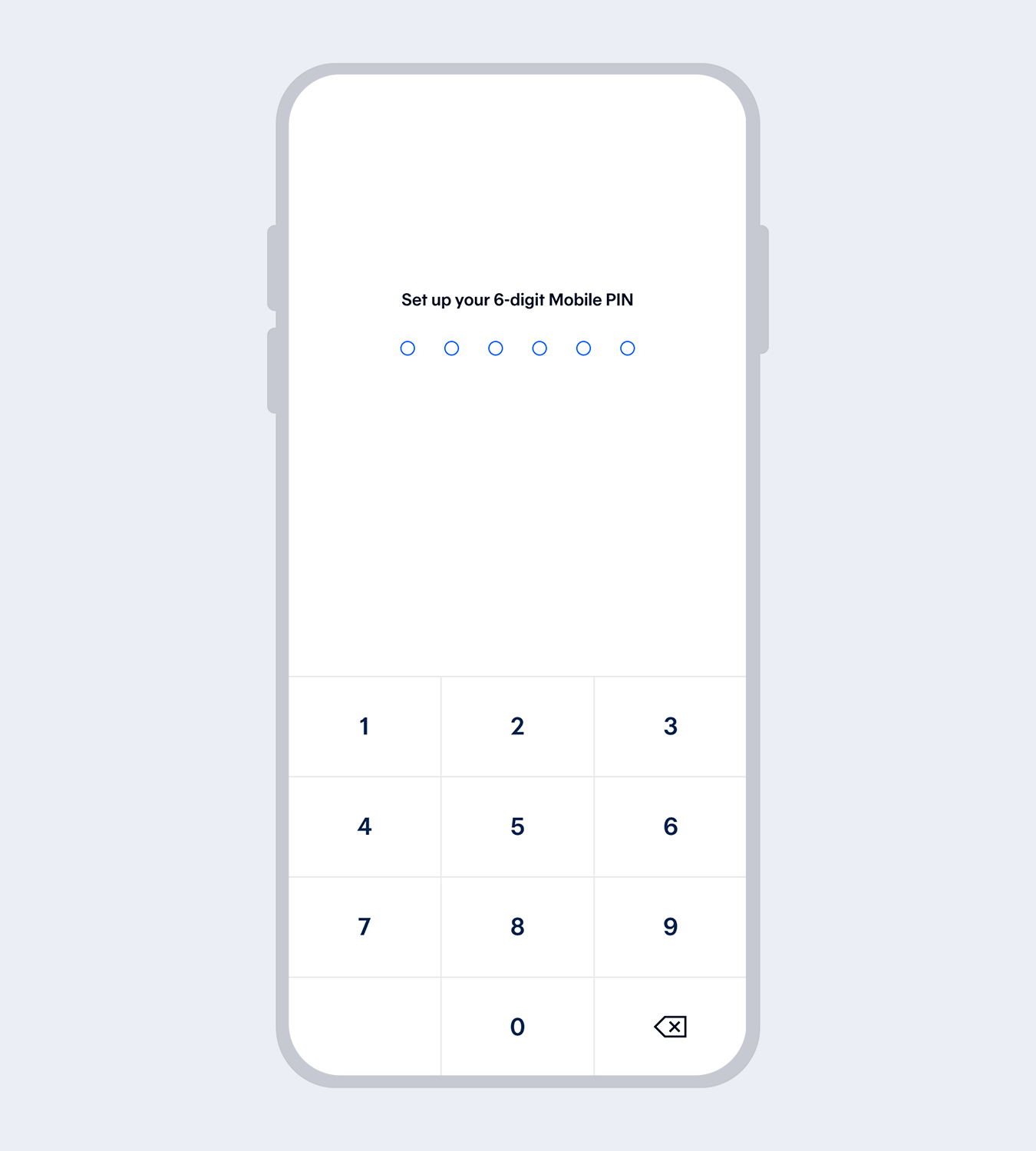

Set up your 6-digit Mobile PIN and re-enter to reconfirm.

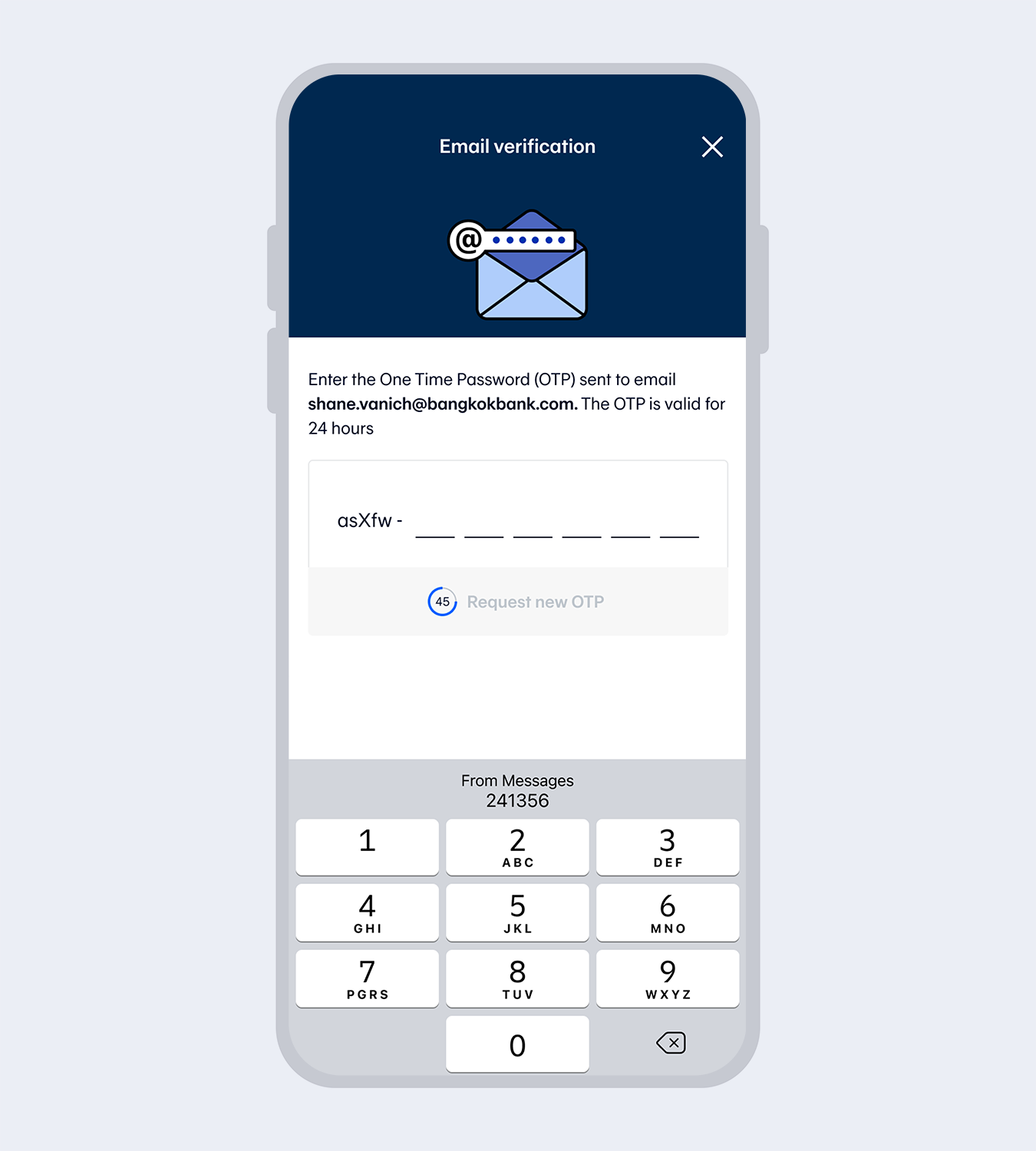

9.

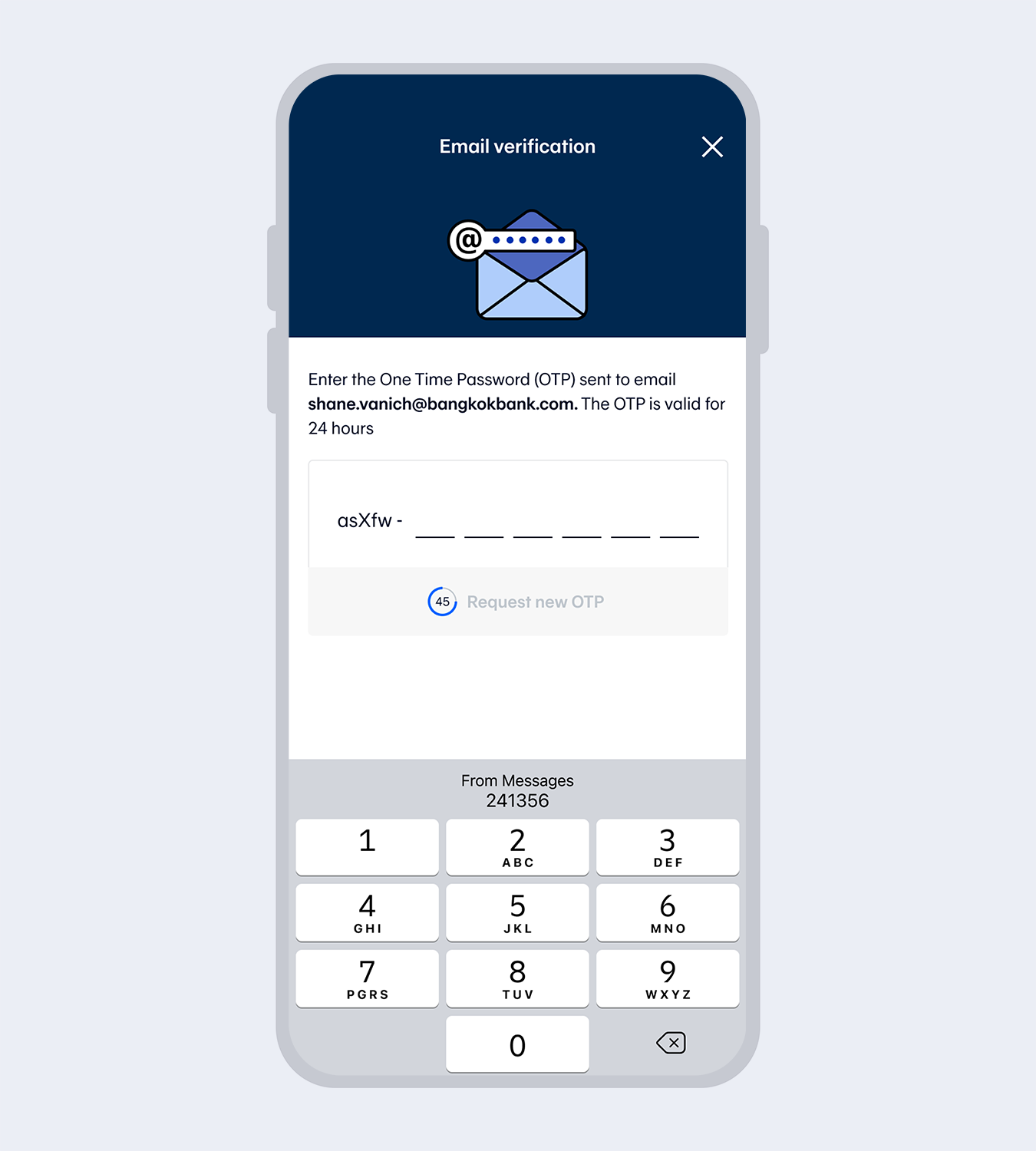

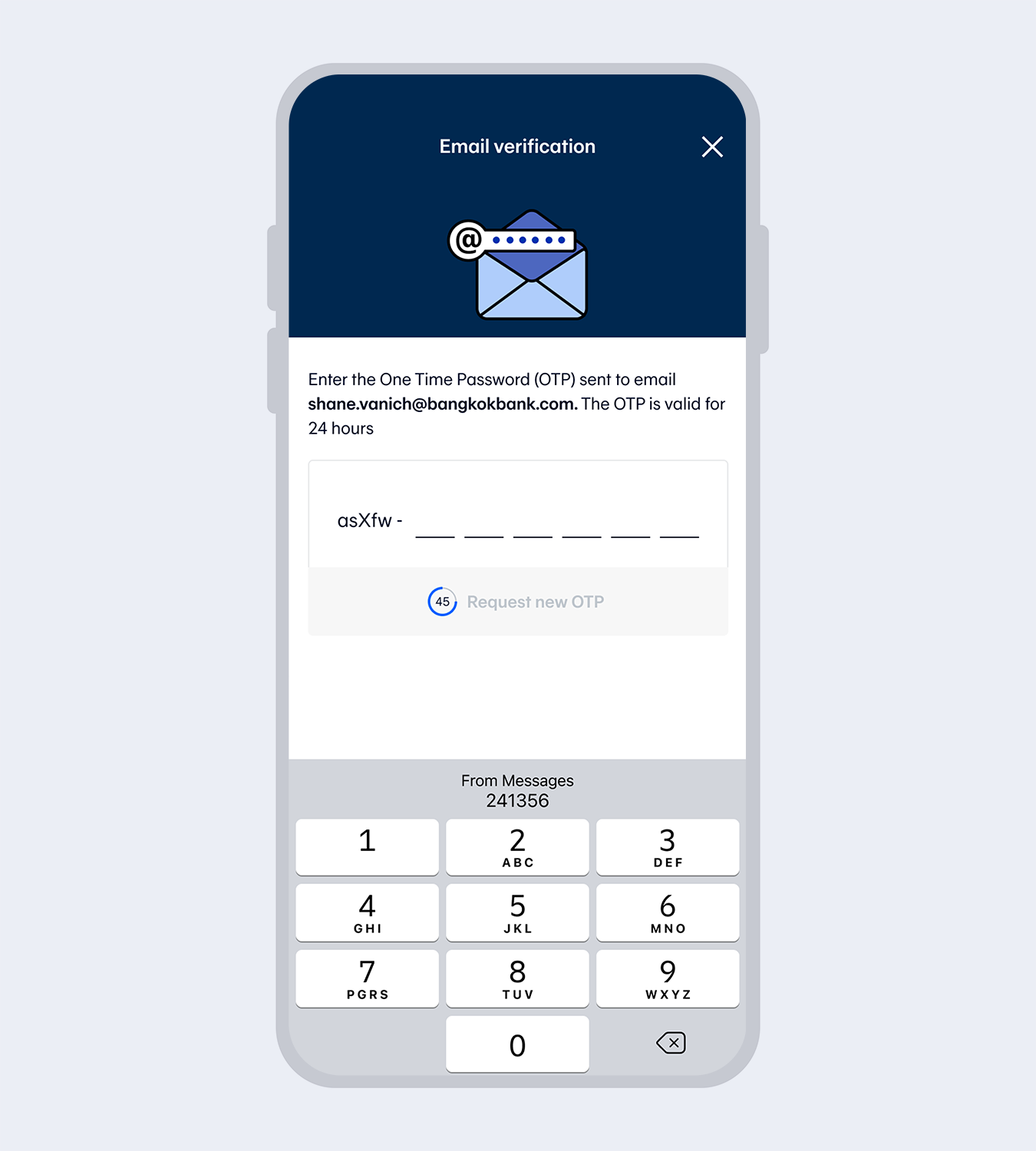

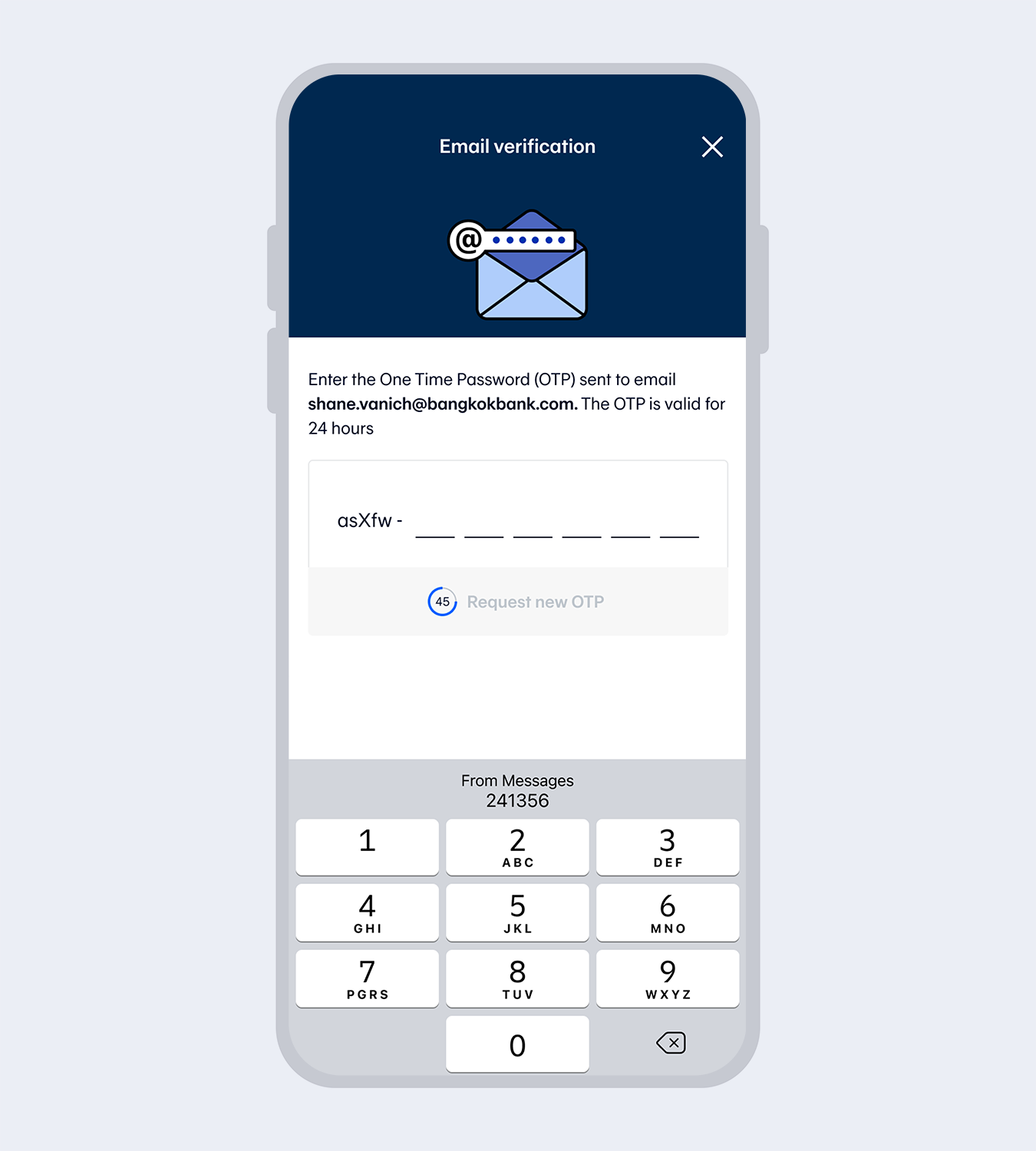

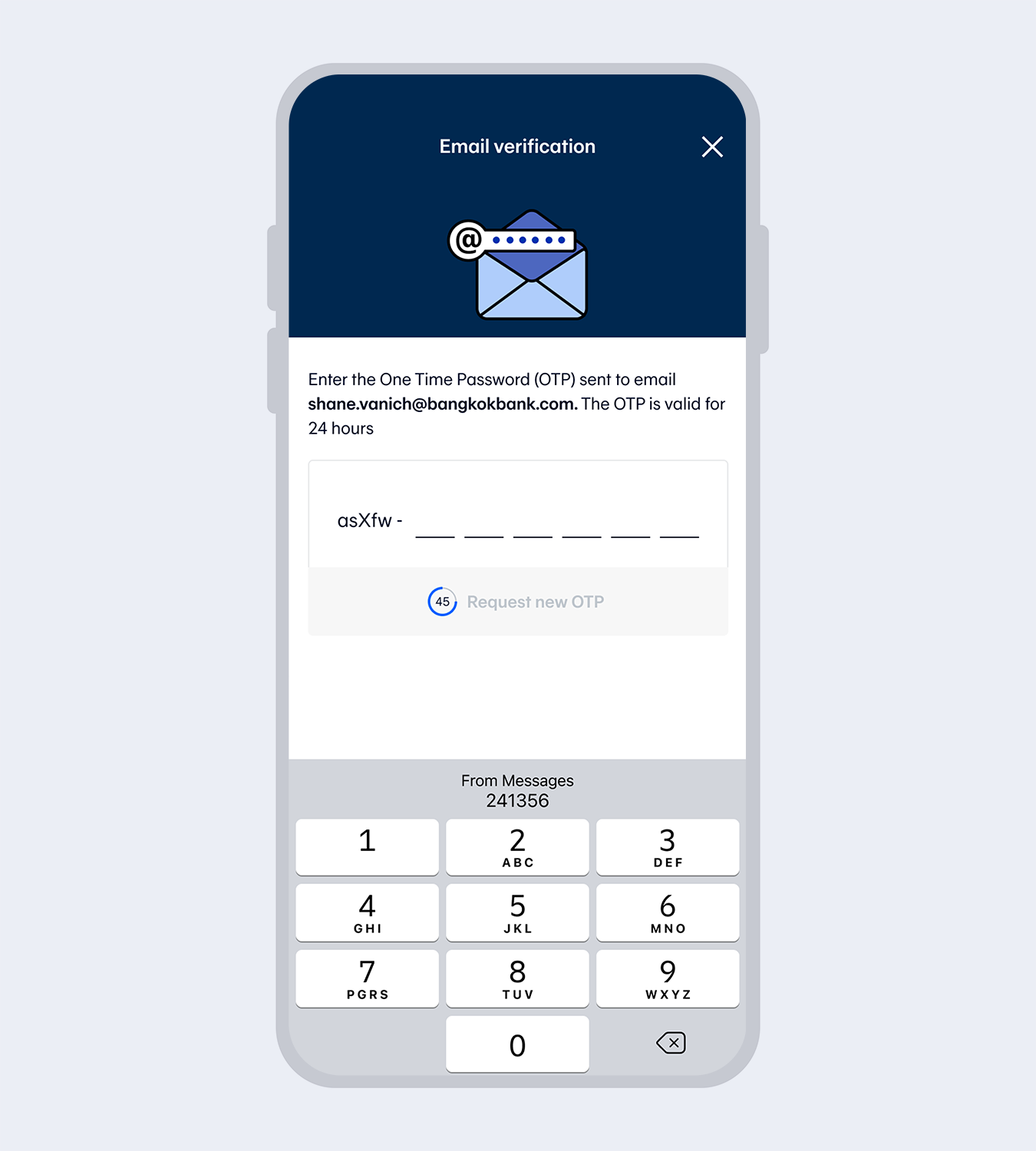

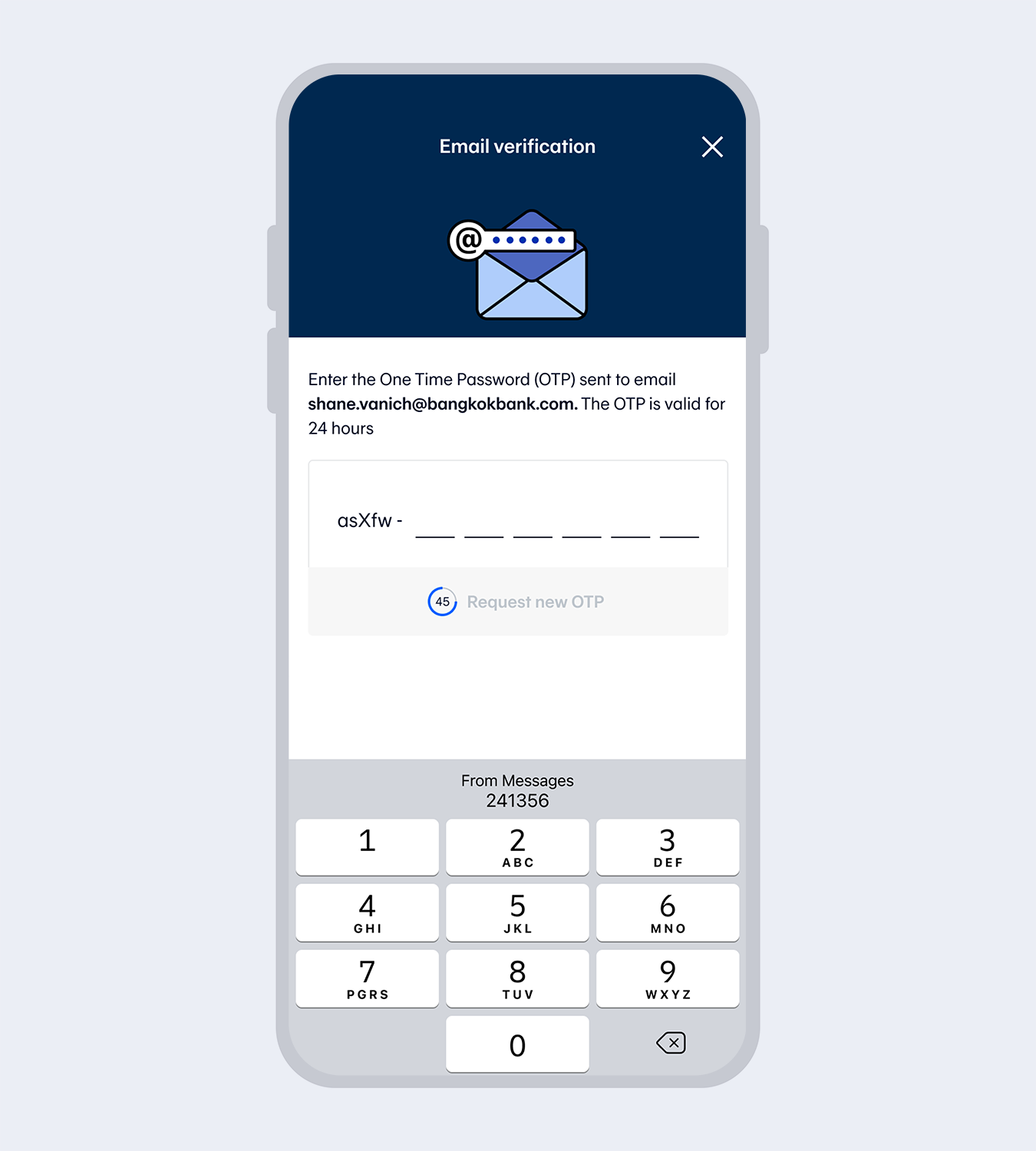

Enter email (if any) and the One Time Password (OTP) sent to your email to verify.

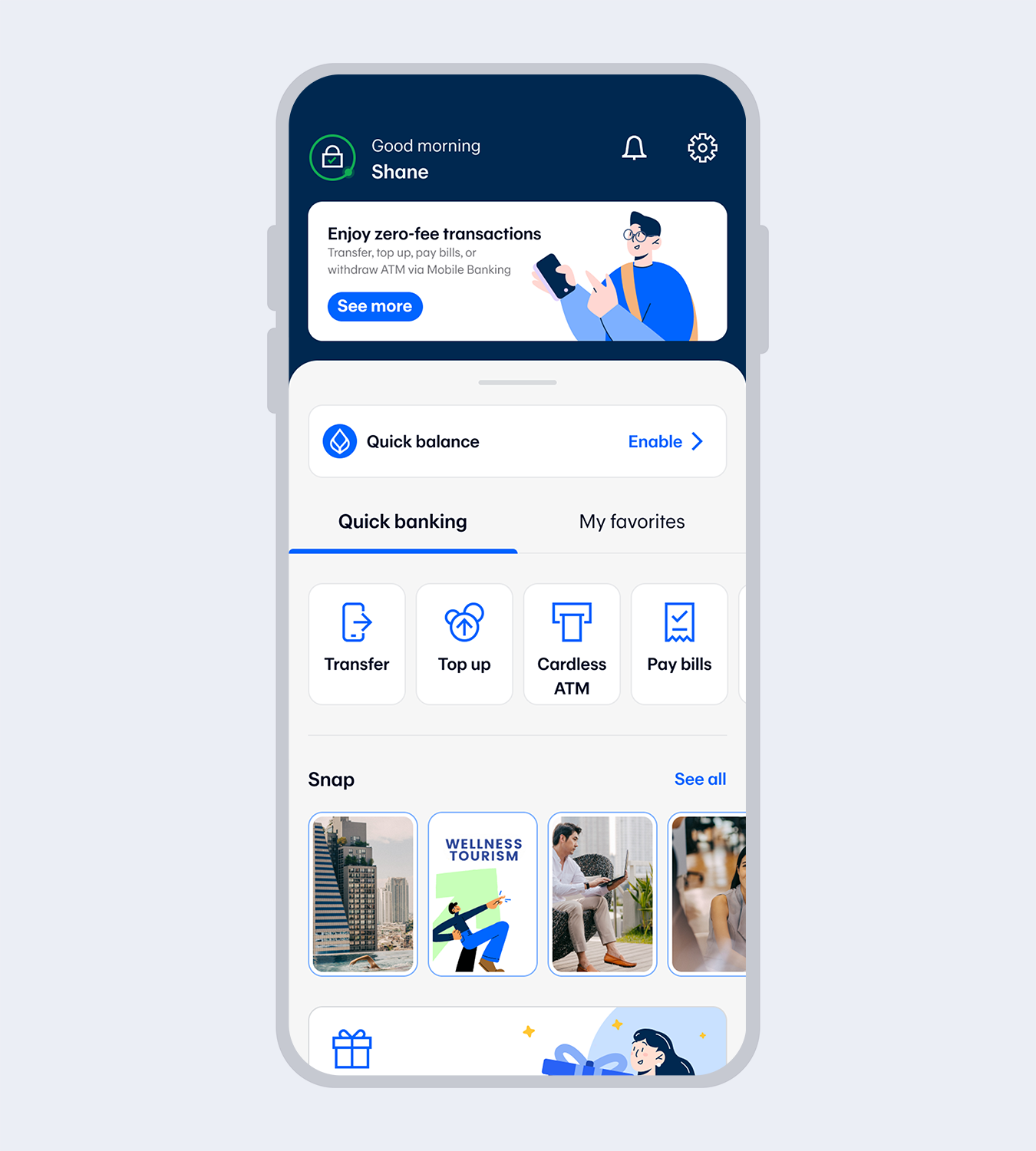

10.

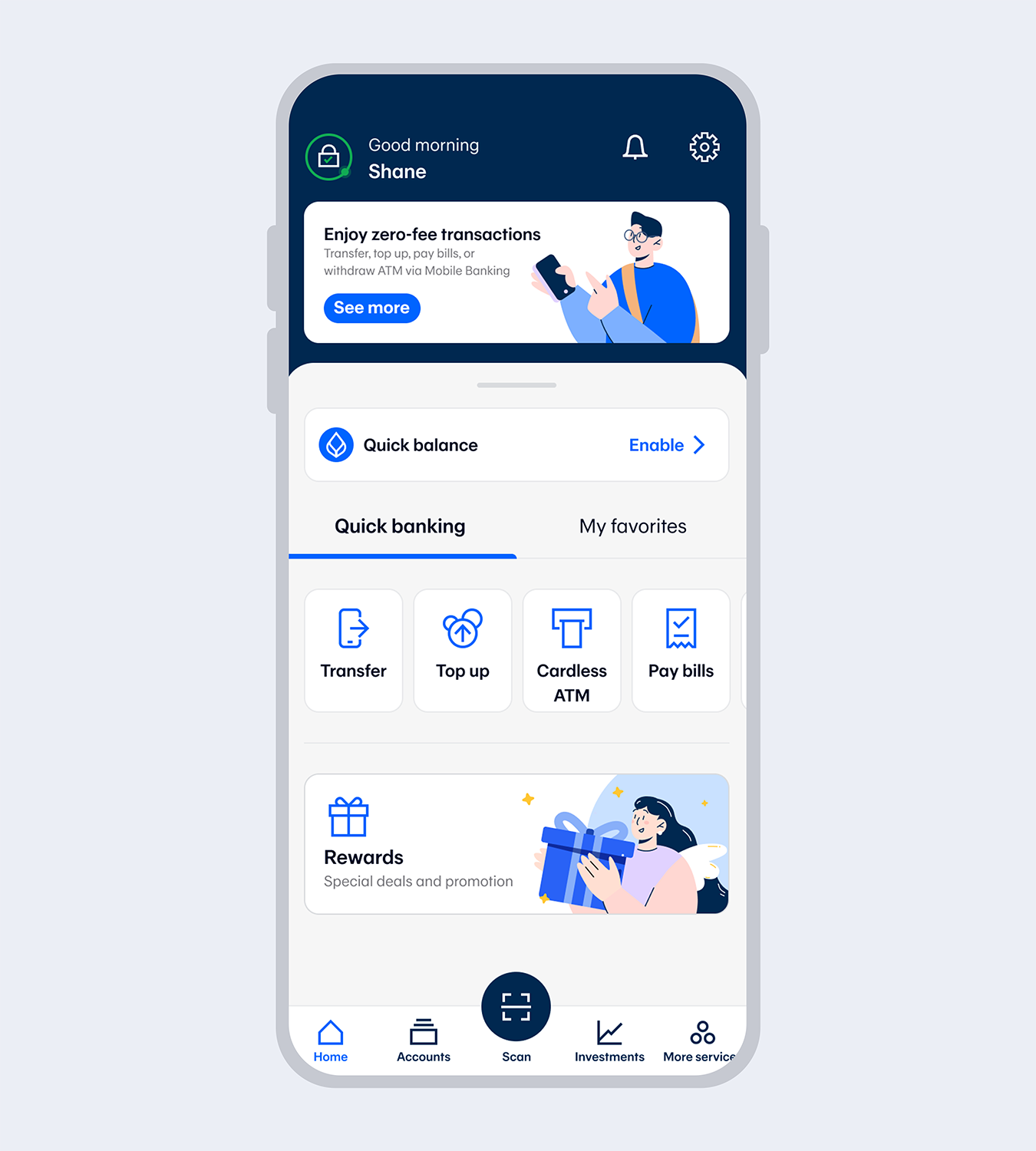

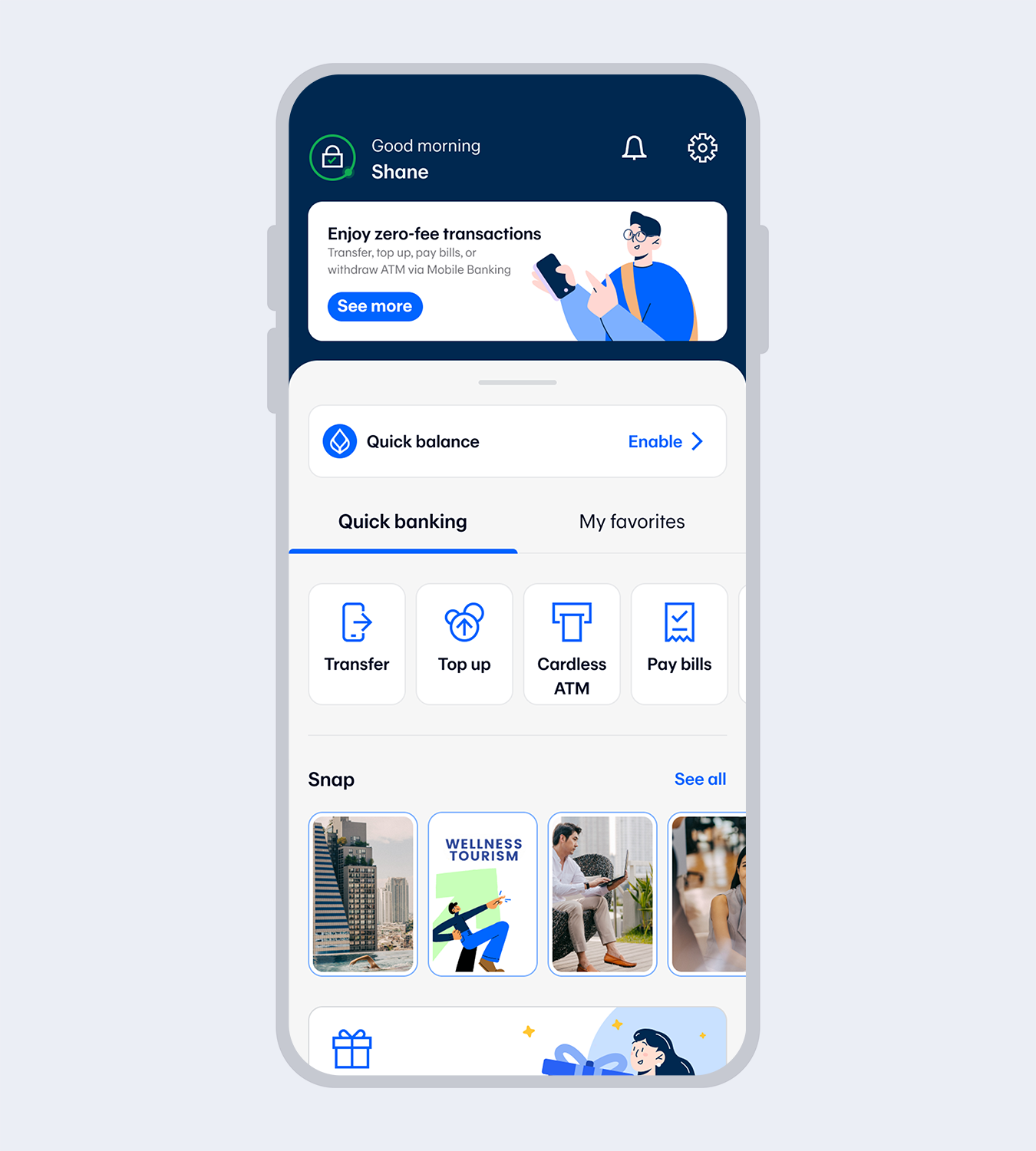

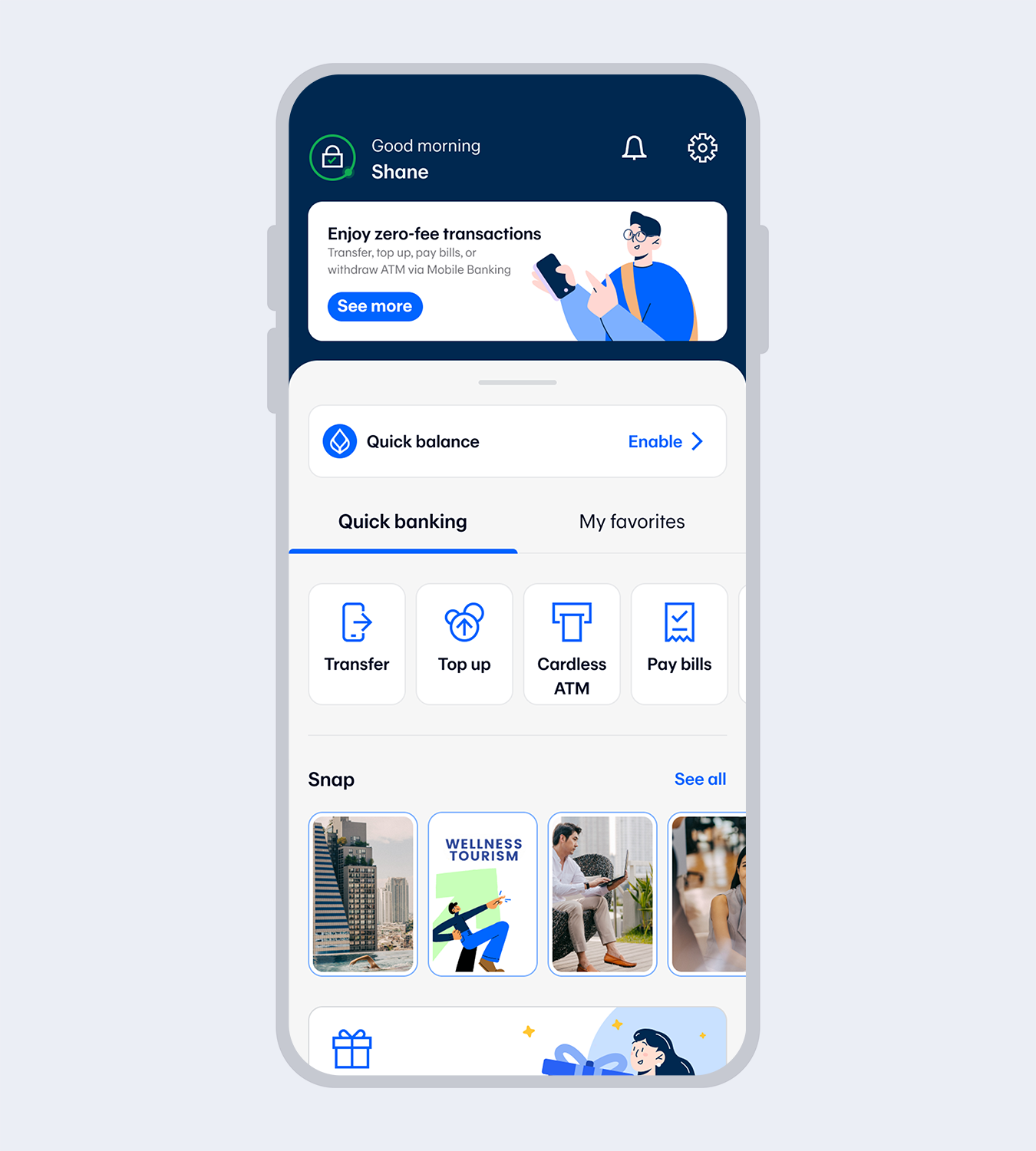

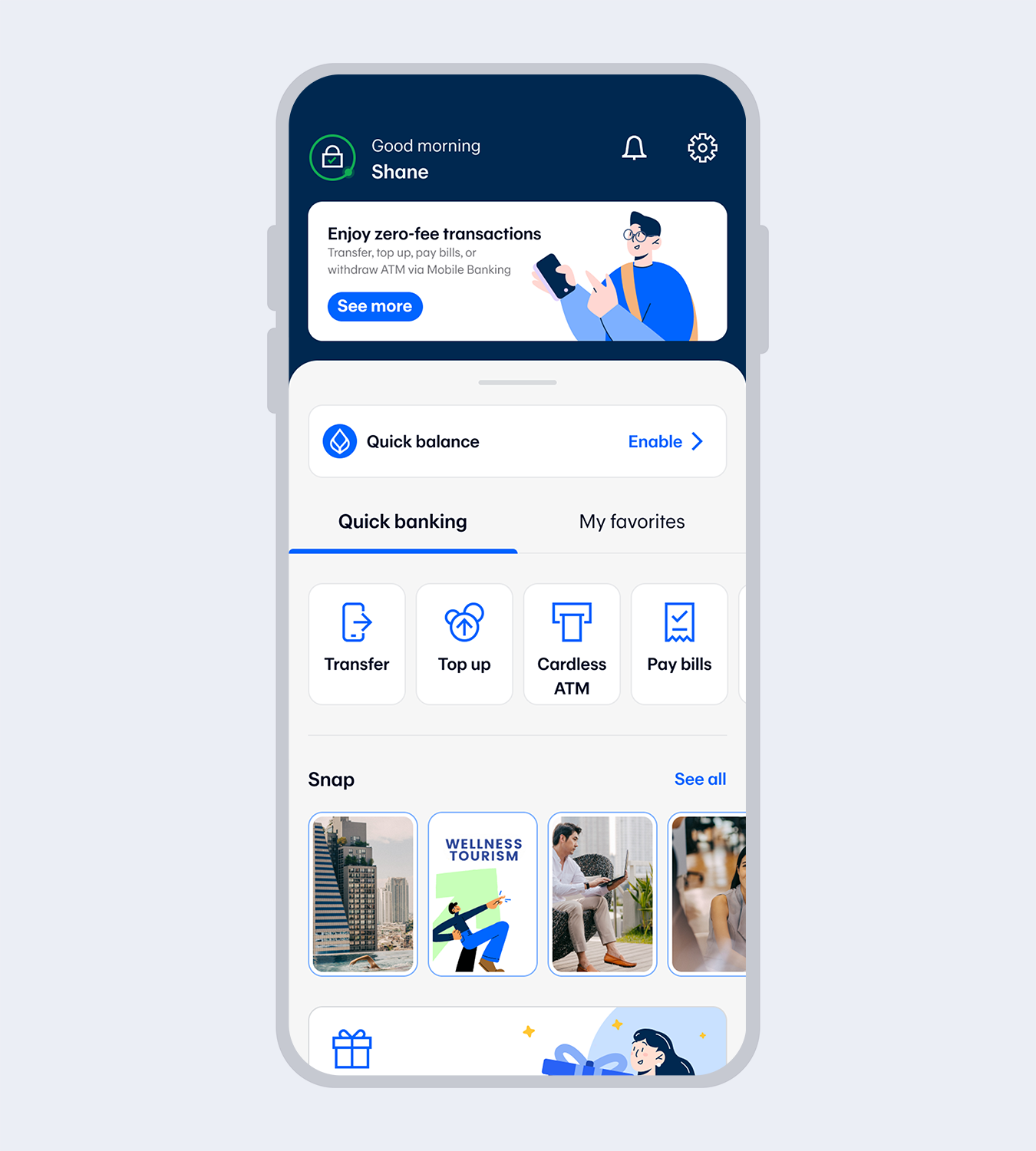

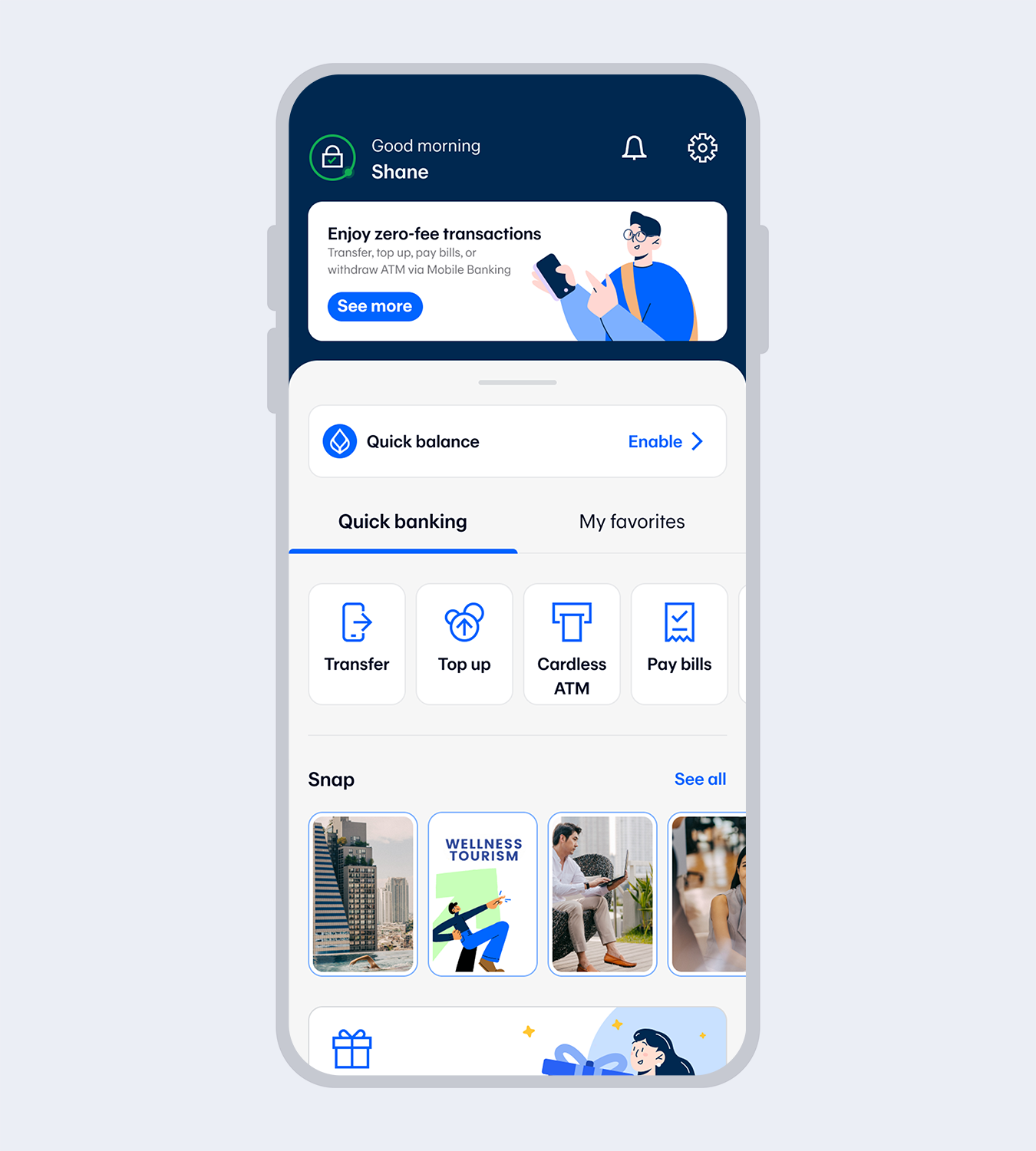

Application successful. You’re all set!

1.

Download Bangkok Bank Mobile Banking.Select “Get started” if you have a Bangkok Bank debit card.

2.

Enter your Citizen ID no. and date of birth.*for Thai citizens only.

3.

Read and accept the terms and conditions.

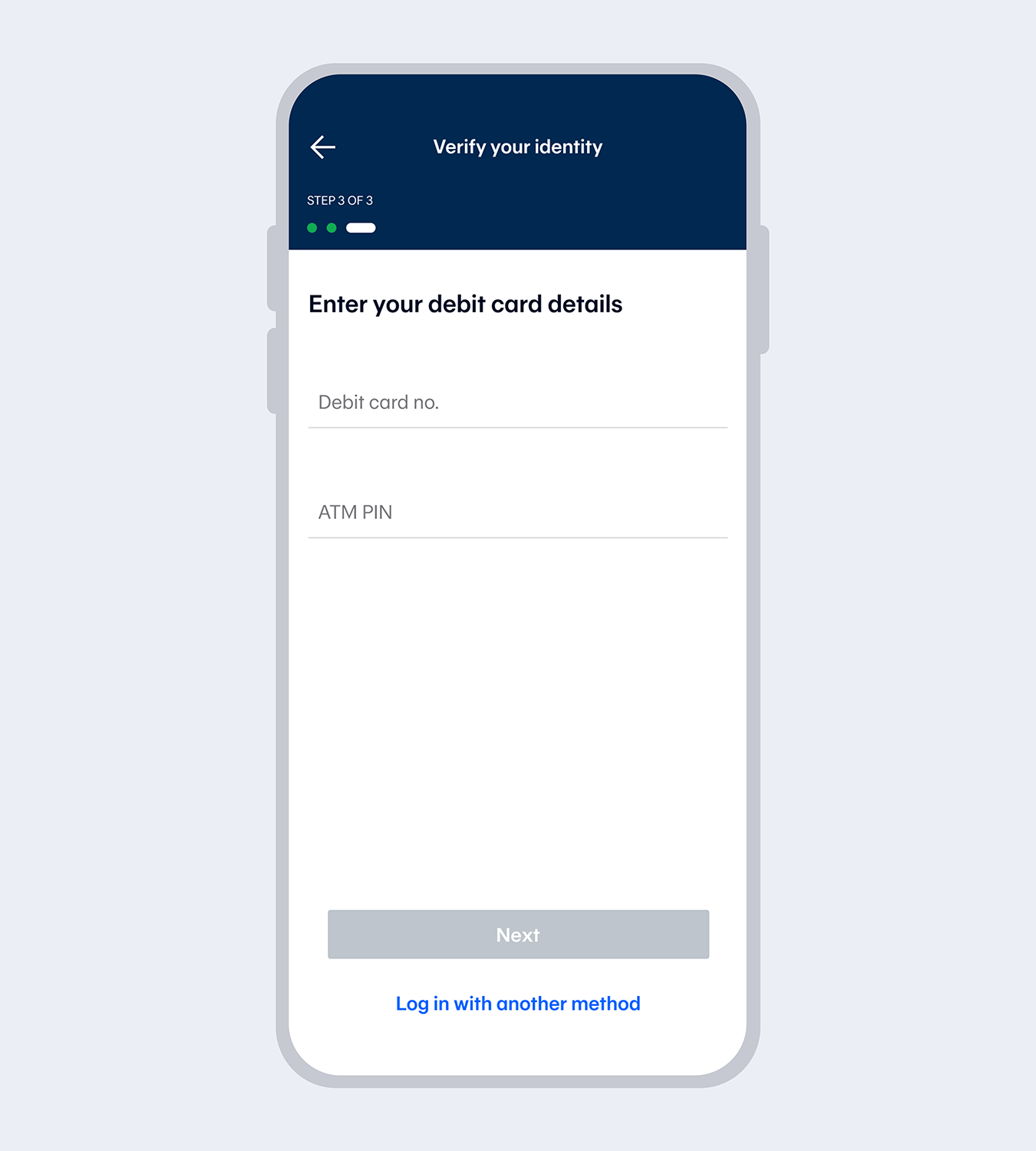

4.

Select “Debit card”Enter the debit card number and referral code (if any).

5.

Enter your laser no.

6.

Enter the One Time Password (OTP) from the SMS to verify your mobile no.Note: The mobile number will be drawn automatically from the SIM card for service registration purposes.

The mobile number must match the one you have provided to the Bank.

7.

Verify your identity with facial recognition.

8.

Set up your 6-digit Mobile PIN and re-enter to reconfirm.

9.

Enter email (if any) and the One Time Password (OTP) sent to your email to verify.

10.

Application successful. You’re all set!Applying with your Be1st Smart debit card will enable you to use all functions when you provide your mobile phone number that matches the one you registered with the Bank.

(If your mobile phone number does not match, you will only be able to use some functions i.e. check balance and view account activity for every account linked to your card.) You can request to use all functions at our Bualuang ATM or any Bangkok Bank branch.

1.

Download Bangkok Bank Mobile Banking.Select “Get started” if you have a Bangkok Bank credit card.

2.

Enter your Citizen ID no. and date of birth.*for Thai citizens only.

3.

Read and accept the terms and conditions.

4.

Select “Credit card”.Enter the Credit card number and referral code (if any).

5.

Enter your laser no.

6.

Enter the One Time Password (OTP) from the SMS to verify your mobile no.Note: The mobile number will be drawn automatically from the SIM card for service registration purposes.

The mobile number must match the one you have provided to the Bank.

7.

Verify your identity with facial recognition.

8.

Set up your 6-digit Mobile PIN and re-enter to reconfirm.

9.

Enter email (if any) and the One Time Password (OTP) sent to your email to verify.

10.

Application successful. You’re all set!Applying with your Bangkok Bank credit card will enable you to use some functions i.e.view credit card account and check your Thank You rewards. To use all functions, please visit any Bangkok Bank branch.

1.

Insert the Bangkok Bank debit card. Select “Apply for / Amend Bangkok Bank Mobile Banking and Bualuang ibanking” menu and select “Apply”2.

Create your 4-digit PIN at the ATM then enter your mobile number.

3.

Download Bangkok Bank Mobile Banking.Select “Get started”

4.

Enter your Citizen ID no. and date of birth.*for Thai citizens only.

5.

Read and accept the terms and conditions.

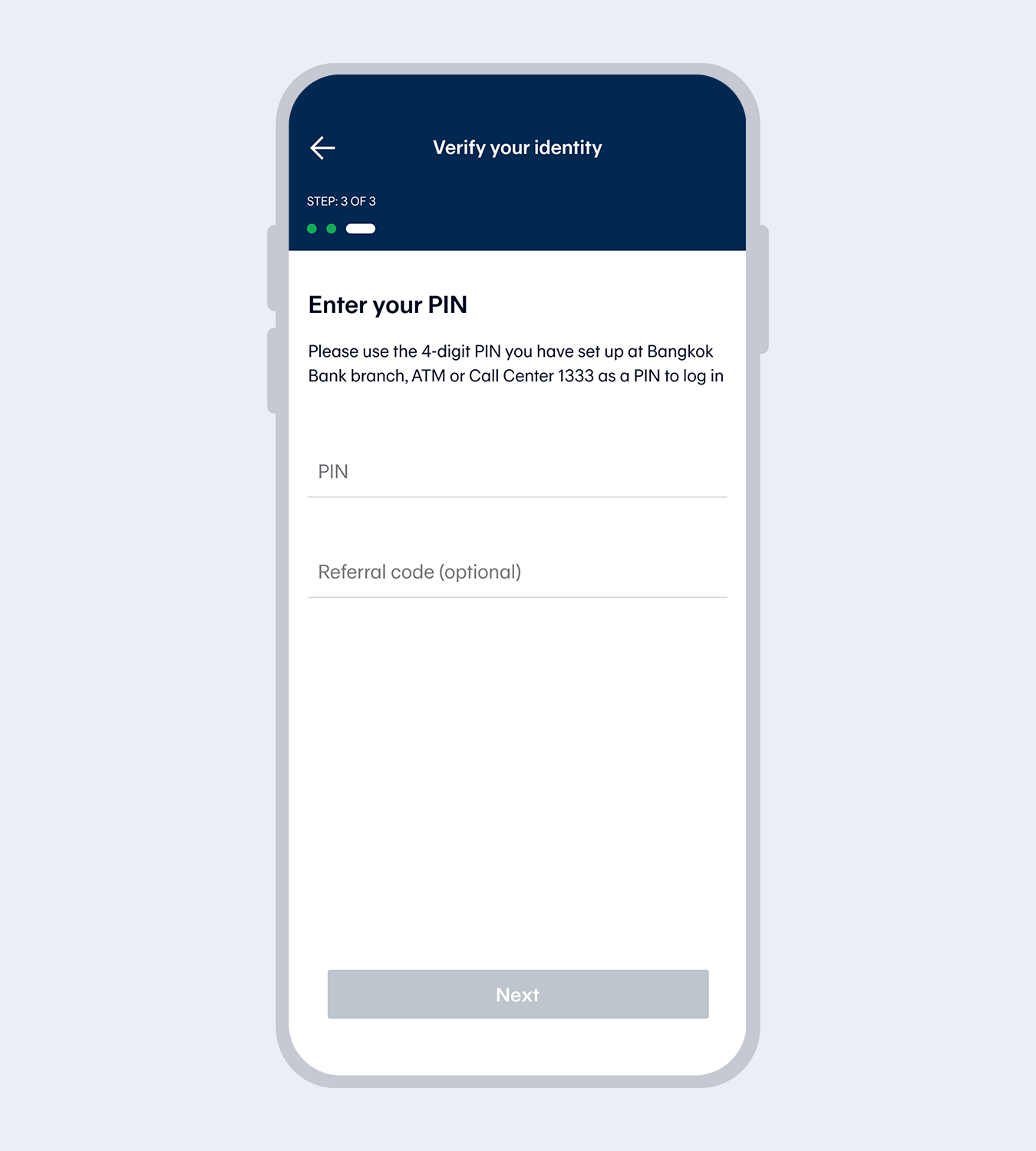

6.

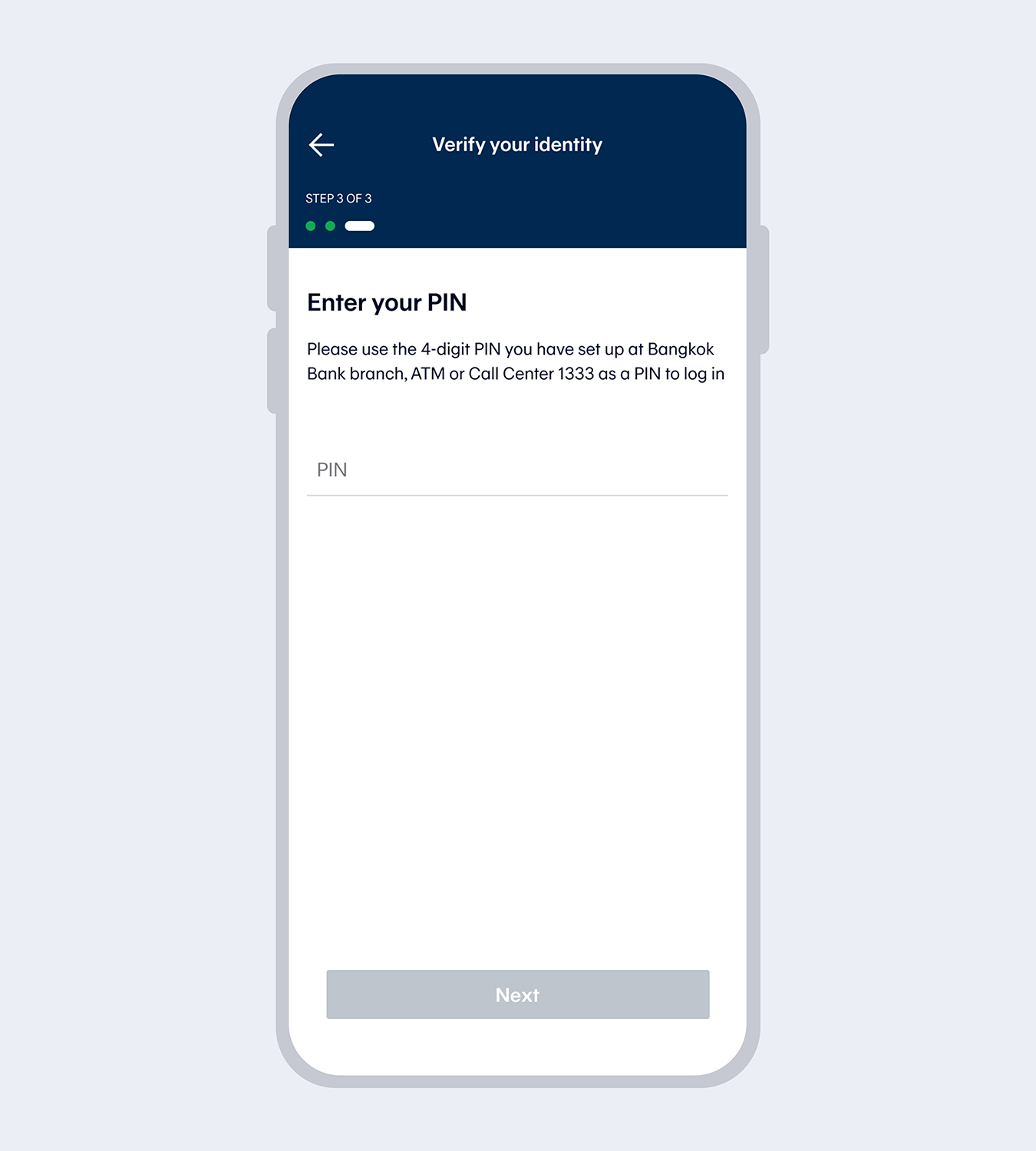

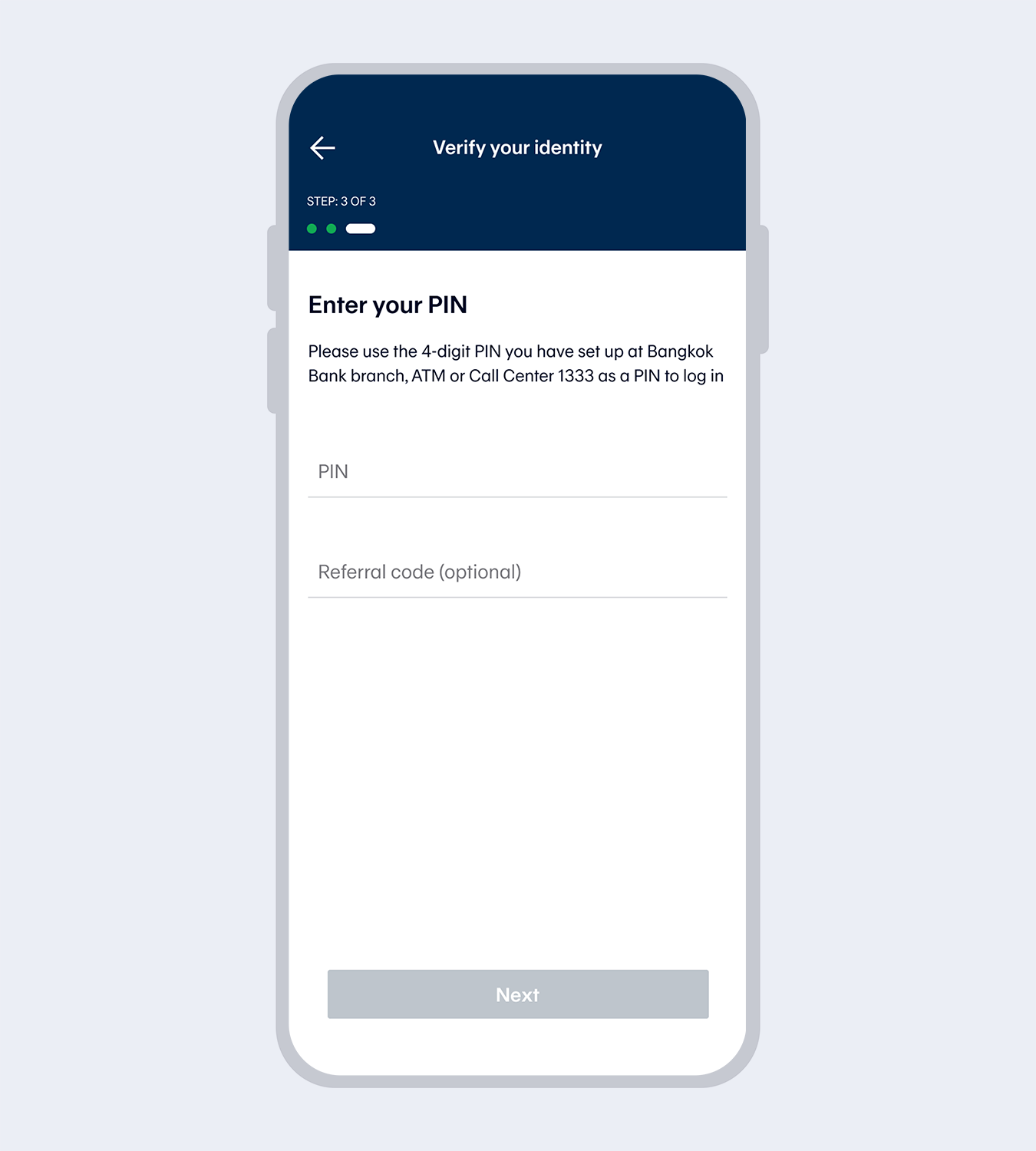

Enter the 4-digit PIN you set up at the ATM and referral code (if any)

7.

Enter your laser no.

8.

Enter the One Time Password (OTP) from the SMS to verify your mobile no.Note: The mobile number will be drawn automatically from the SIM card for service registration purposes.

The mobile number must match the one you have provided to the Bank.

9.

Verify your identity with facial recognition.

10.

Set up your 6-digit Mobile PIN and re-enter to reconfirm.

11.

Enter email (if any) and the One Time Password (OTP) sent to your email to verify.

12.

Application successful. You’re all set!

At Bangkok Bank branch

1.

Complete the Bangkok Bank Mobile Banking application form and provide your Citizen ID card and passbook to the staff.

2.

Set your 4-digit PIN at the branch

3.

Download Bangkok Bank Mobile Banking.Select “Get started” if you have a Bangkok Bank debit card.

4.

Enter your personal information and date of birth.Thai citizen: Enter your Citizen ID no.

Foreigner: Enter your passport no. or Alien identification card no.

5.

Read and accept the terms and conditions.

6.

Enter the 4-digit PIN you set up at the branch and referral code (if any)

7.

Enter the One Time Password (OTP) from the SMS to verify your mobile no.Note: The mobile number will be drawn automatically from the SIM card for service registration purposes.

The mobile number must match the one you have provided to the Bank.

8.

Verify your identity with facial recognition.

9.

Set up your 6-digit Mobile PIN and re-enter to reconfirm.

10.

Enter email (if any) and the One Time Password (OTP) sent to your email to verify.

11.

Application successful. You’re all set!For Thais & Foreigners