1.

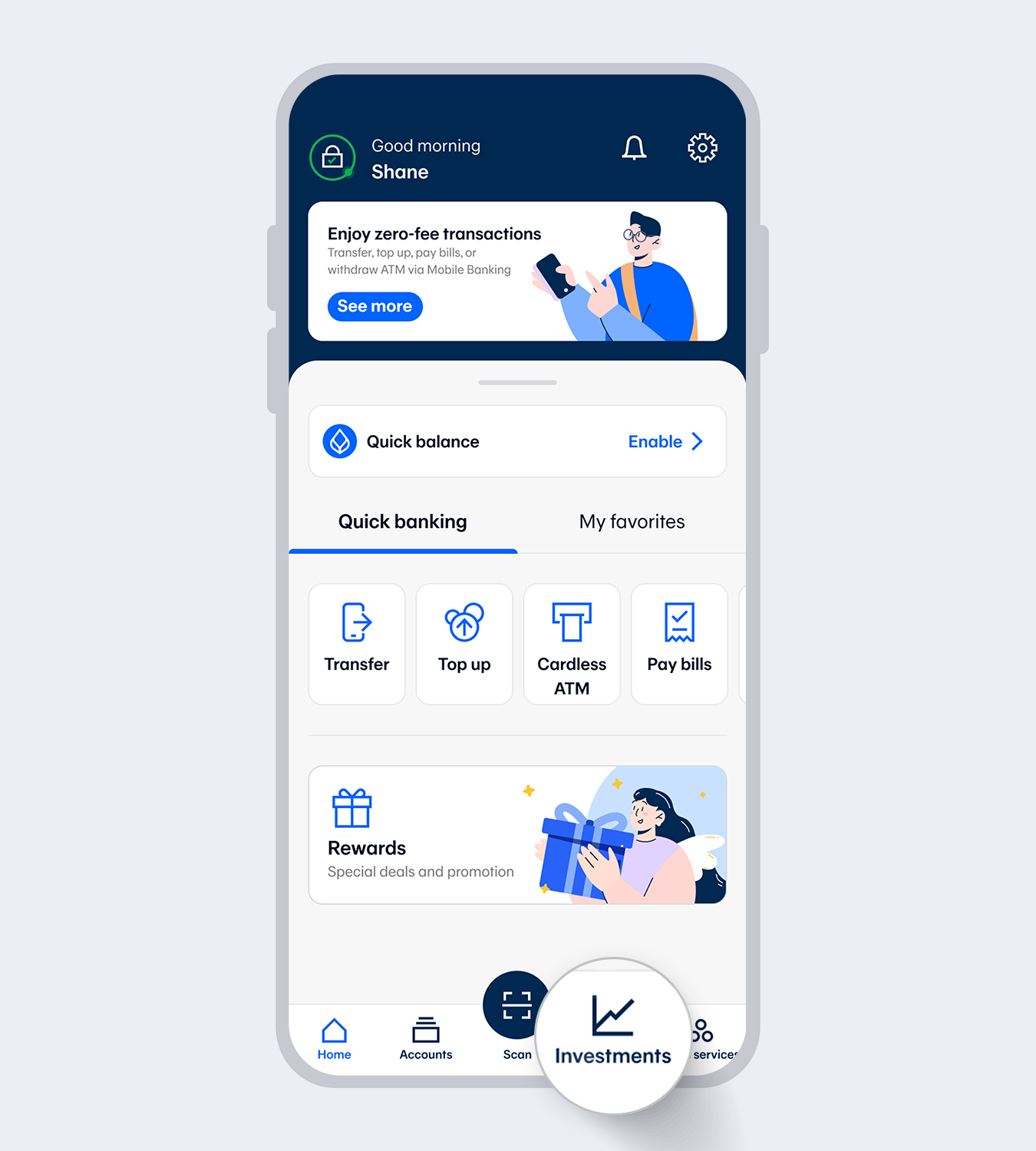

Select “Investments”

2.

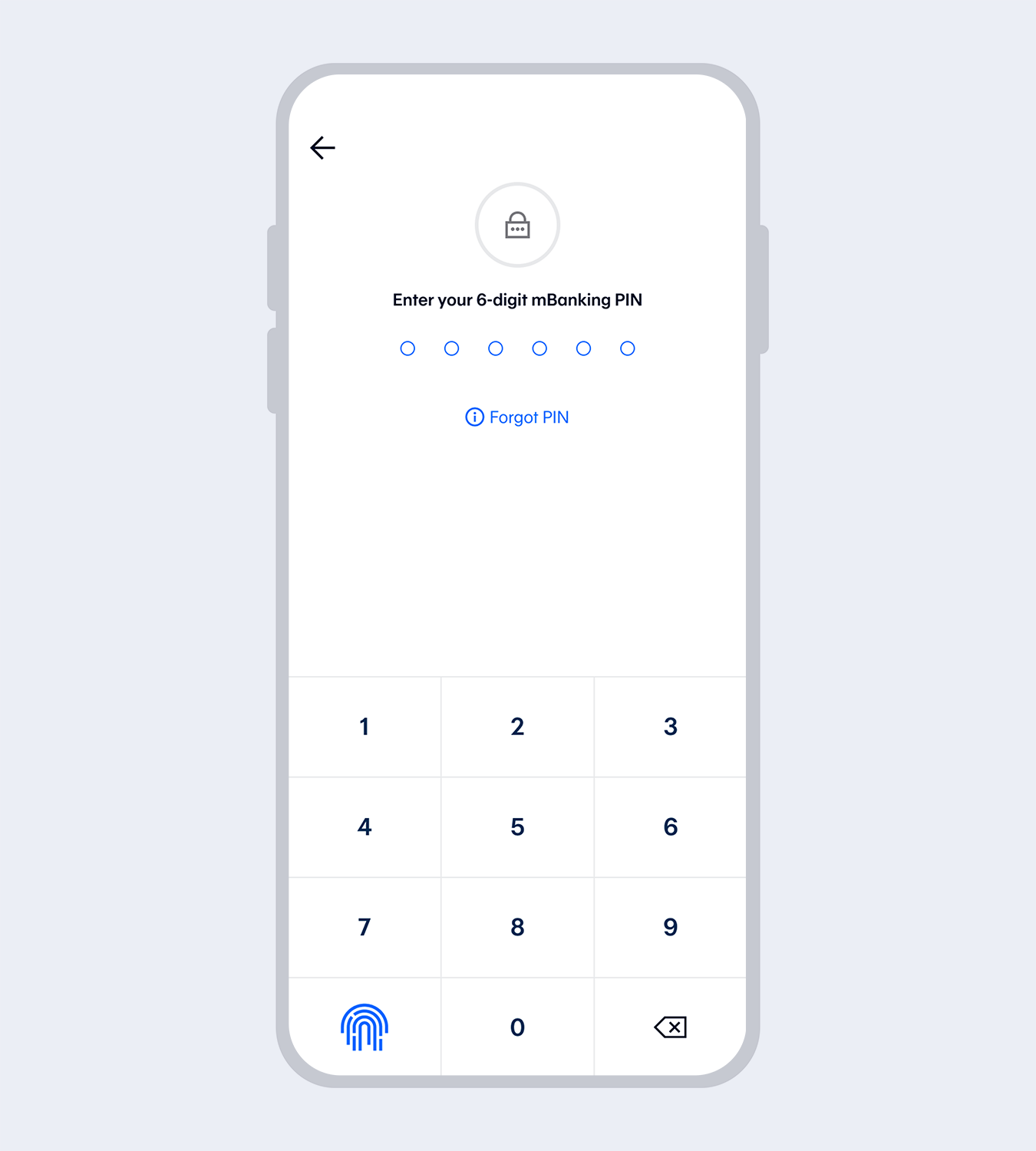

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

3.

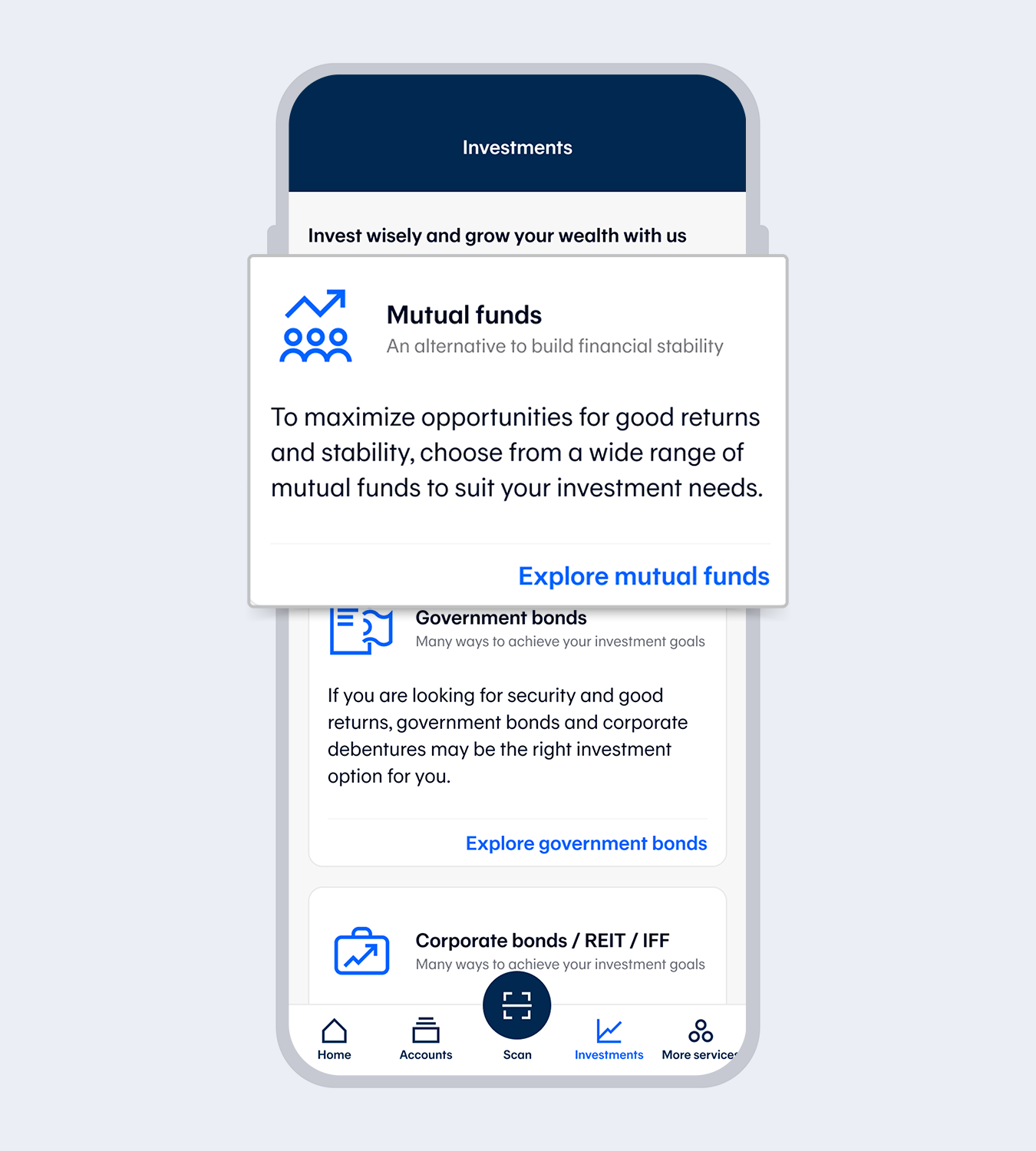

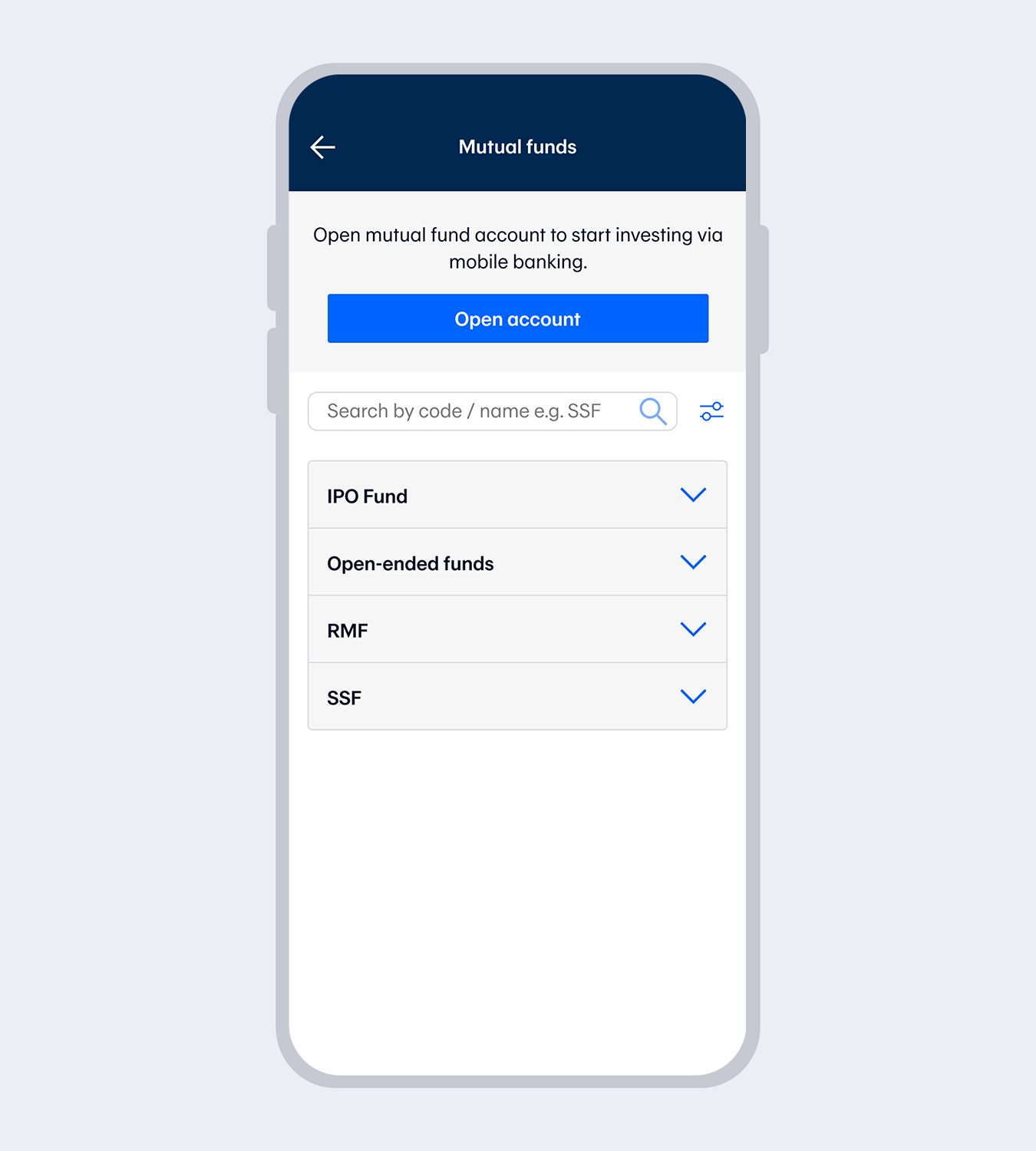

Select “Mutual funds”

4.

For customers who do not have a mutual fund account, select “Open account”Customers who already have a mutual fund account can open other types of mutual fund accounts by selecting “Other funds”. Then select your preferred fund and select “Buy”.

5.

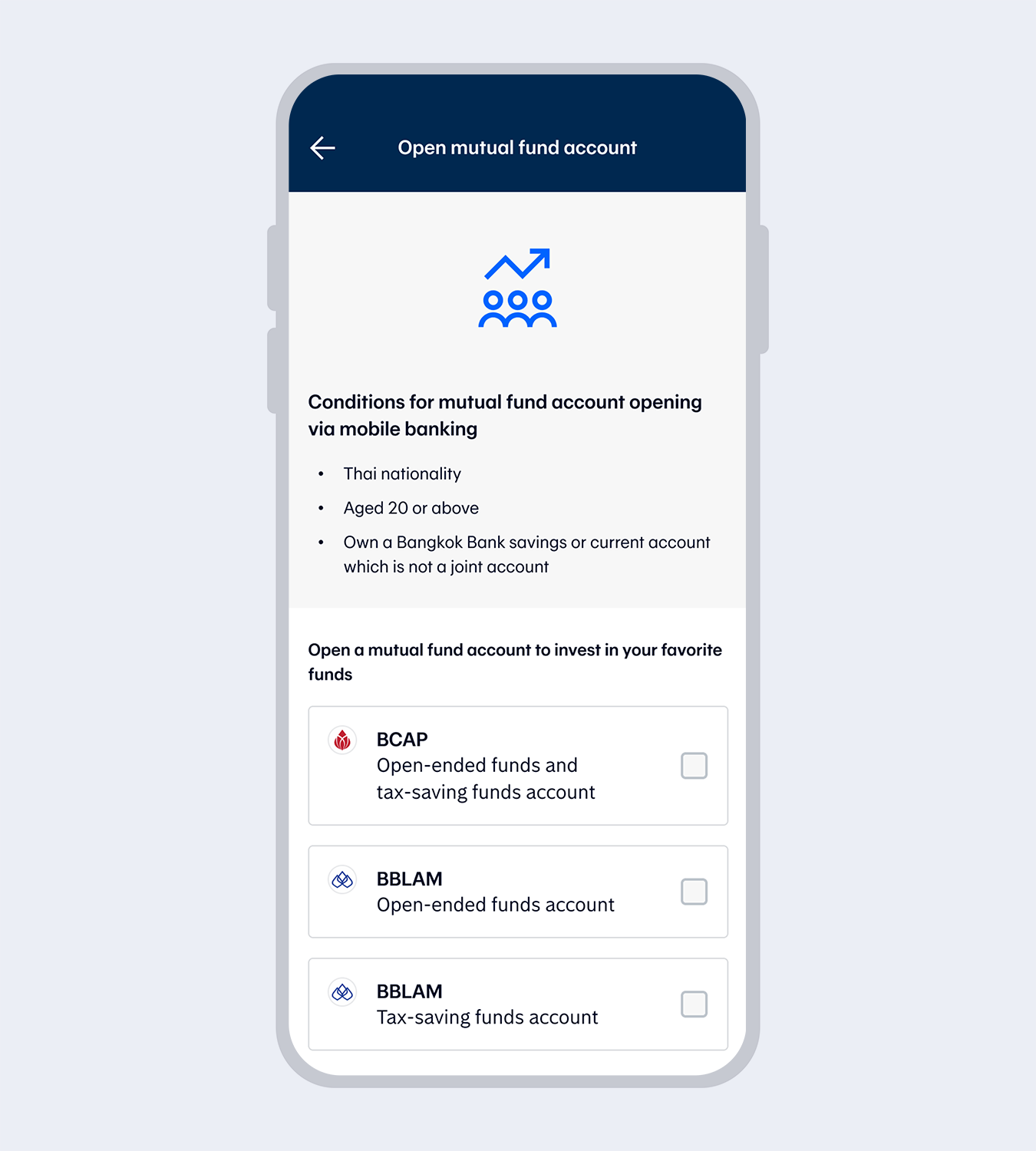

Select asset management company and select the fund

6.

Enter your 6-digit Mobile PIN if you access with Touch ID / Face ID / FingerprintThen, read the terms and conditions and select “Next”

7.

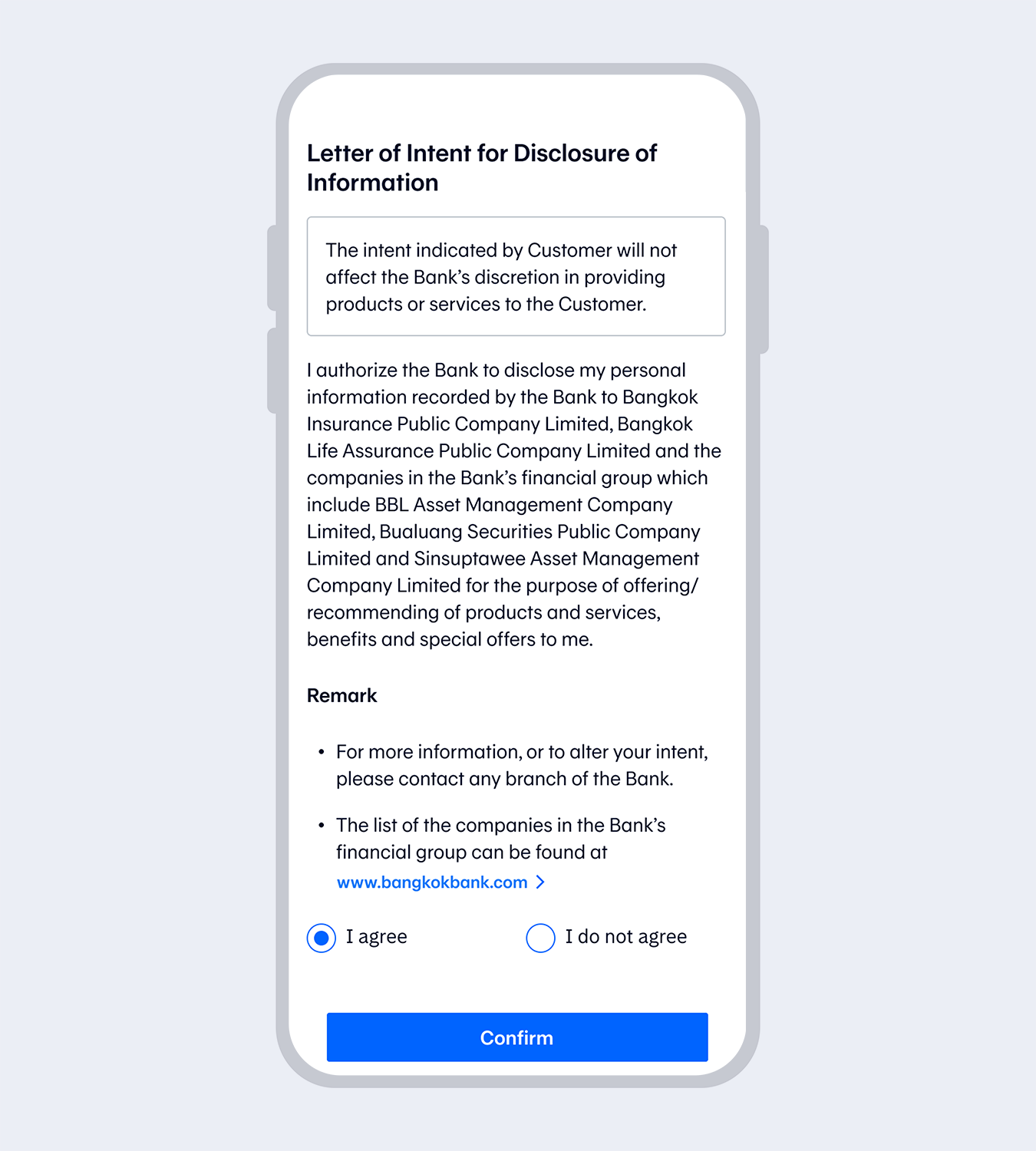

Read the Market Conduct and select “Confirm”

8.

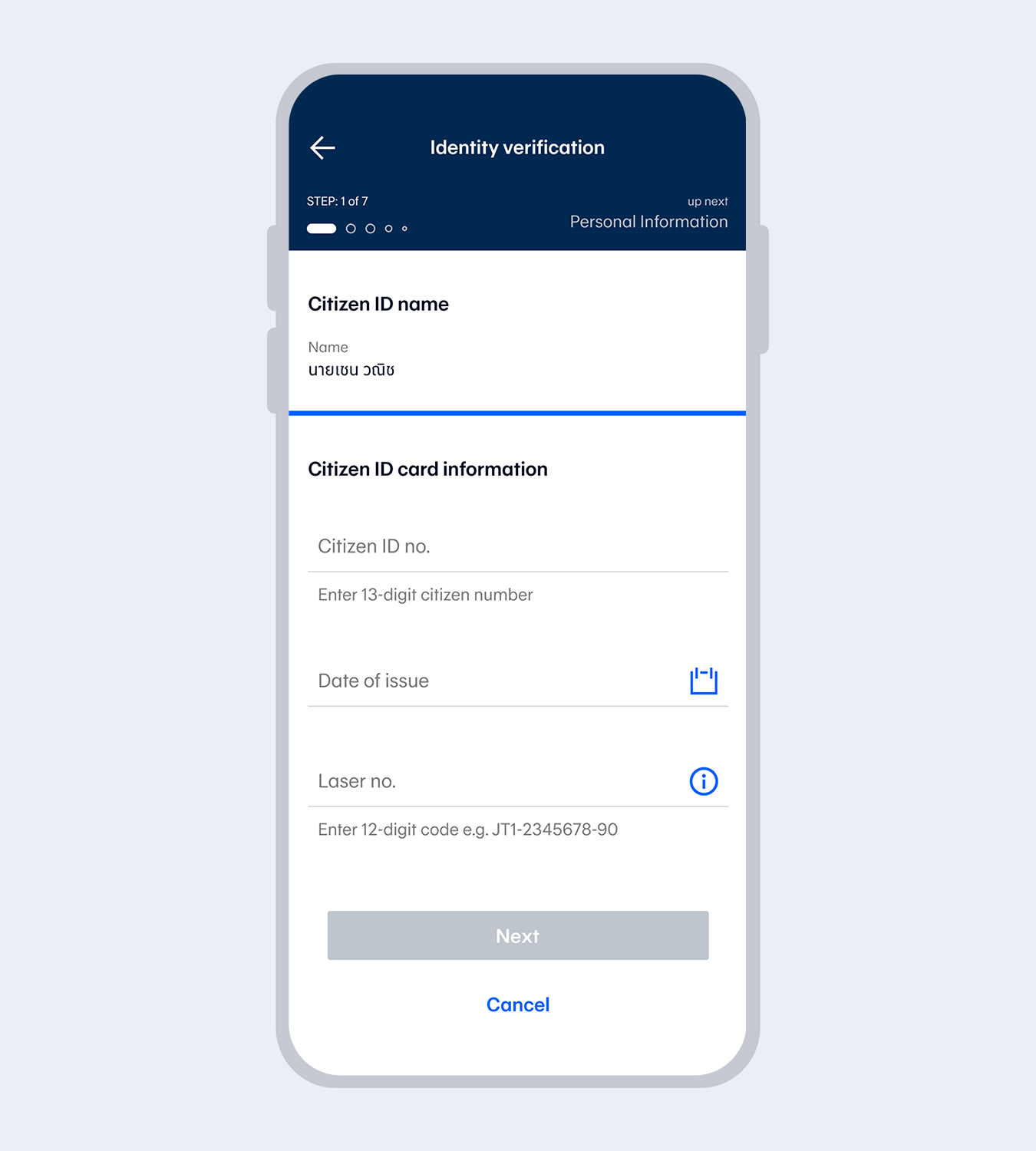

Enter Citizen ID information and select “Next”

9.

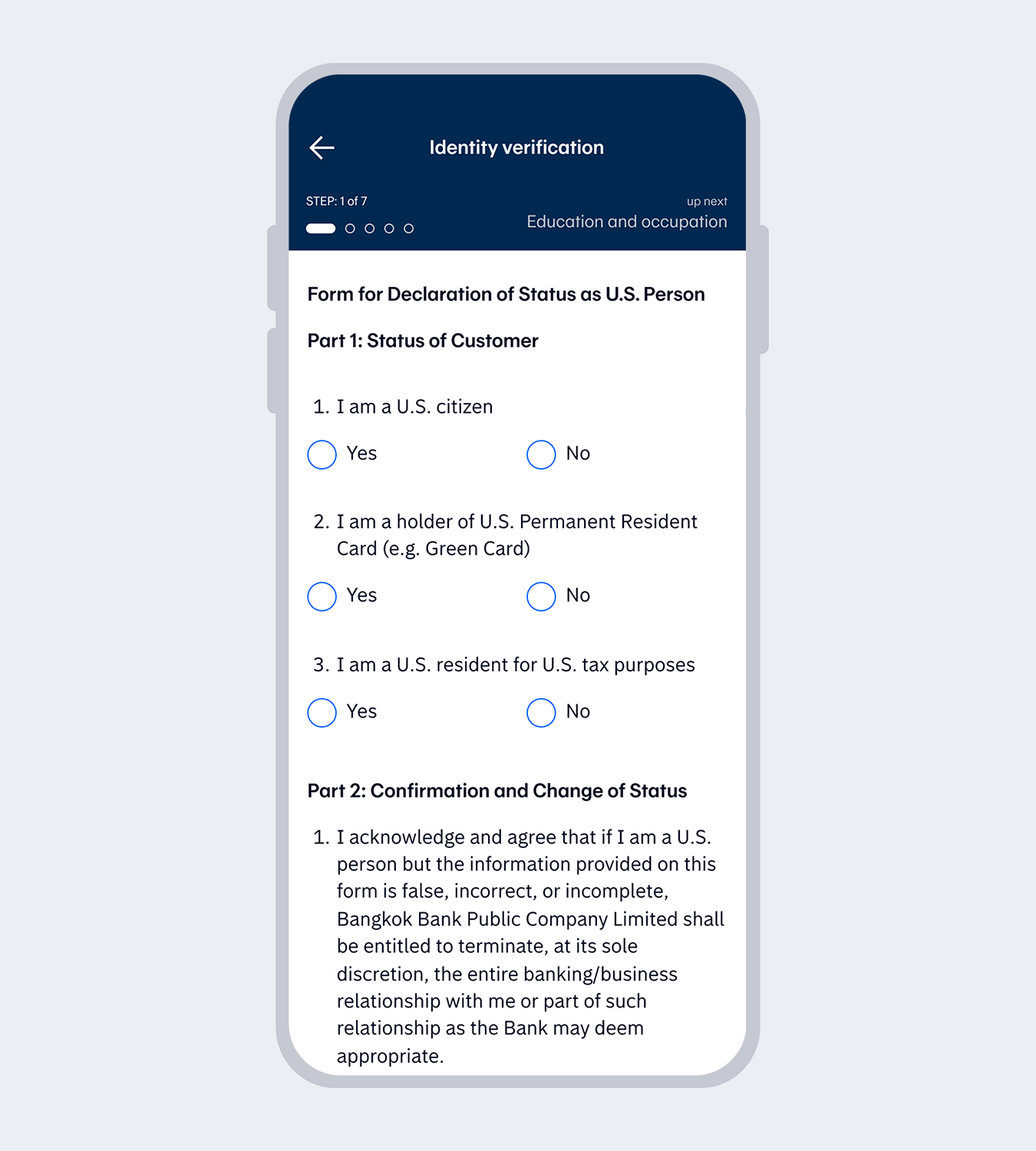

Answer 3 questions in the Form for Declaration of Status of Customer as U.S. Person or Non-U.S. Person (FATCA) and select “Accept”

10.

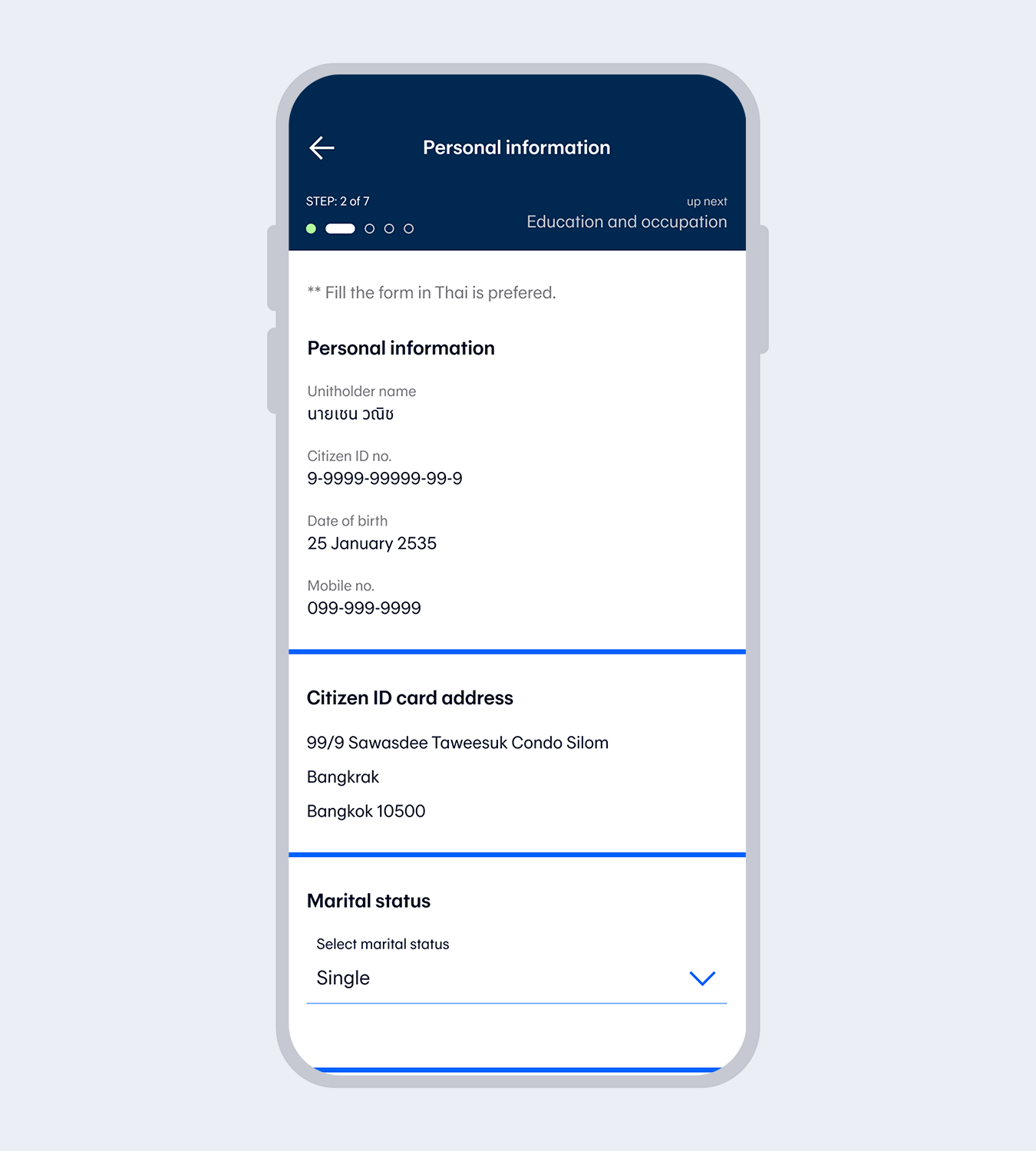

Enter your personal information and select “Next”

11.

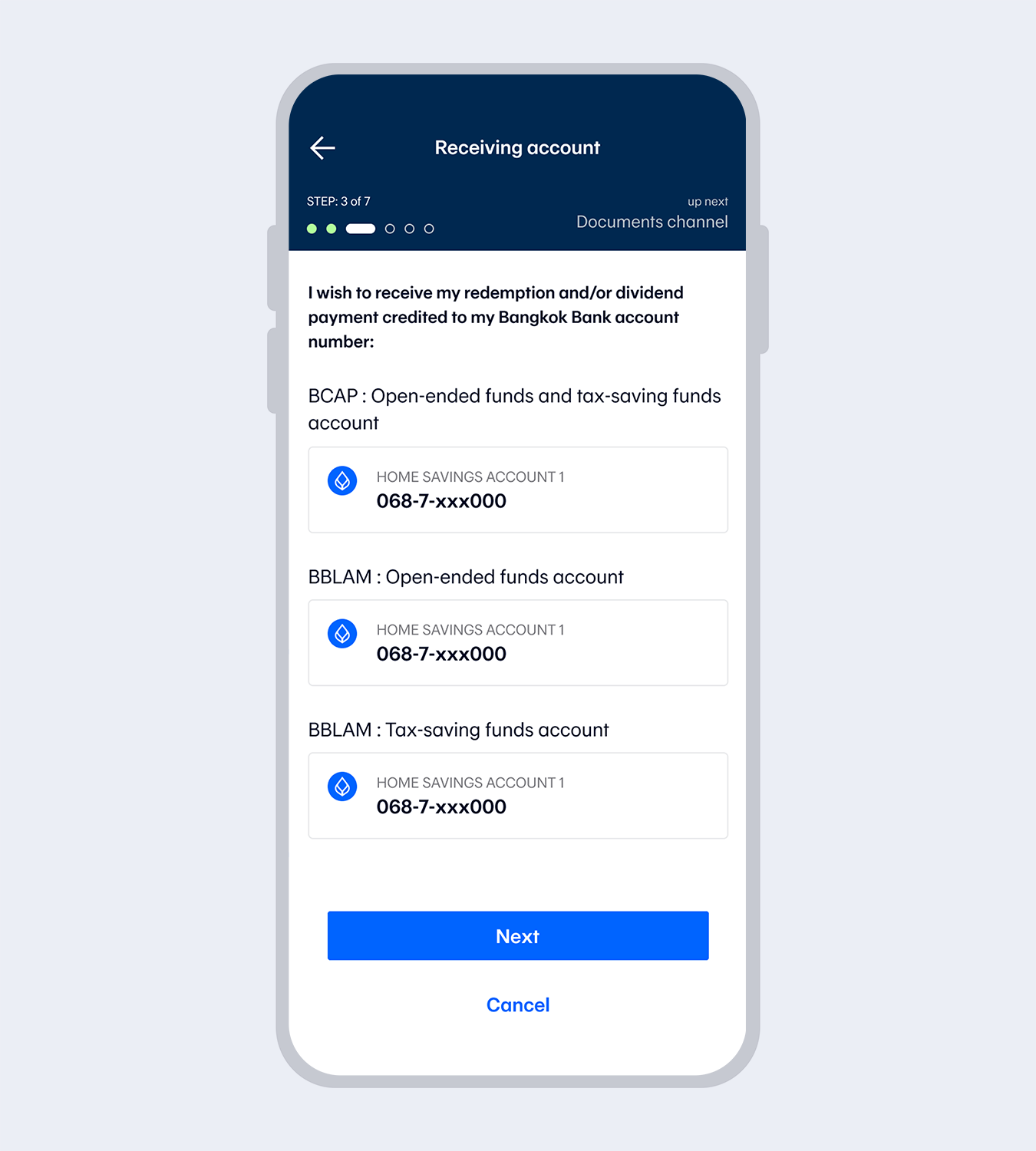

Select an account to receive fund redemption and dividends and select “Next”

12.

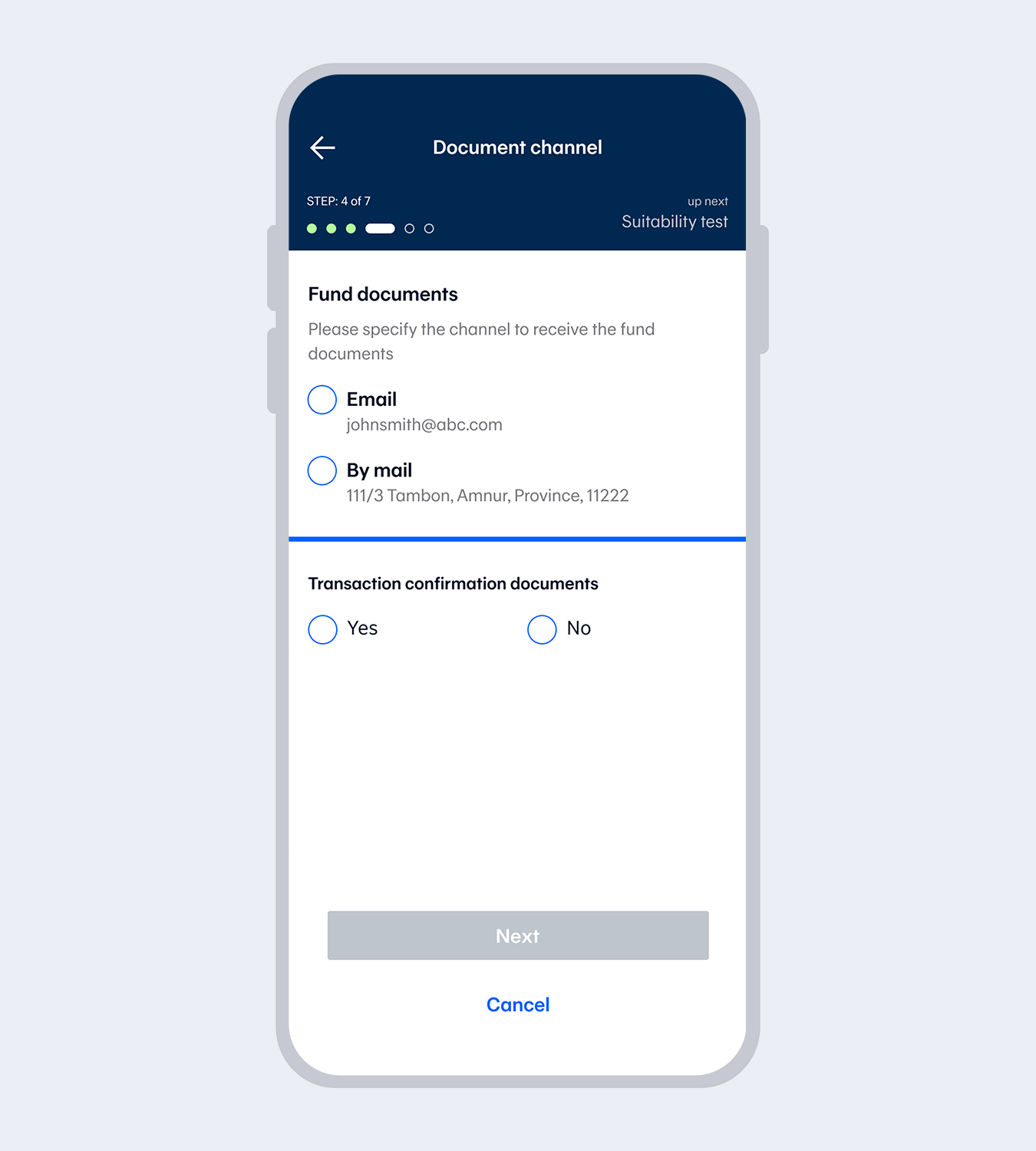

Select a channel to receive investment related documents and select “Next”

13.

Complete the Suitability Test and select “Next”If you have completed the test before, the system will take you to the next step.

14.

Review the information and select “Next”

15.

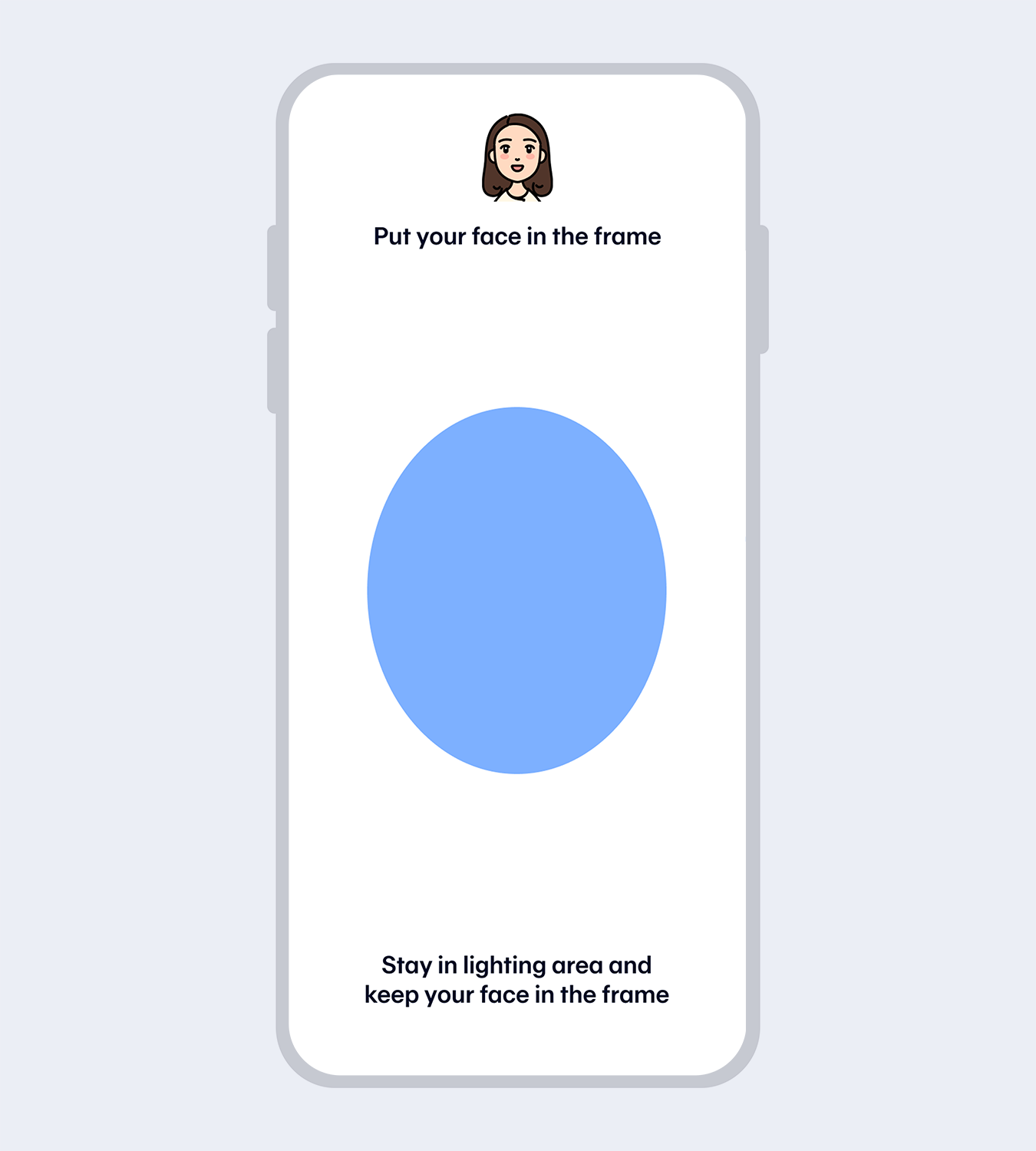

Take a selfie photo to verify your identity with facial recognition, fit your face in the frame and follow the instructions

16.

Enter your 6-digit Mobile PIN to confirm your mutual funds account opening

17.

Account(s) successfully opened