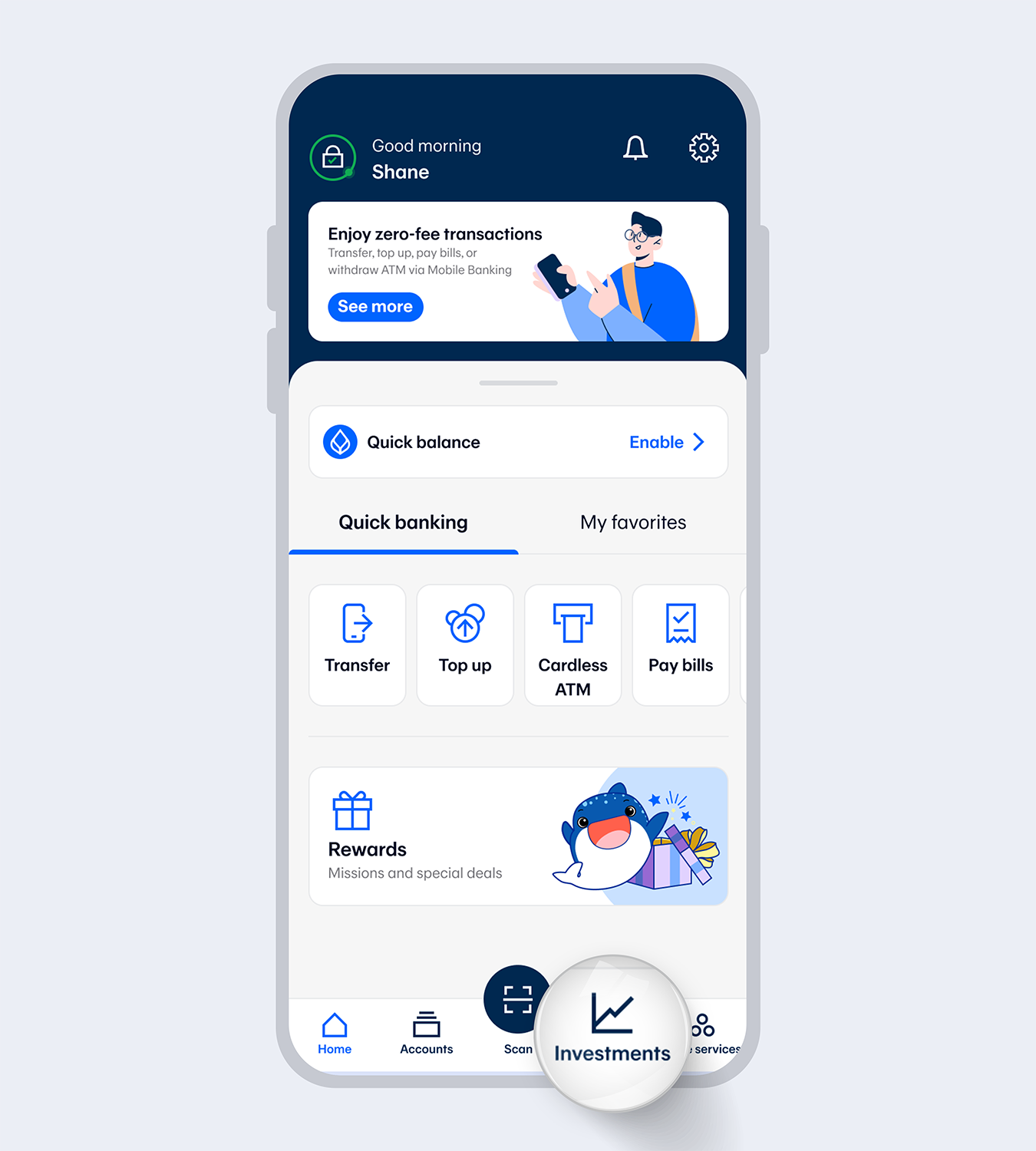

1.

Select “Investment” menu2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

3.

Select “Discover bonds”

4.

Select “Open an account”5.

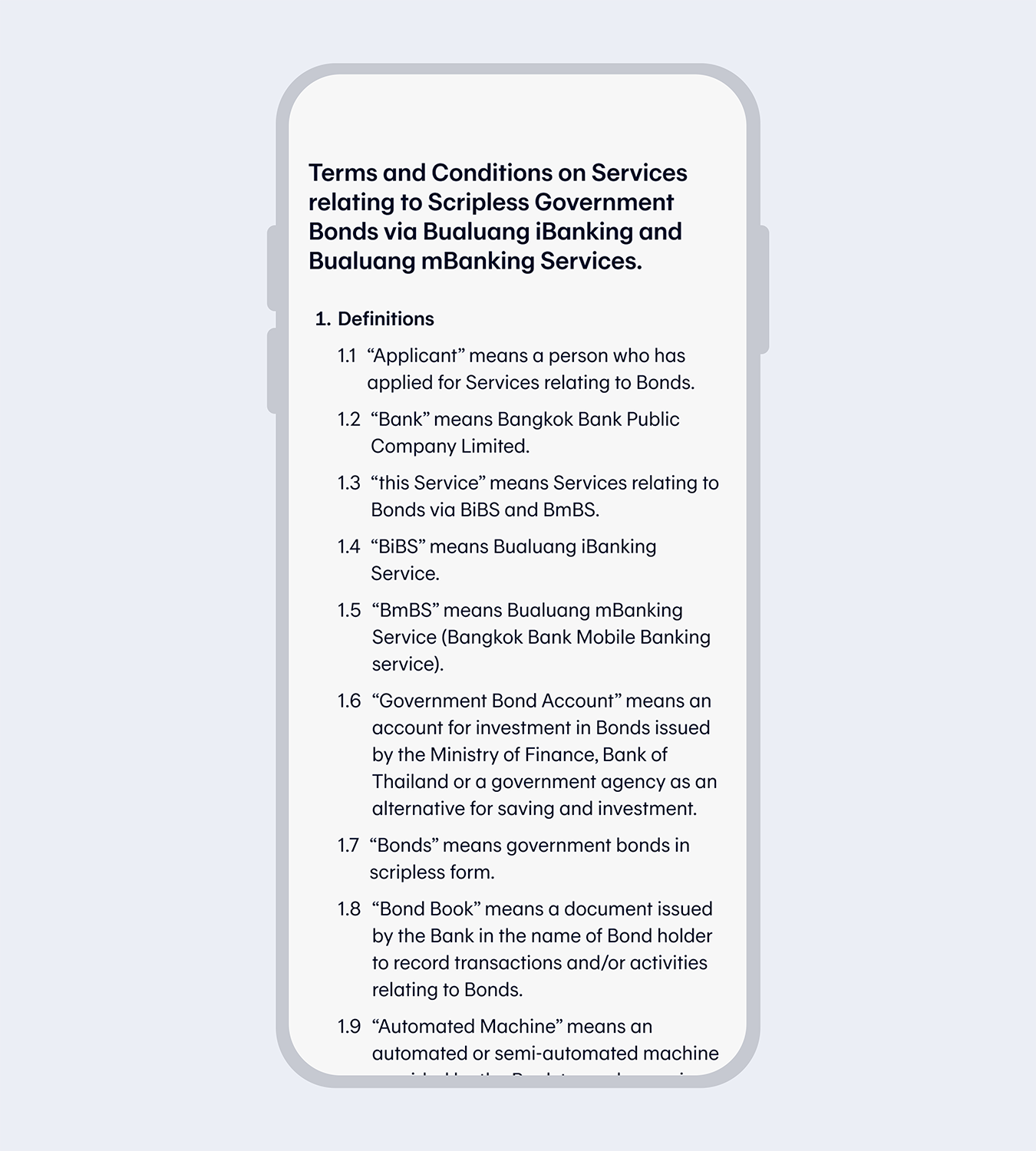

Read the terms and conditions and select “Accept”

6.

Read the Letter of Intent for Disclosure of Information, select “I agree" or “I do not agree“, then select “Confirm”7.

Provide consent for the use of Face data (PDPA)

8.

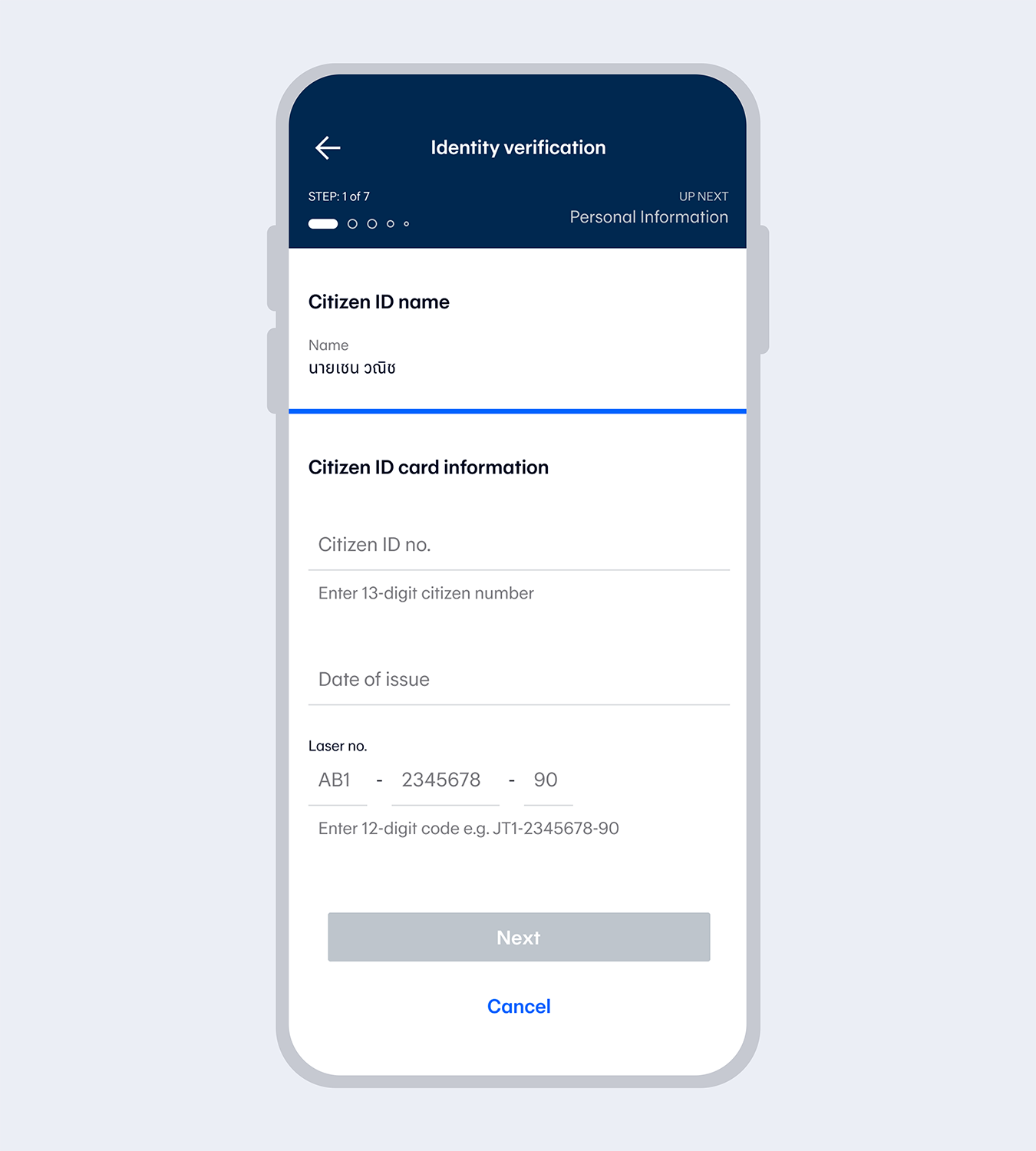

Enter your personal information and select “Next”

9.

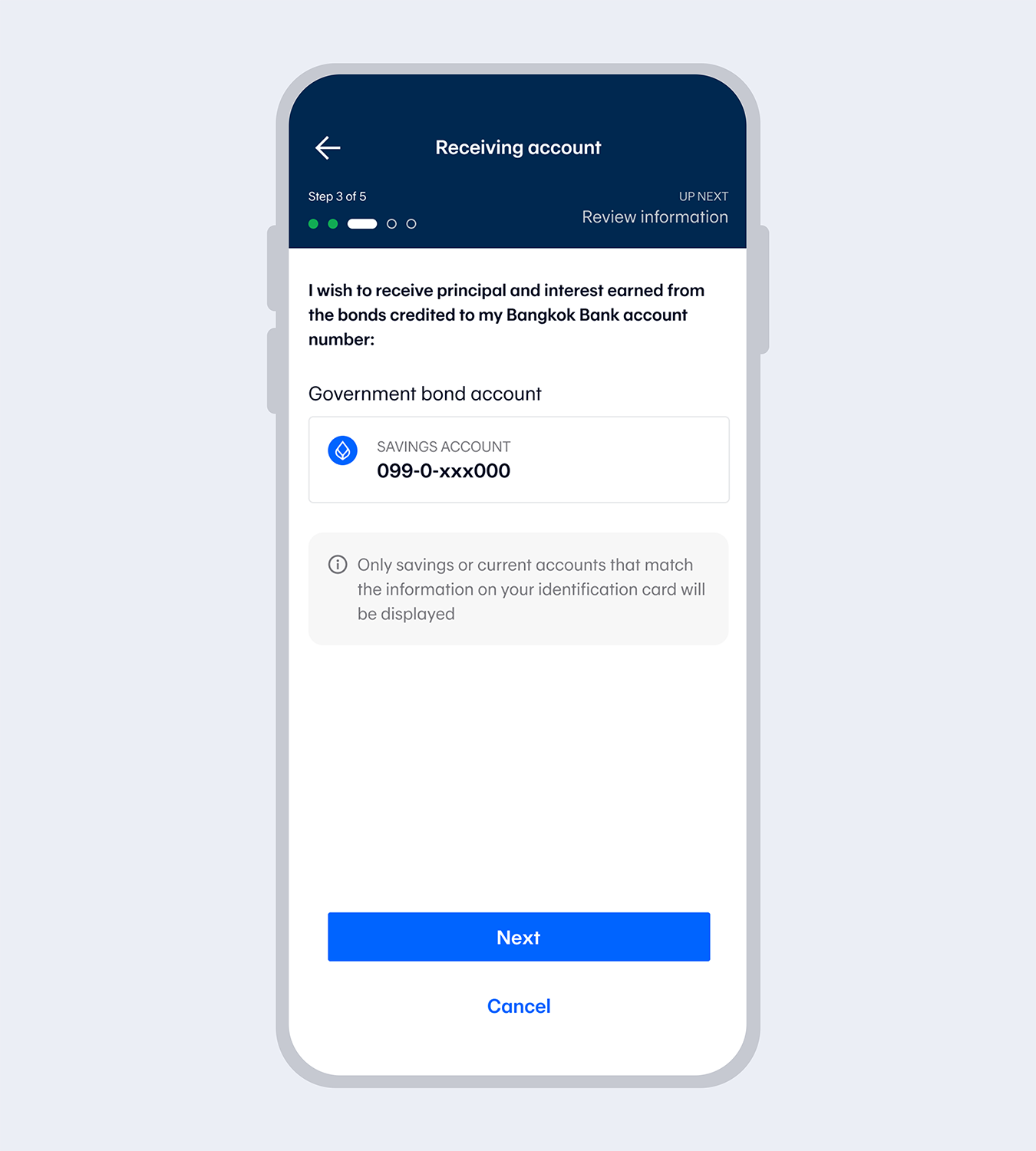

Select a receiving/refund account and select "Next"10.

Review the information and select "Next"11.

Verify identity with facial recognition

12.

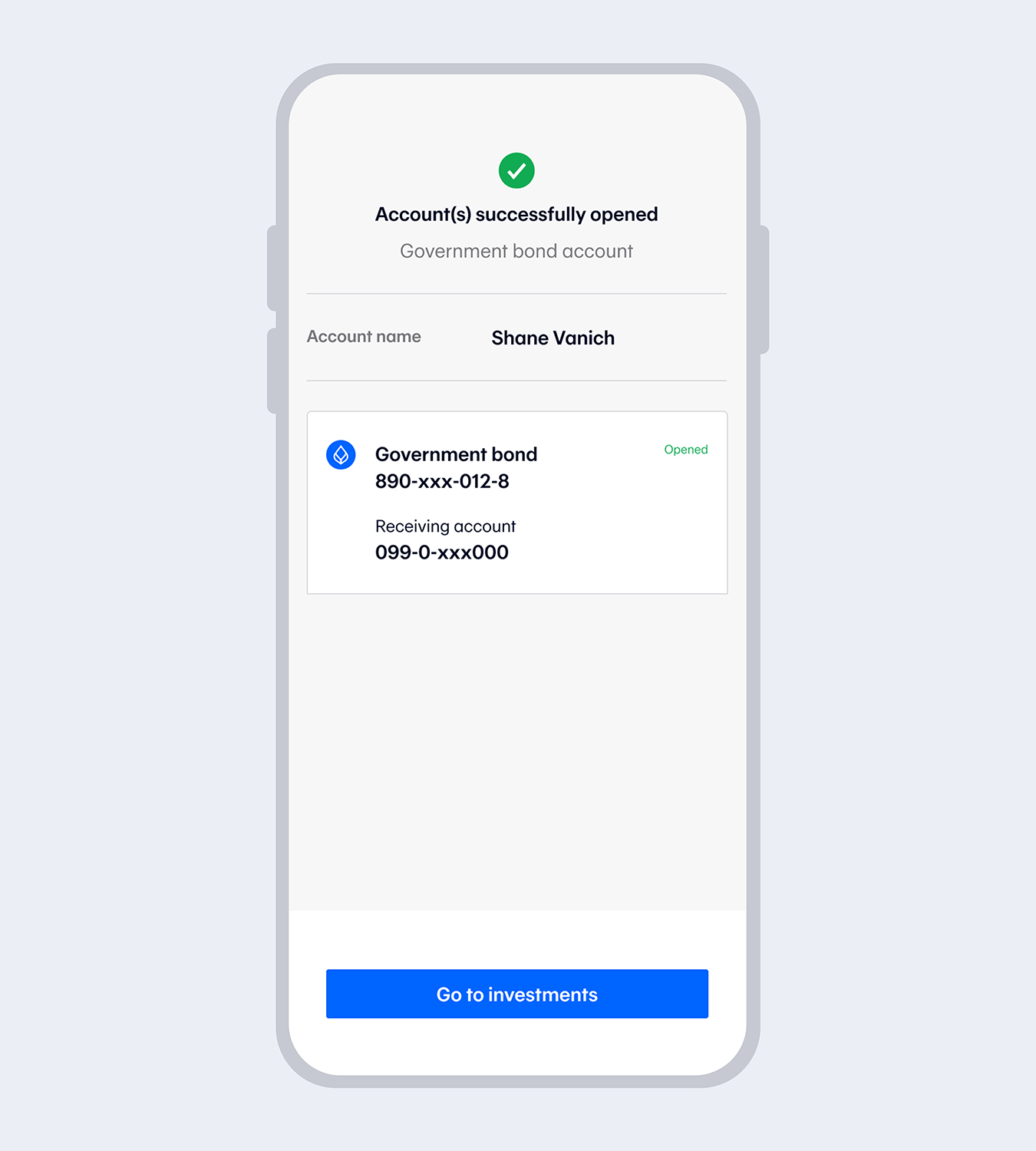

Once the transaction has been completed, you will receive a confirmation email.

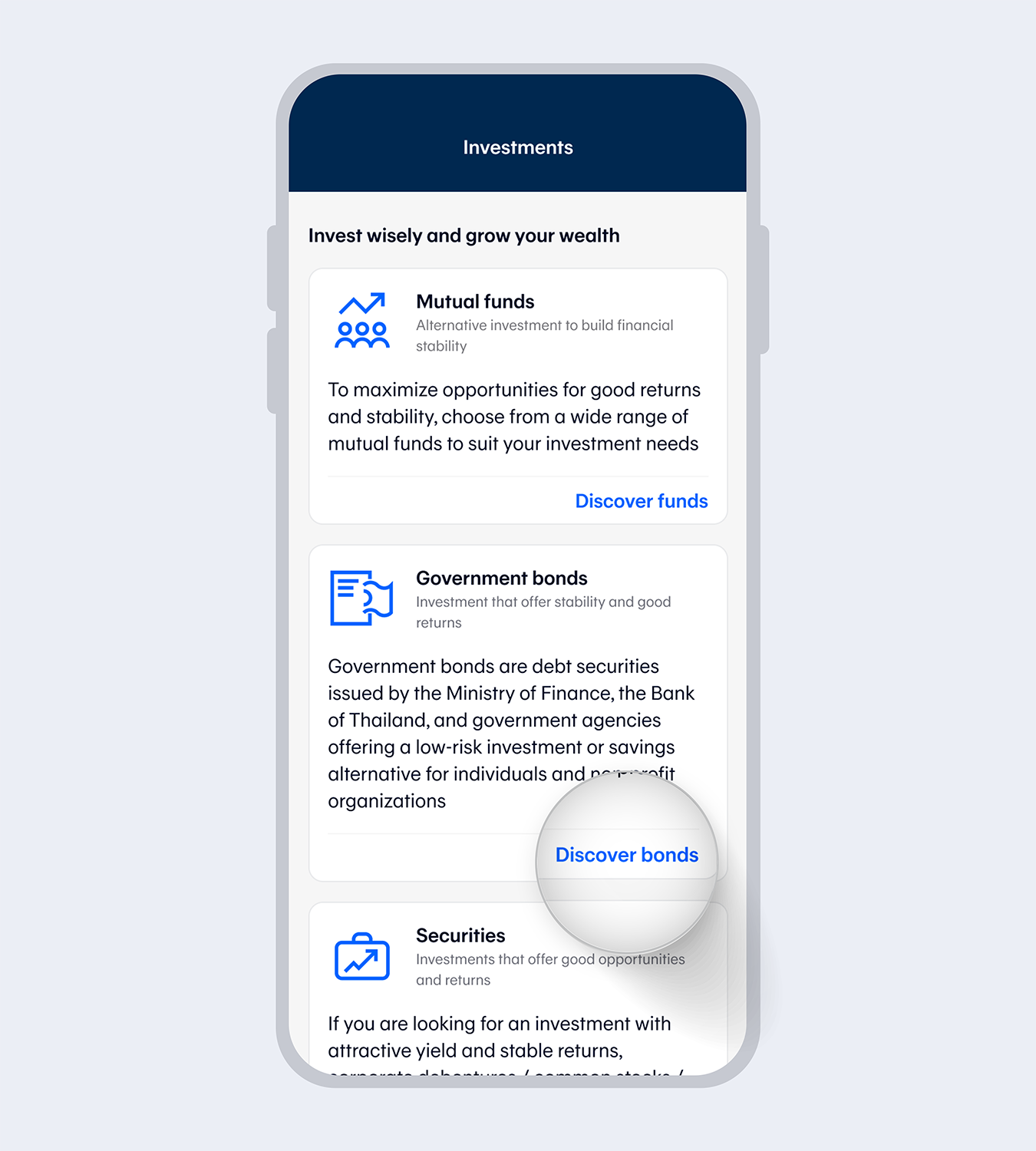

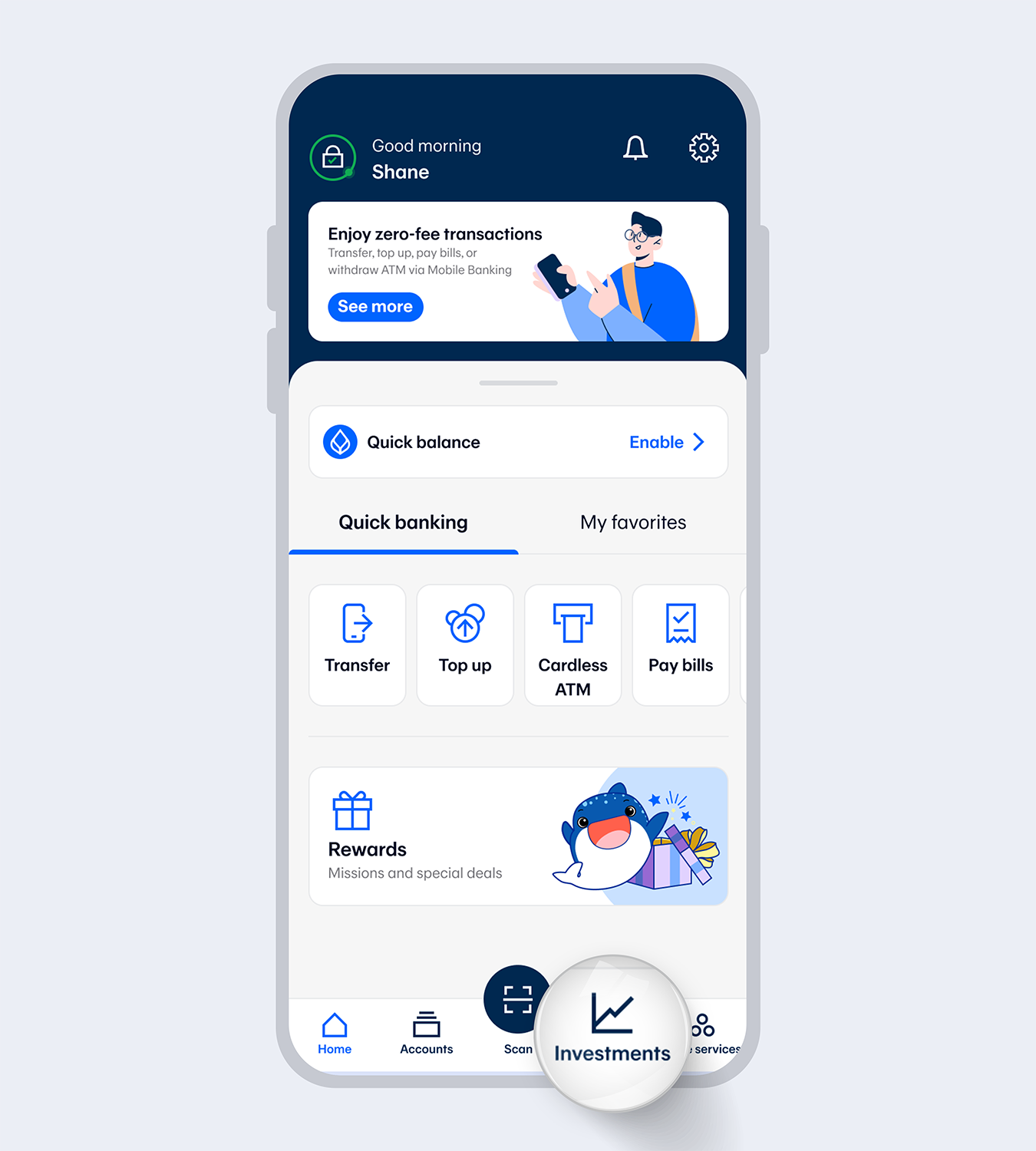

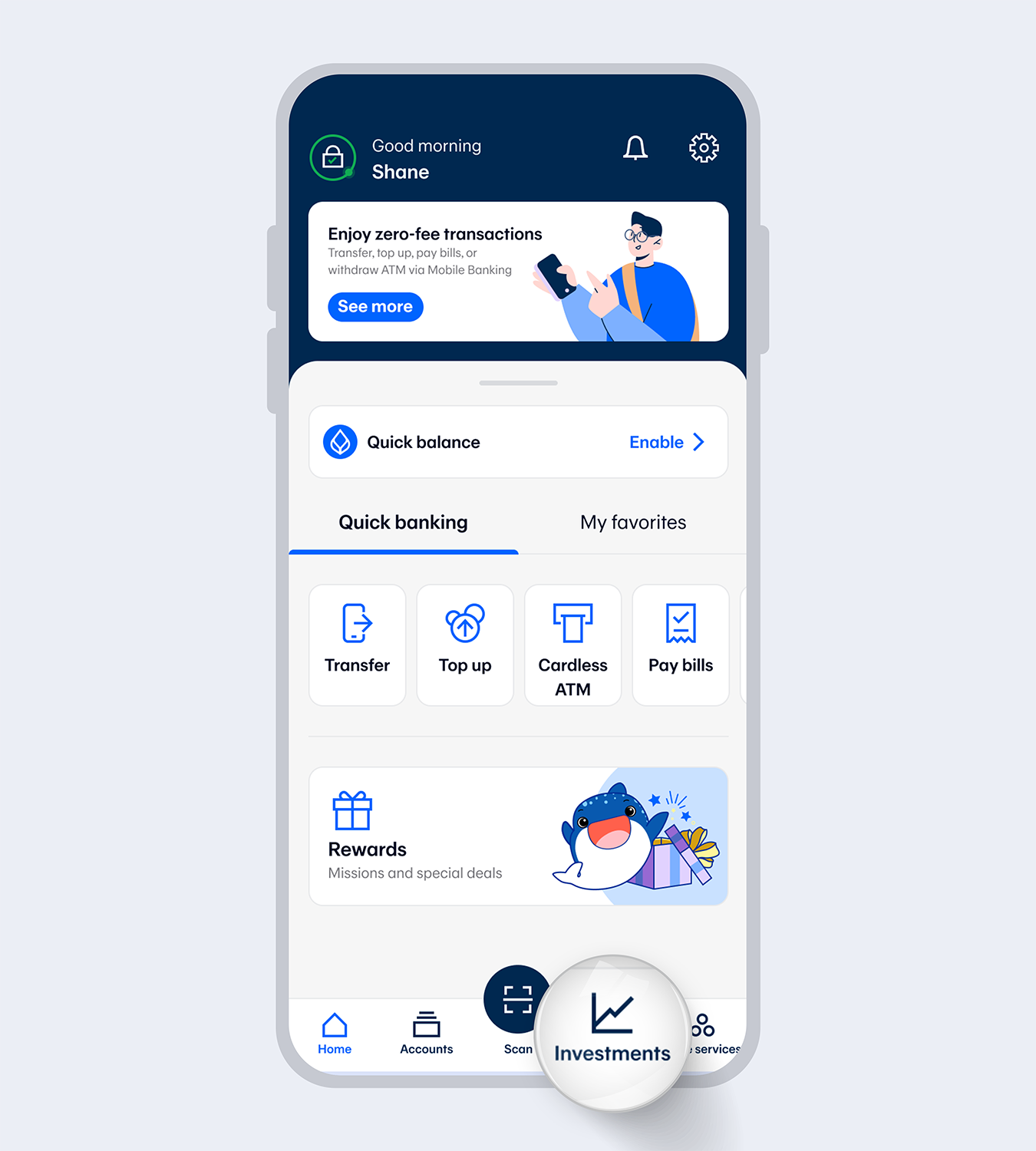

1.

Select “Investment” menu2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

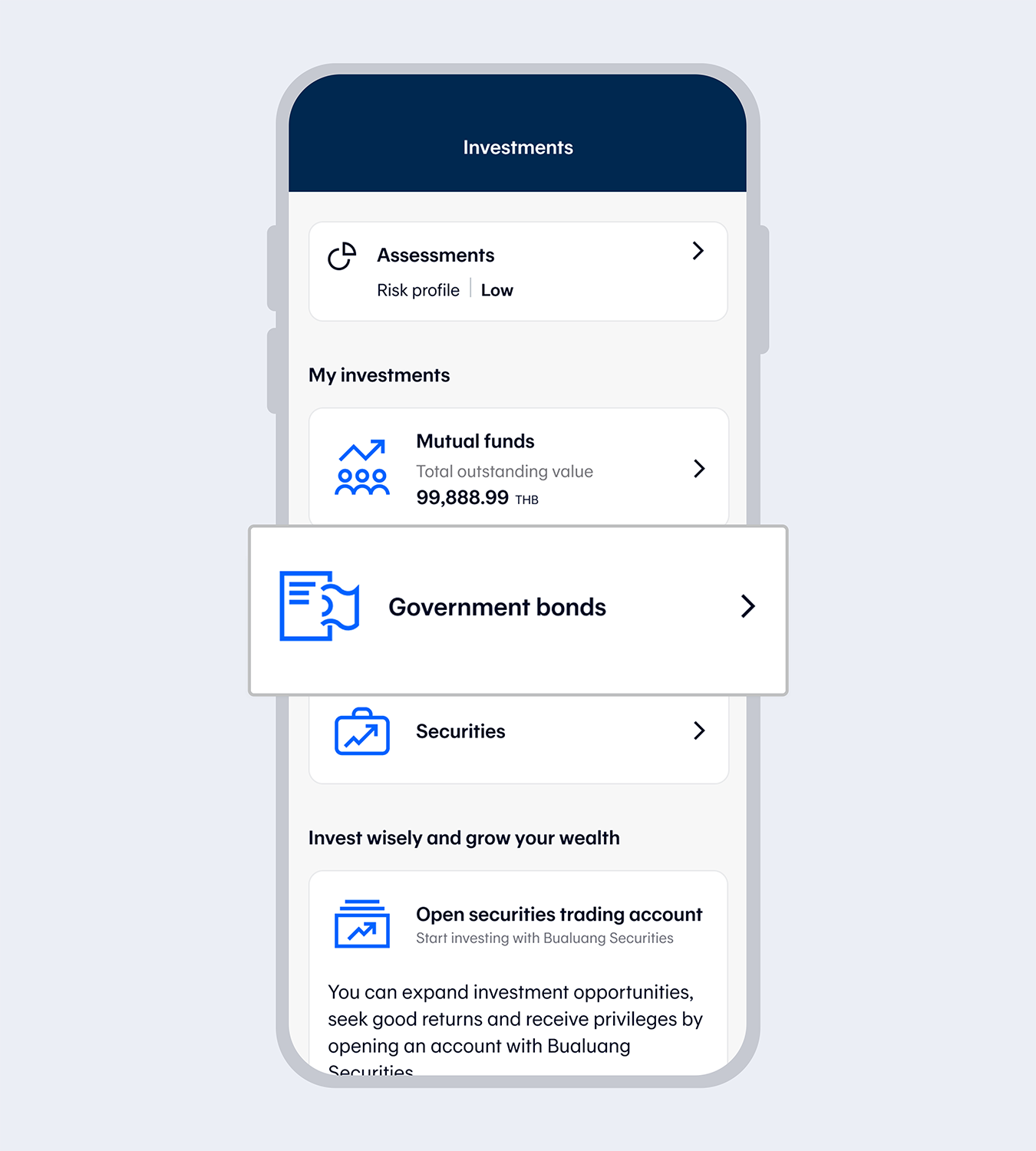

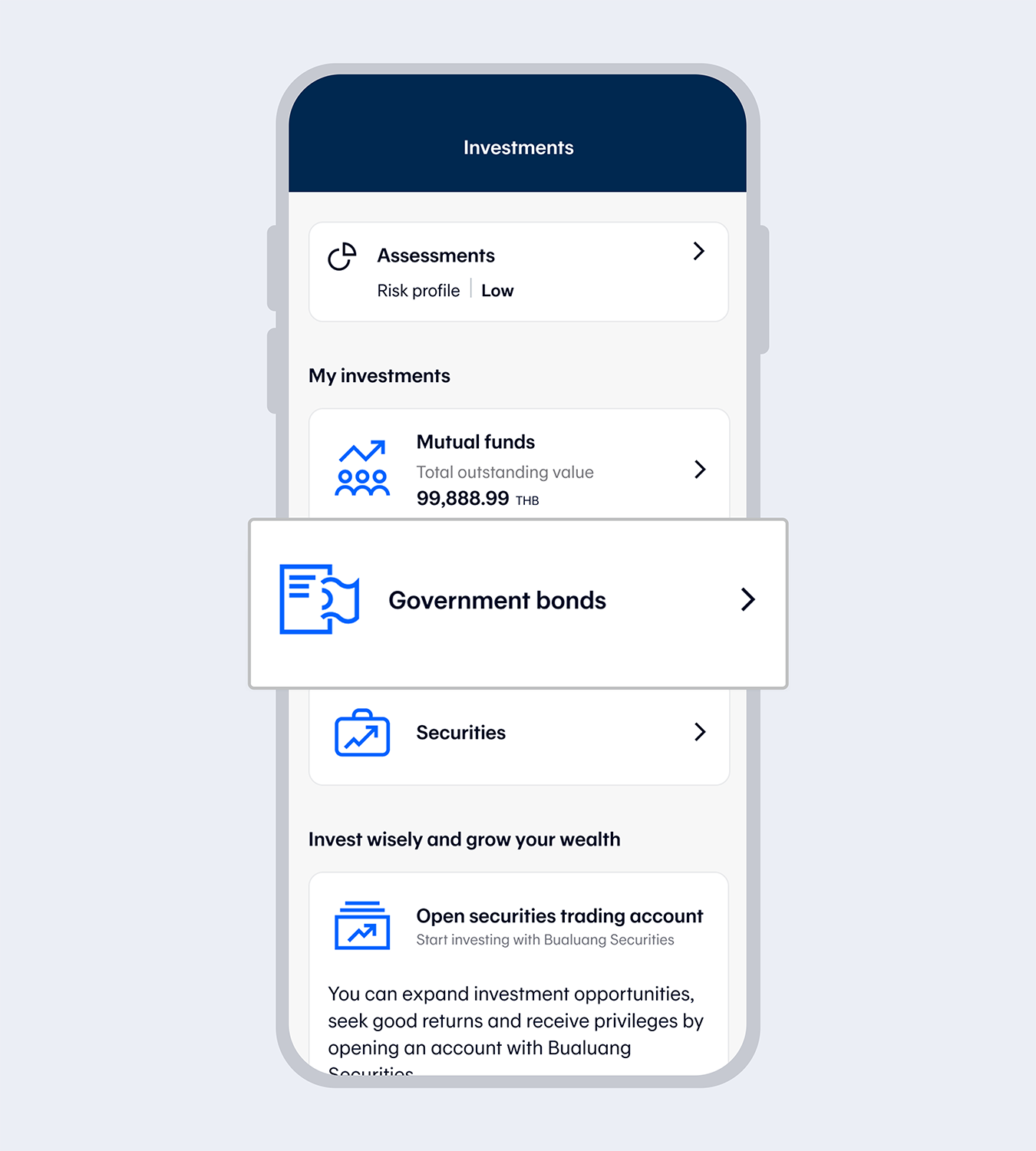

3.

Select “Government bonds”

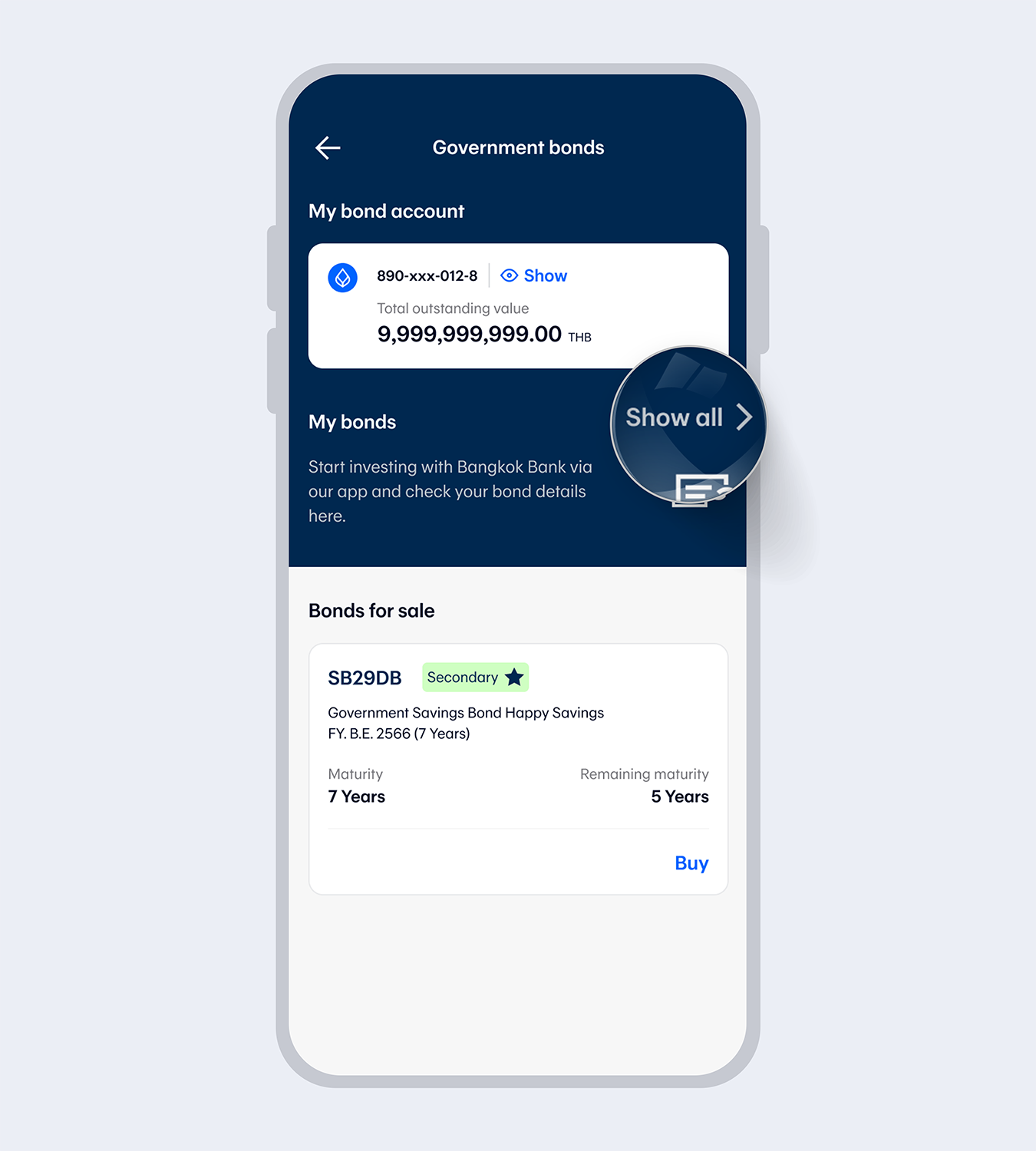

4.

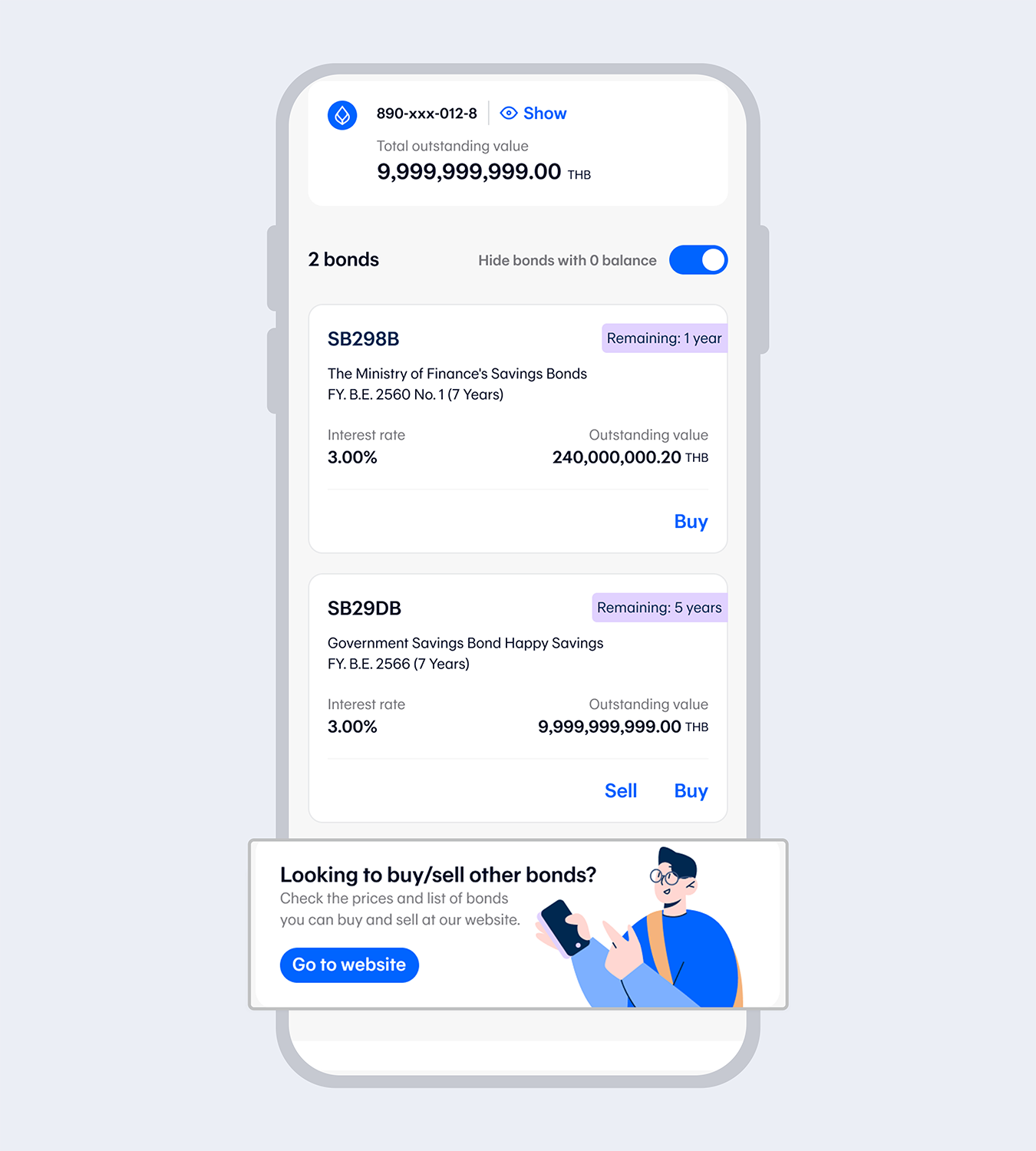

The system will display bond cards available in the primary and secondary markets. When you select “Show all”, it will display all bonds in your account.

5.

If you're interested in buying/selling other bonds, you can scroll down and select the banner to view the price table of secondary market bonds on the Bank's website

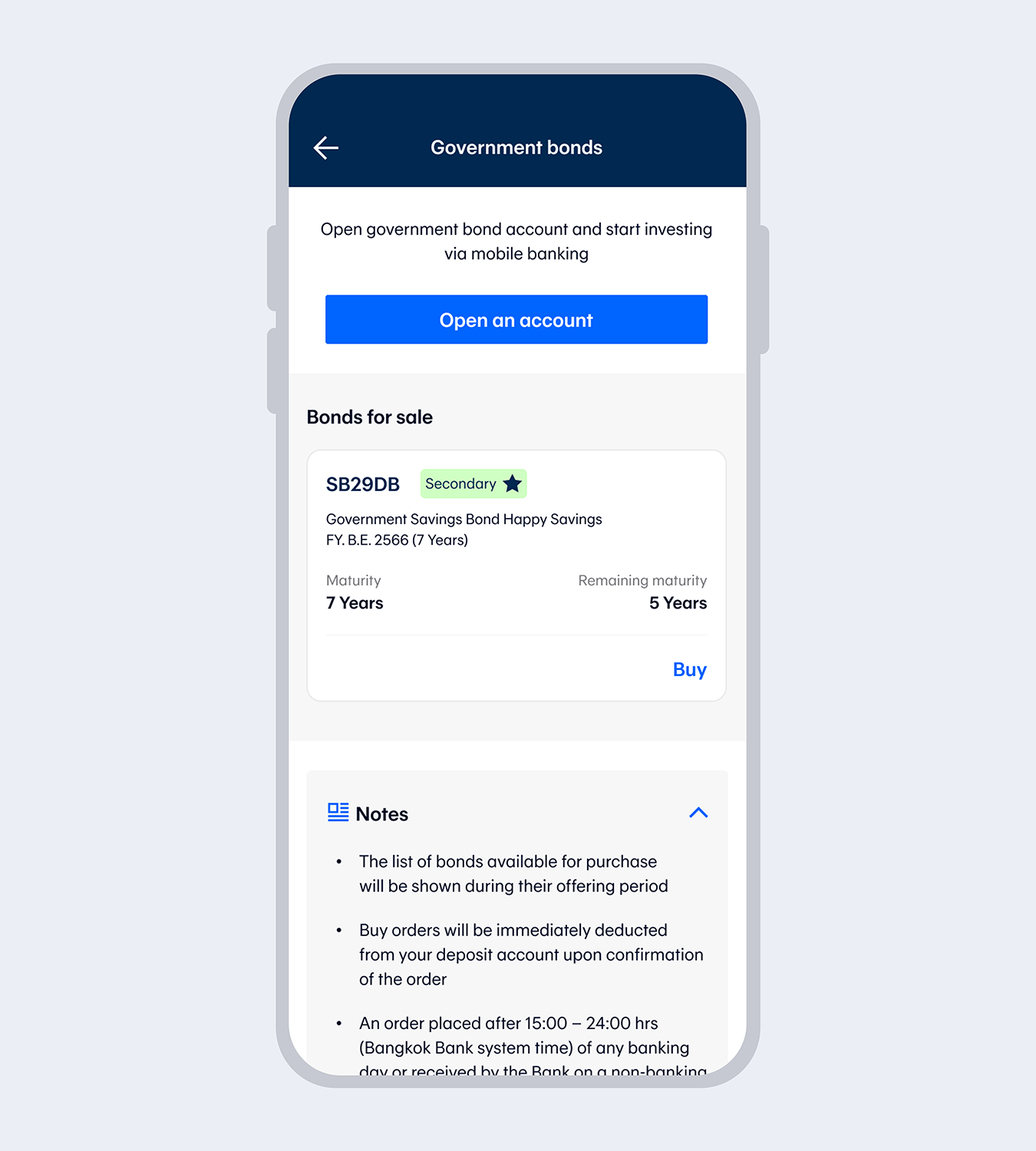

6.

Select the bond you wish to purchase and select "Buy"7.

Read the terms and conditions and select “Accept”

8.

Enter the number of investment units you wish to purchase and select "Next"

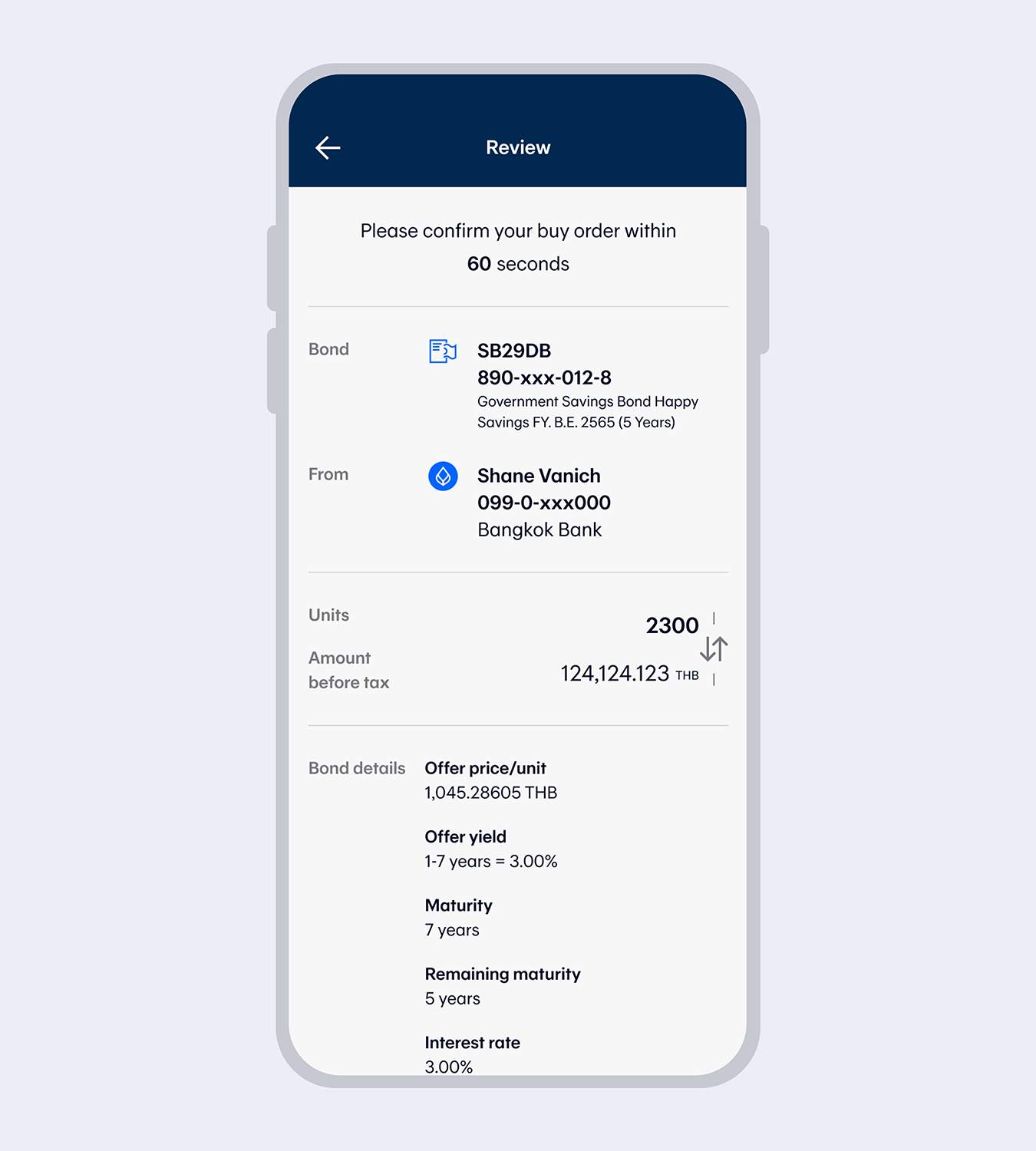

9.

Review the transaction details and select “Confirm” within 60 seconds

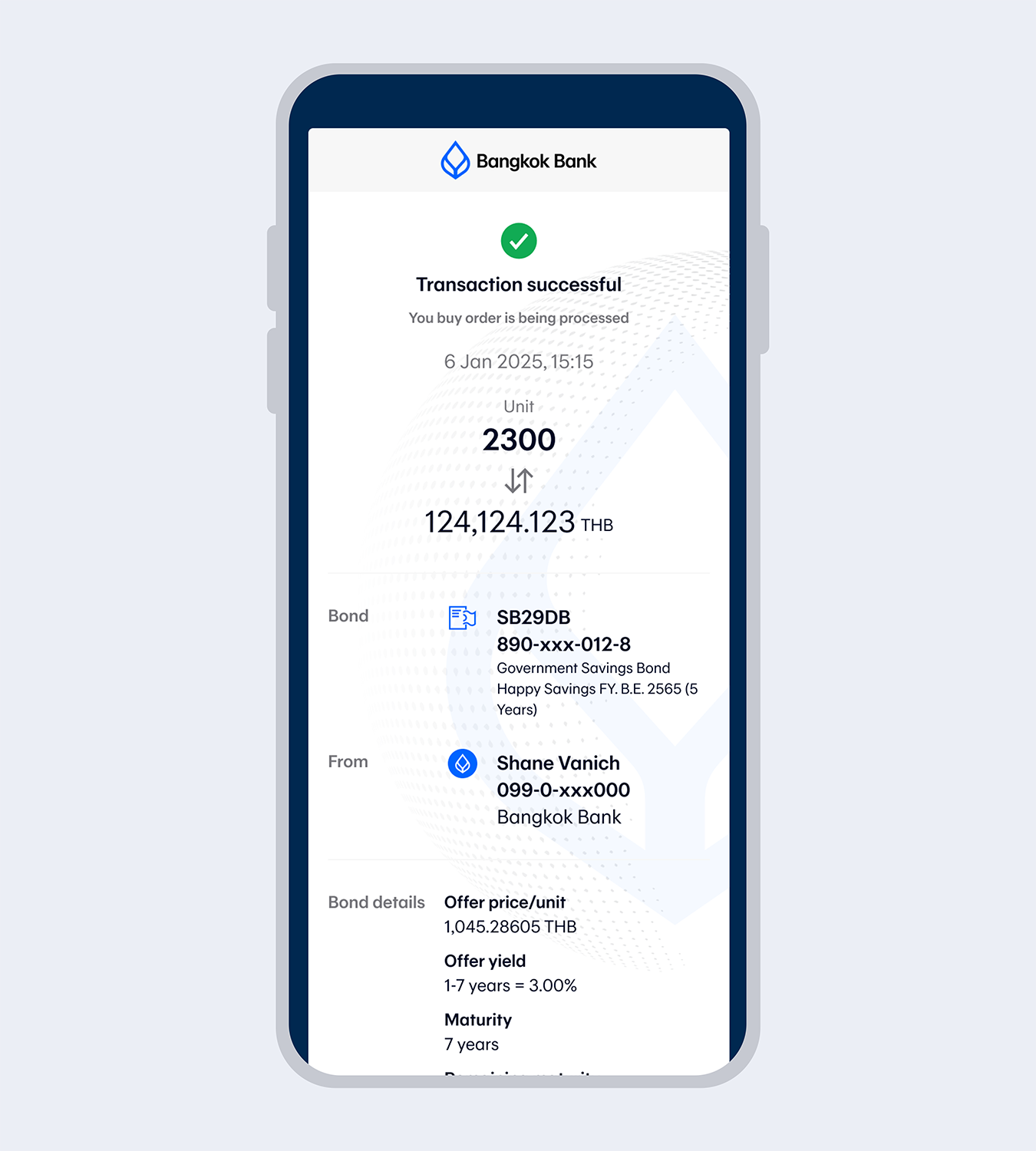

10.

Once the transaction has been completed, you will receive an eSlipNote: The purchased bonds will be credited to your bond account immediately after the transaction has been successfully completed

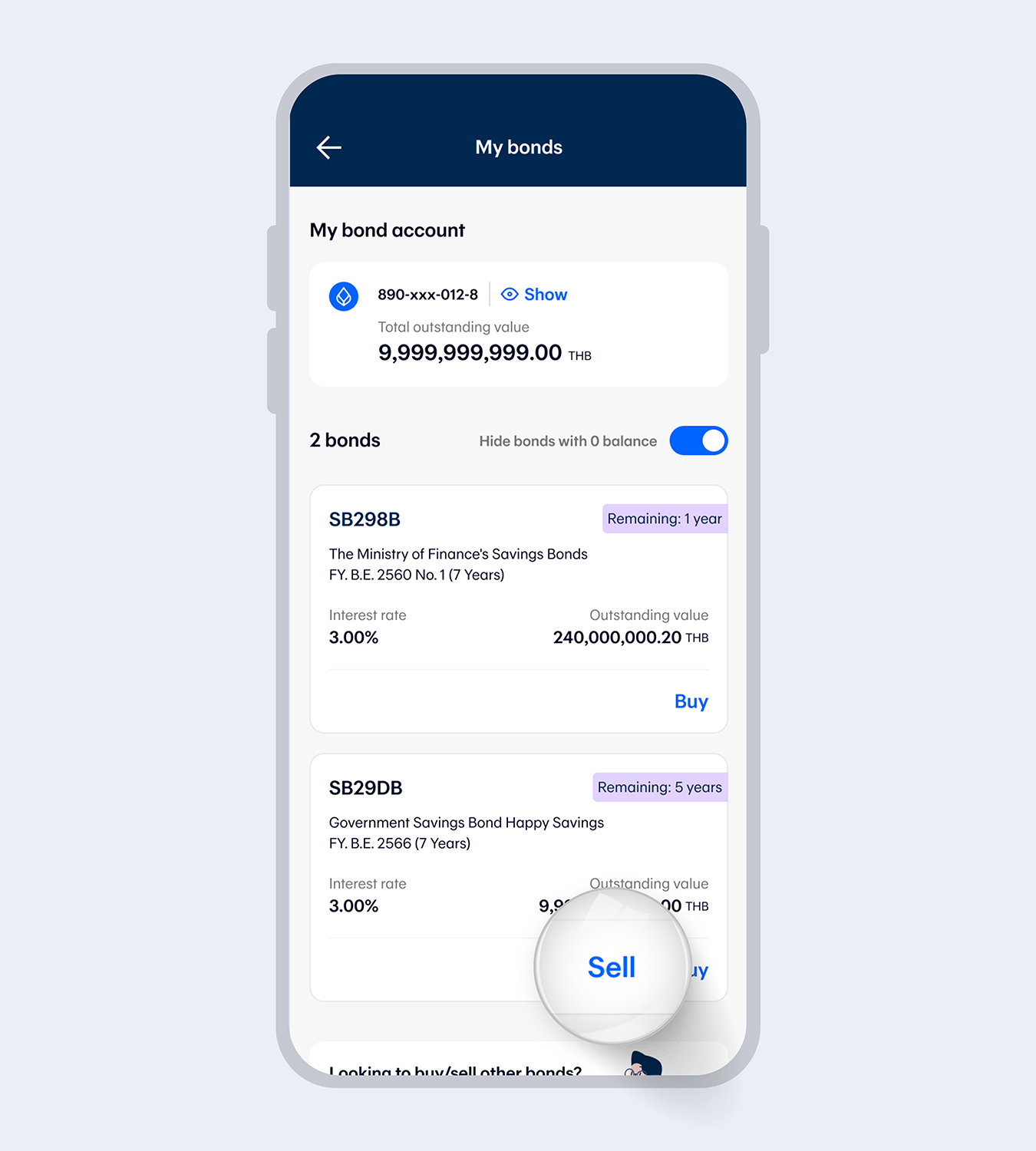

1.

Select “Investment” menu2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

3.

Select “Government bonds”

4.

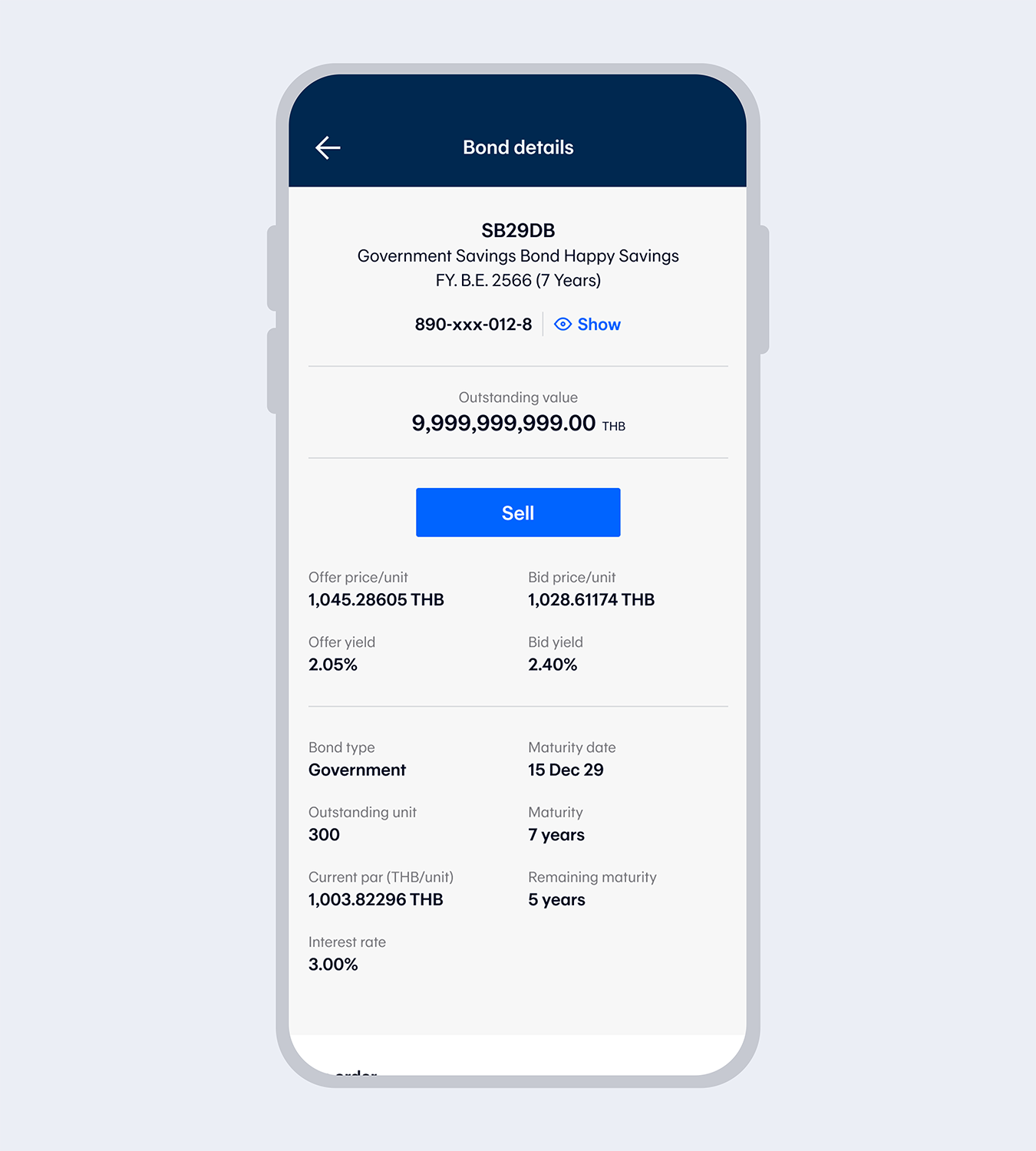

Select “My bonds”5.

If the Bank is buying bonds and you still have remaining units, the system will display a "Sell" button. Then, select "Sell"

6.

Select “Sell”7.

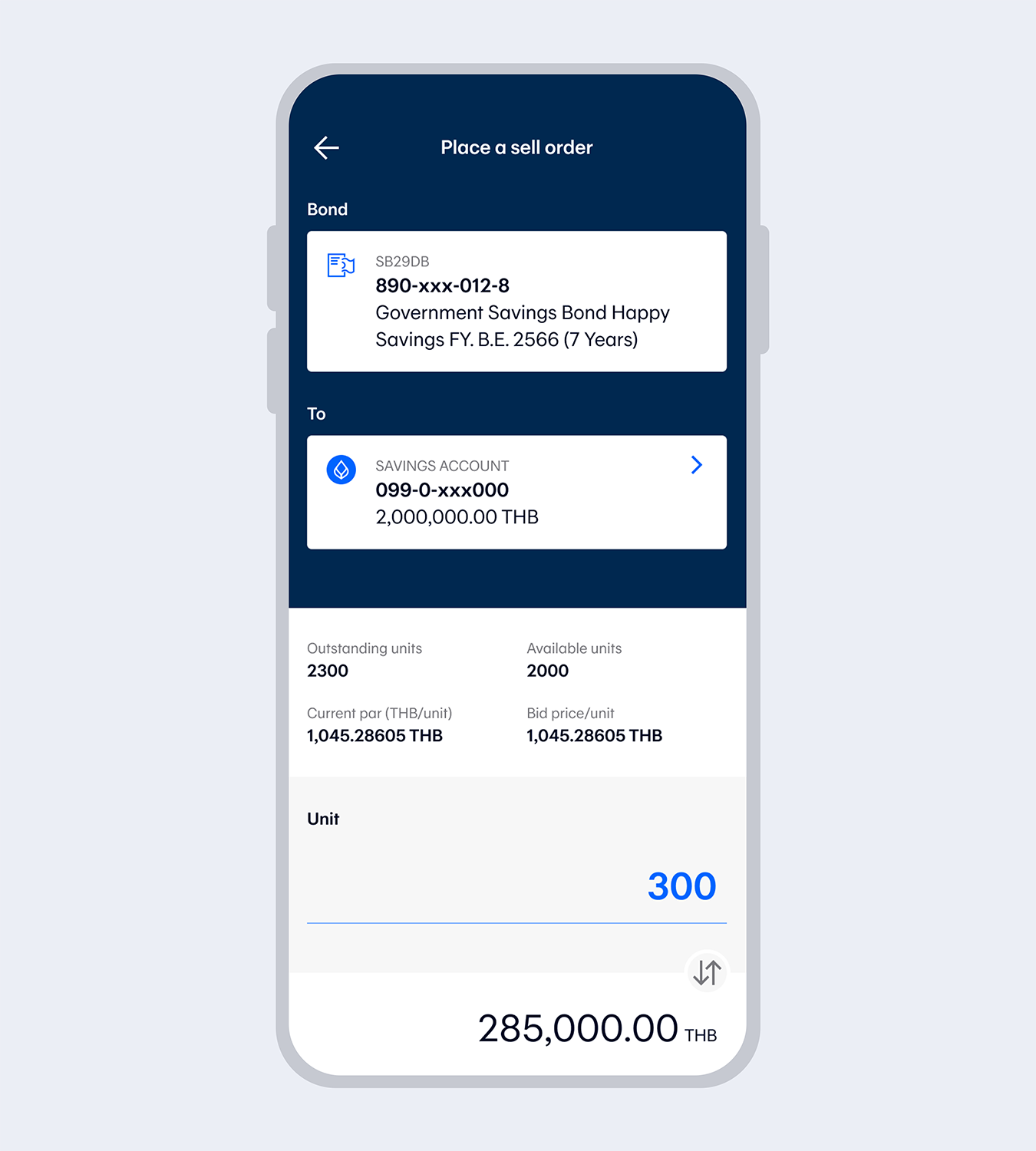

Read the terms and conditions and select “Accept”

8.

Enter the number of investment units you wish to sell and select "Next"

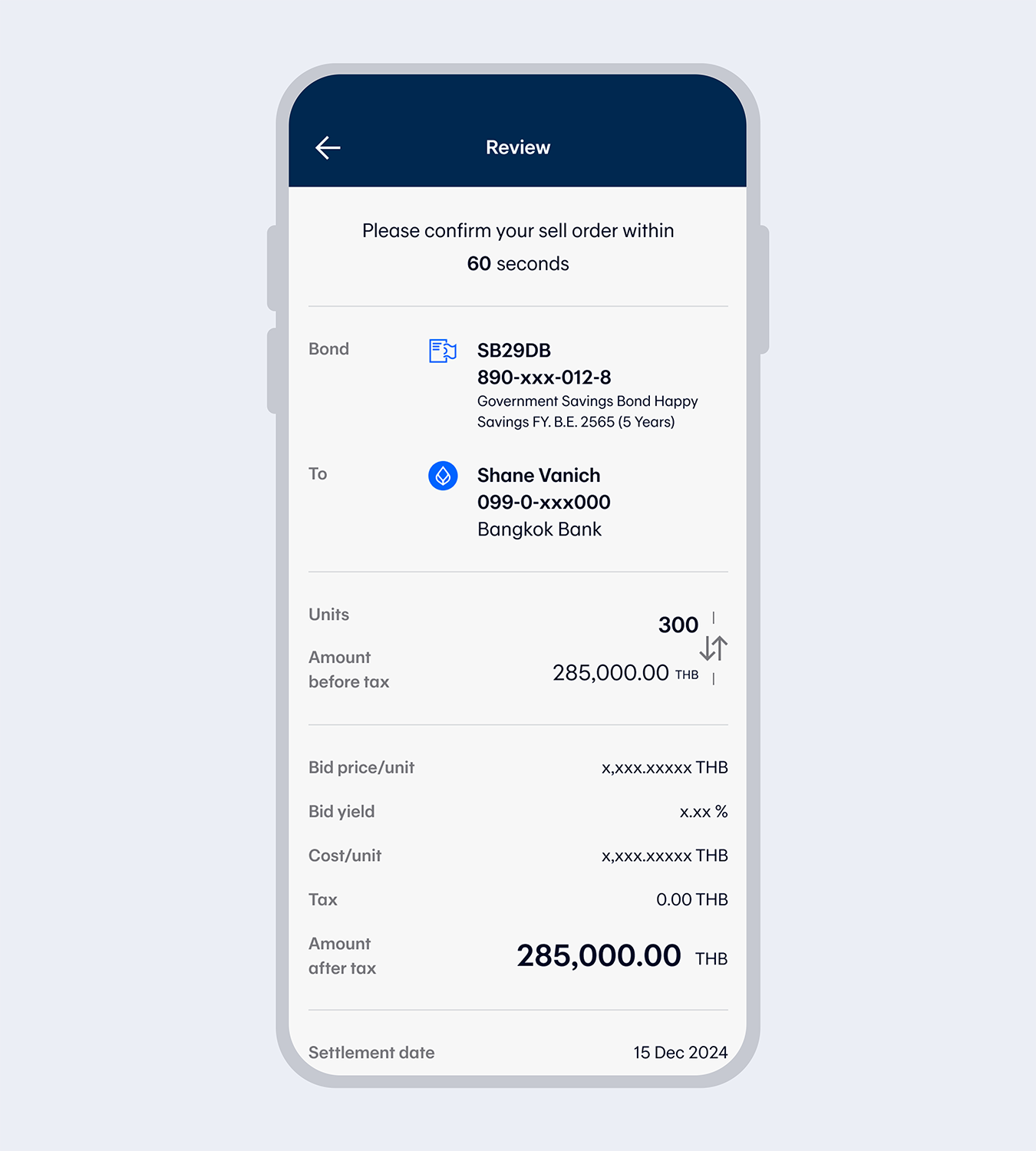

9.

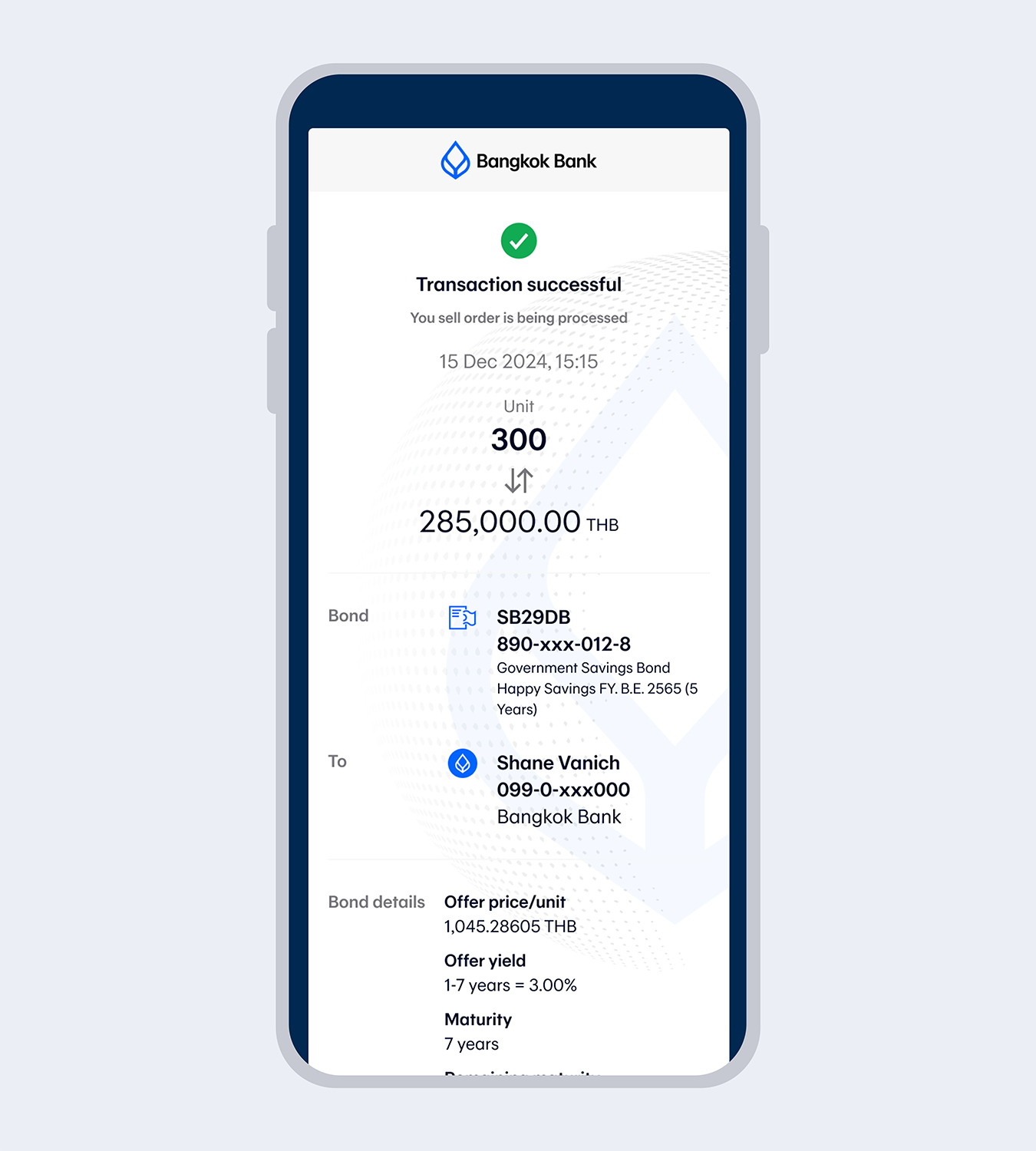

Review the transaction details and select “Confirm” within 60 seconds

10.

Once the transaction has been completed, you will receive a confirmation e-Slip.Note:

You will receive money from selling bonds via the Bond Book method within 2 business days of the sale transaction (T+2)