Online Banking

Personal

- Bualuang iBanking

- Bualuang iBanking

- Bualuang iBanking

- Mobile Banking

- Mobile Banking

- Mobile Banking

- Bualuang iFunds

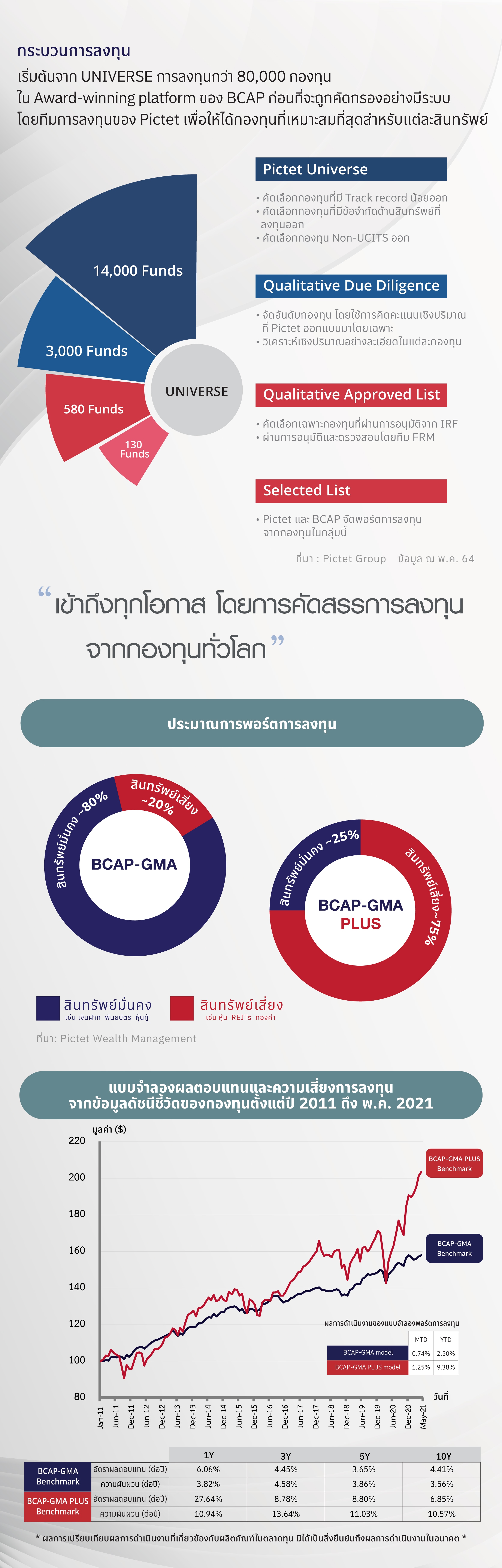

in various types of foreign assets through the investment units of mutual funds

under the scope of professional recommendations by, Bank Pictet & Cie (Asia) Ltd.

by monitoring and rebalancing your portfolio with fund selection by a specialized global wealth management team

|

Fund Code |

Risk Level |

|

BCAP-GMA |

5 |

|

BCAP-GMA PLUS |

6 |

|

Every trading day of the Fund, 8:30 a.m. - 3:30 p.m. | |

|

Every day 24 hours (Orders placed after 4:00 p.m. or on non-trading days will be processed on the next trading day) |

|