- Renew expiring debit card

- Card Replacement

- Request

- Activate

- Change limits

- Suspend

- Turn on Push Notifications

- Lock / Unlock Debit Card

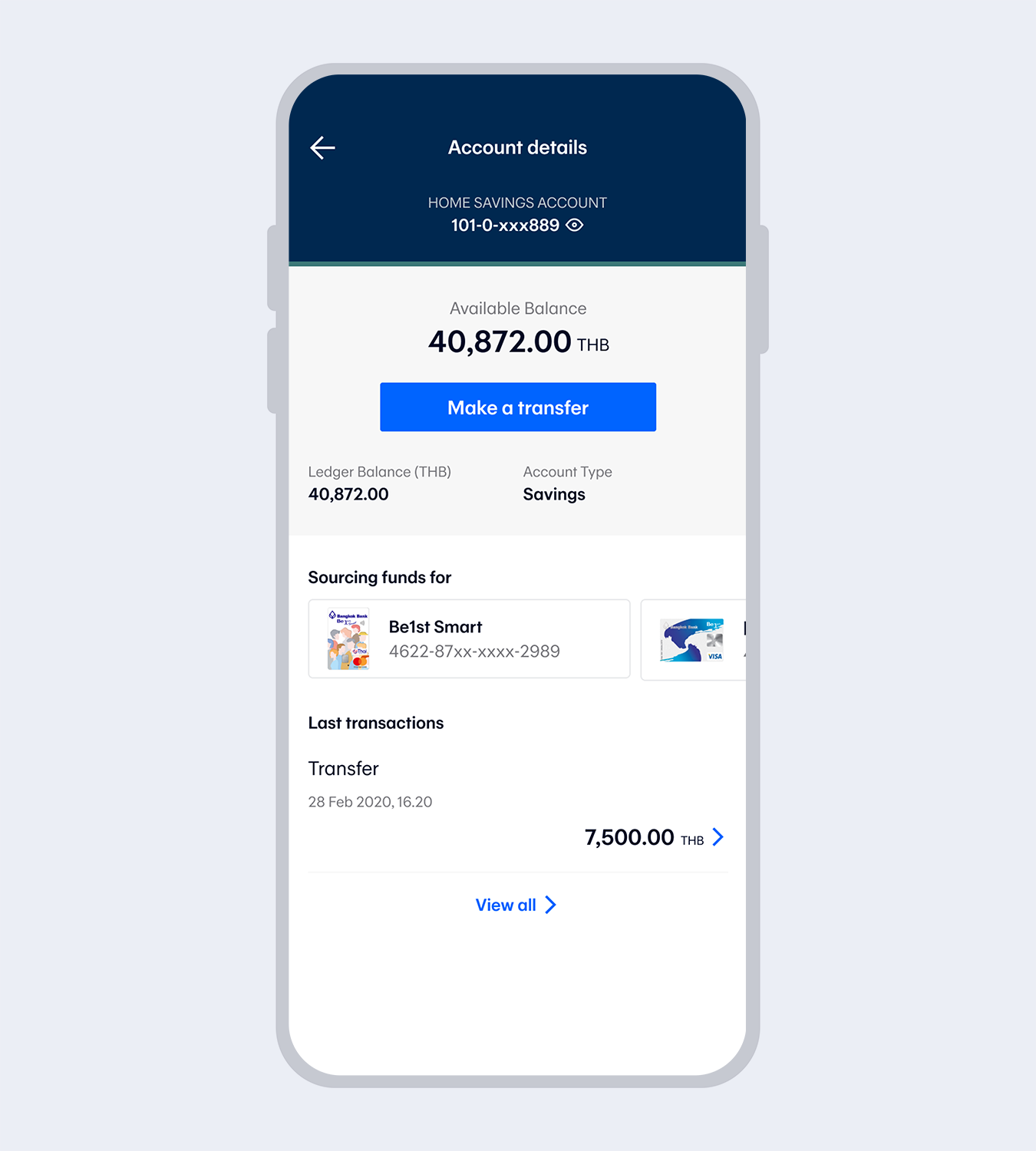

1.

Select a debit card on the account details screen.

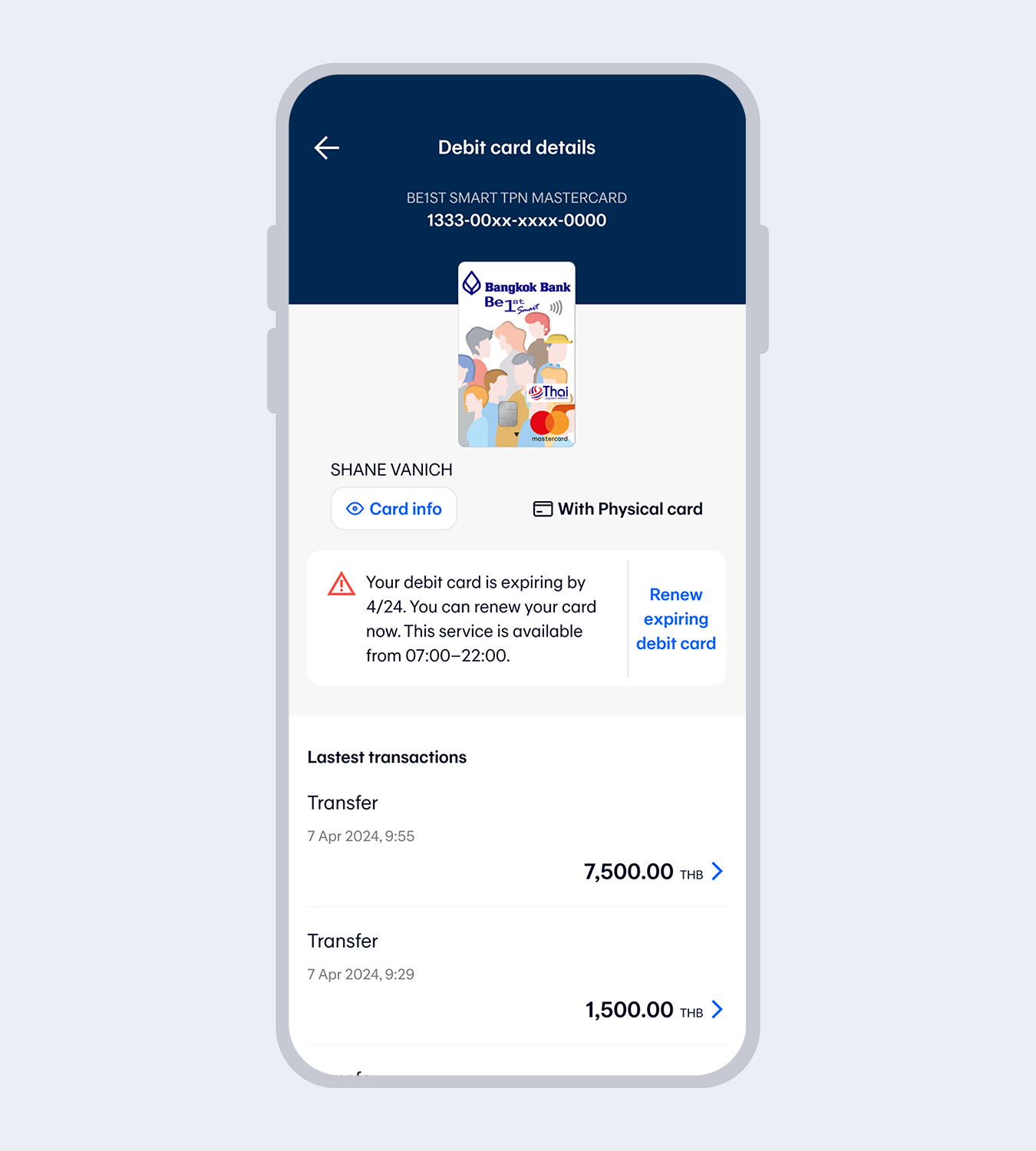

2.

Select "Renew expiring debit card".You can process the transaction up to 60 days in advance before the debit card expires.

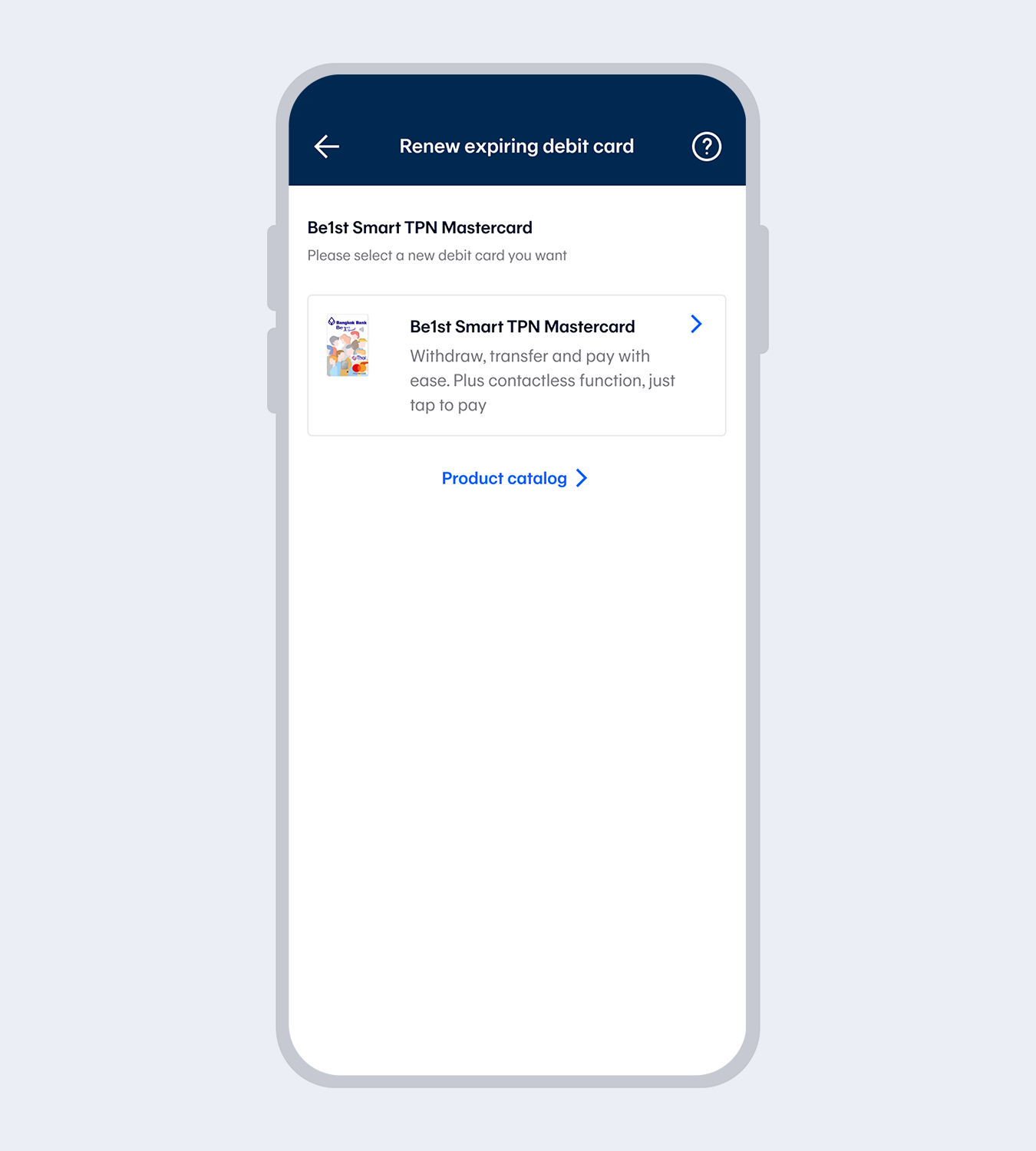

3.

Choose the type of debit card you want to renew.

4.

Check debit card details, select “Request debit card”. Then read the terms and conditions and select “I agree”.If changing the card from a digital debit card to a combination physical and digital debit card, there will be a card issuance fee of 100 baht.

5.

Review the transaction details and select "Confirm and activate digital card”.

6.

Once the transaction has been completed, you will receive an eSlip and email transaction record.

- You will receive your debit card within 7 working days; however, it also depends on delivery distance.

- After receiving the debit card, please activate the card according to the bank's instructions.

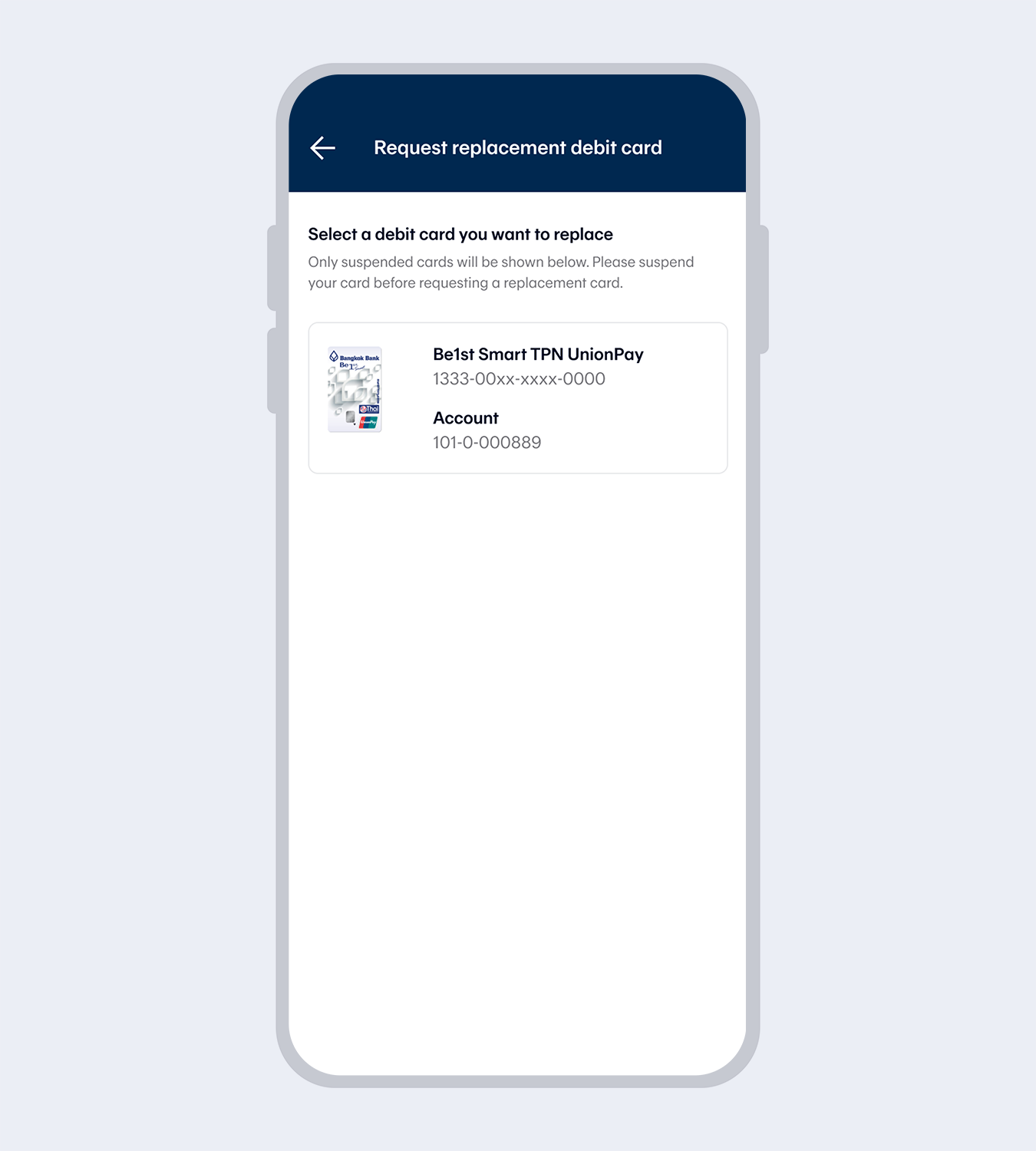

1.

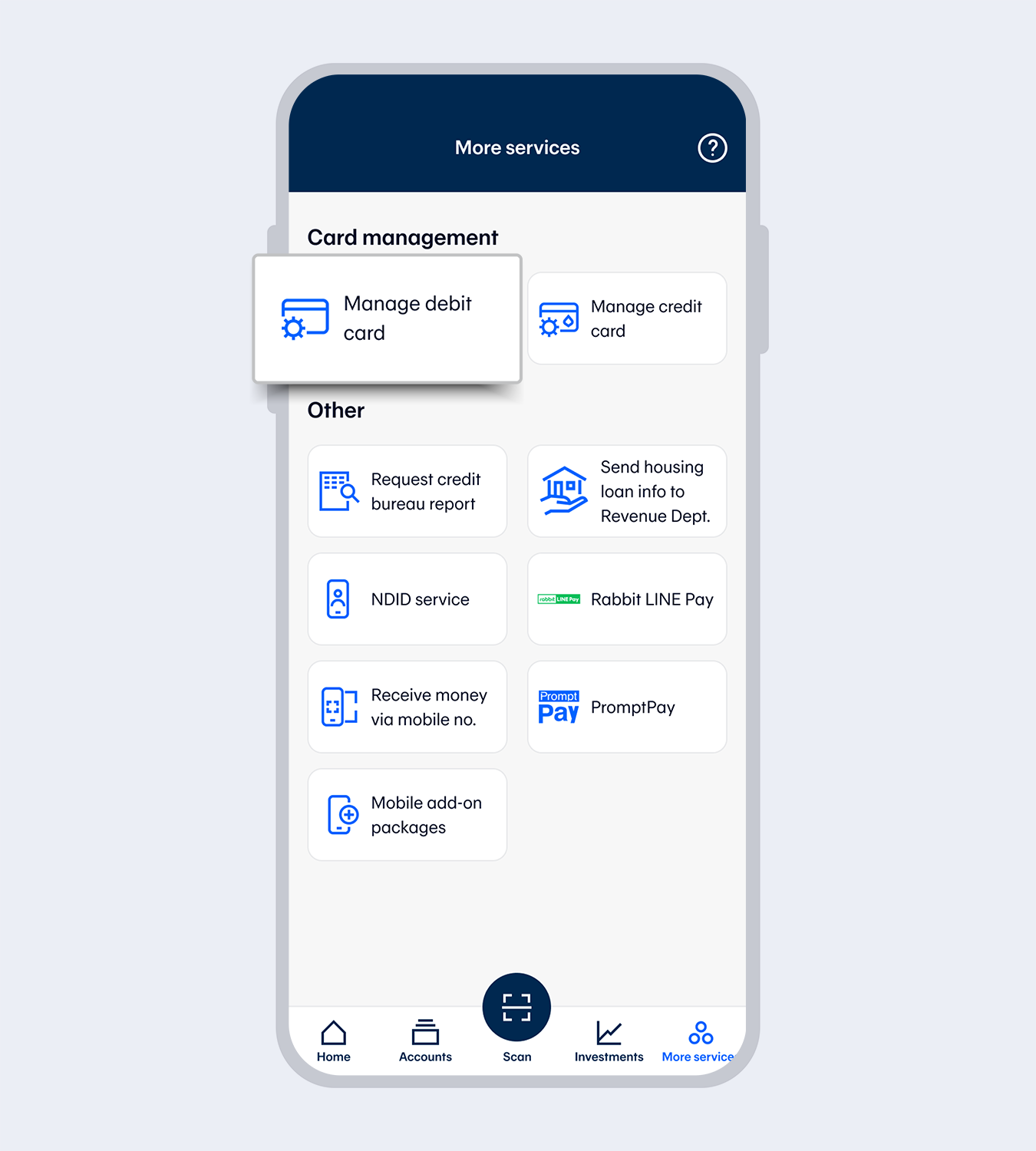

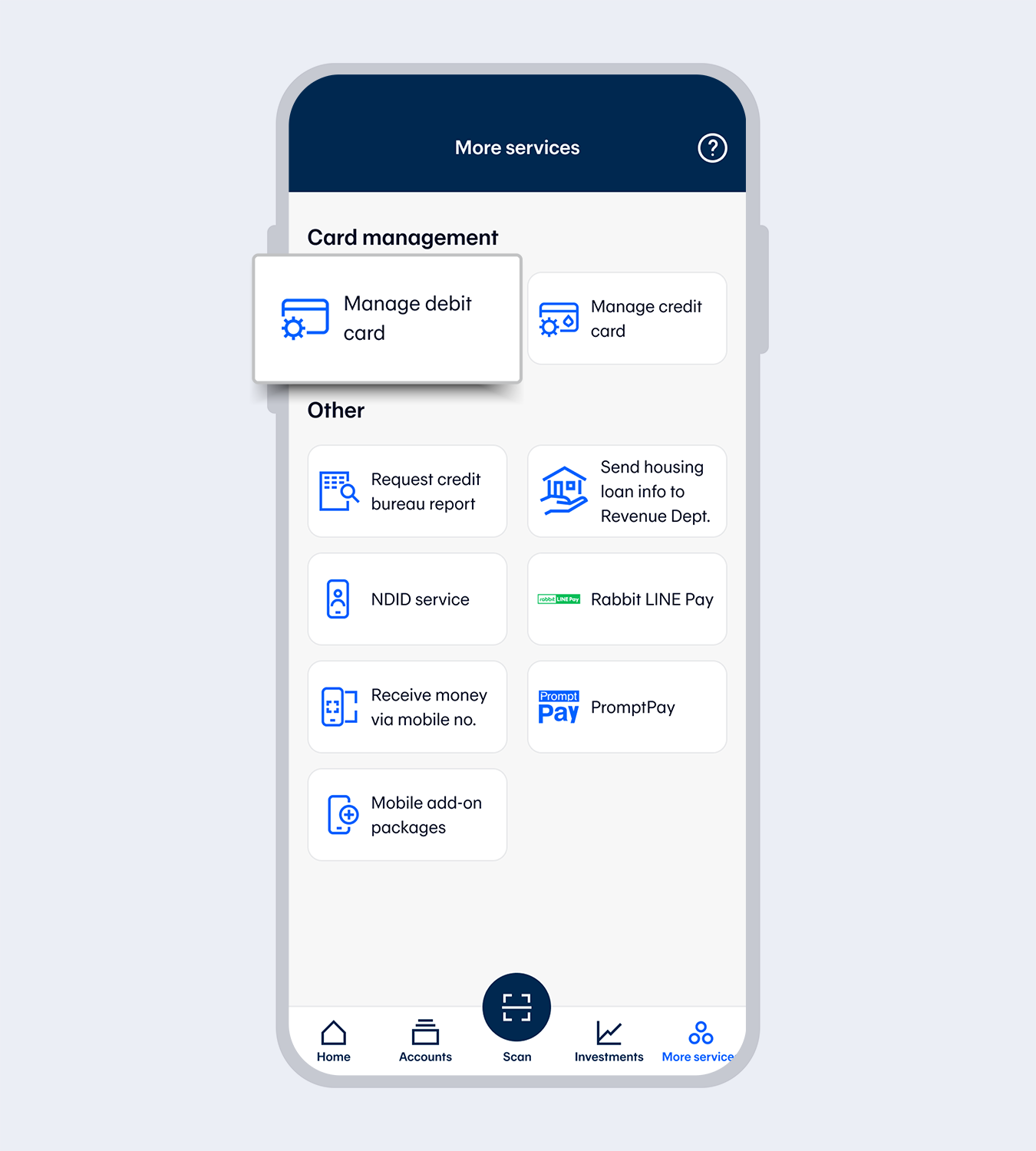

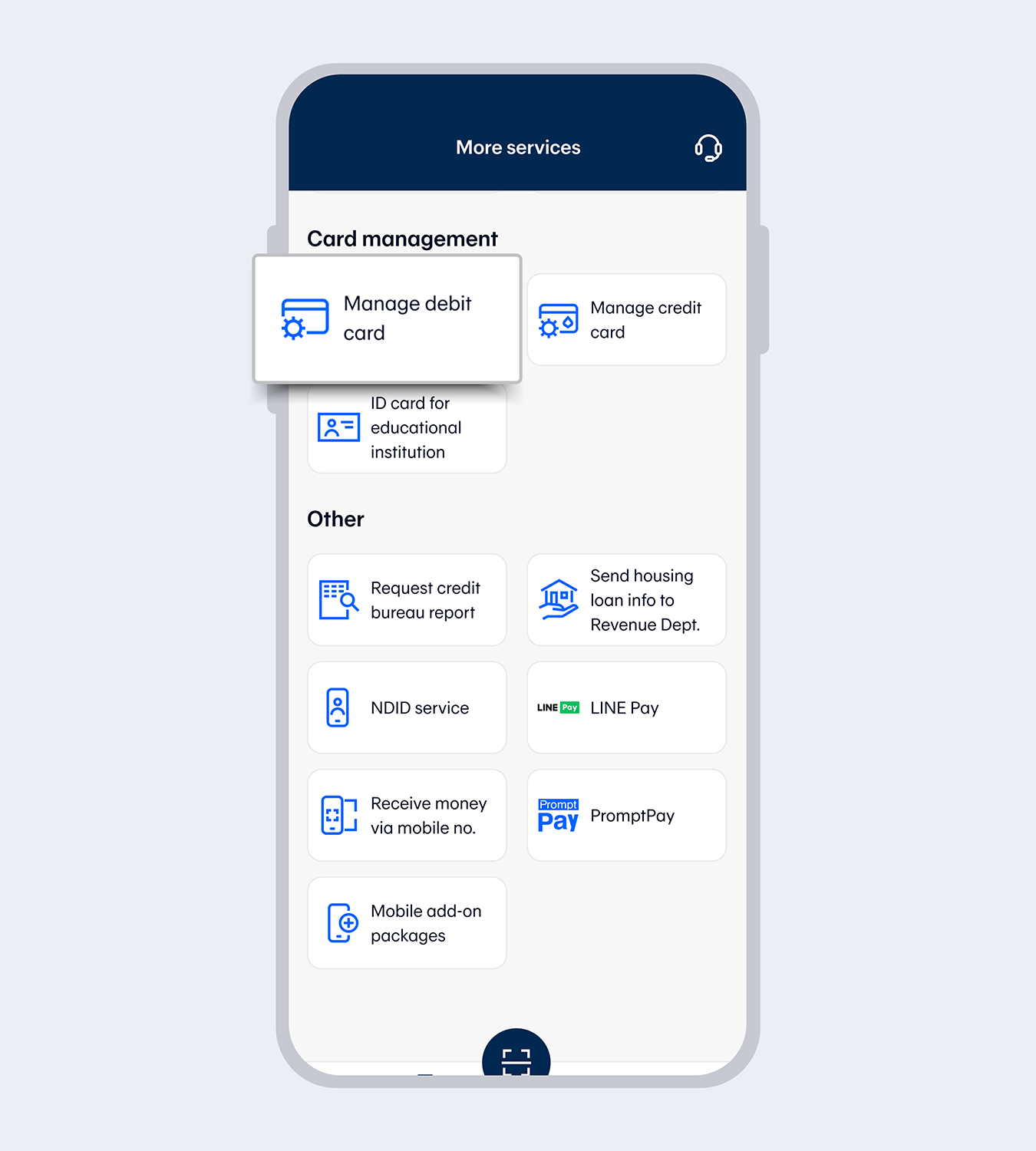

Go to “More services” and select “Manage debit card”

2.

Enter your 6-digit Mobile PIN

3.

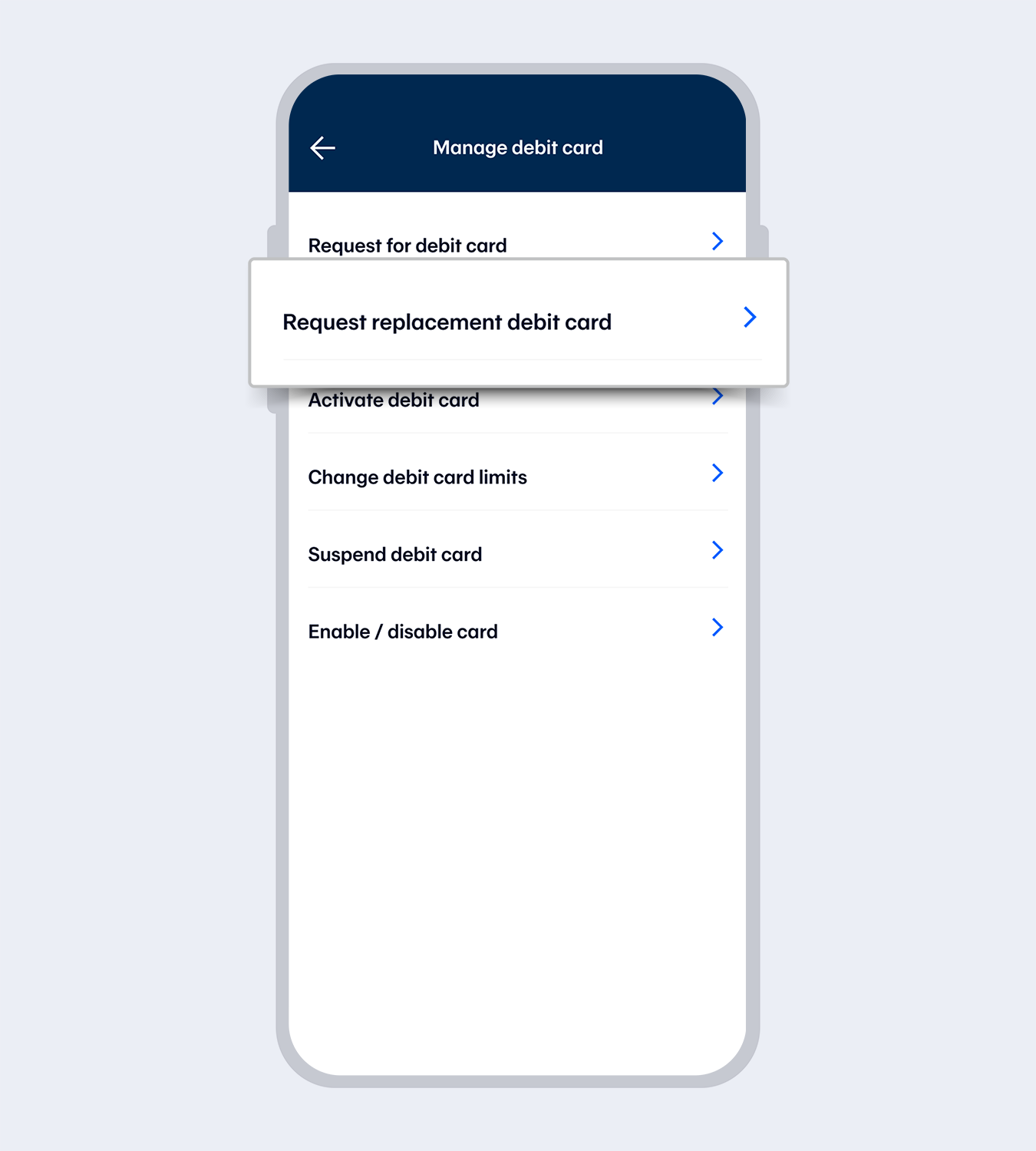

Select “Request replacement debit card”

4.

Select the card you want to suspend (The system will display all debit cards from all accounts added in Mobile Banking which have been suspended)

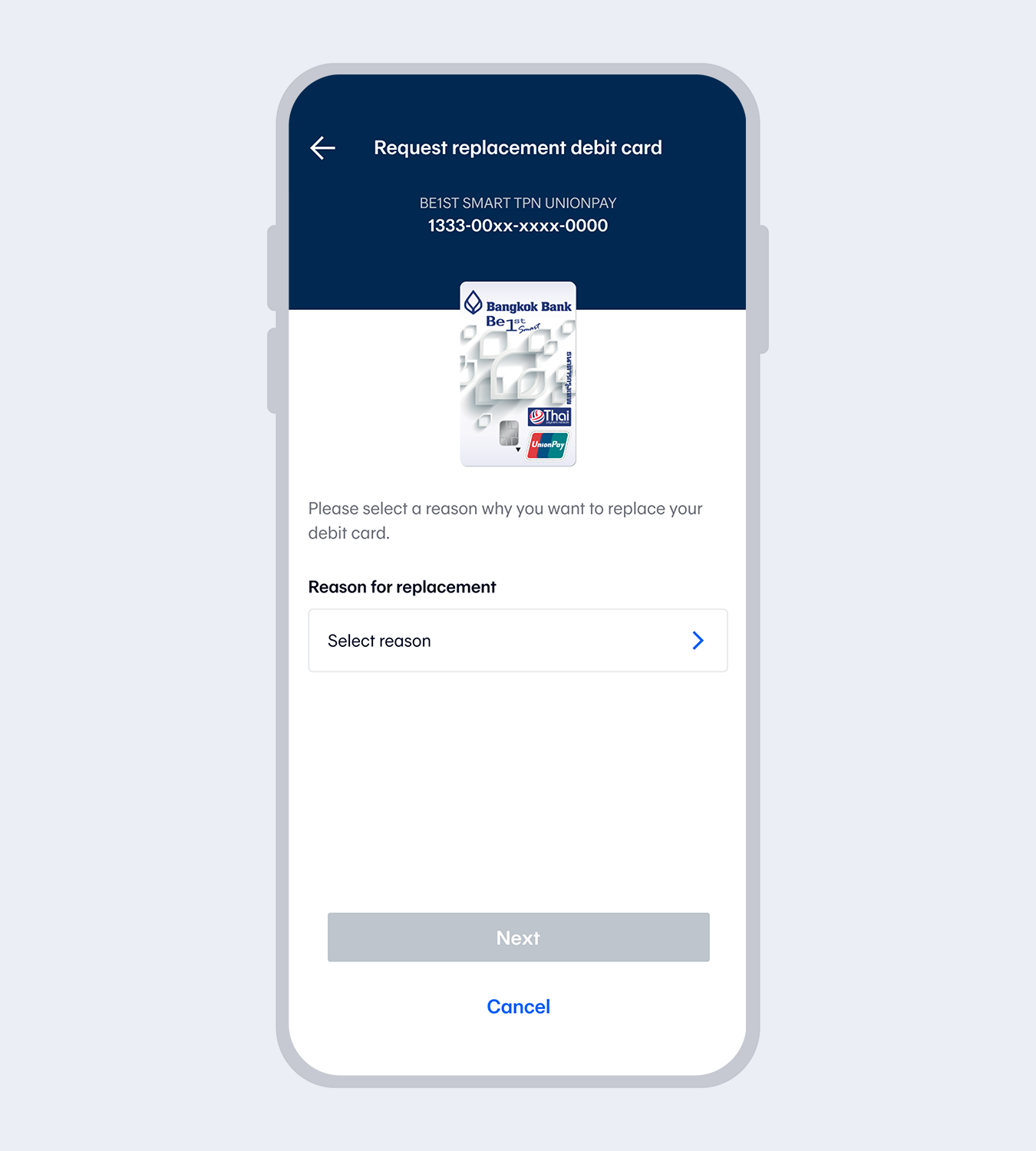

5.

Select the reason for a replacement (card damaged / card lost / forgot ATM PIN / card retained by ATM / other) and select “Next”

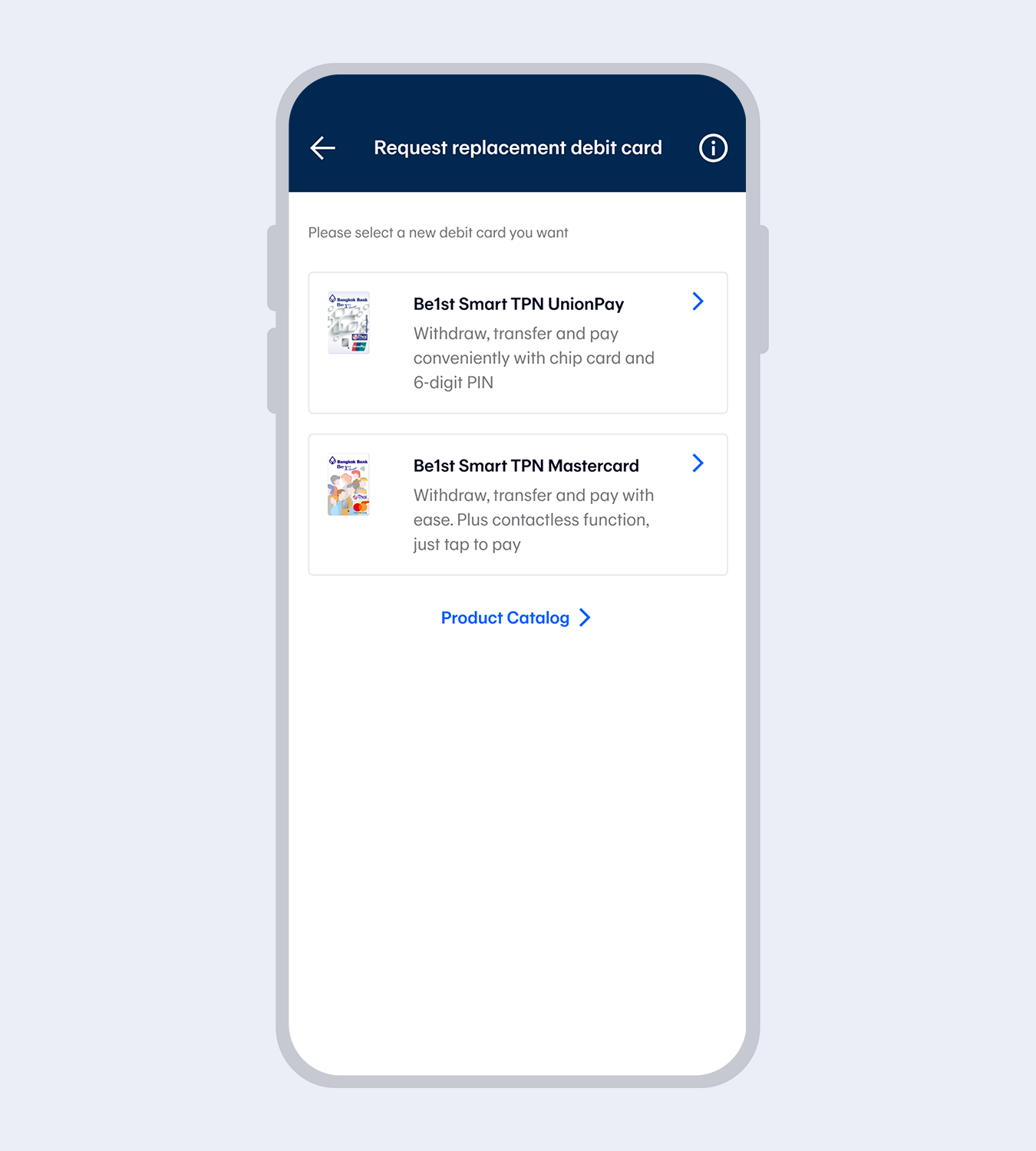

6.

The system will display cards eligible for replacement.Select a replacement card.

7.

The system will display debit card details (for digital cards, the system will also provide options for requesting a physical card)Read the sales sheet before requesting a debit card and select “Confirm”

Select “Request debit card”

8.

Read the consent (different for each card type)9.

Read the terms and conditions and then select “Accept”

10.

Select “Confirm” (In case of a digital card, this is to confirm and activate the card)11.

Enter your 6-digit Mobile PIN as an e-Signature

12.

Request for replacement card successful. You will receive a confirmation email and your card via post within 3-7 business days.

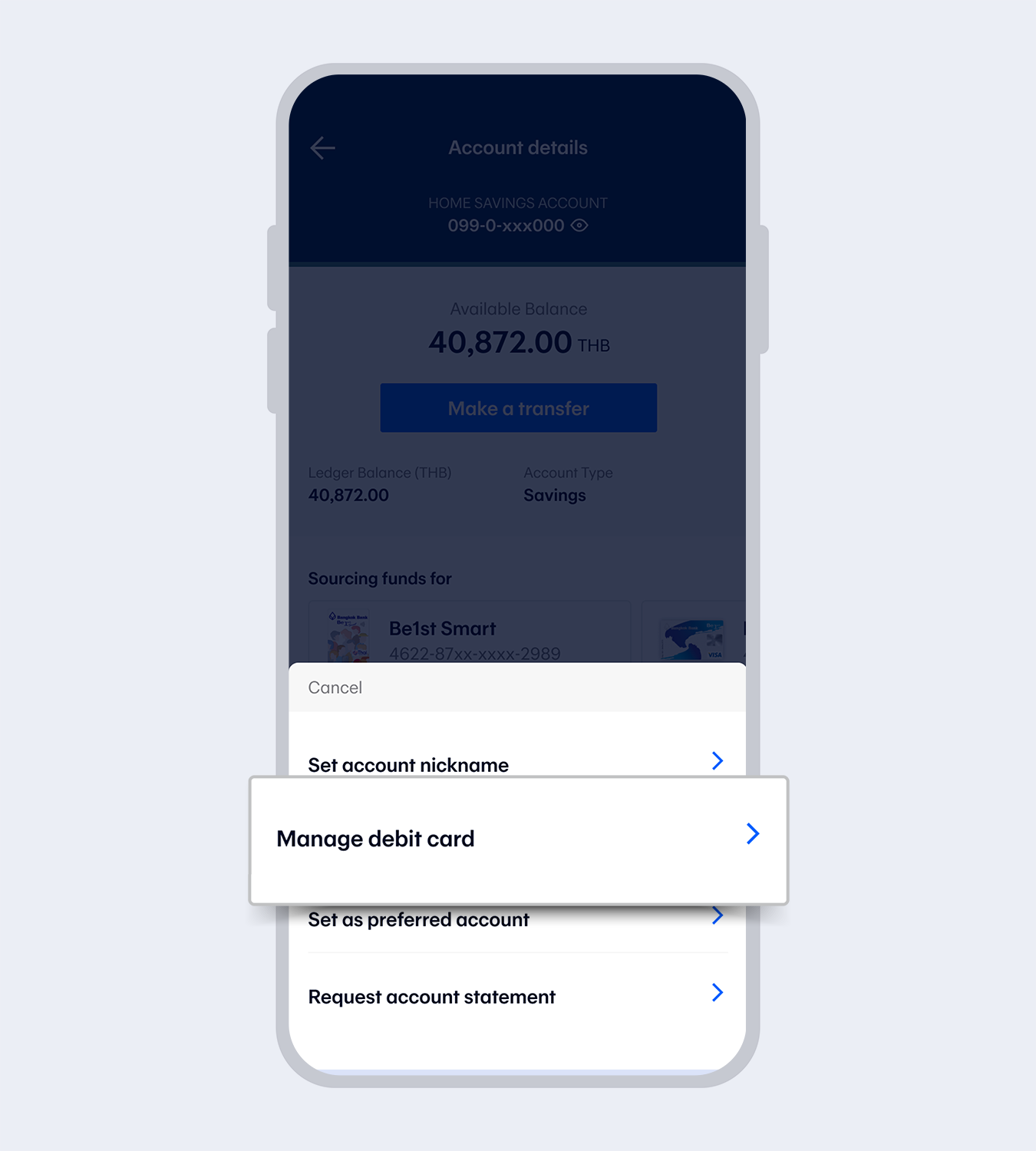

1.

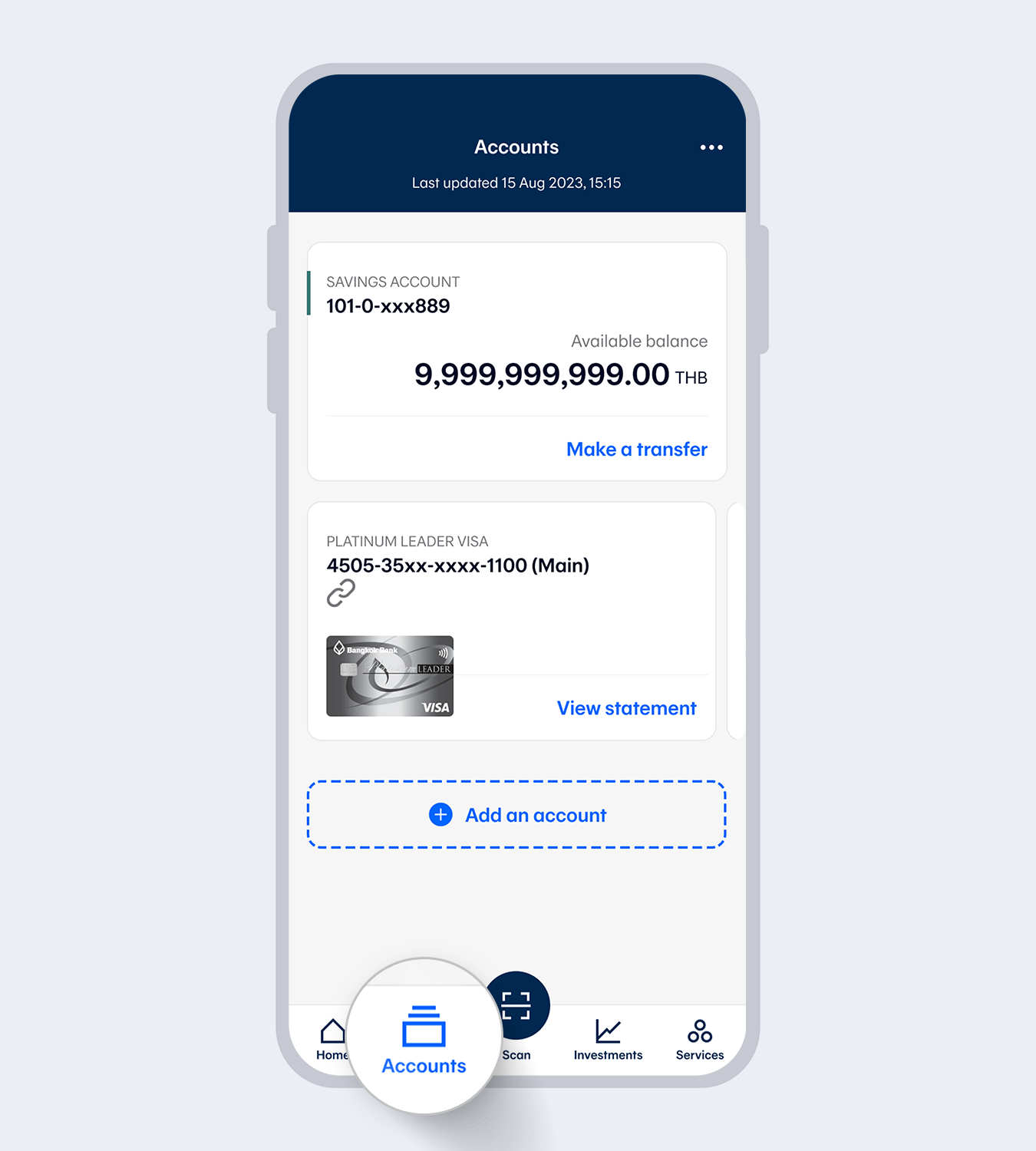

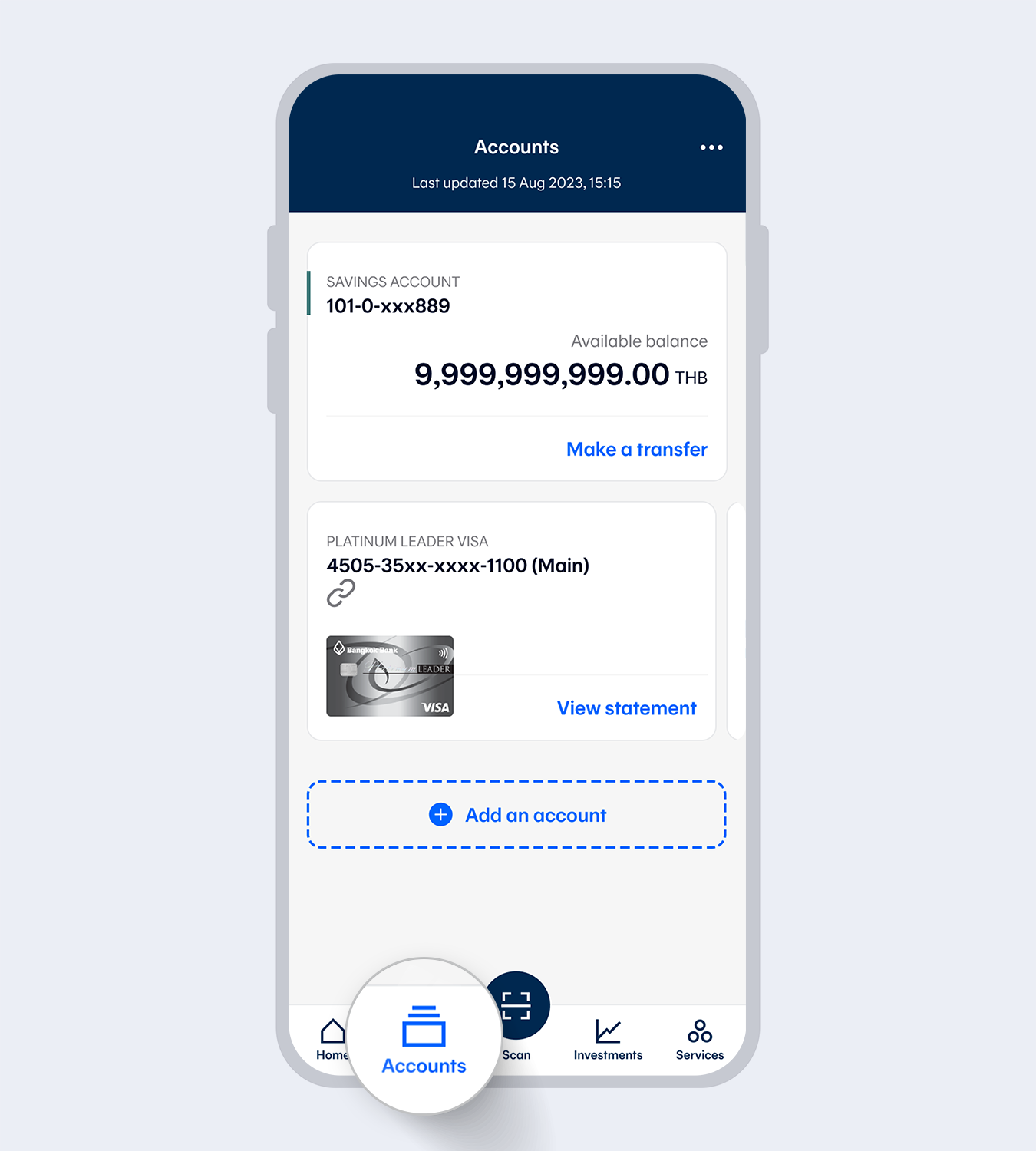

Select “Accounts”, then select the account for your debit card request

2.

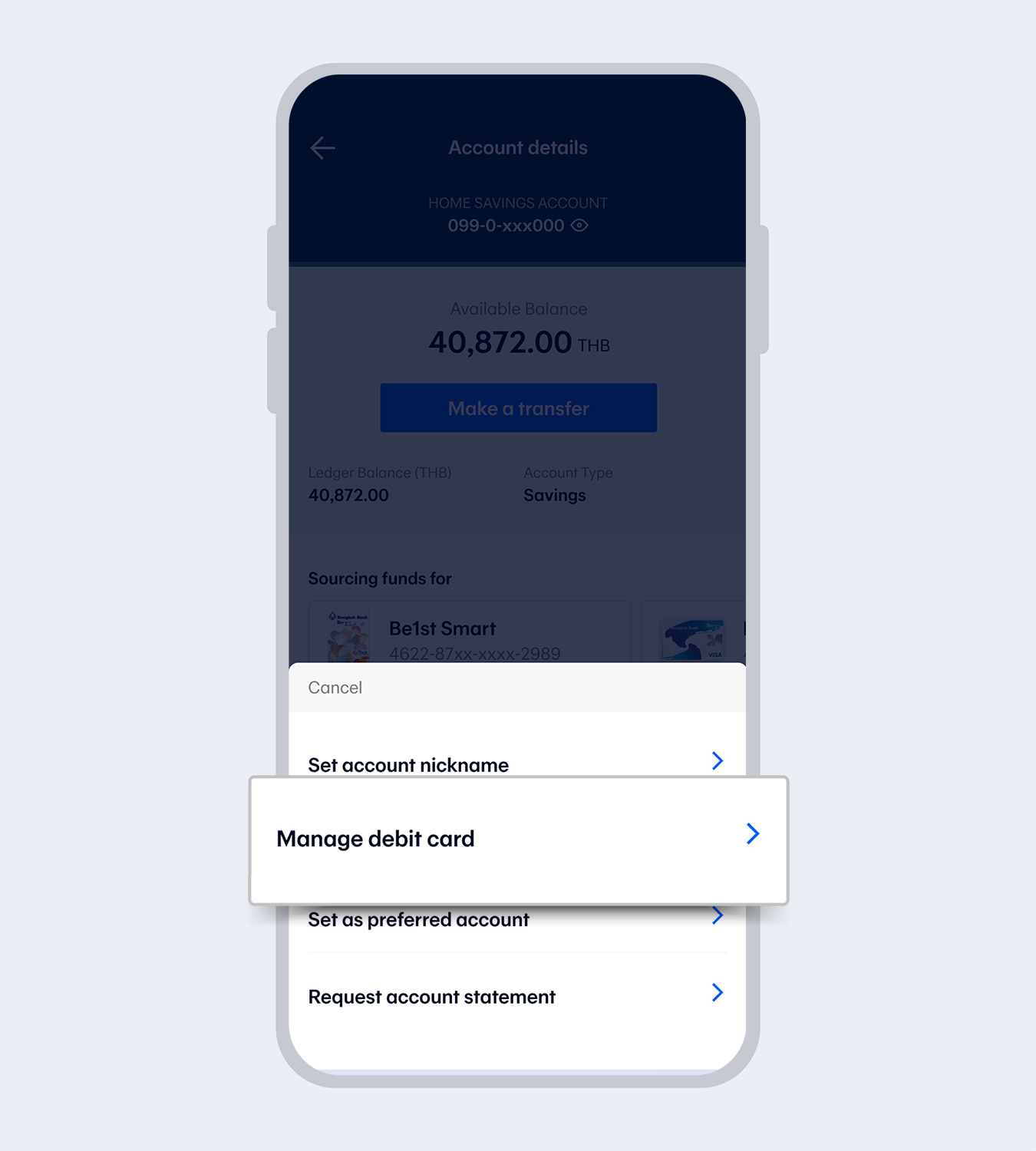

Select “…” at the top right corner

3.

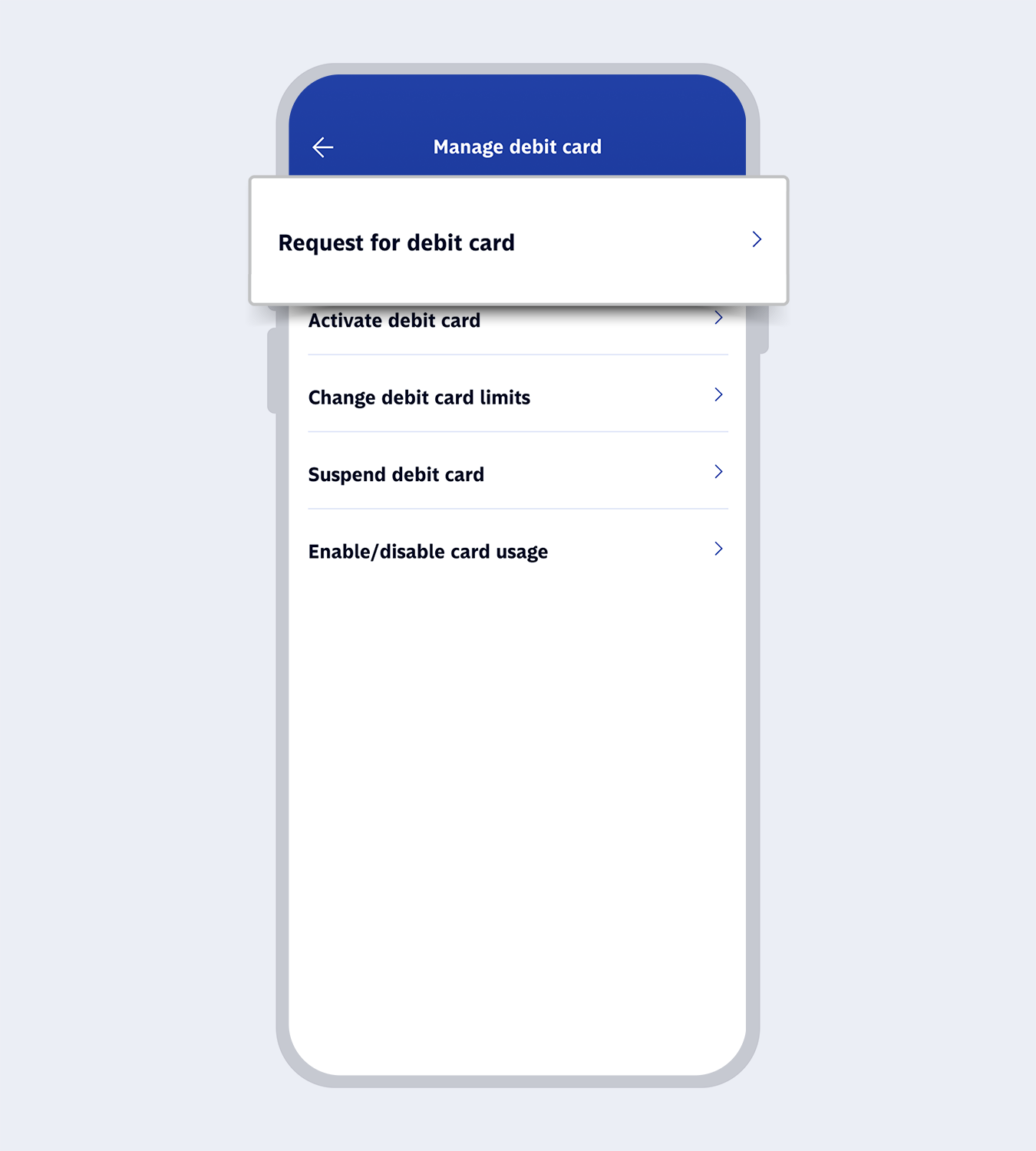

Select “Manage debit card”

4.

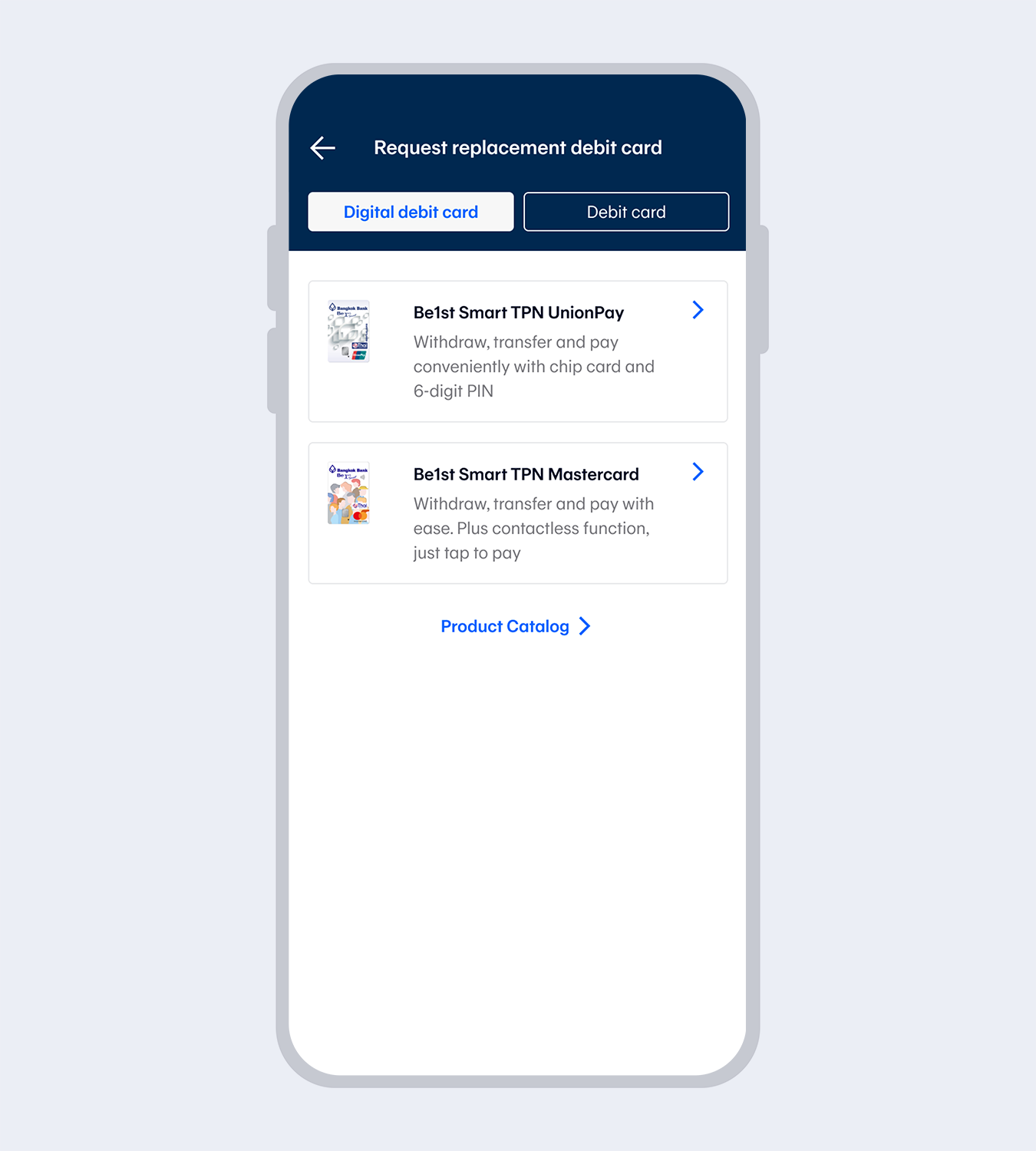

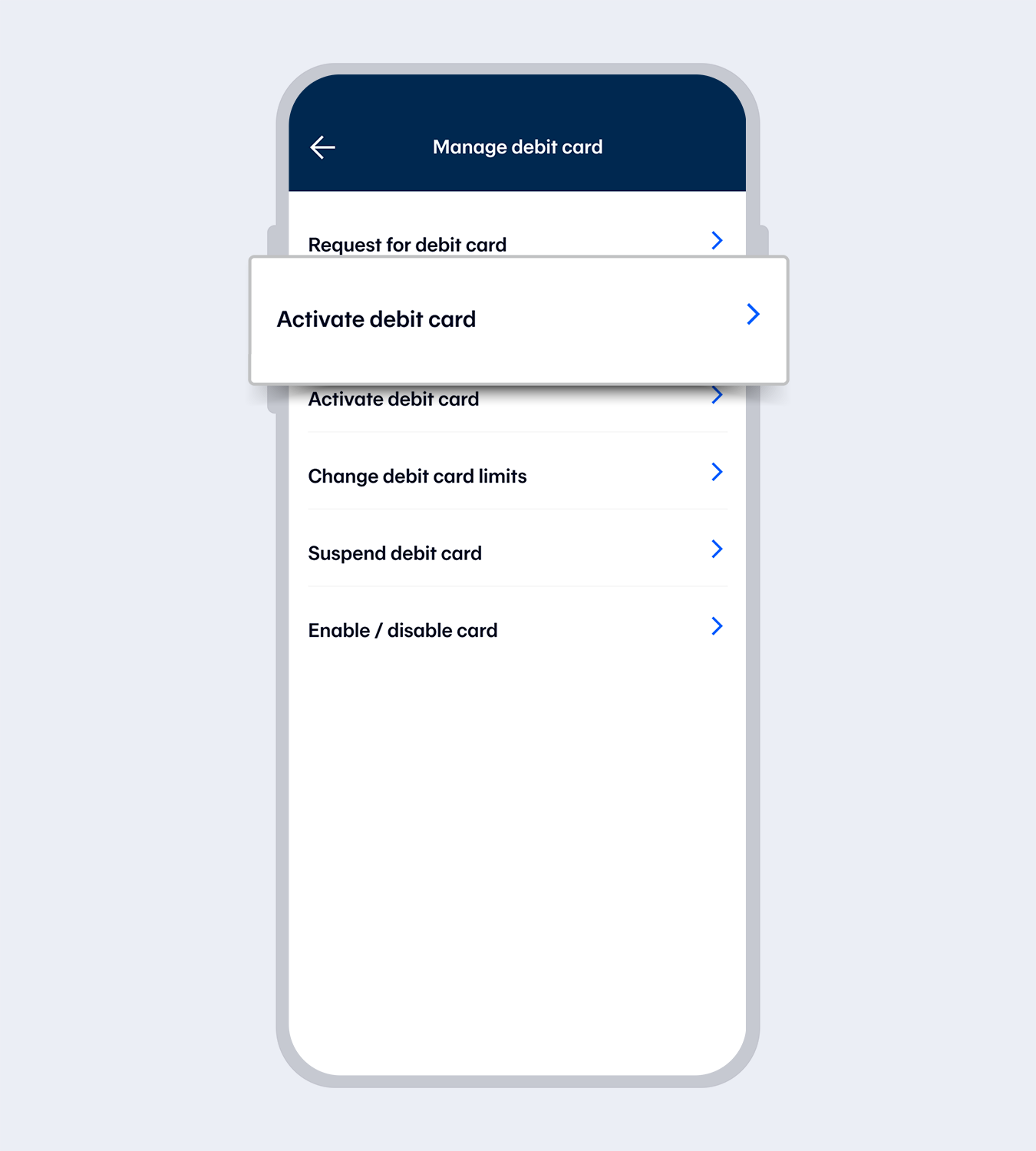

Select “Request for debit card”

5.

The system will display debit cards in the category of- Digital Debit Card

- Debit Card

6.

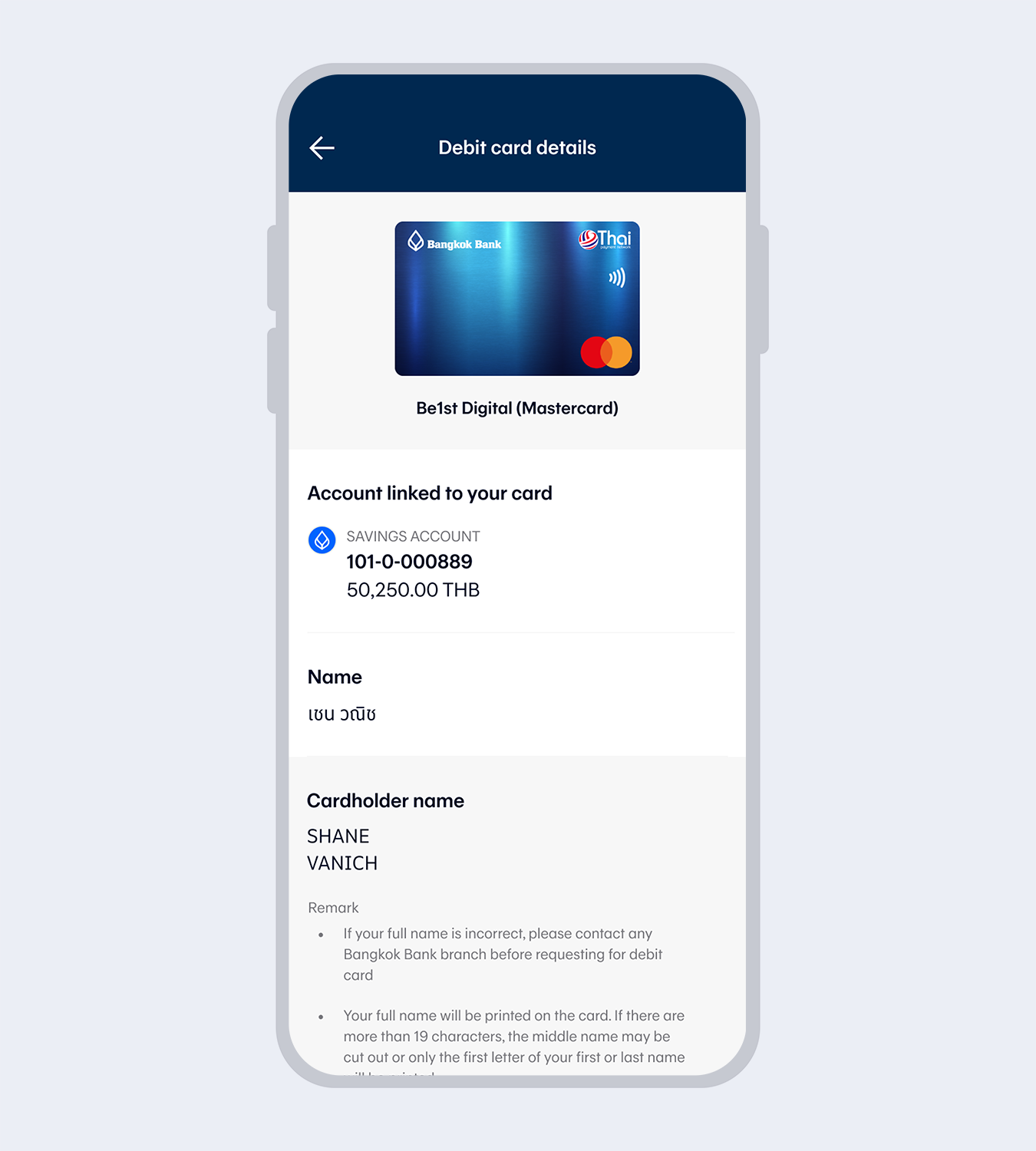

Read the selected card details and select “Accept”

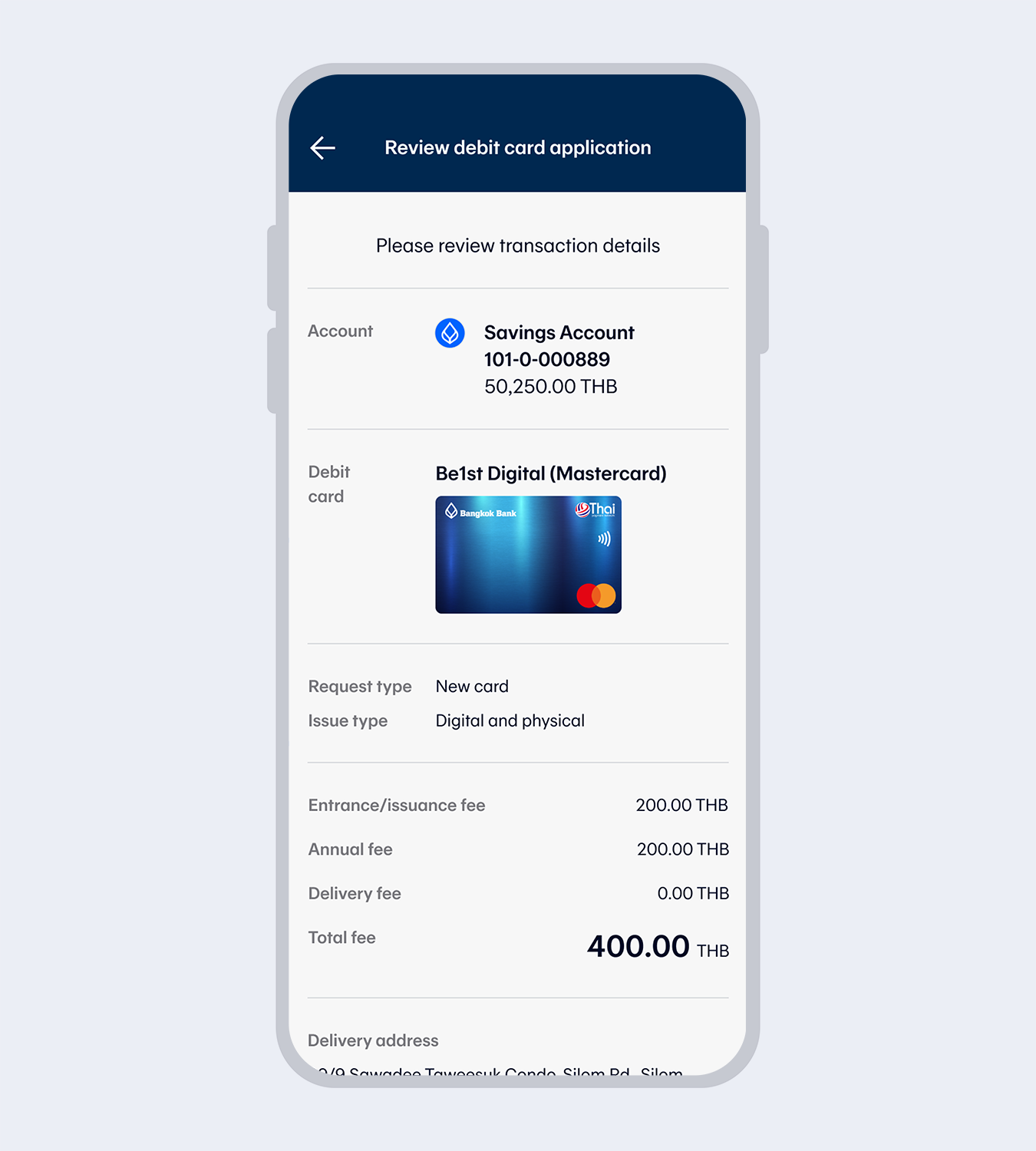

7.

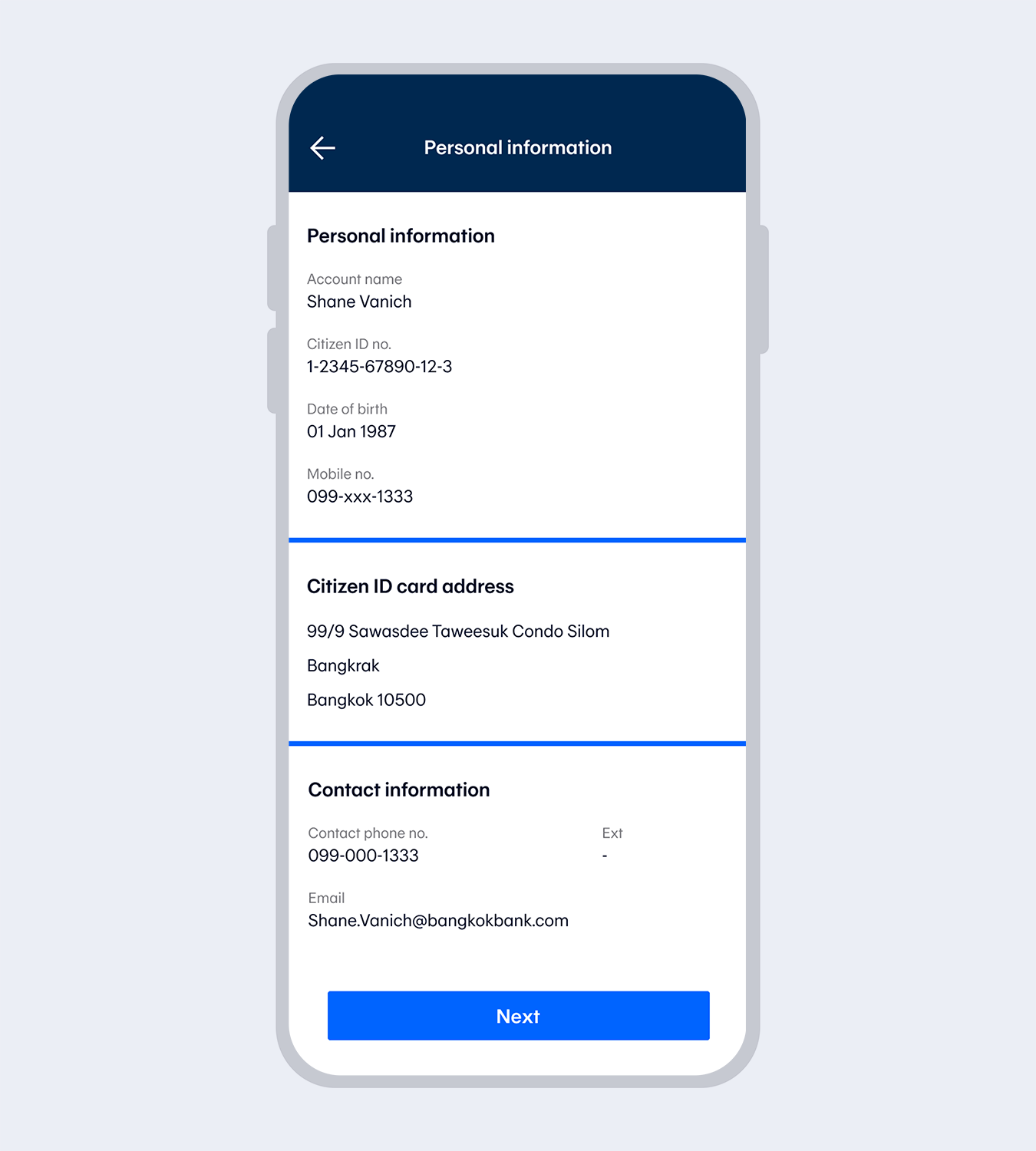

Review request details

8.

Check your information and select “Confirm”

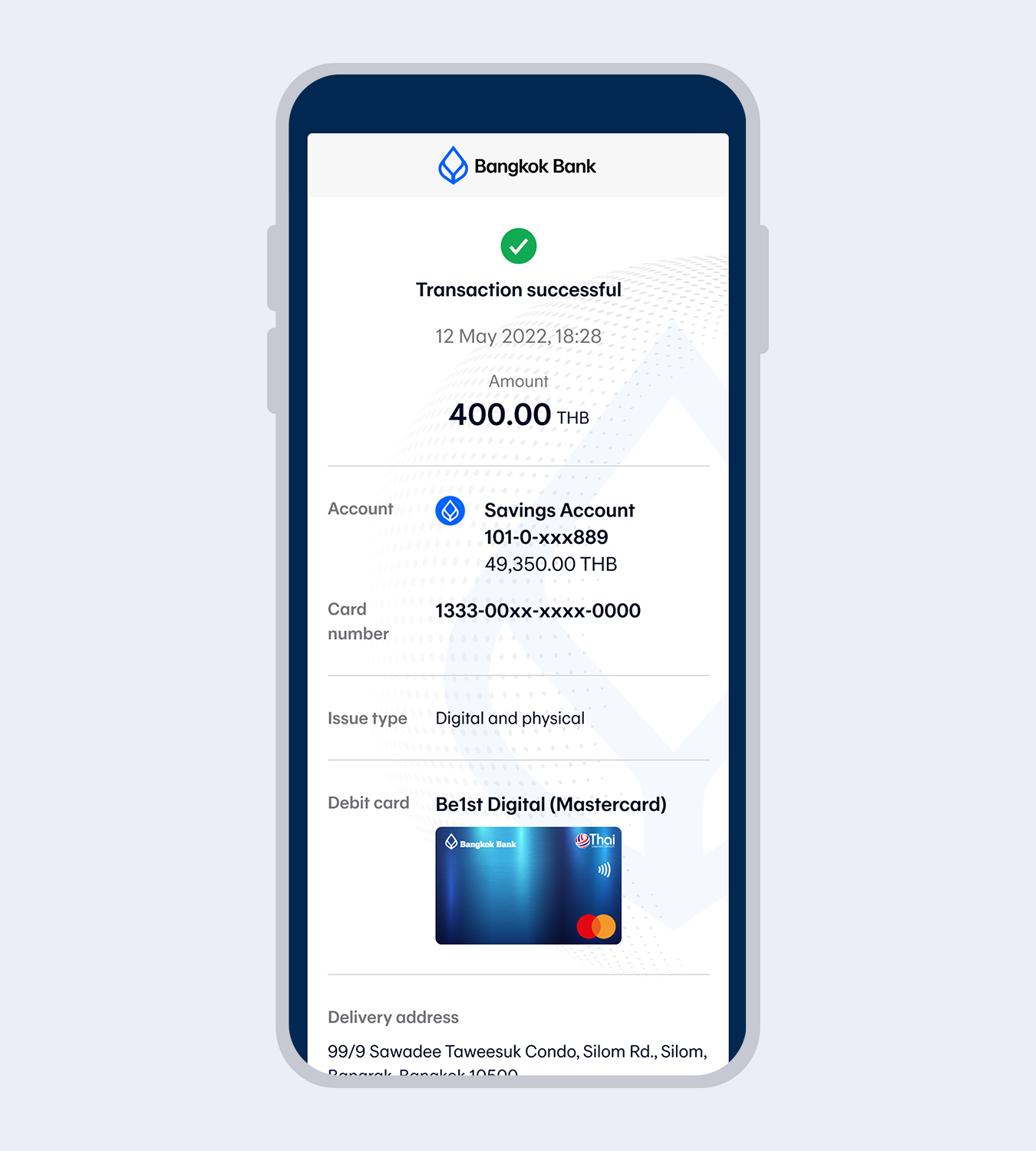

9.

Successfully requested. You will receive your card via post within 3-7 business days.

10.

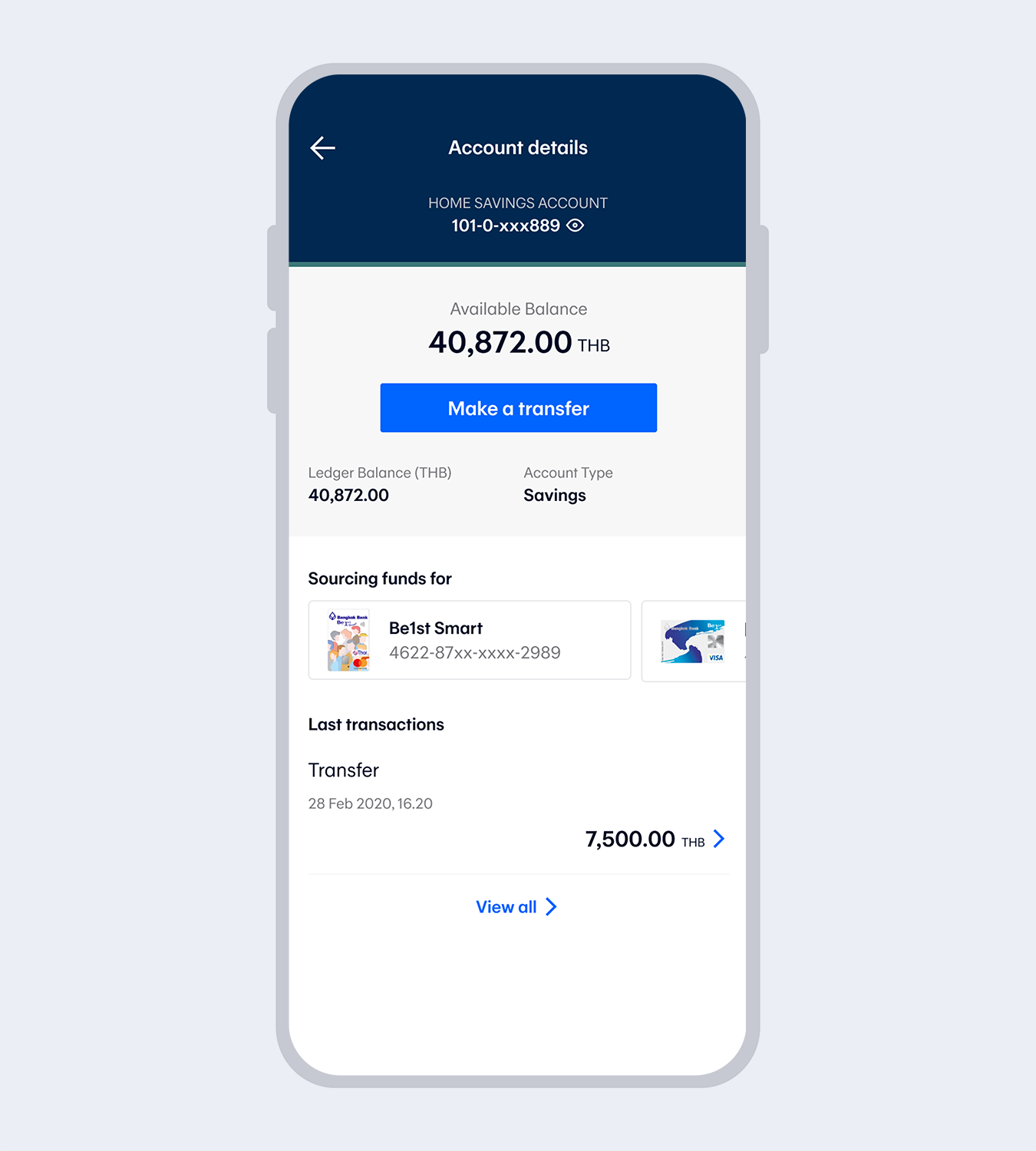

The debit card image will be displayed on the Account details page. Select the card to view the information and transactions.

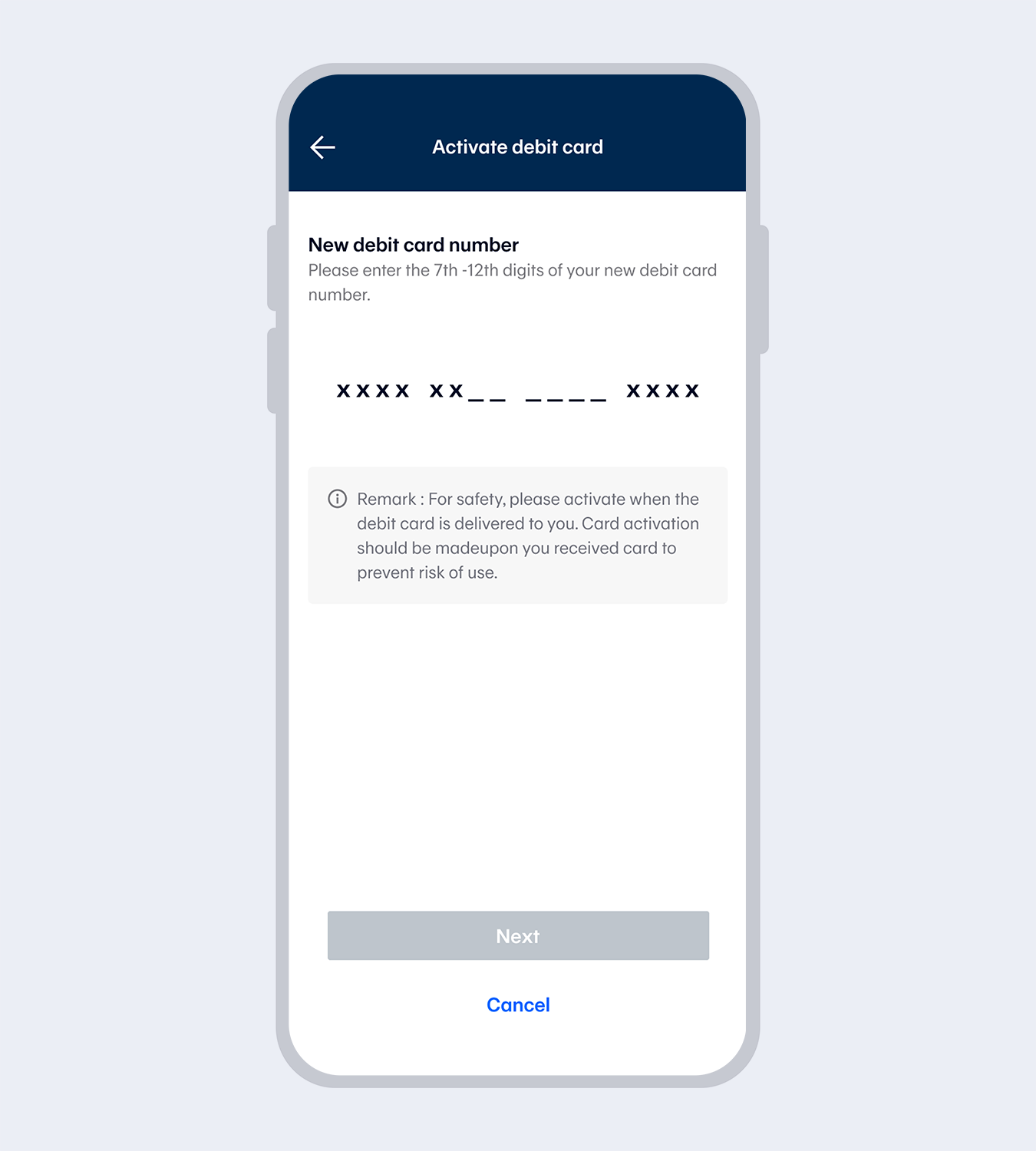

1.

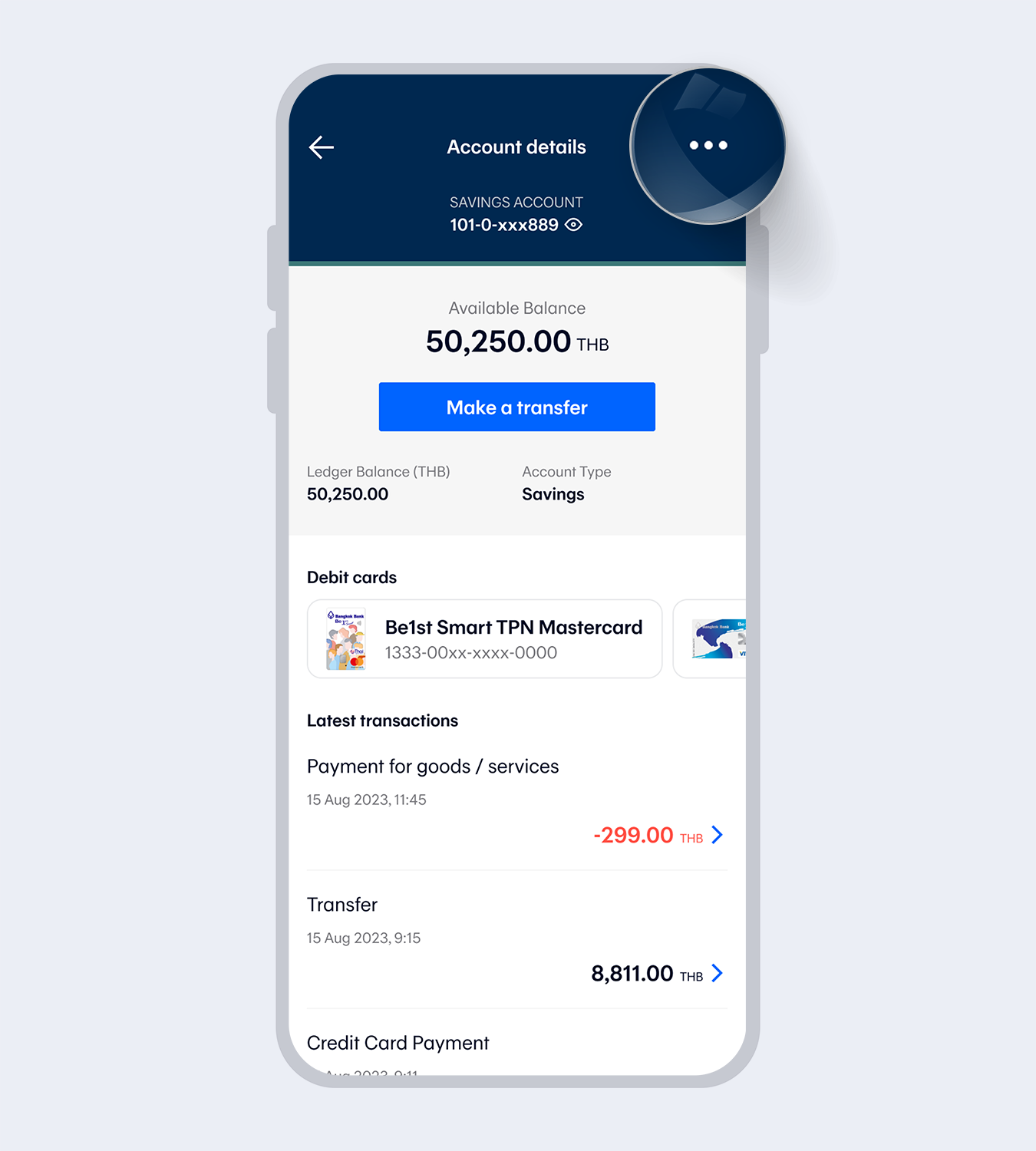

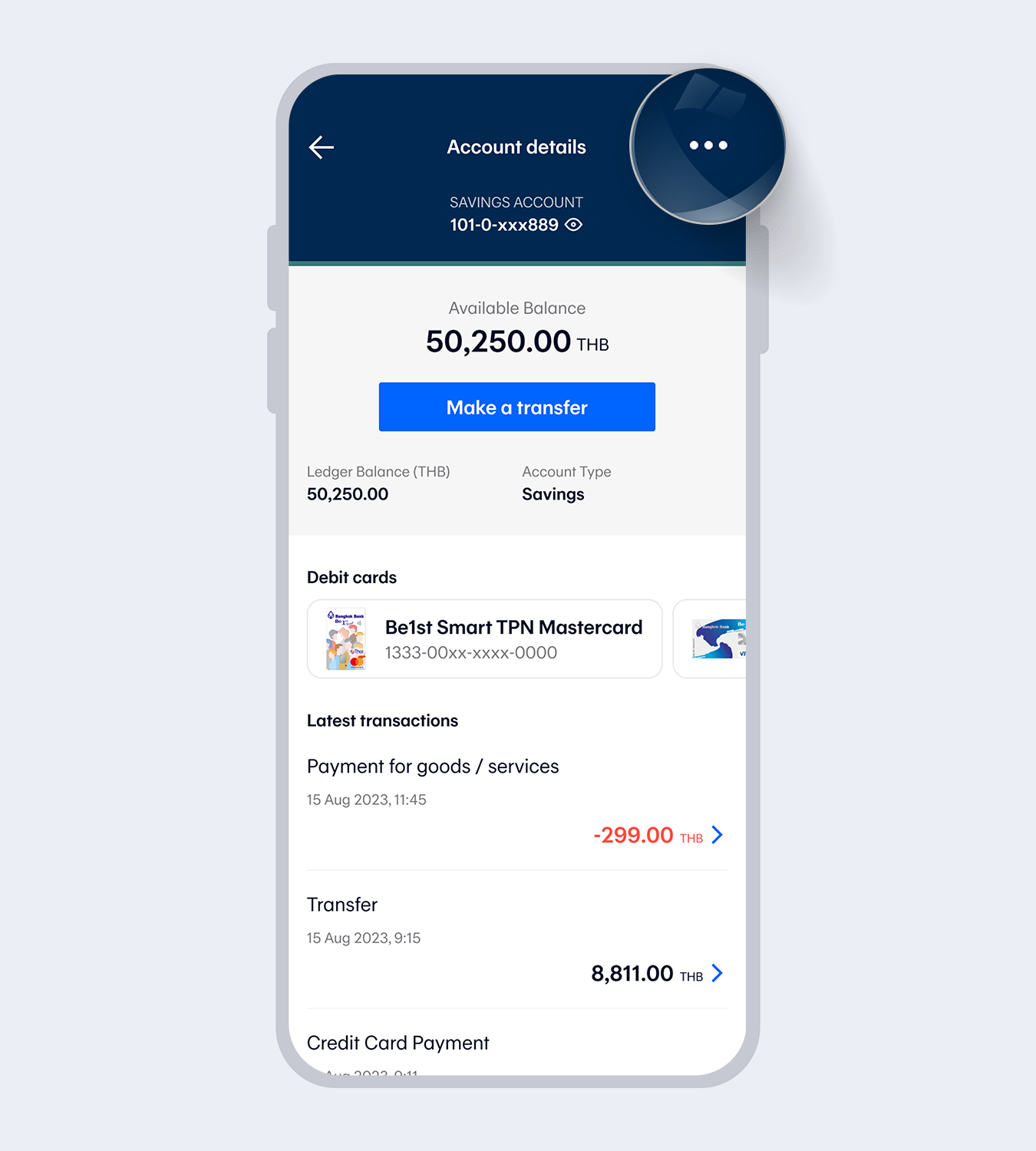

Select “Accounts” and select the account for your debit card request

2.

Select “…” at the top right corner

3.

Select “Manage debit card”

4.

Select “Activate debit card”

5.

Enter the 7th to 12th digits on the cardNote: For Be1st Digital physical card, you can see the full card number by selecting the debit card image on the account details page and select “View card info”.

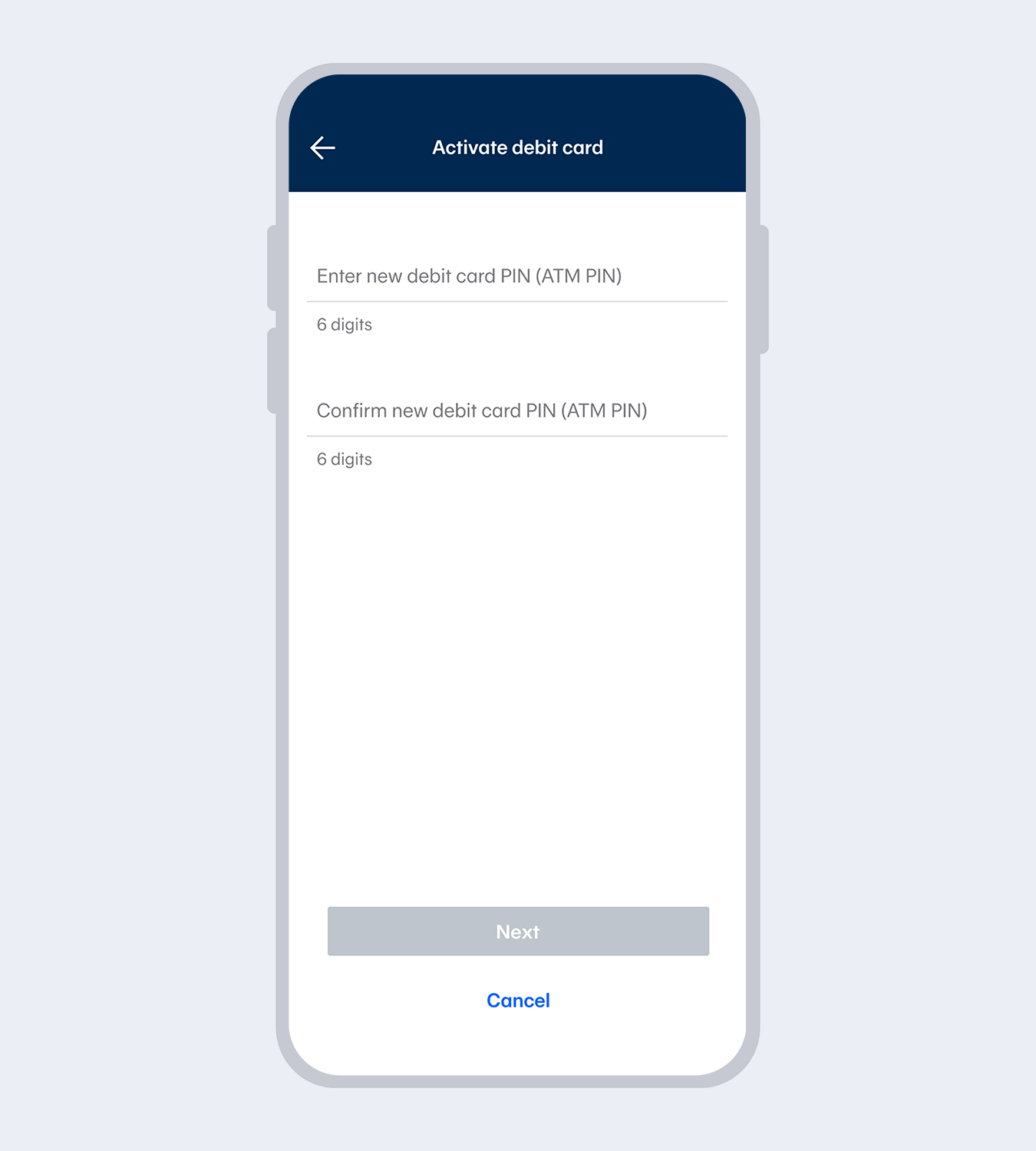

6.

Set and confirm your 6-digit ATM PIN and press “Next”

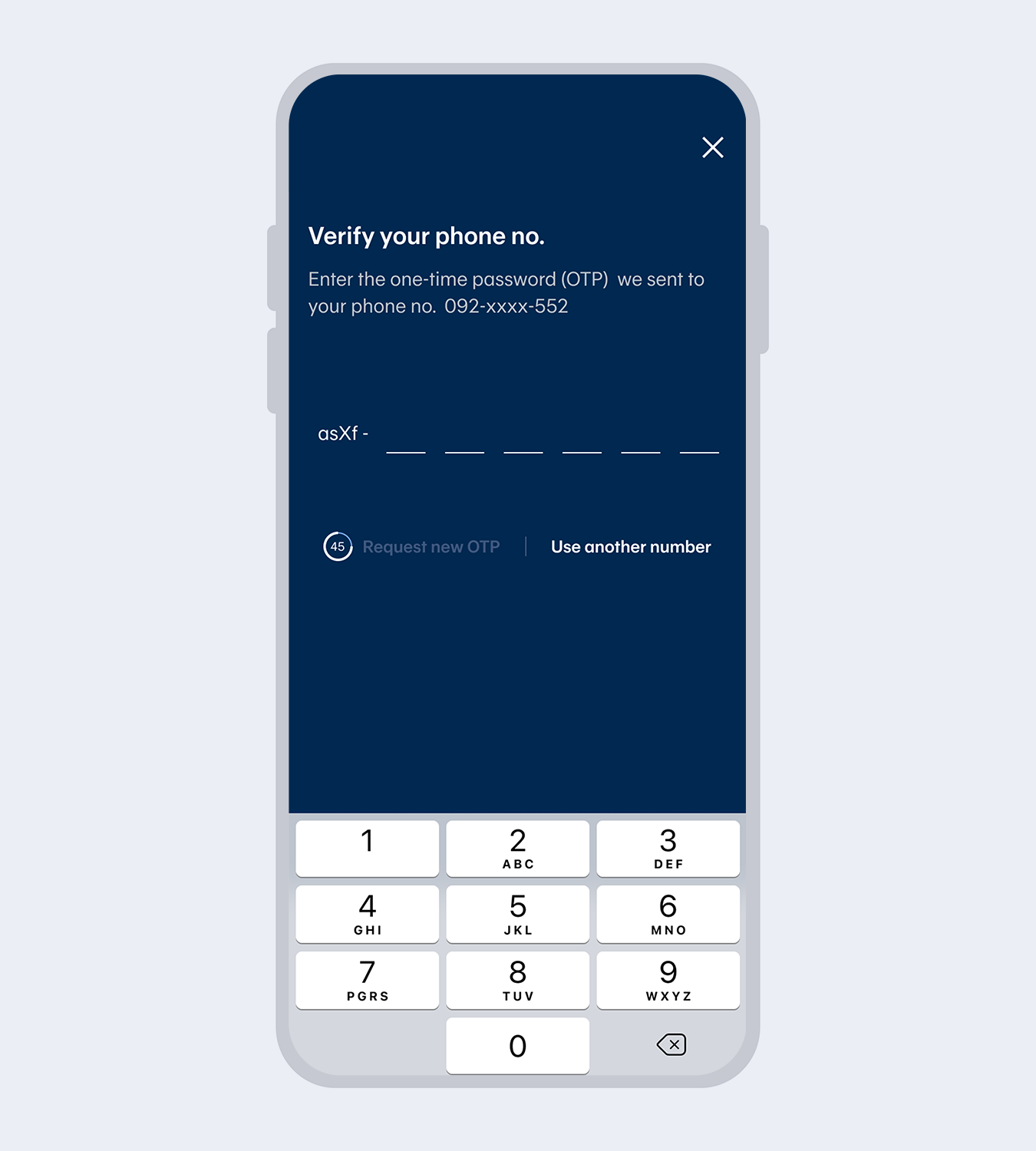

7.

Enter One time Password (OTP) sent via SMS

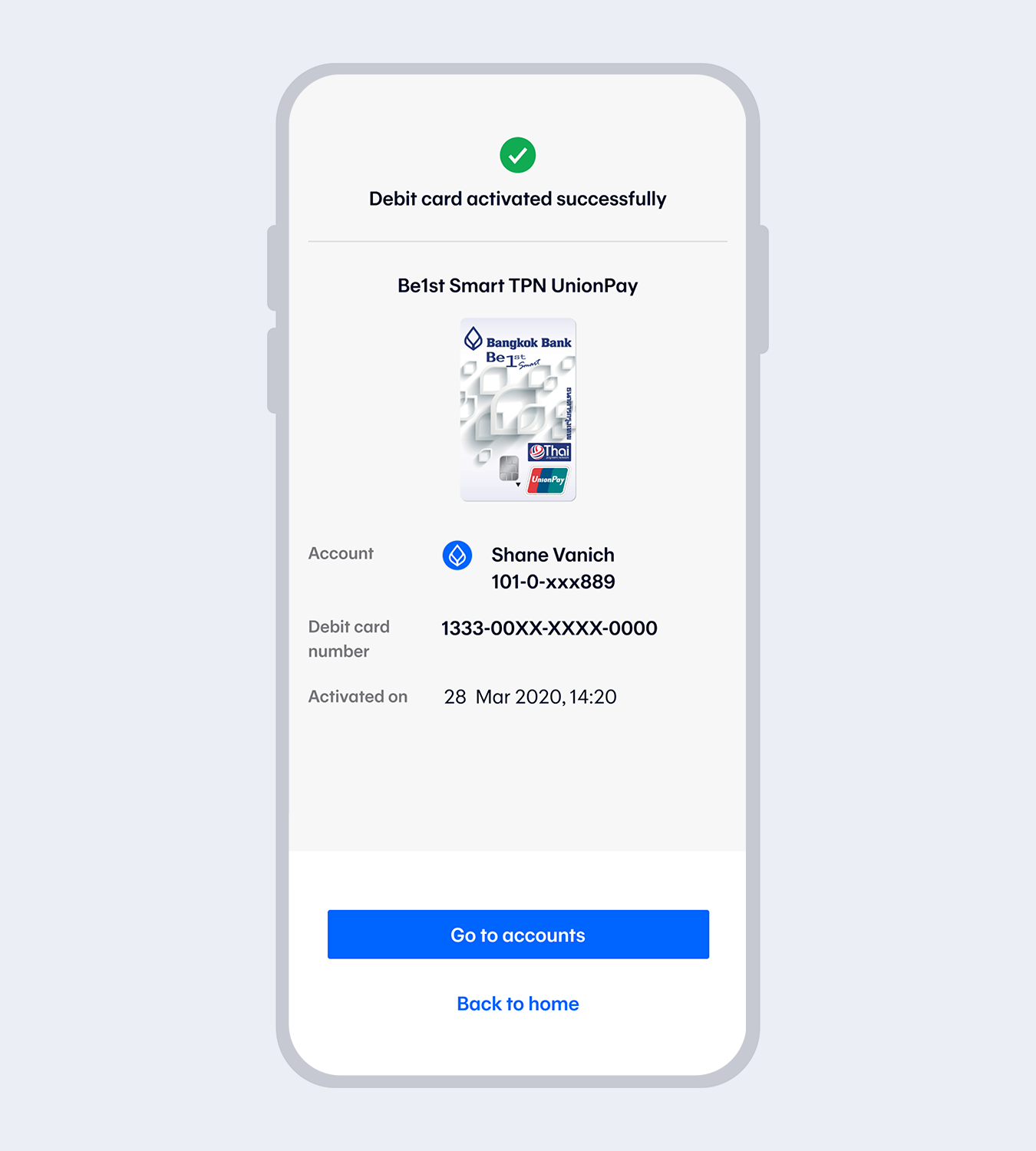

8.

Successfully activated debit card

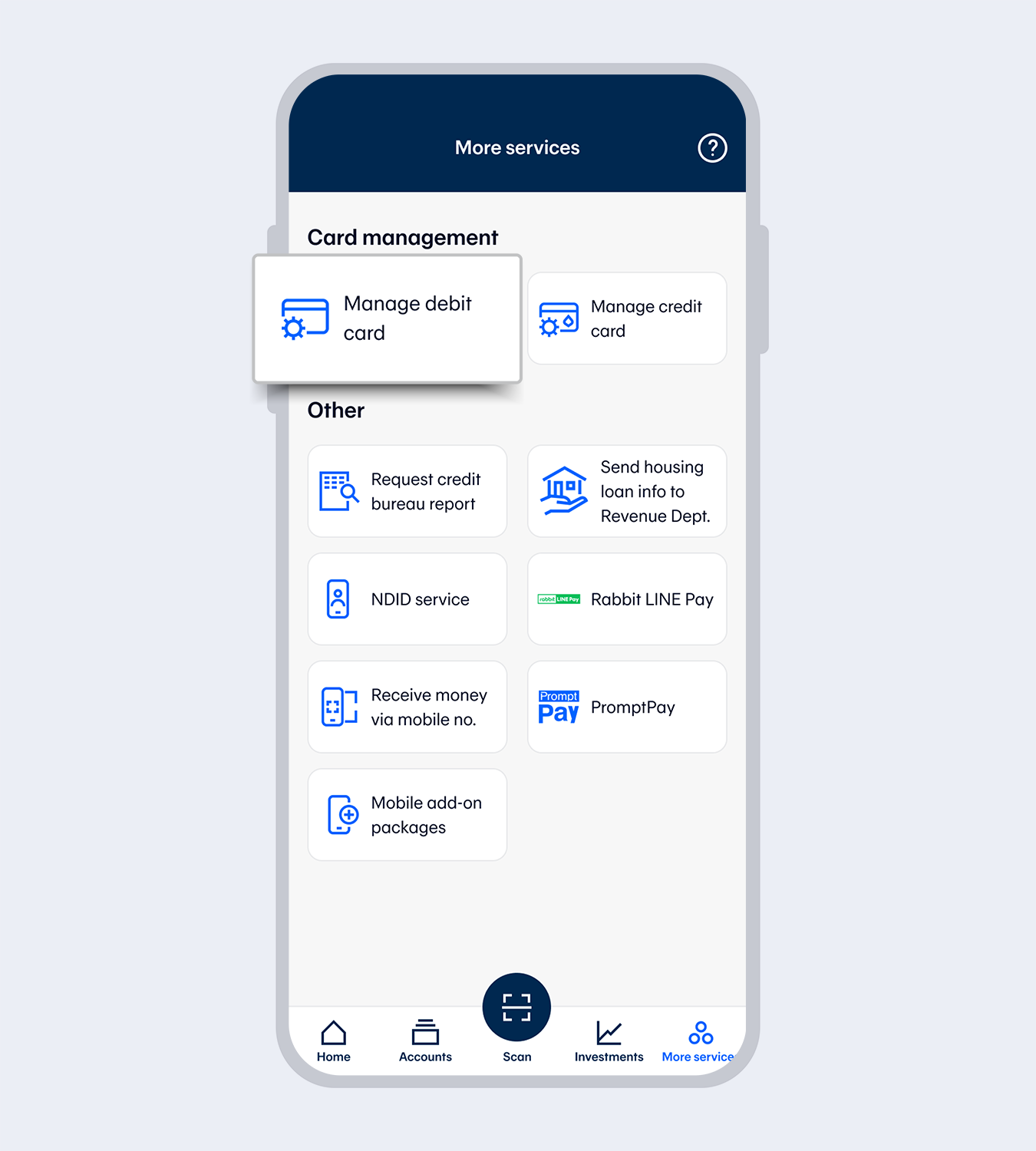

1.

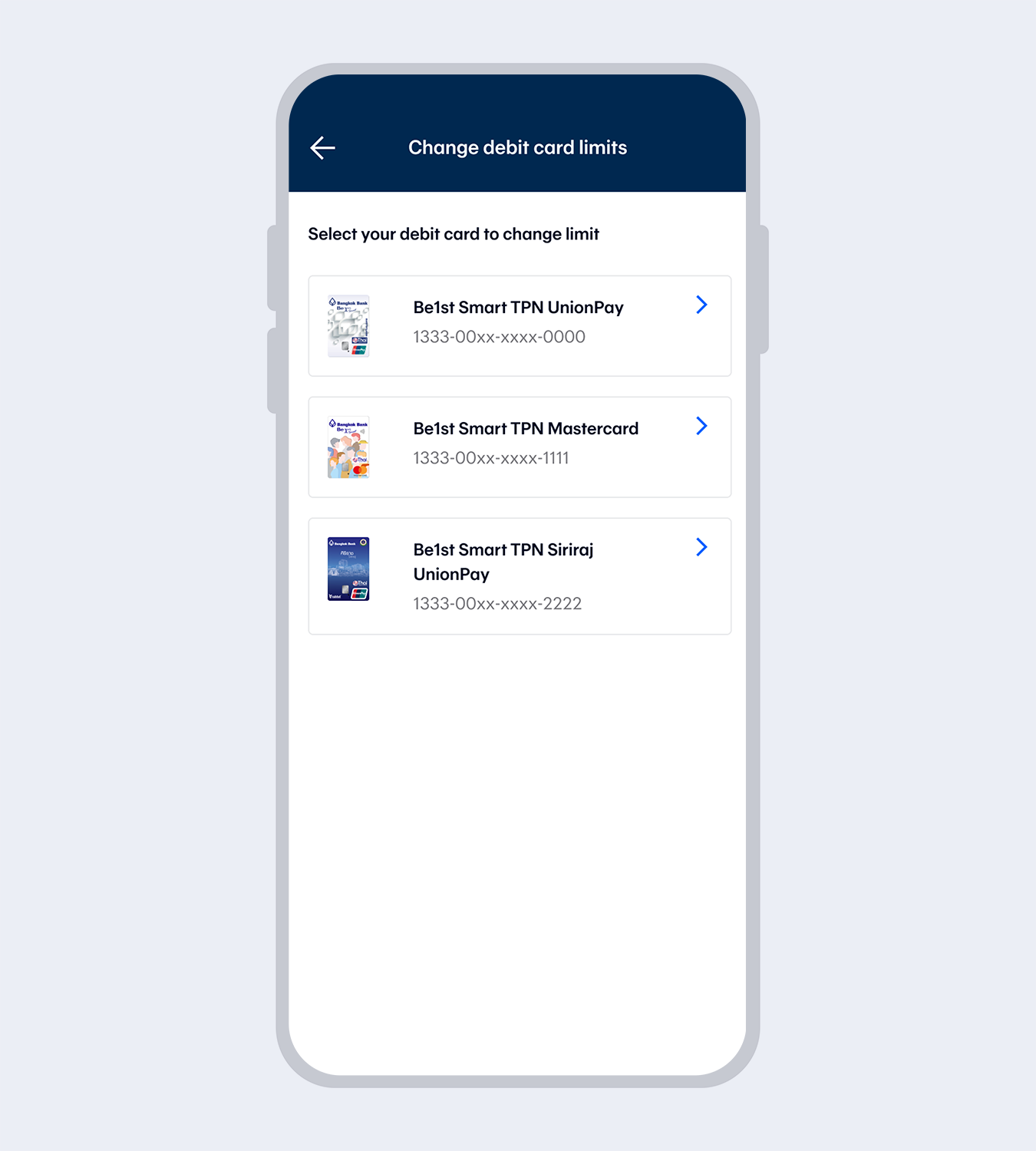

Go to “More Services” and select “Manage debit card”

2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

3.

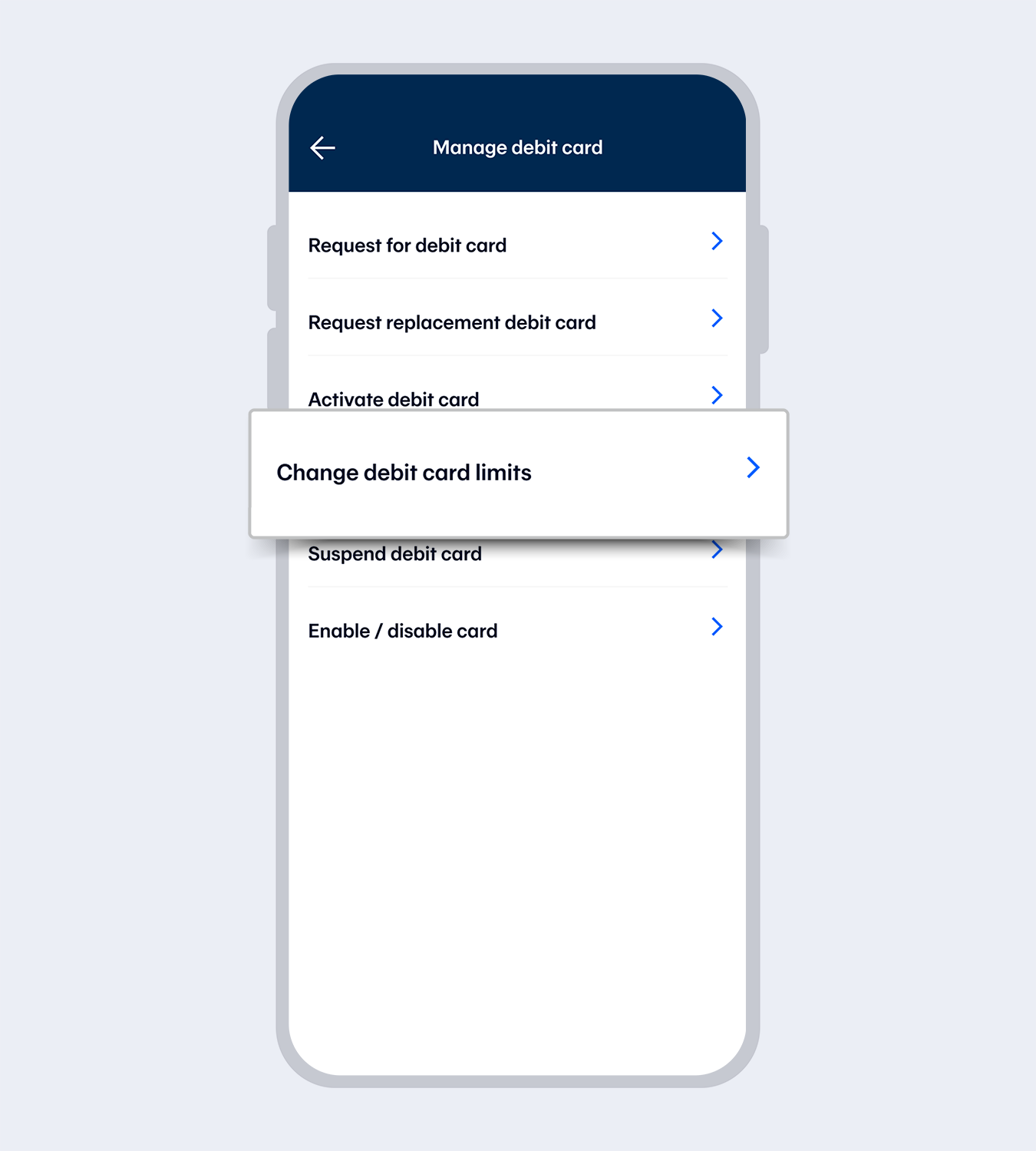

Select “Change debit card limits”

4.

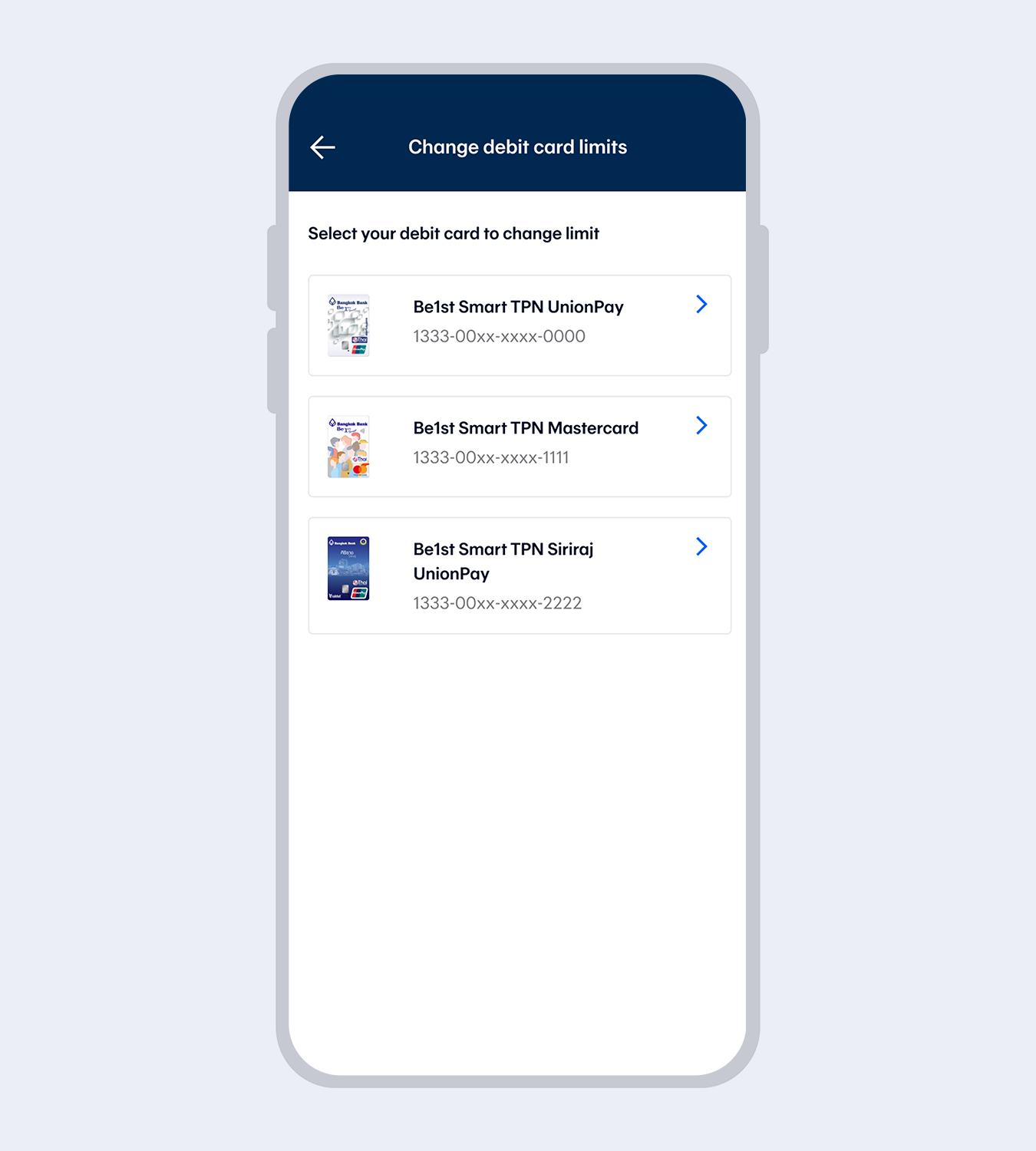

Select the card for which you want to change the limit. (The system will display all debit cards from all accounts added in Mobile Banking.)

5.

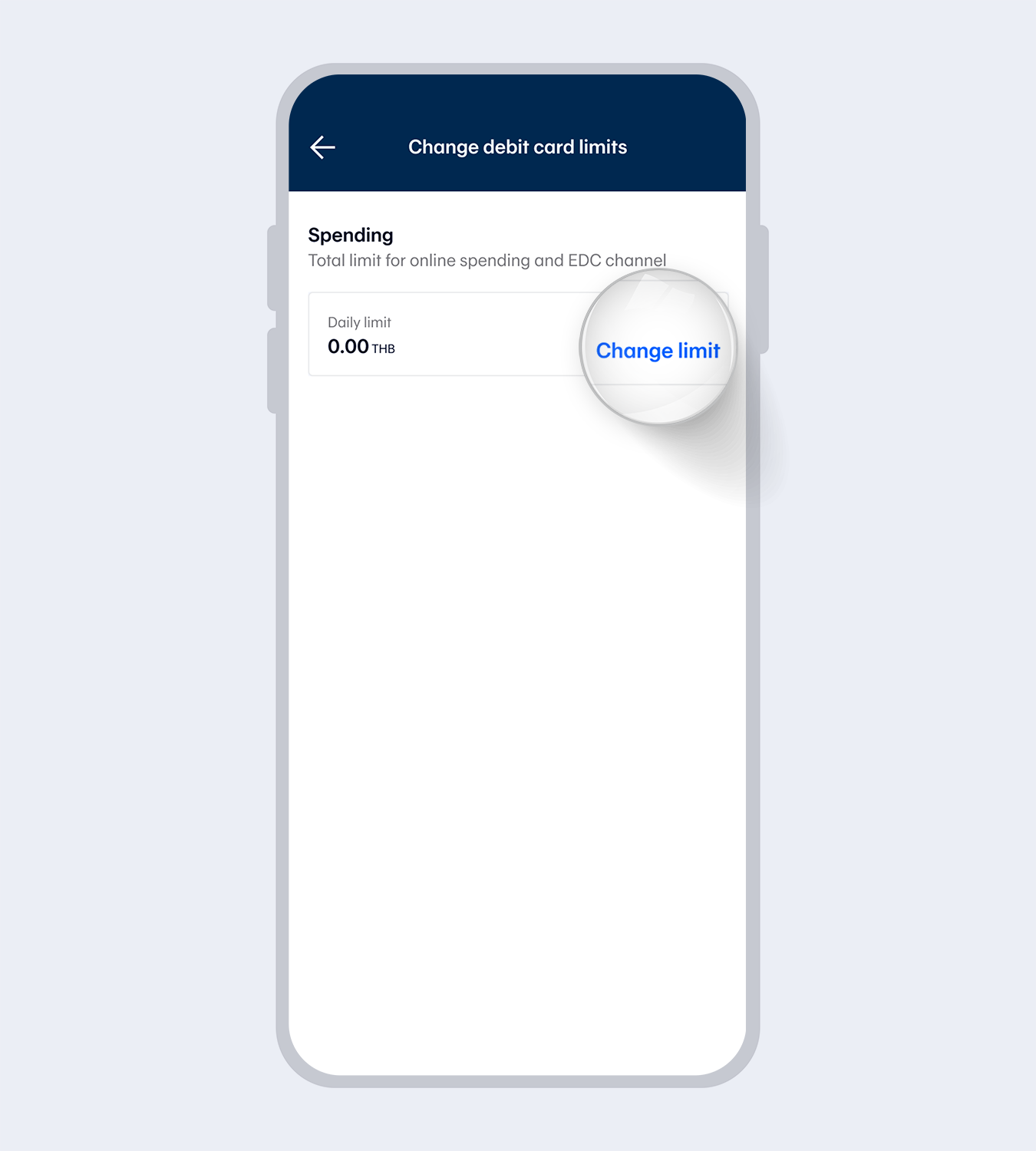

You can check the selected card spending limit and select “Change limit” to choose your preferred limit.

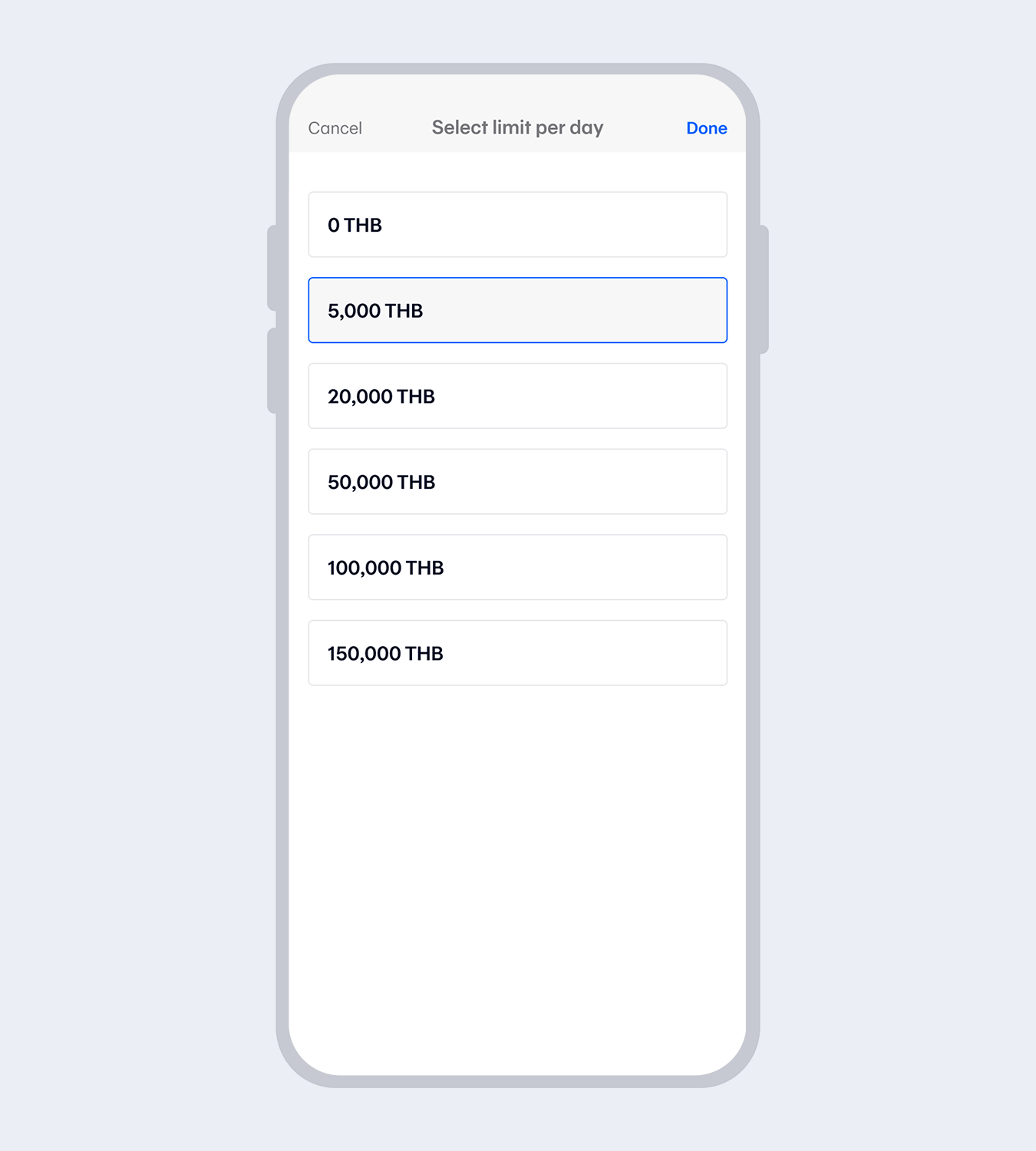

6.

Select your preferred limit per day and select “Done”

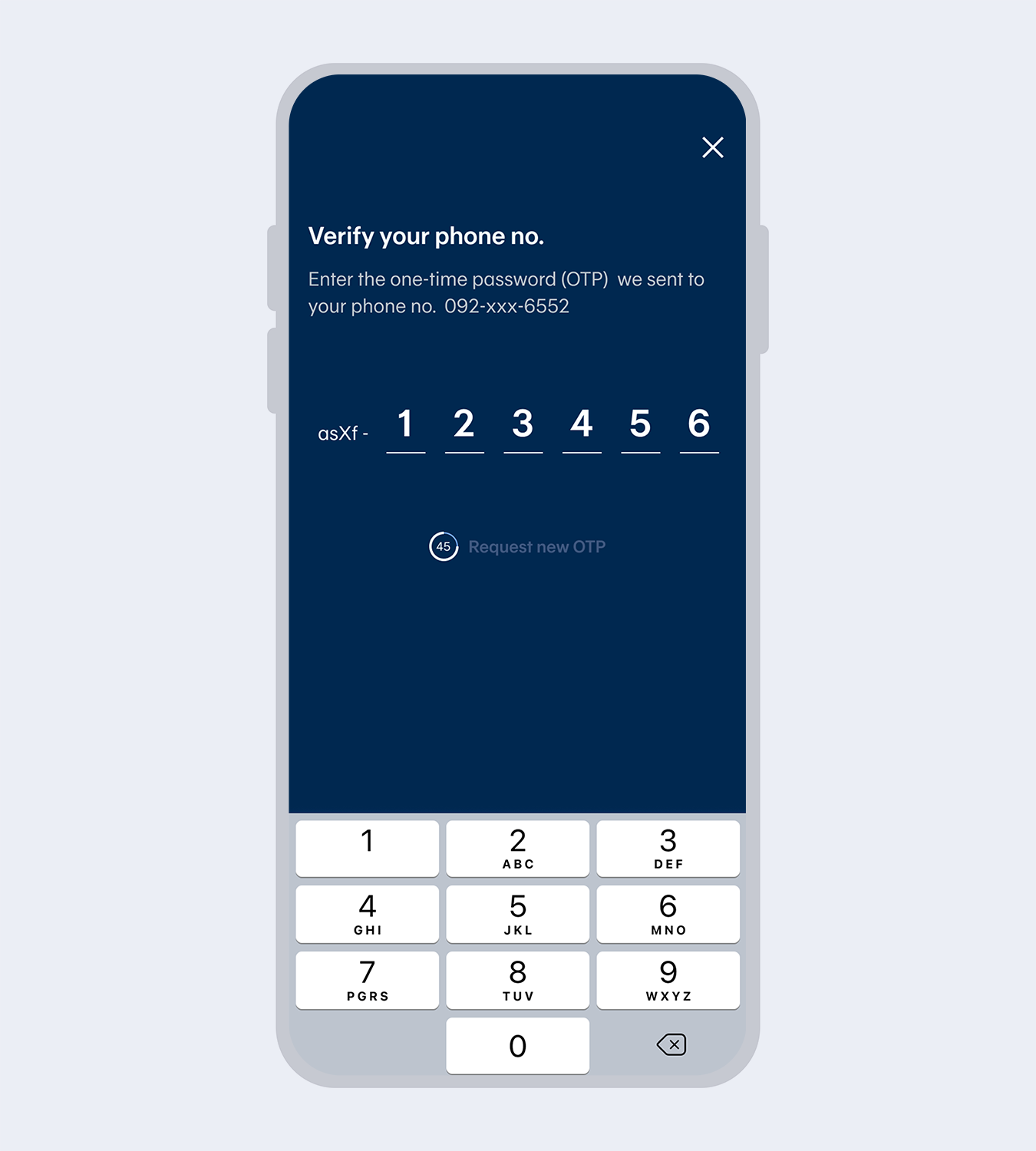

7.

Verify your mobile no. and enter the One Time Password (OTP), only required when you increase the limit.

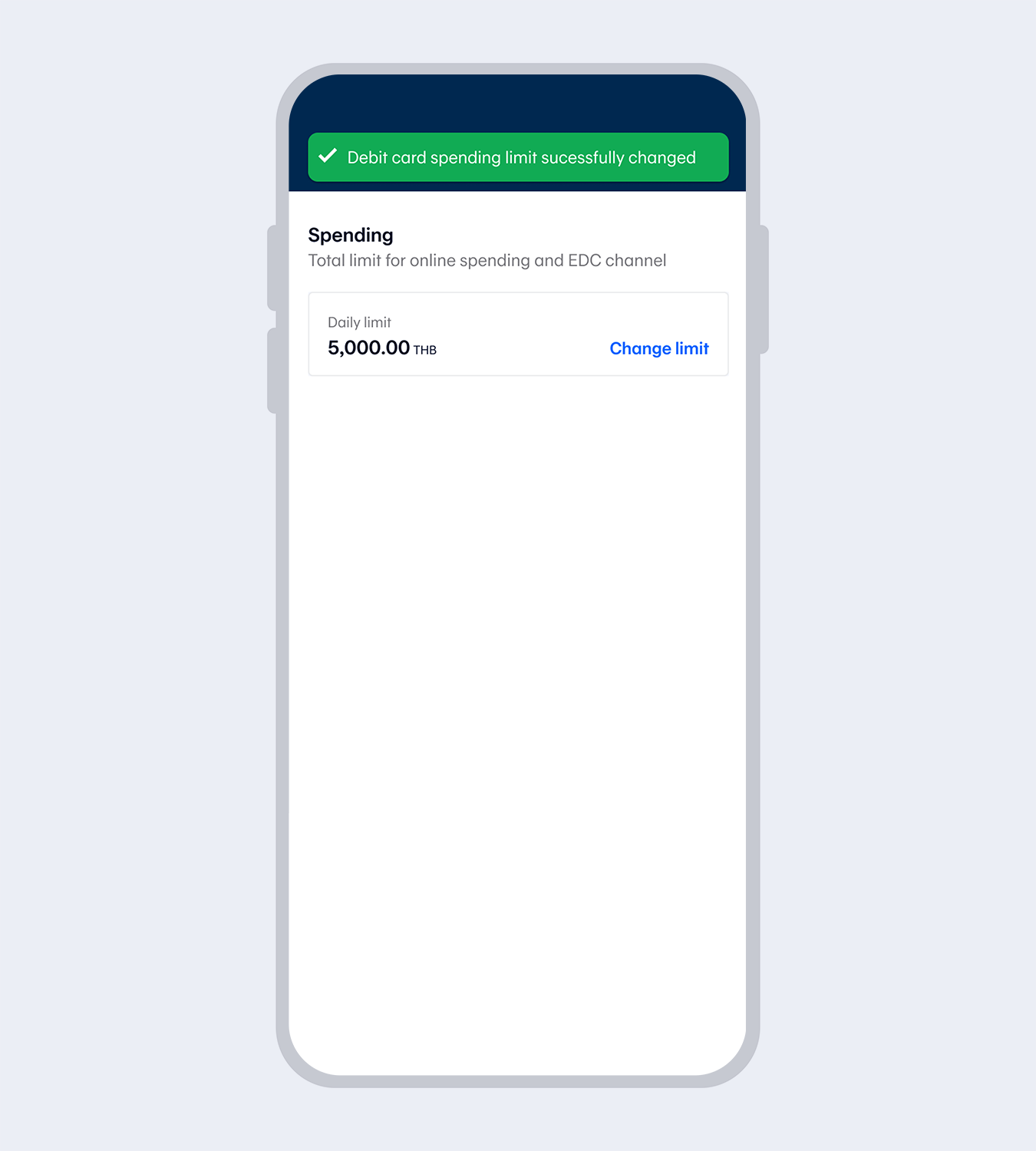

8.

Debit card spending limit successfully changed. You will receive a notification via SMS, Push notification and e-mail.

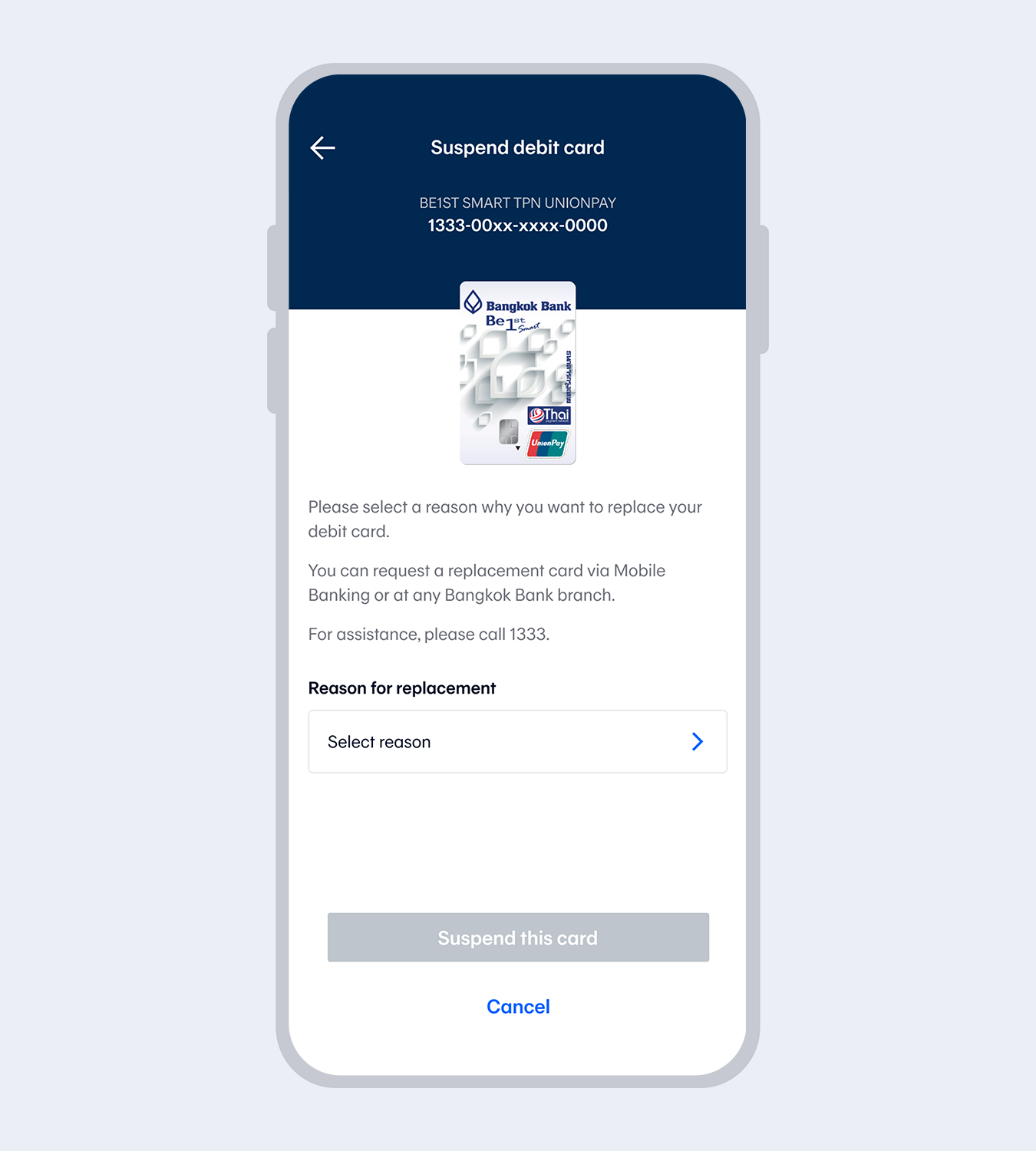

1.

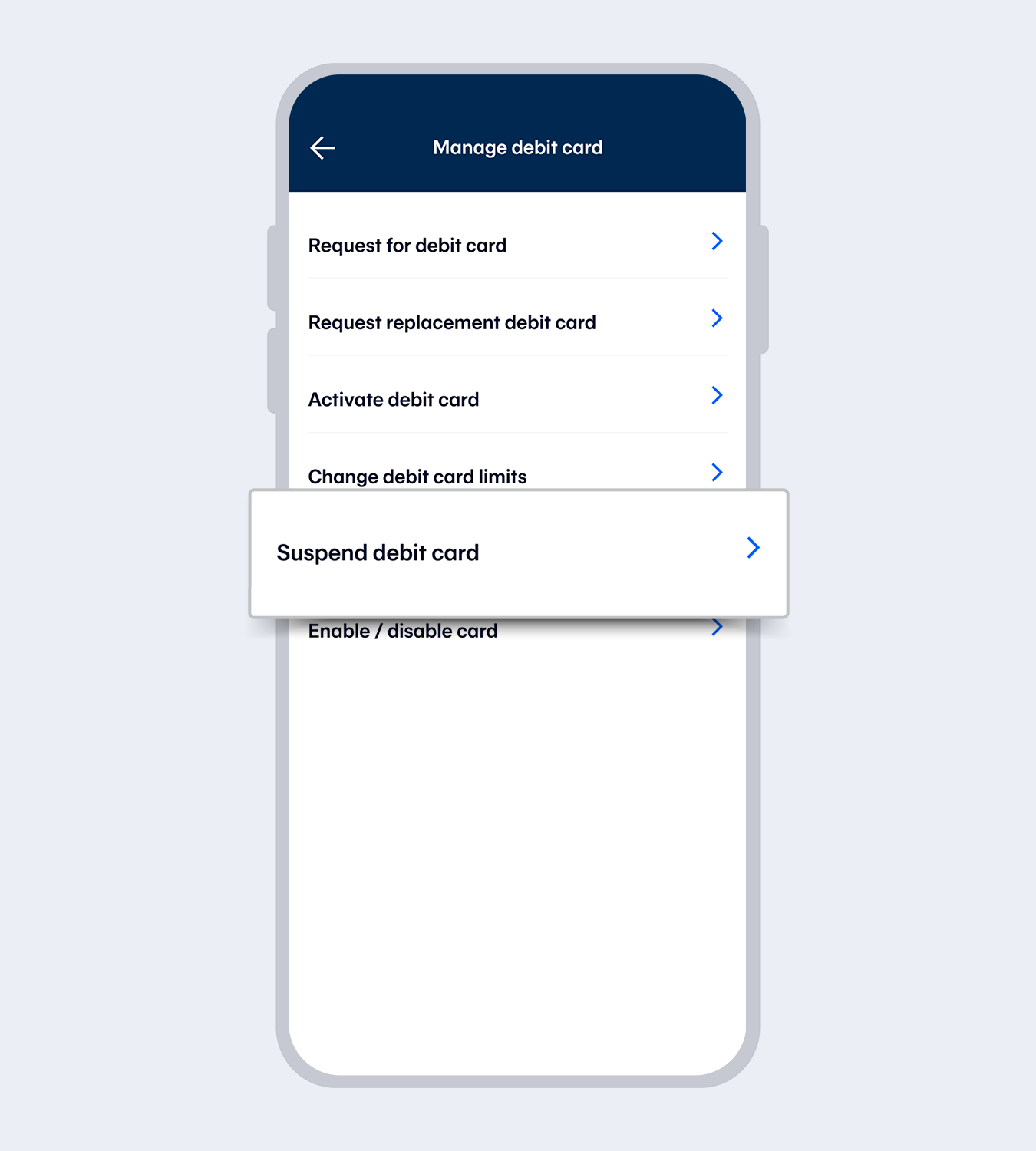

Go to “More services” and select “Manage debit card”

2.

Enter your 6-digit Mobile PIN

3.

Select “Suspend debit card”

4.

Select the card for which you want to suspend (The system will display all debit cards from all accounts added in Mobile Banking.)

5.

Select suspension reason and click “Suspend this card”

6.

Debit card successfully suspended. You will receive a notification via SMS, Push notification and e-mail.

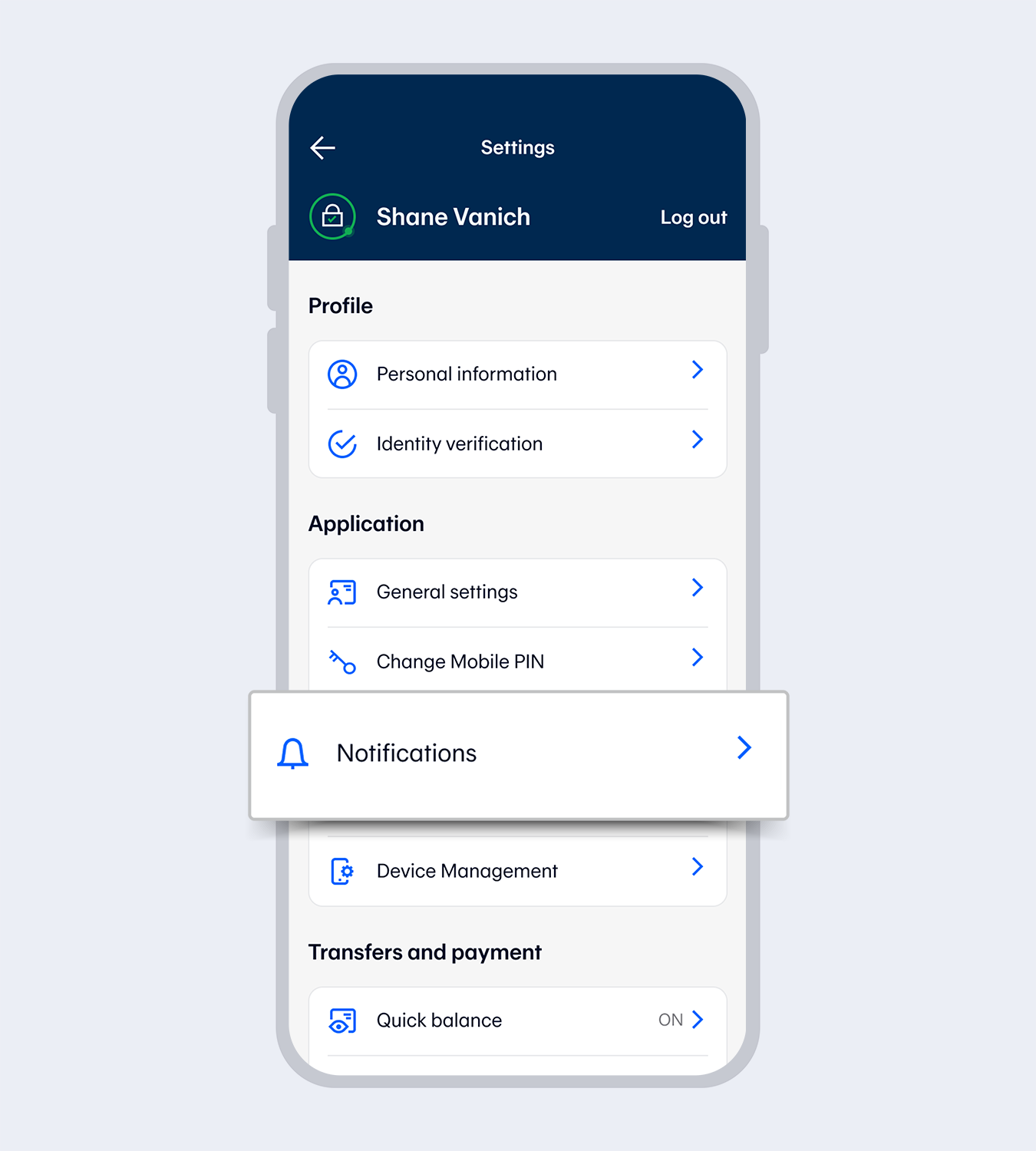

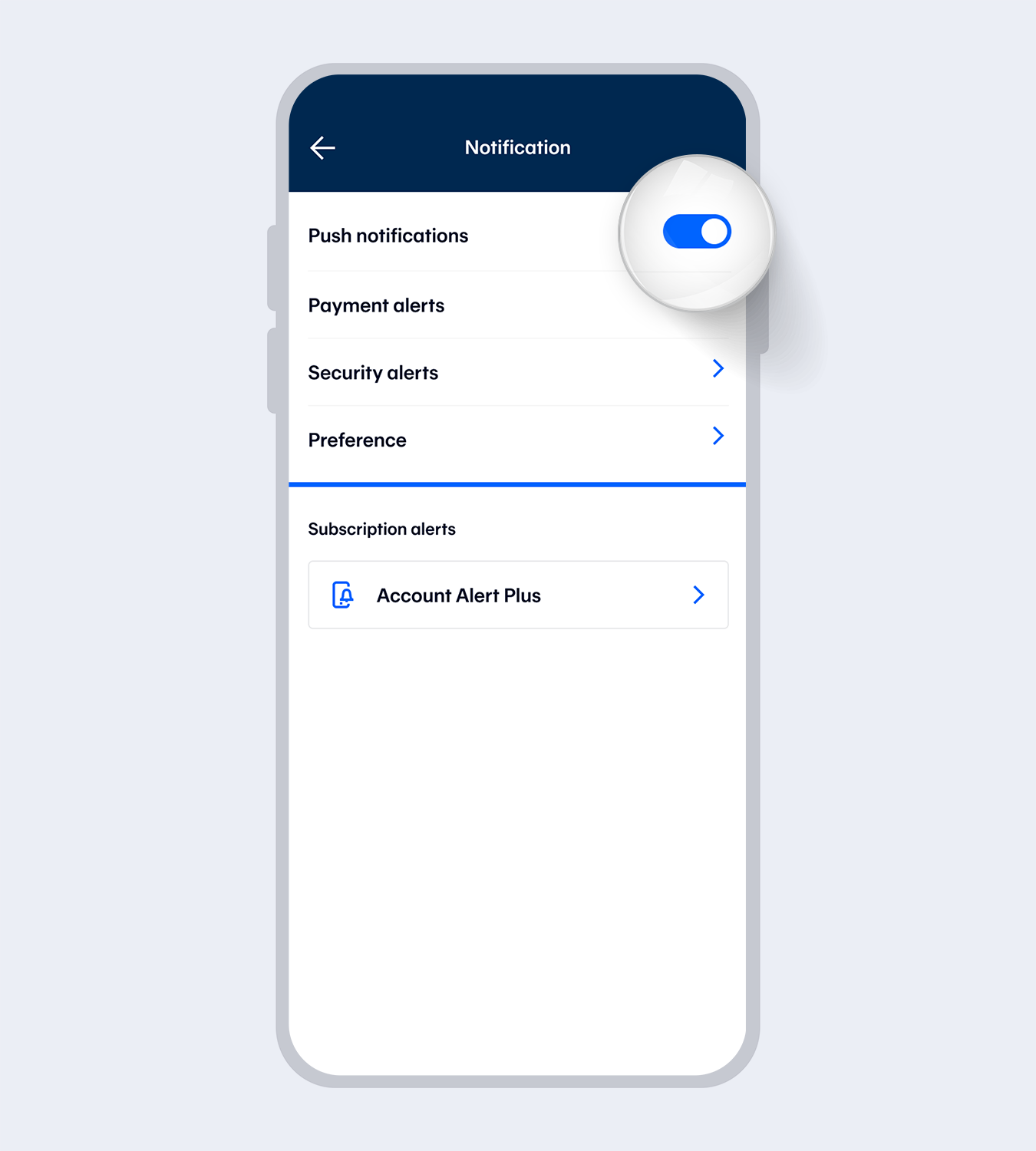

1.

Go to “More” and then select “Notifications”2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

3.

Turn on “Push notifications”Note: Turning off push notifications means all notifications will be disabled, including debit/credit card spending, rewards redemption, PayAlert and bank announcements

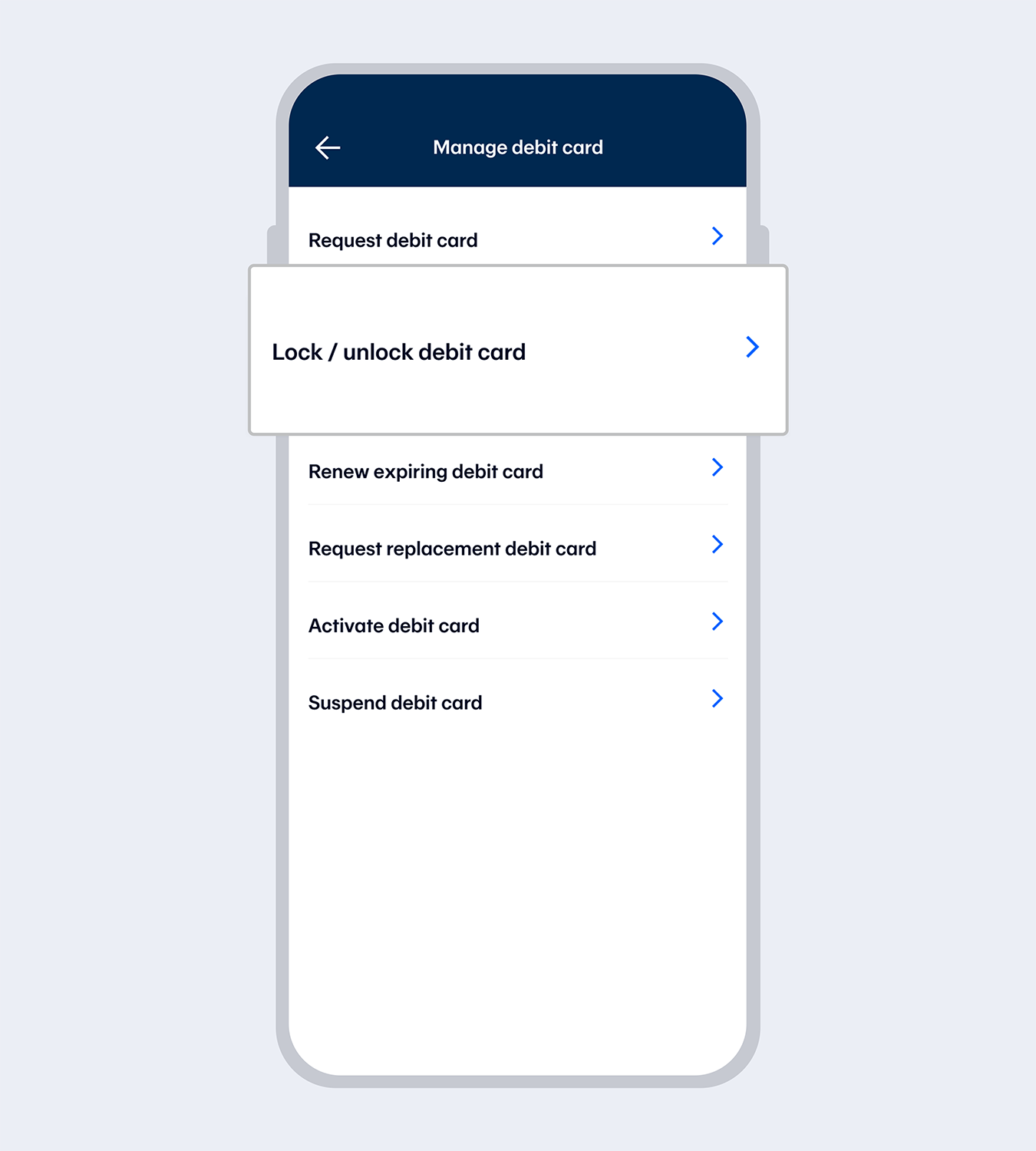

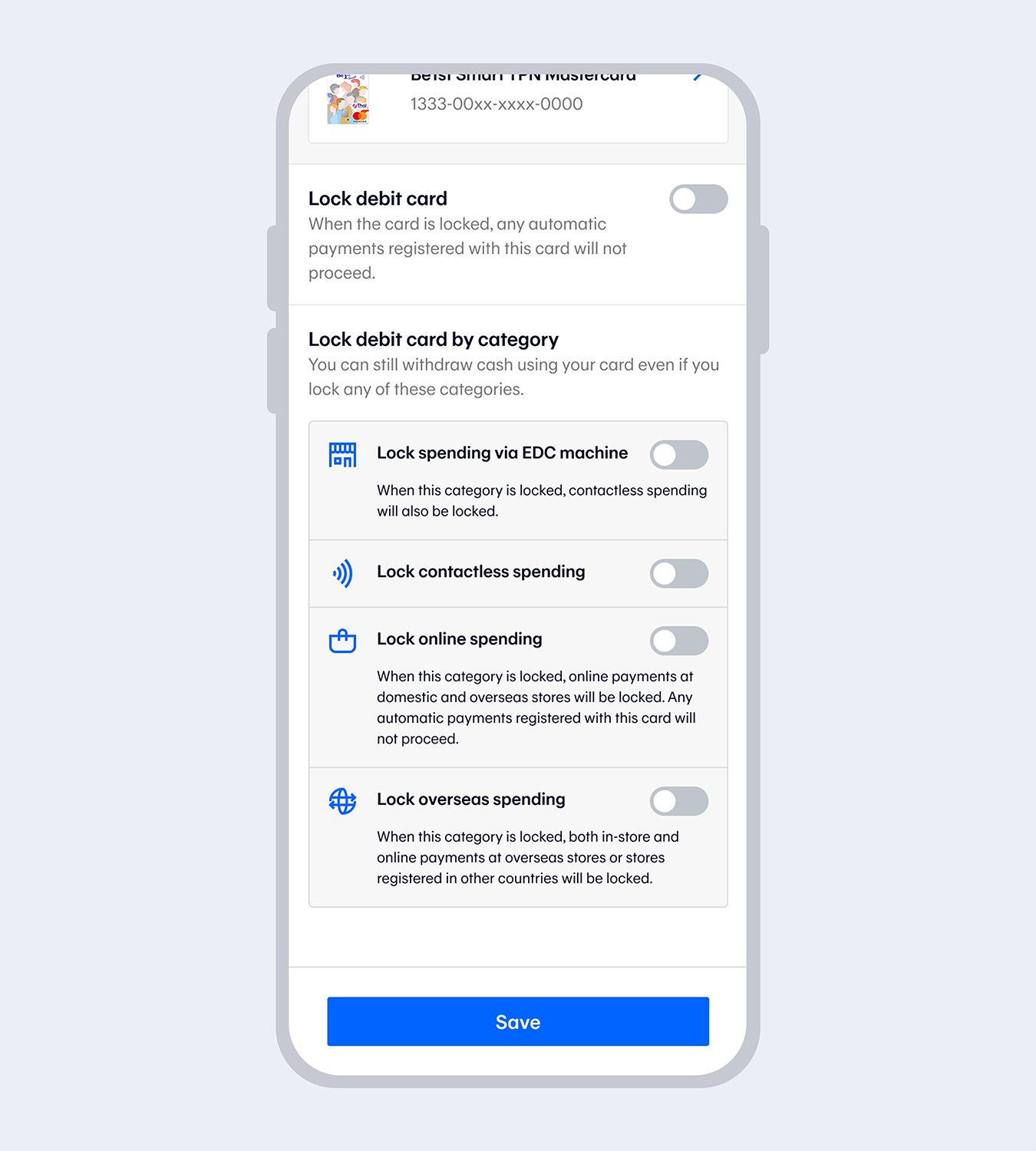

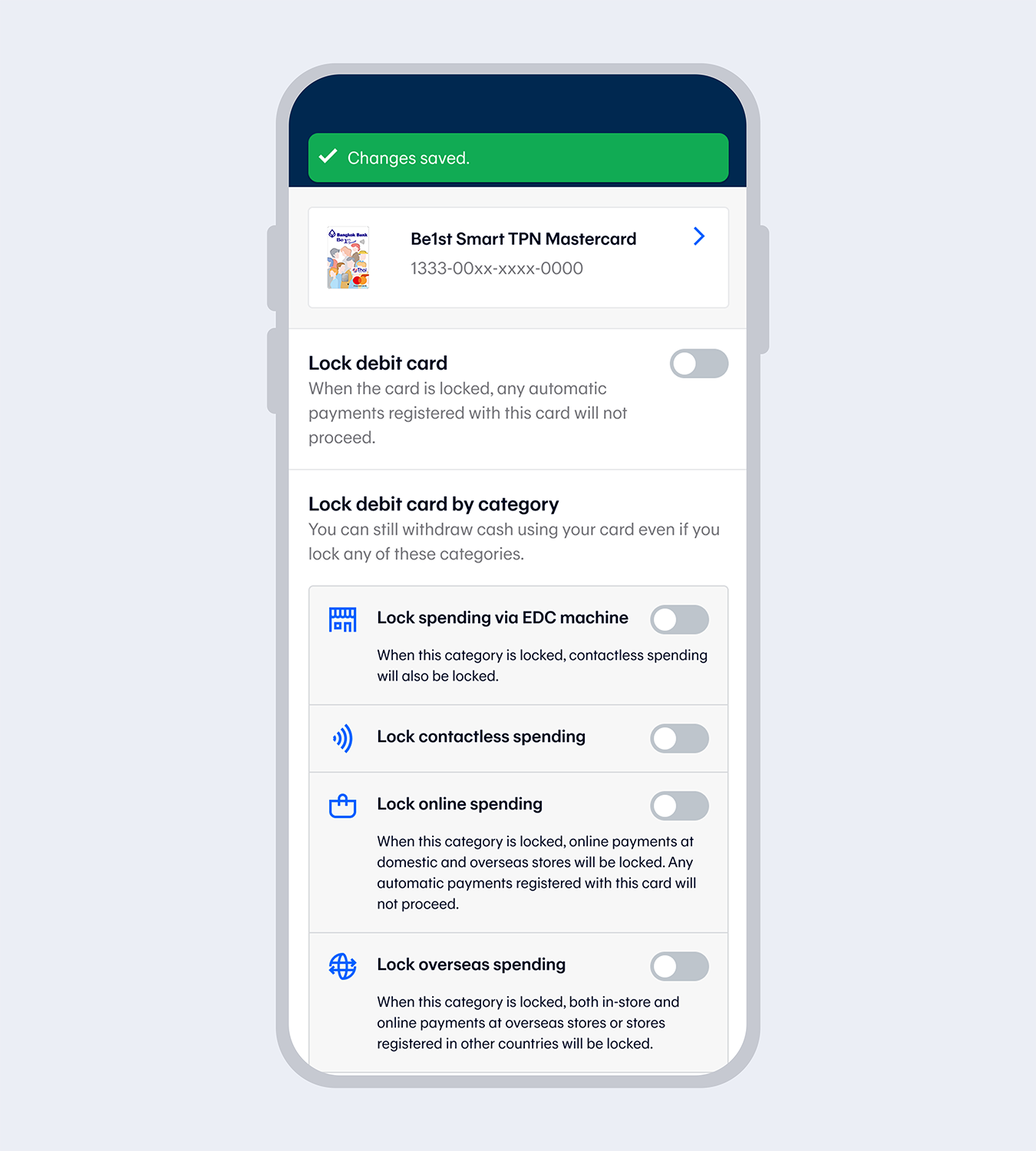

1.

Go to “More services” and select “Manage debit card”.

2.

Enter your 6-digit Mobile PIN.

3.

Select “Lock / unlock debit card”.

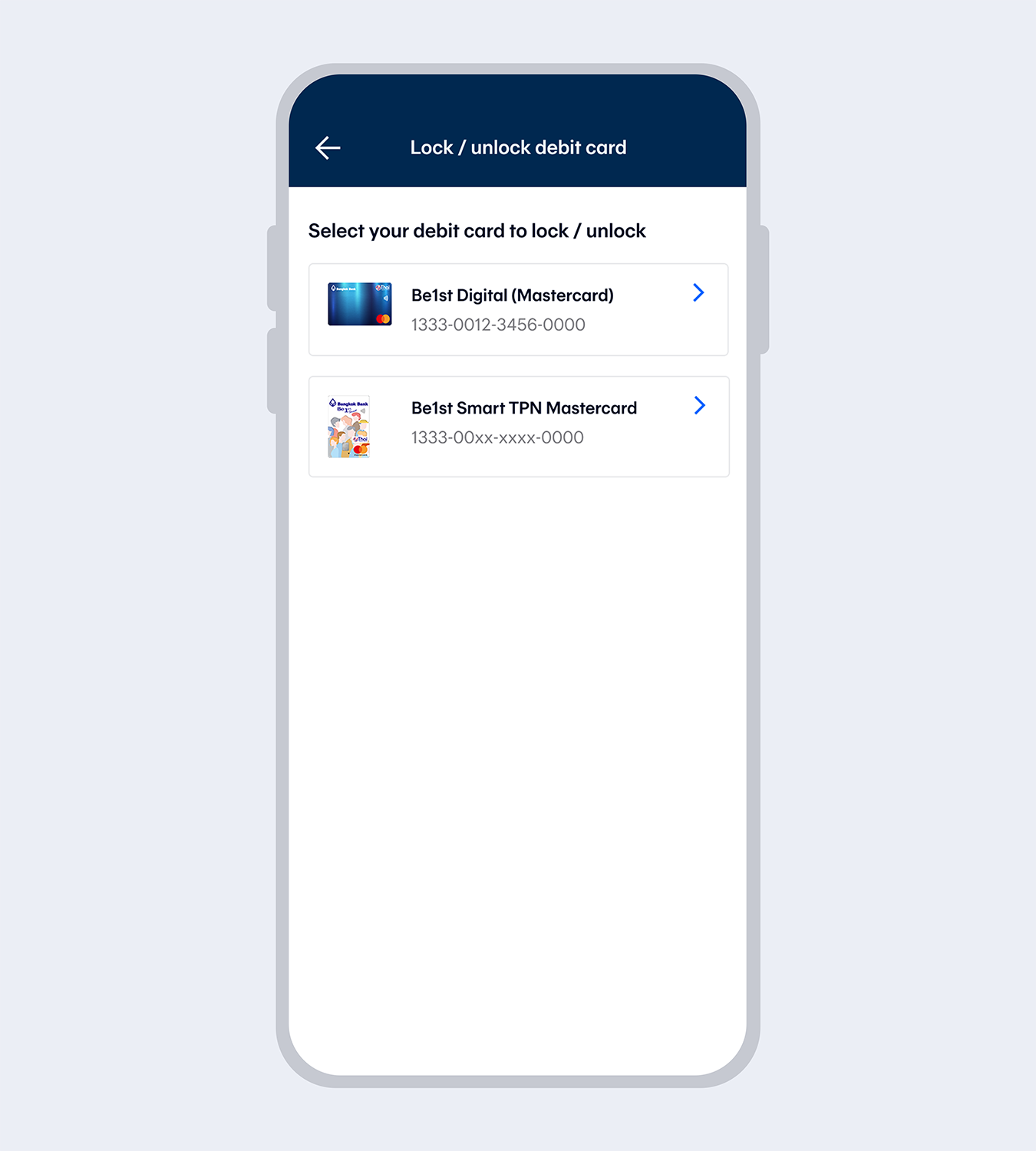

4.

Select the card you want to lock / unlock.

5.

Select the category you want to lock / unlock and select "Save".

6.

Debit card locked / unlocked successfully. You will receive a notification via email.