1.

Select “Open a Bangkok Bank account”

2.

Read the product details and select “Next”

3.

Take a photo of your Citizen ID card, review it and select “Next”

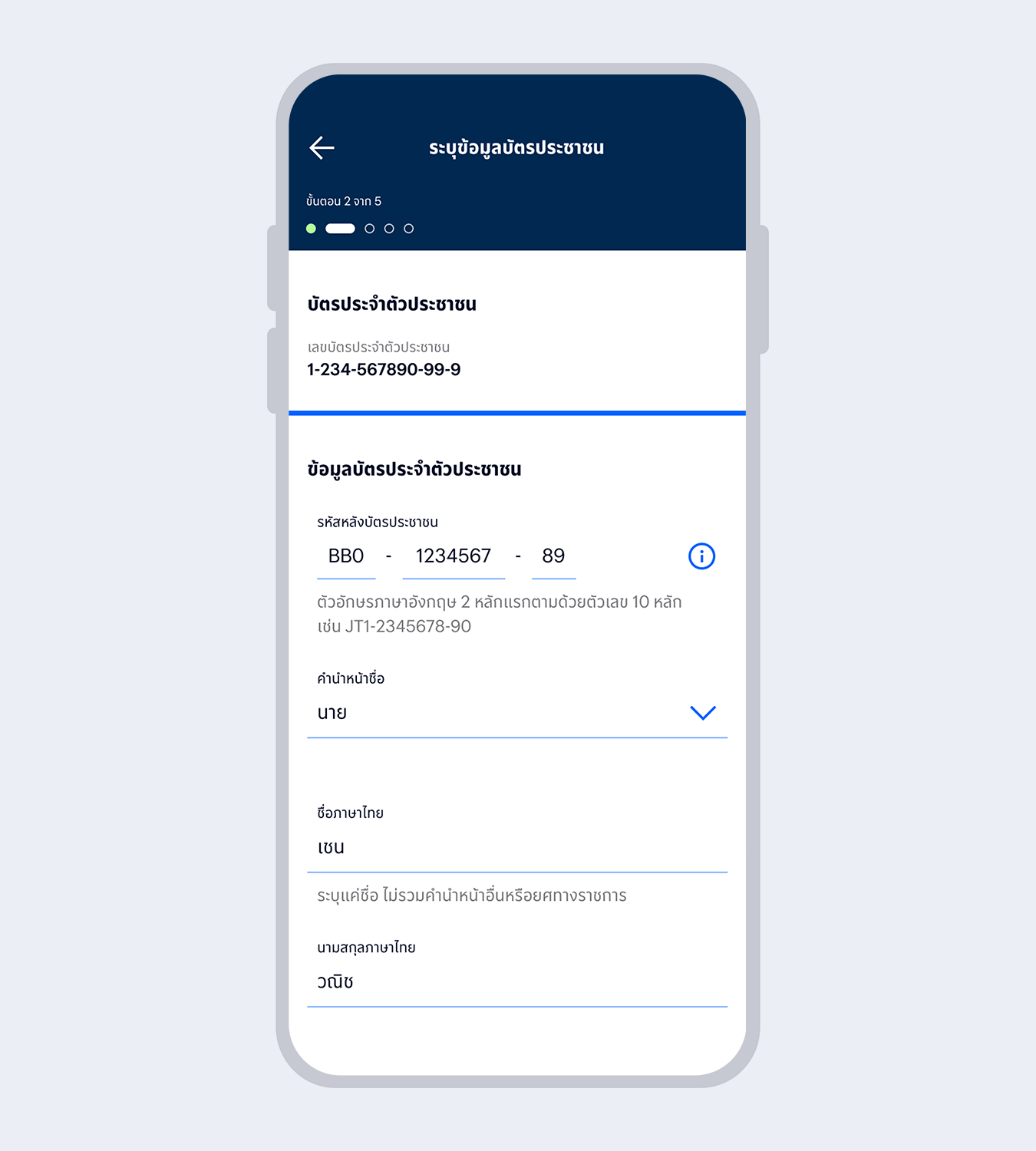

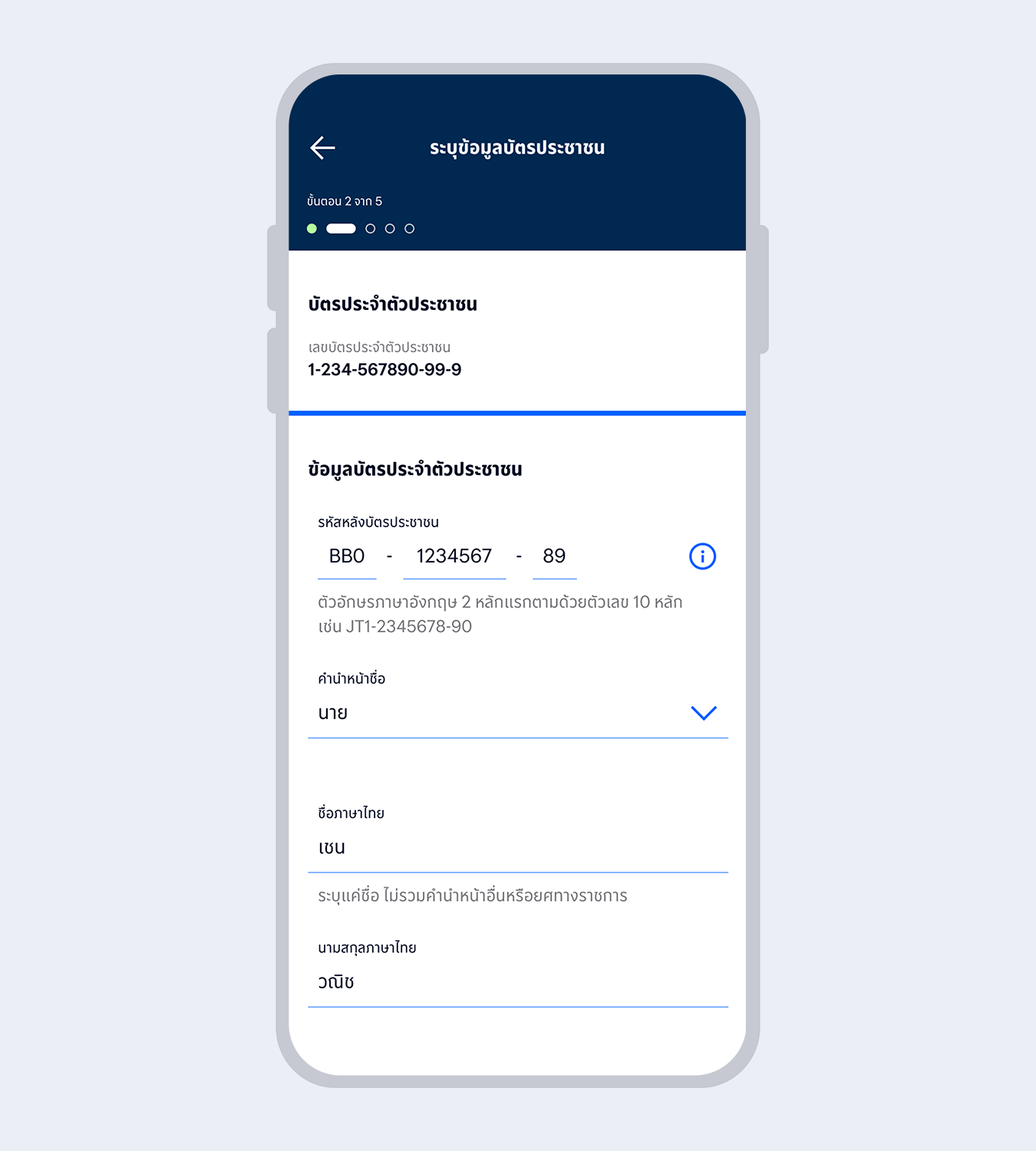

4.

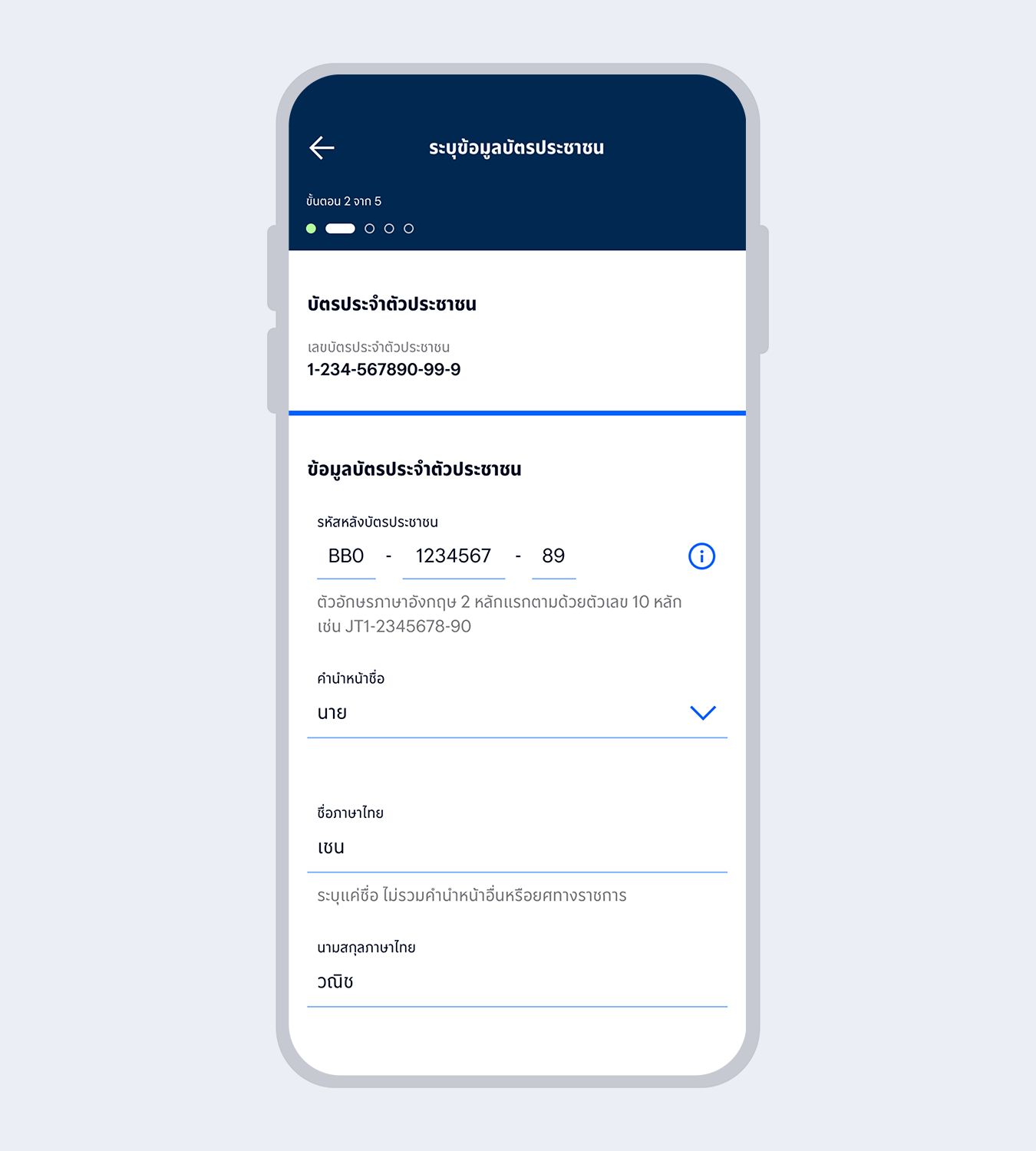

Enter your Citizen ID card information and select “Next”

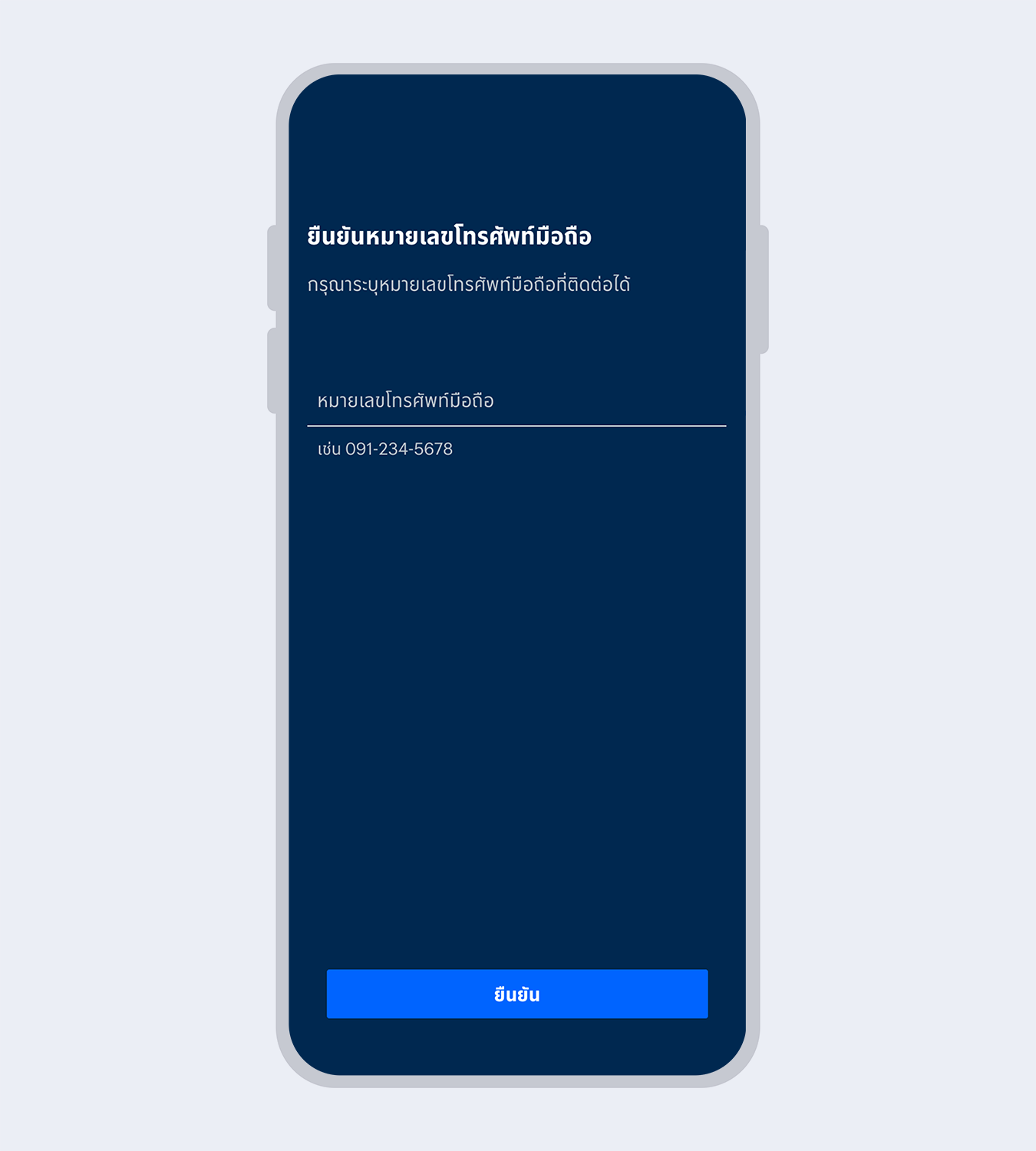

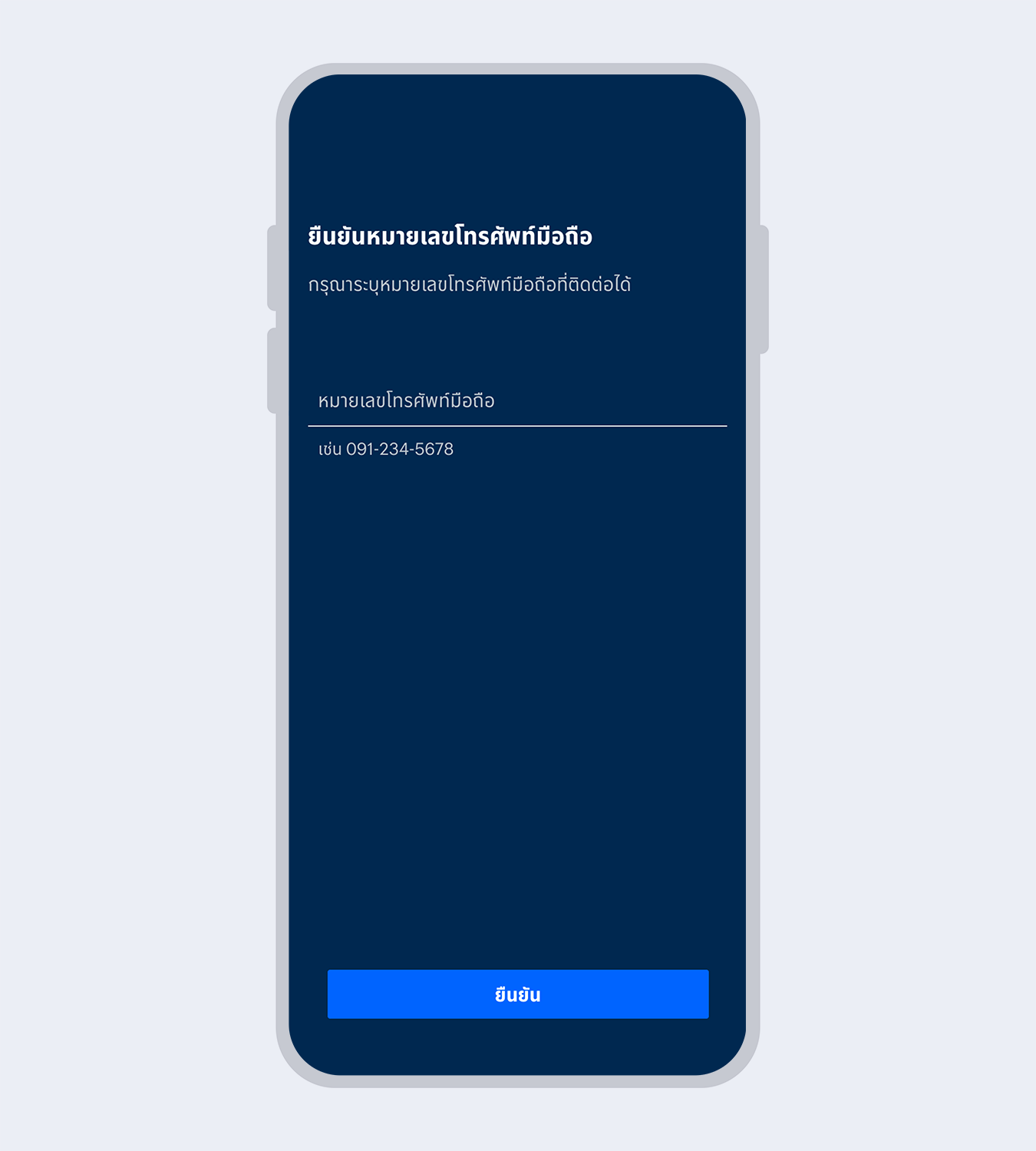

5.

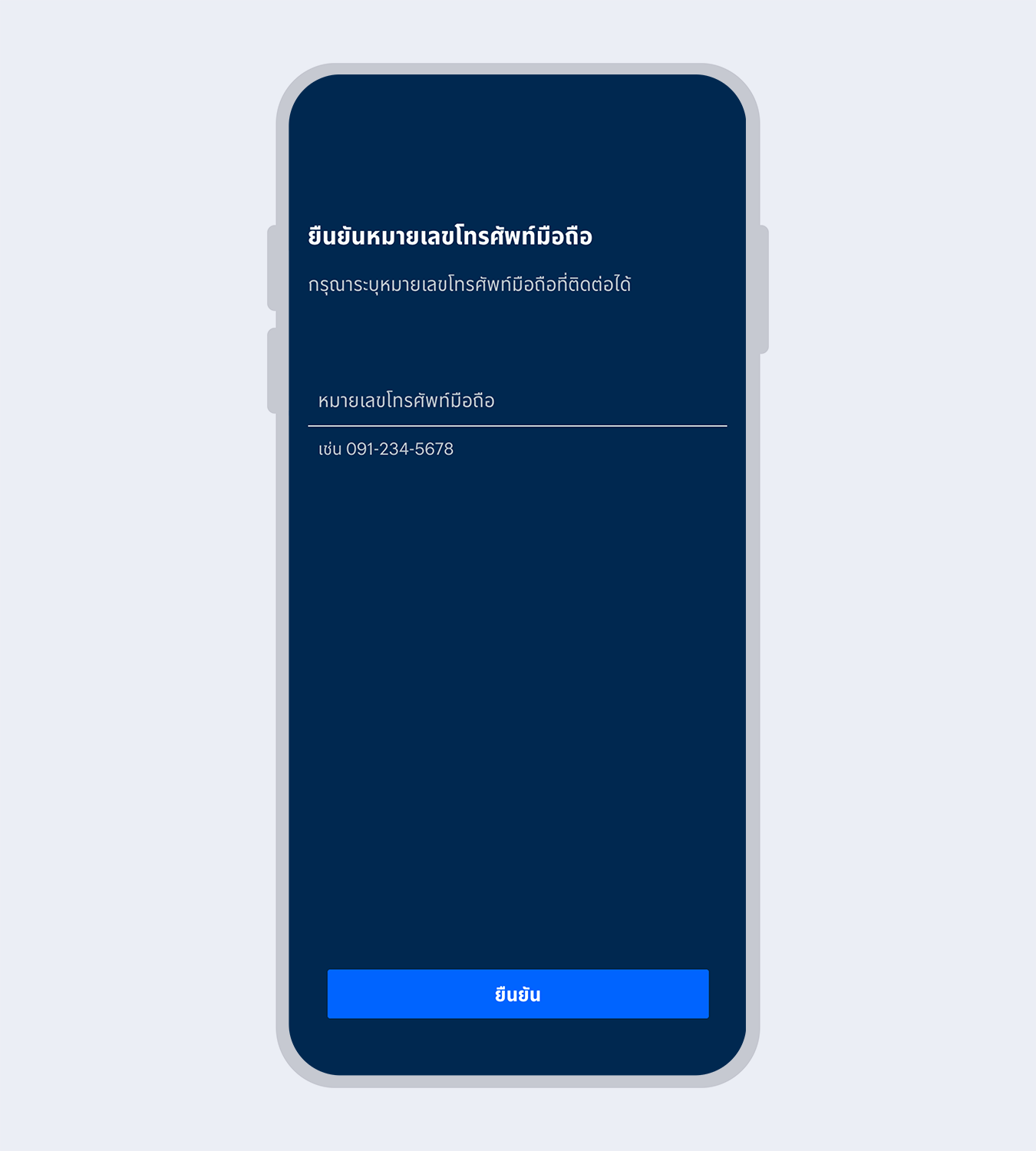

Enter your mobile phone number and select “Confirm”

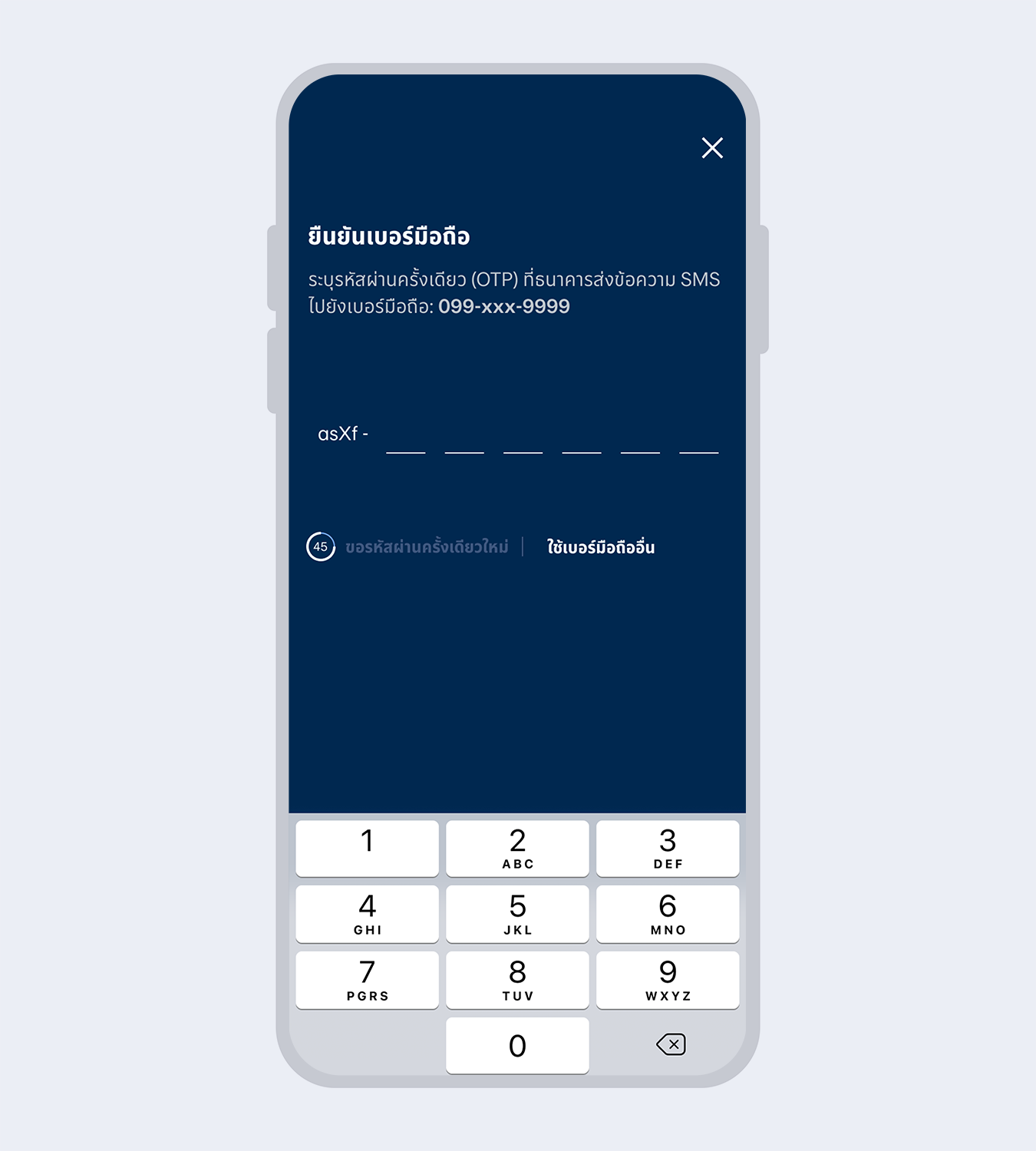

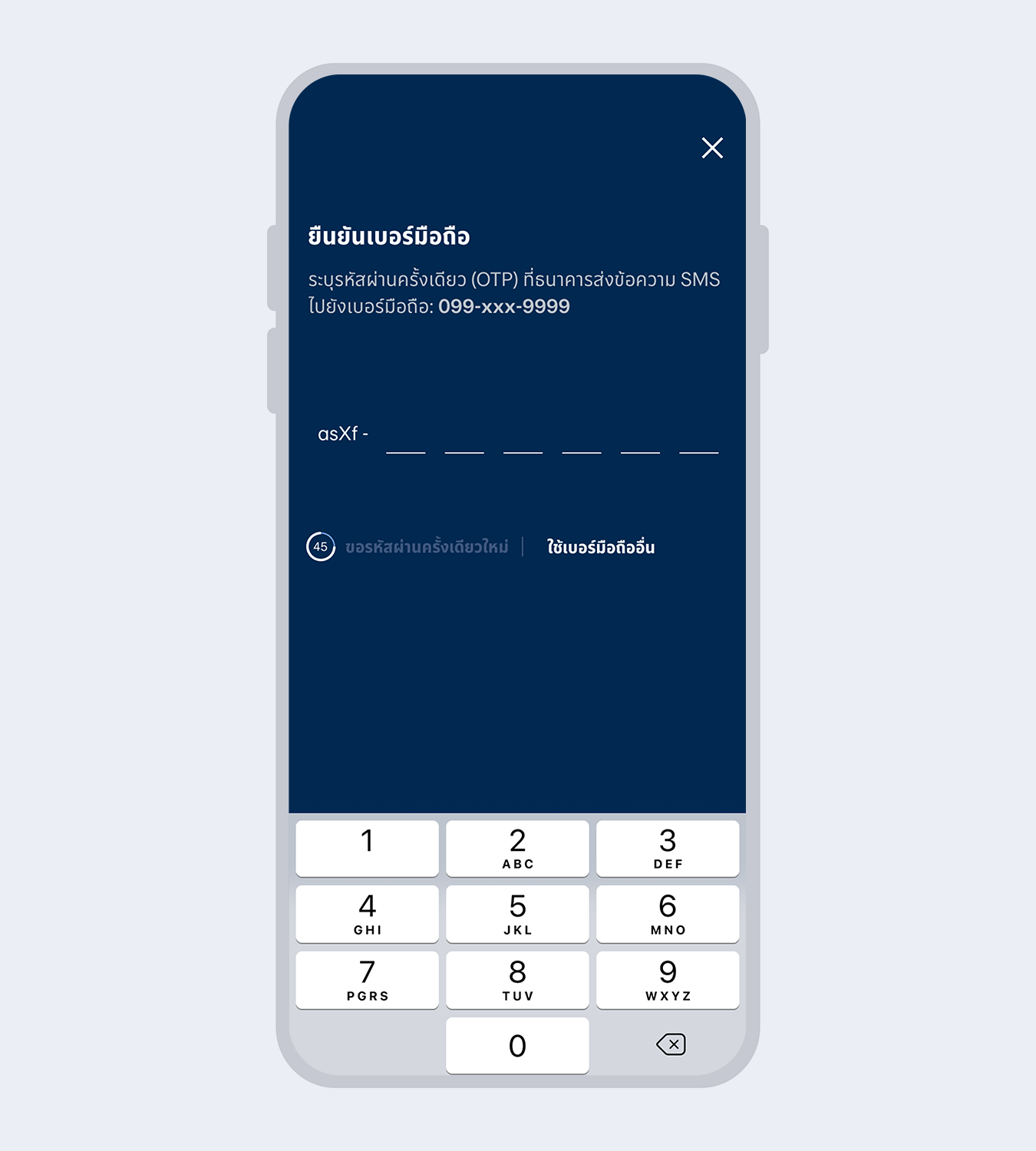

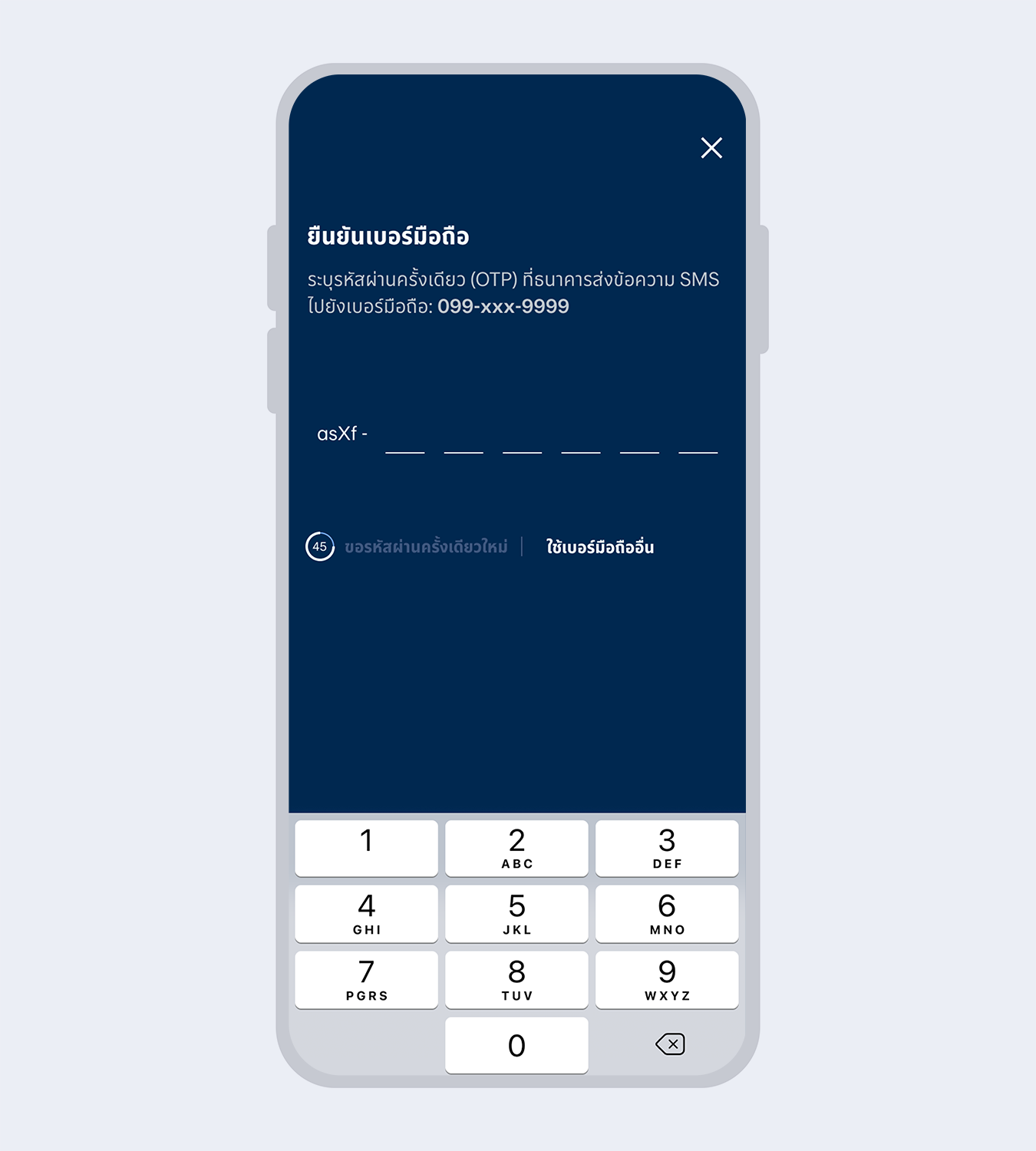

6.

Enter the One Time Password (OTP) received via SMS to verify your mobile number

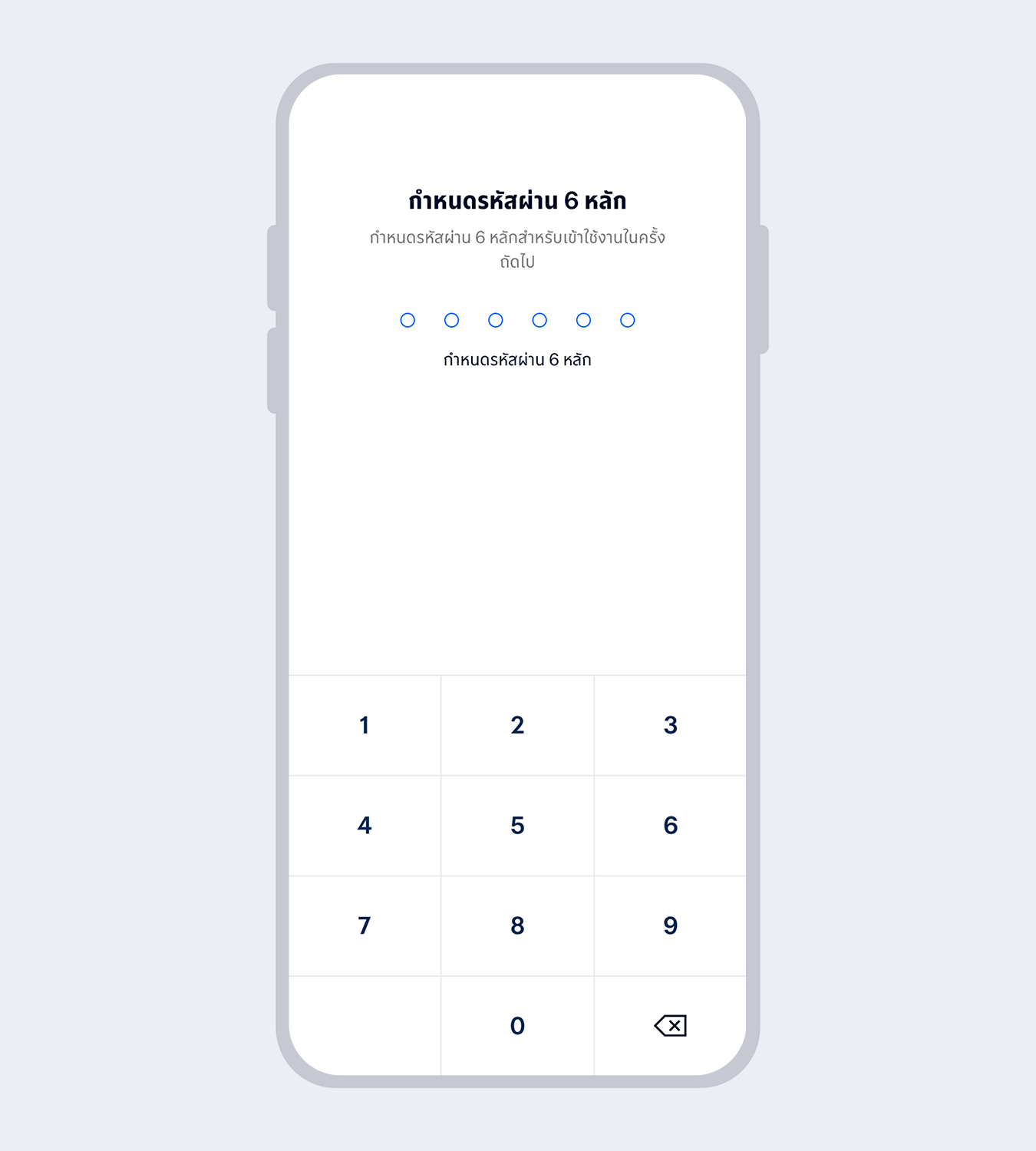

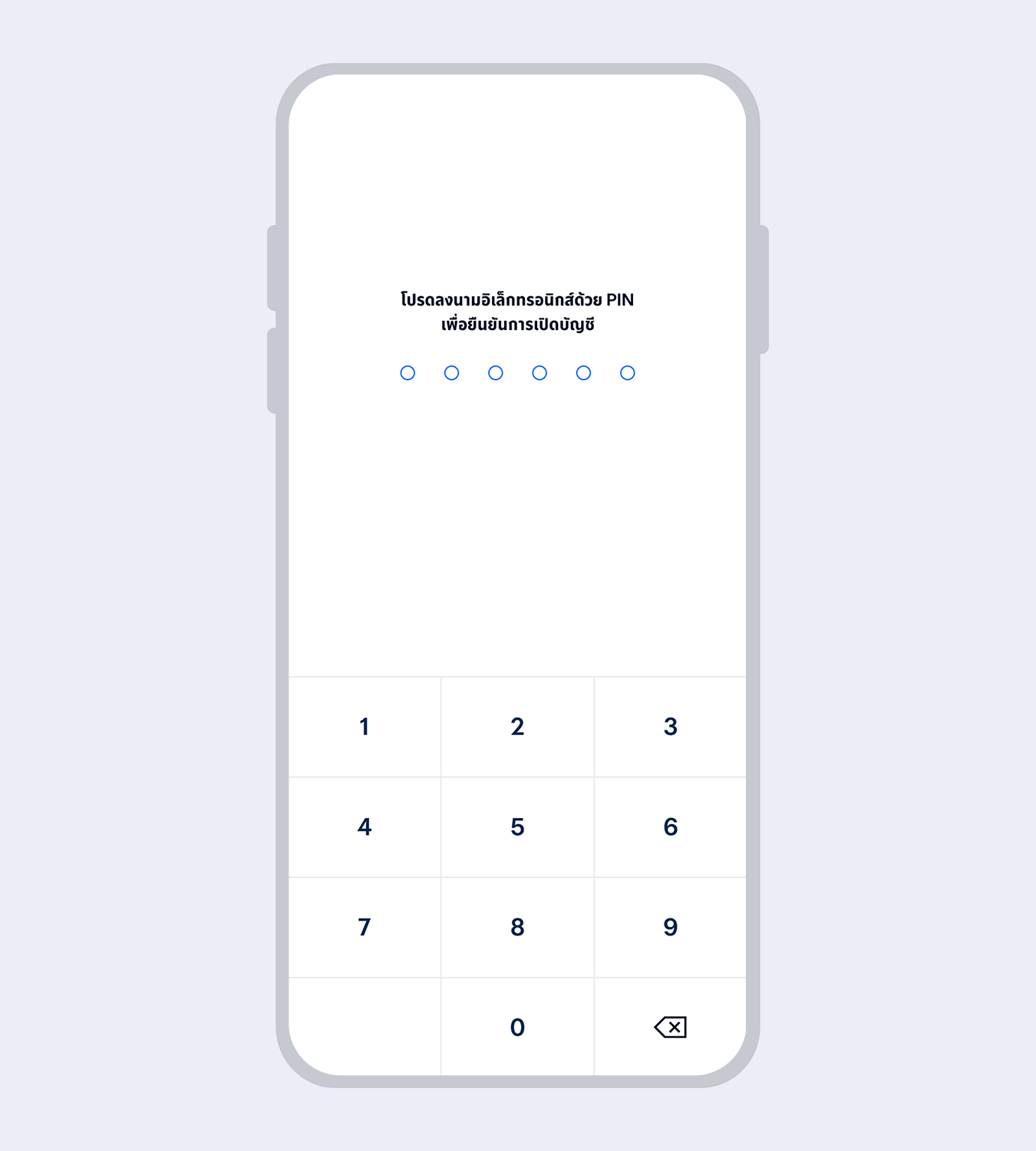

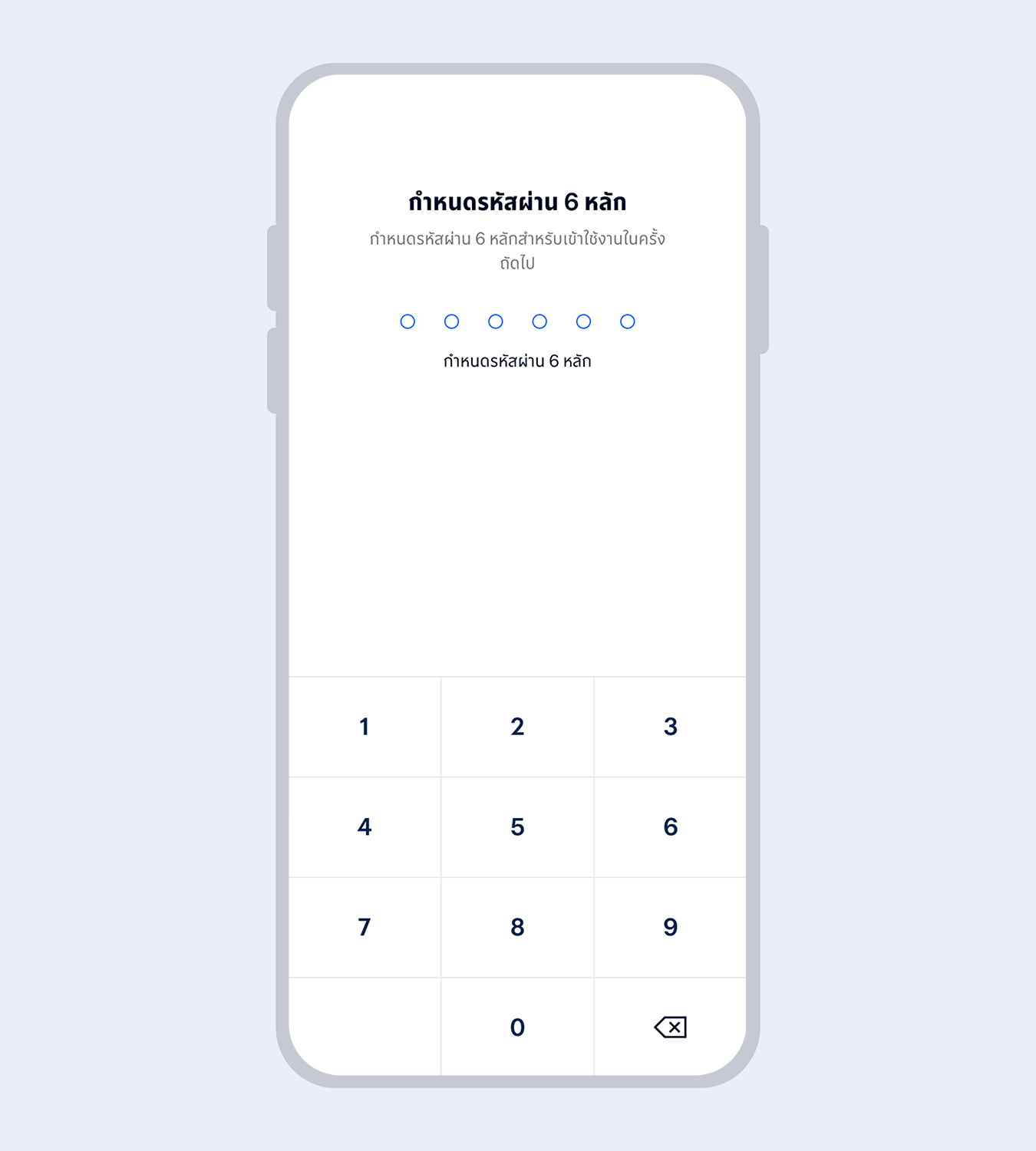

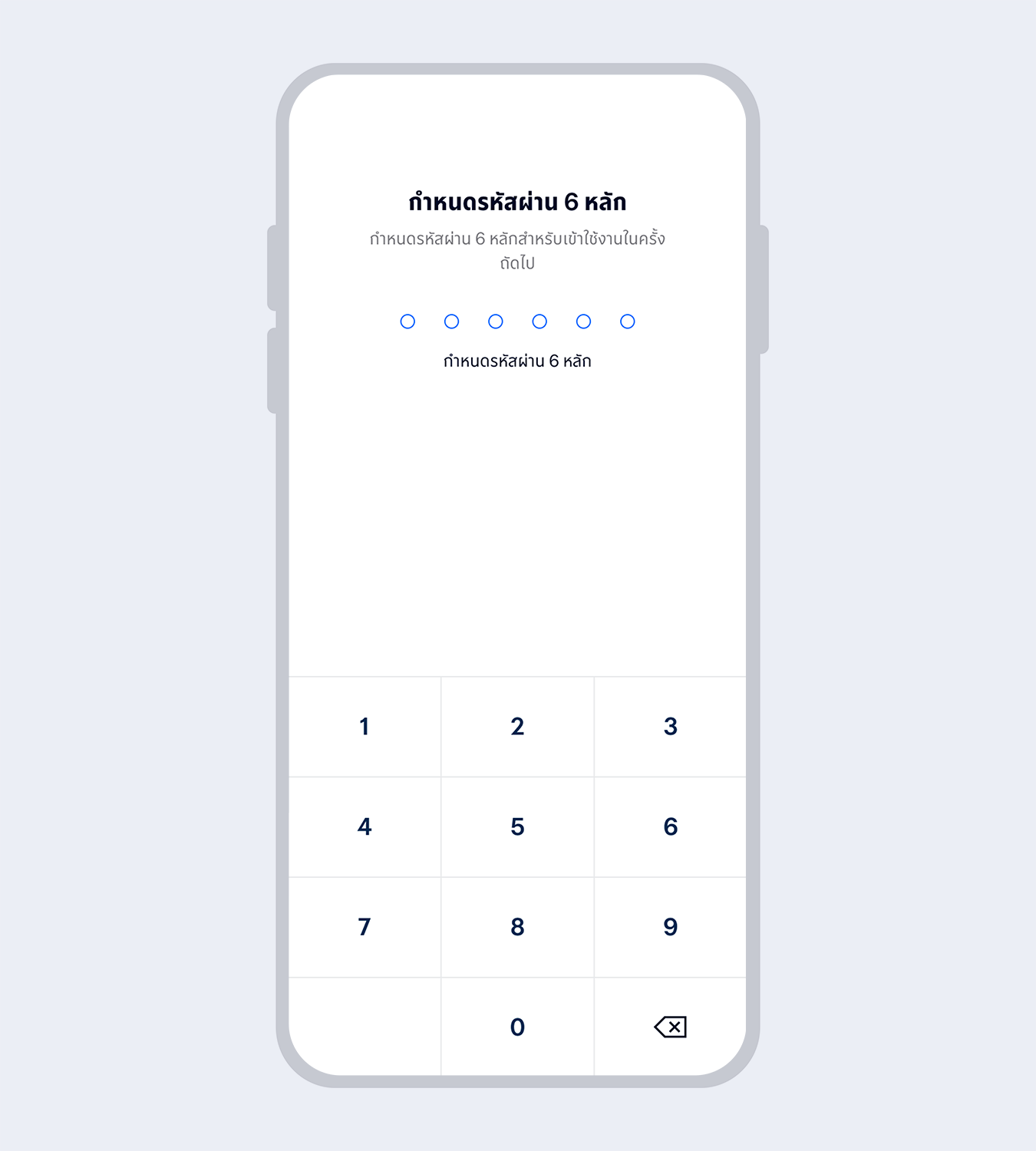

7.

Set up your 6-digit Mobile PIN which you will use for subsequent log on to Mobile Banking

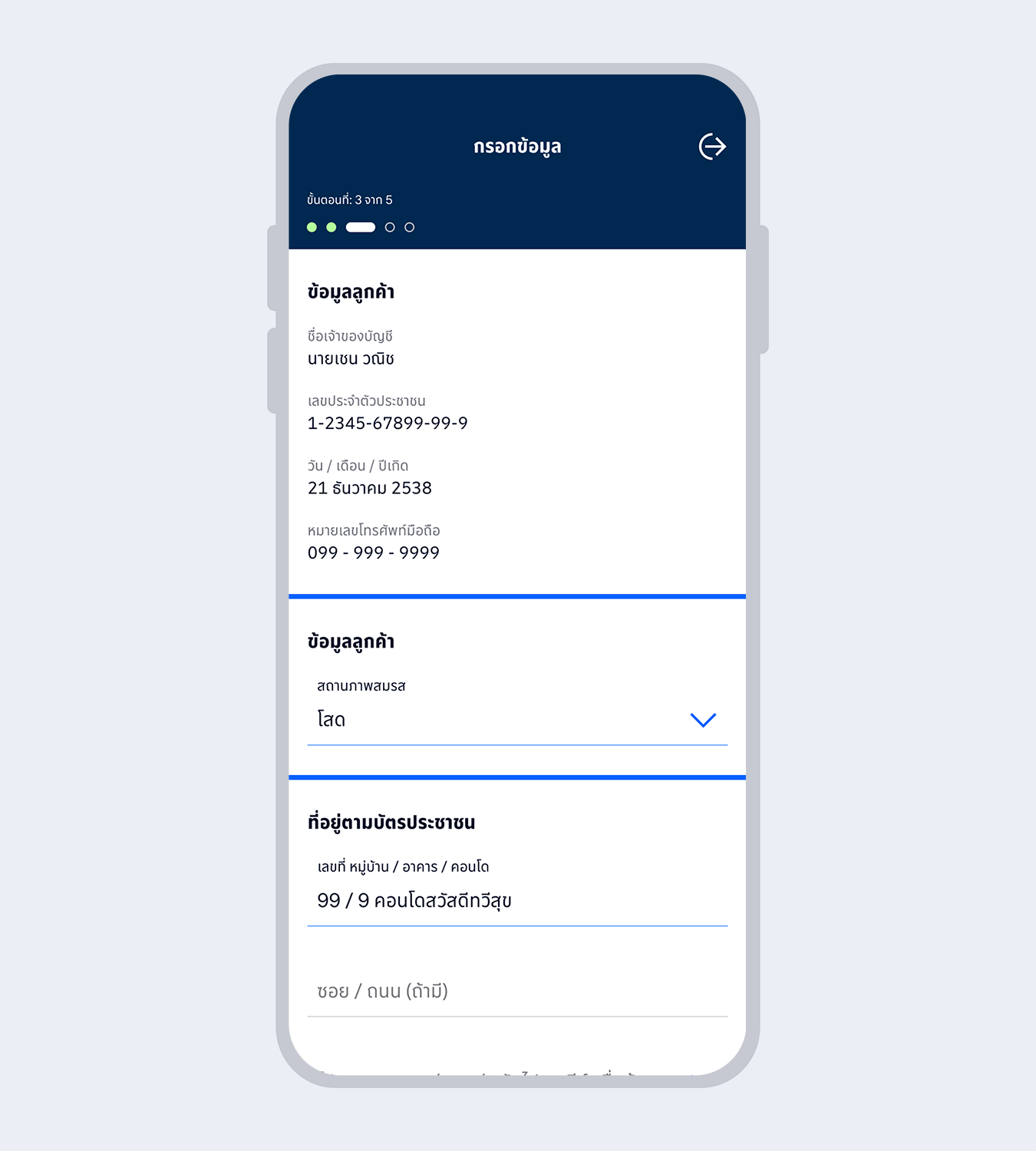

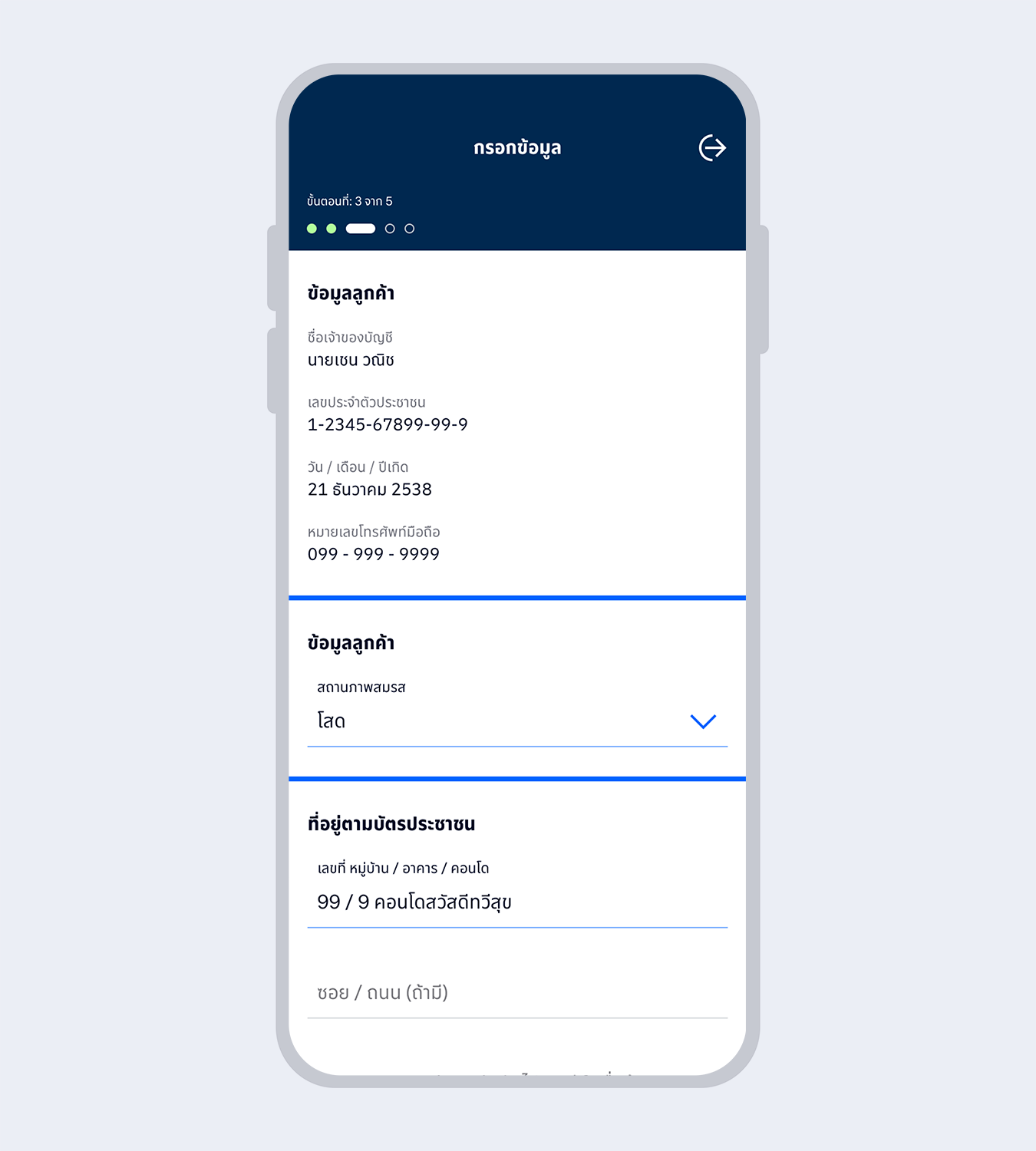

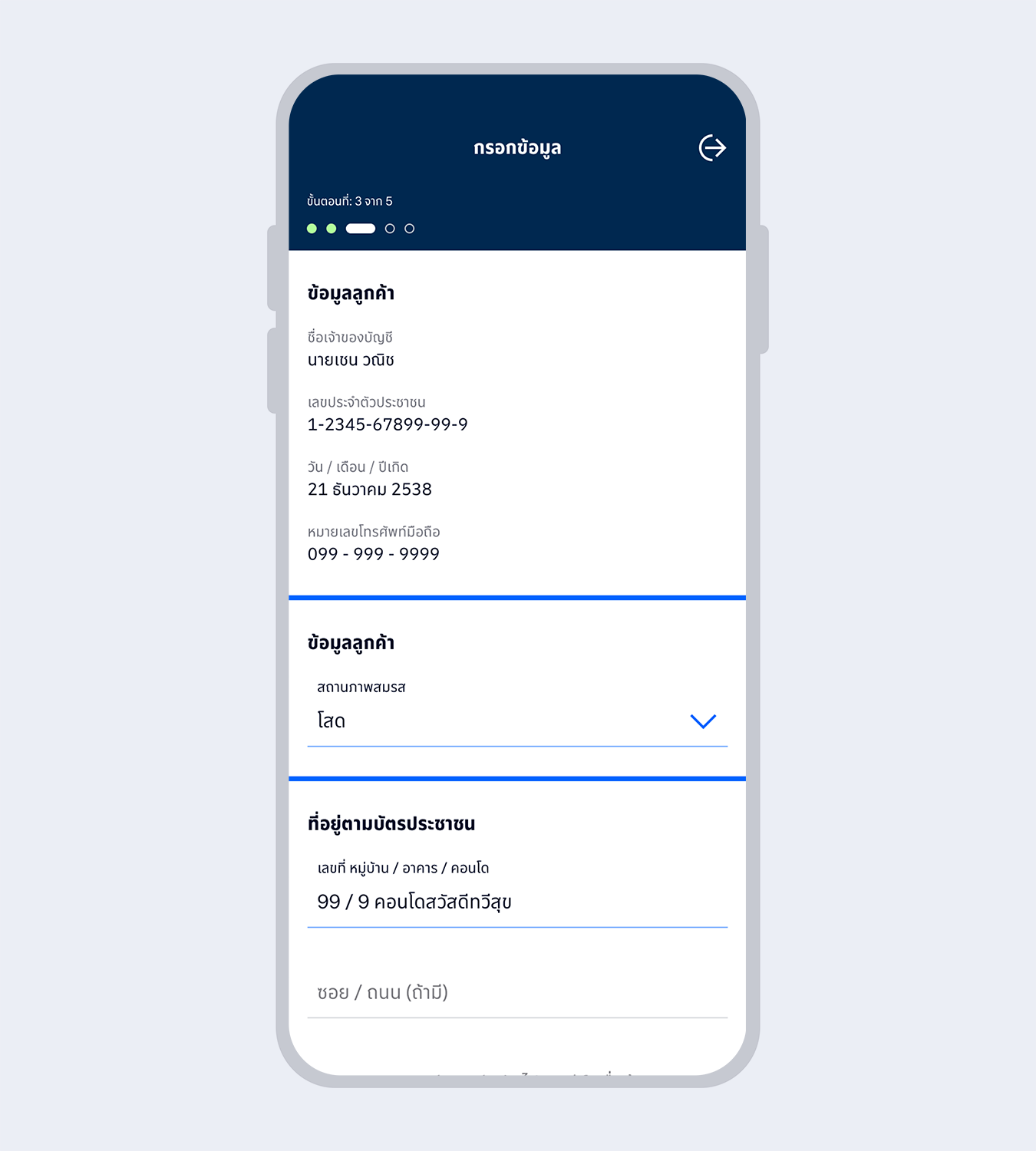

8.

Enter your personal information and select “Next”

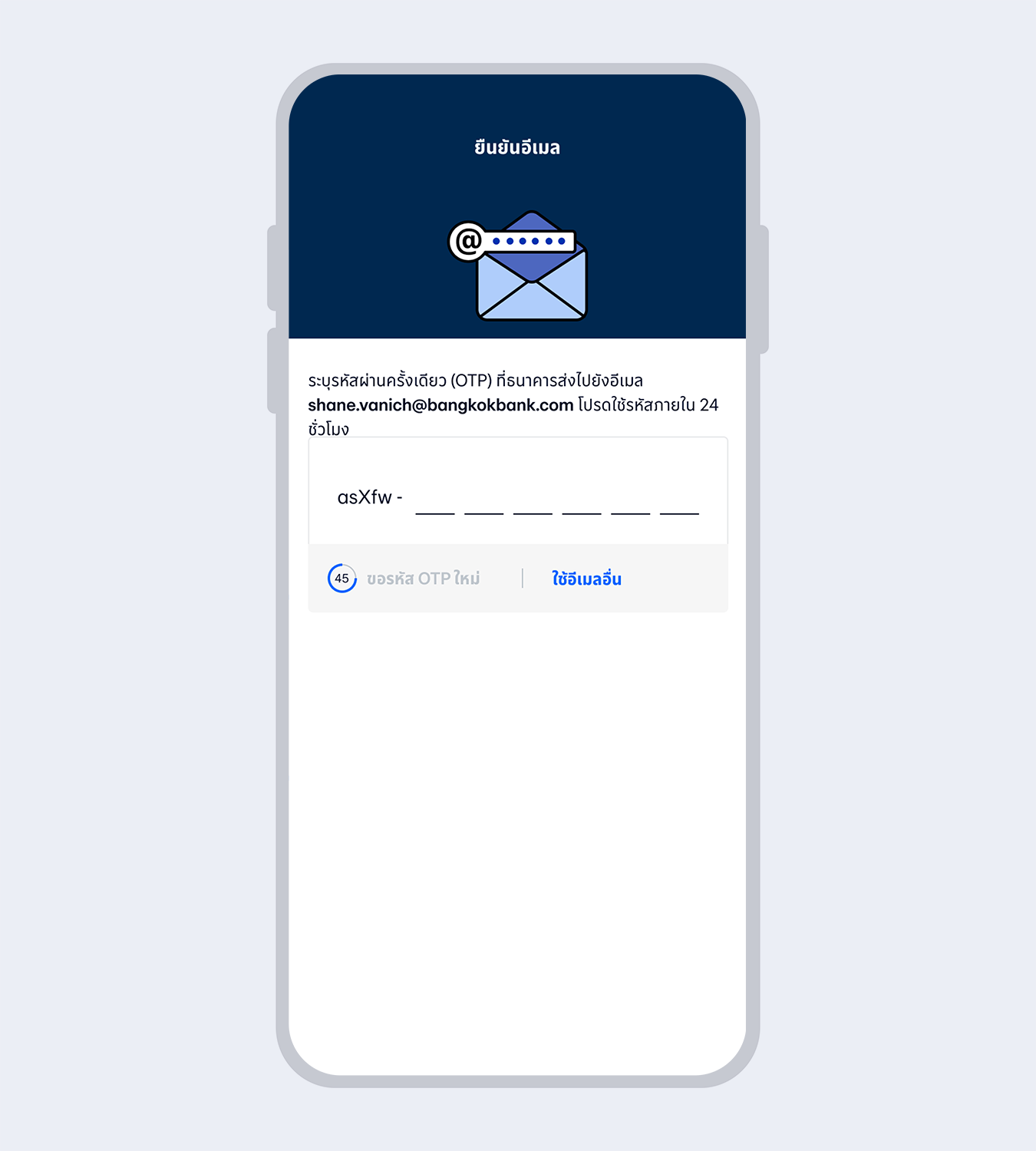

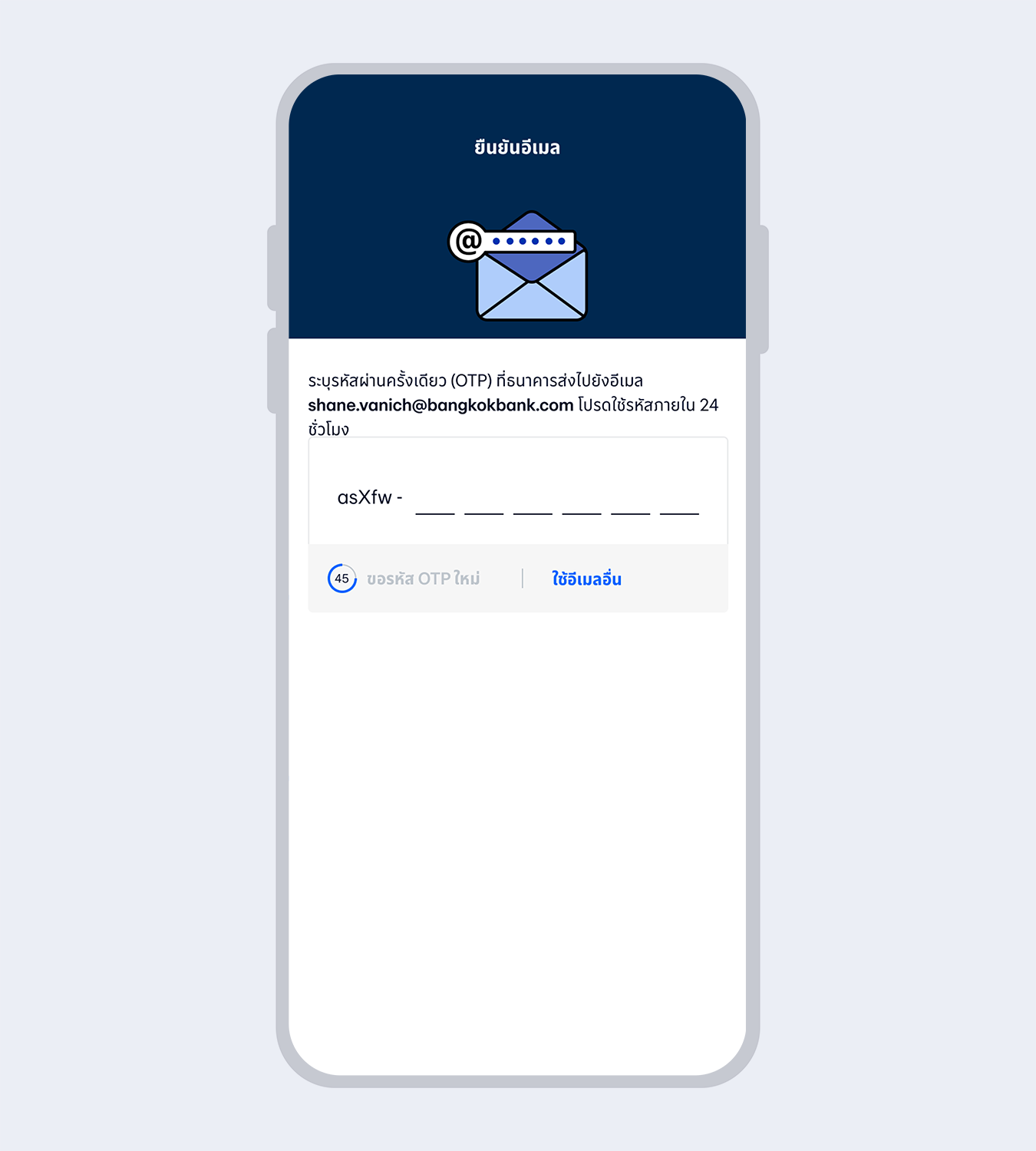

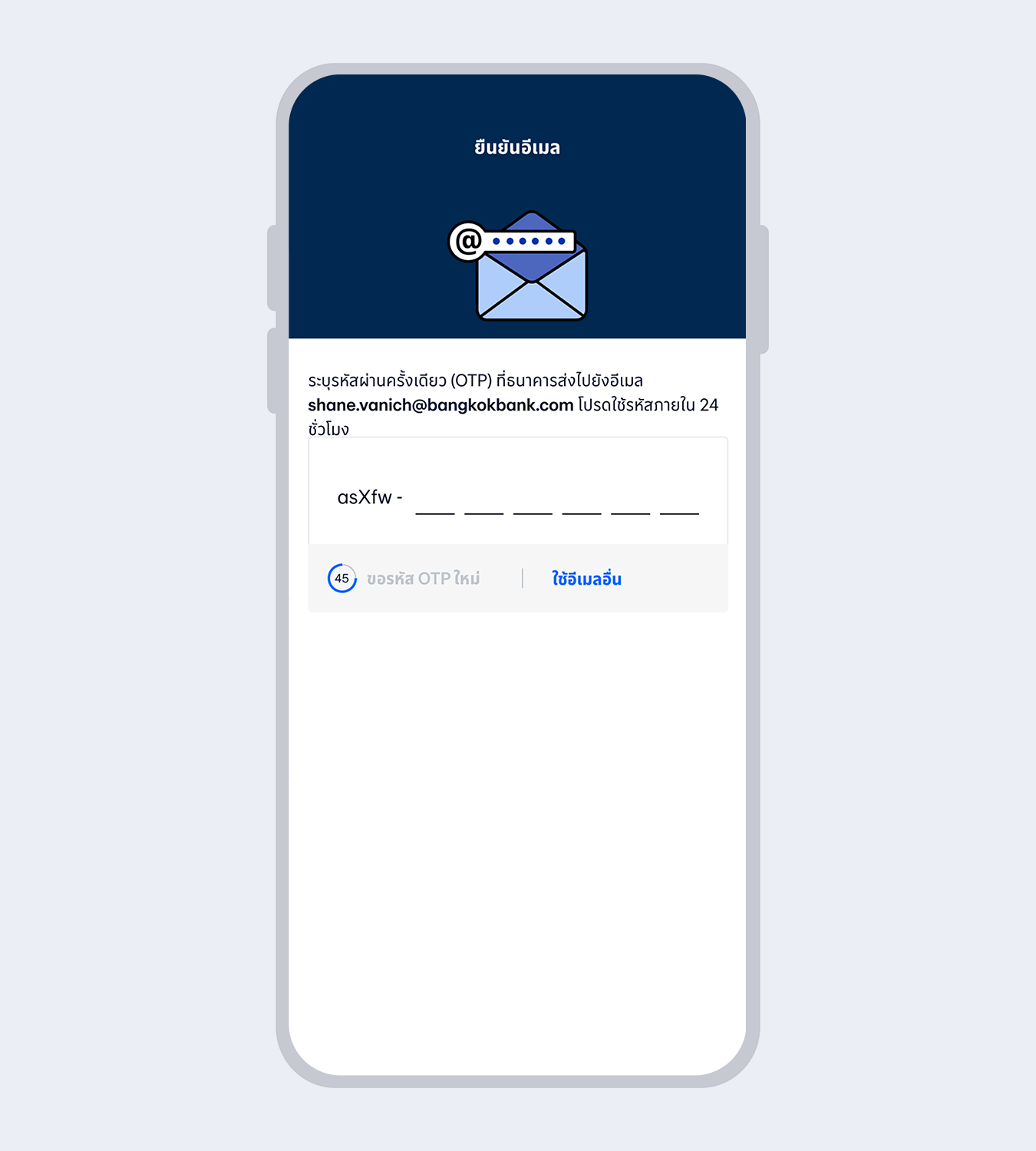

9.

Enter the One Time Password (OTP) received via email to verify your email

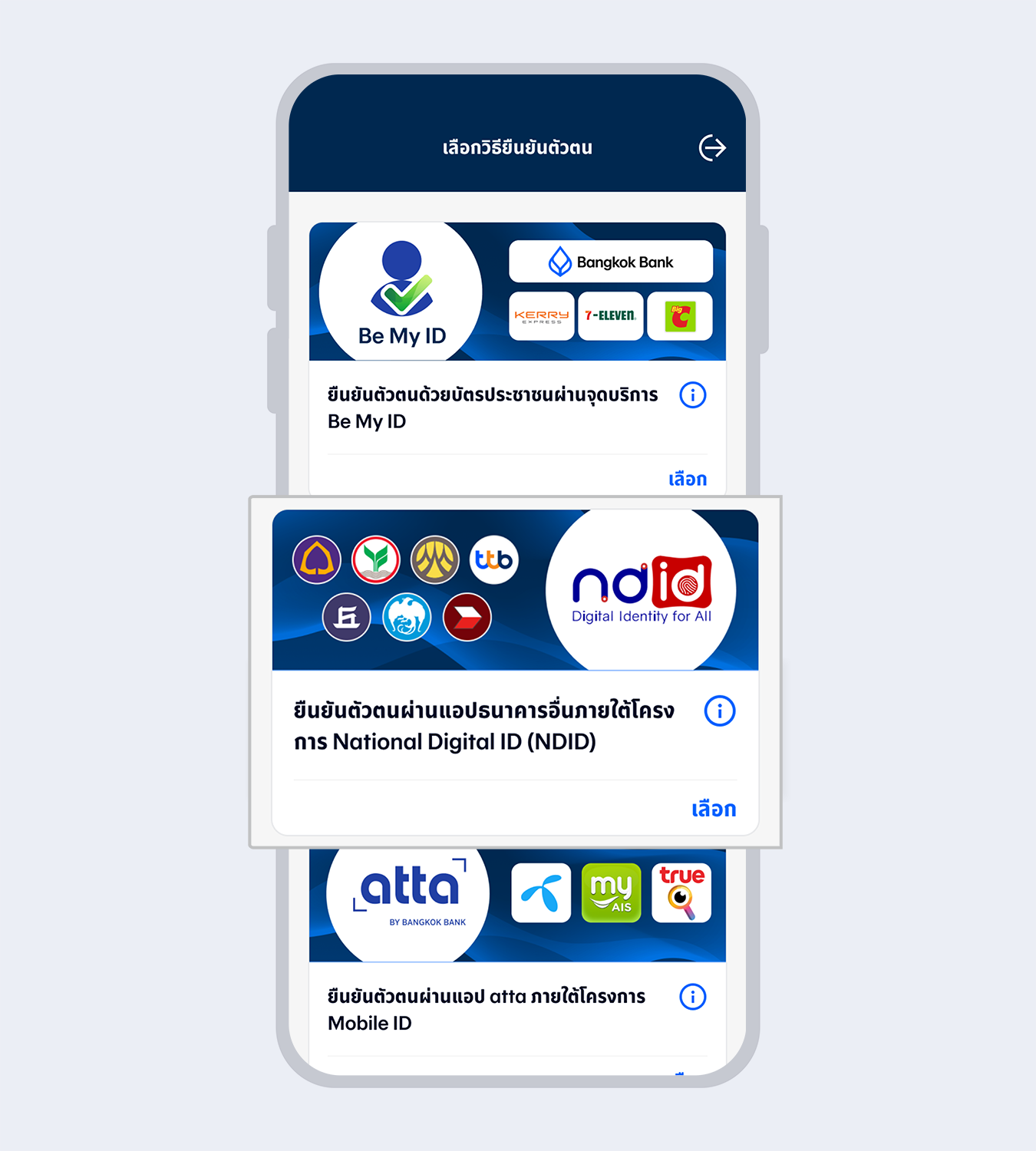

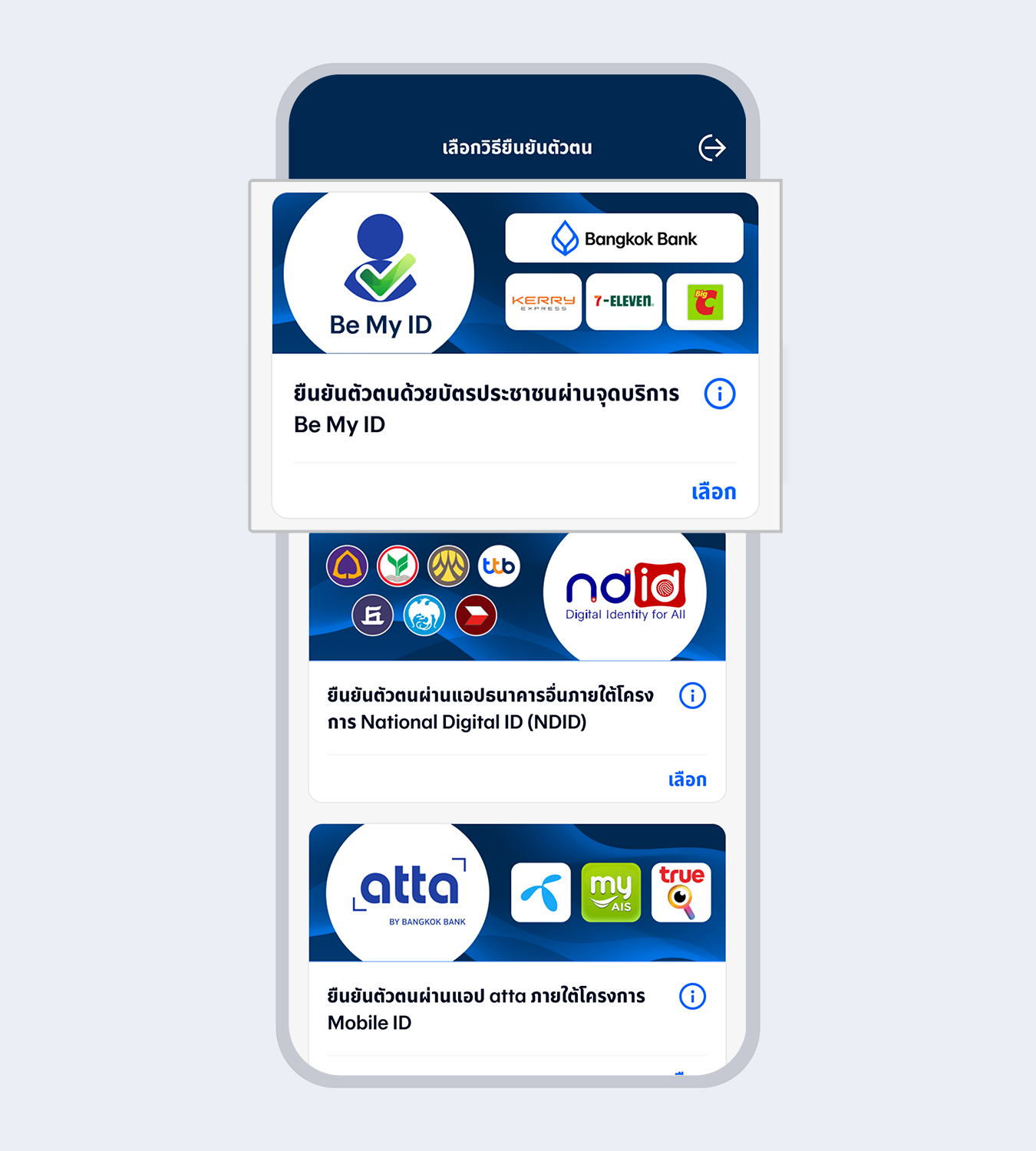

10.

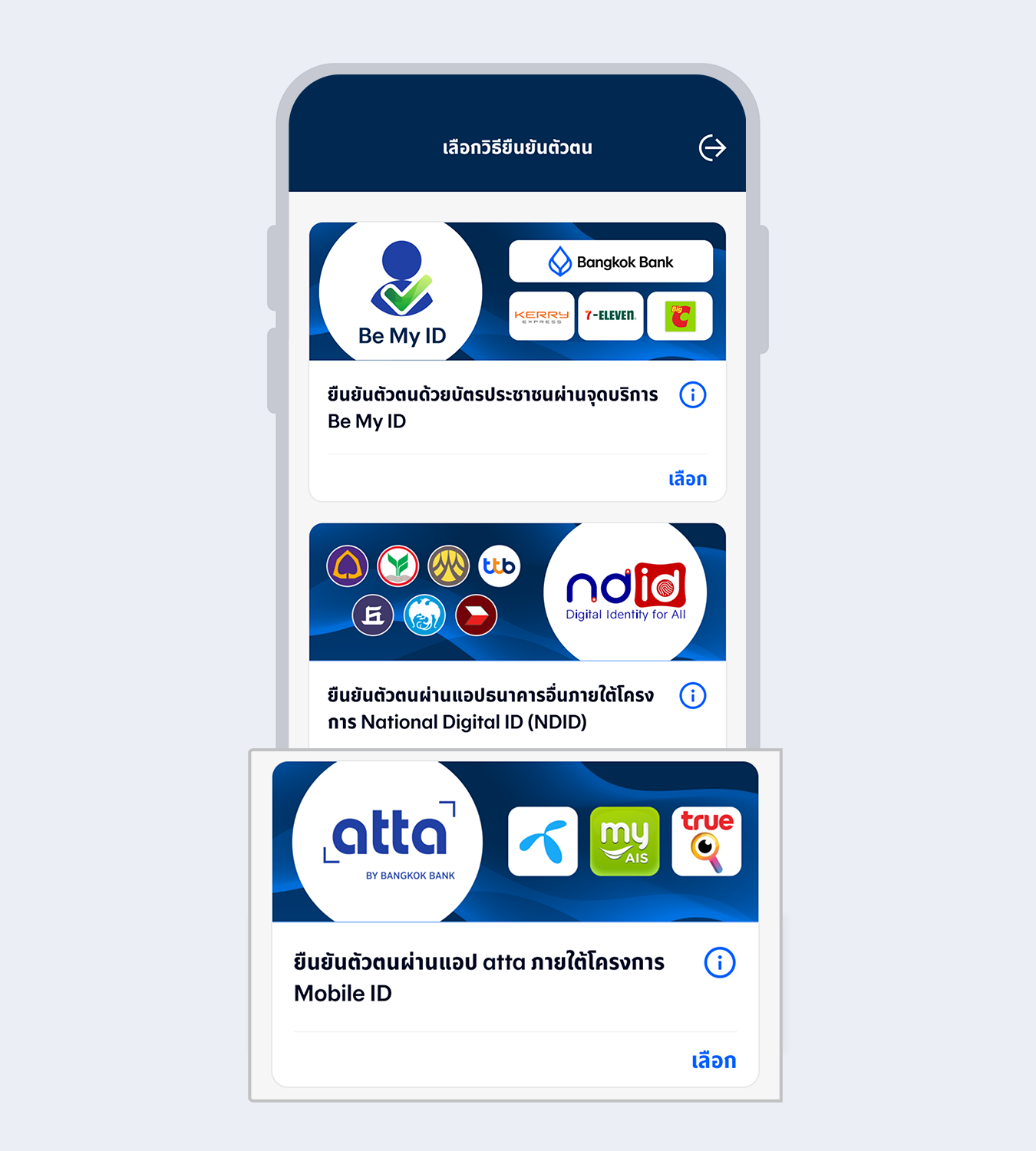

Select “Authenticated by National Digital ID (NDID)”

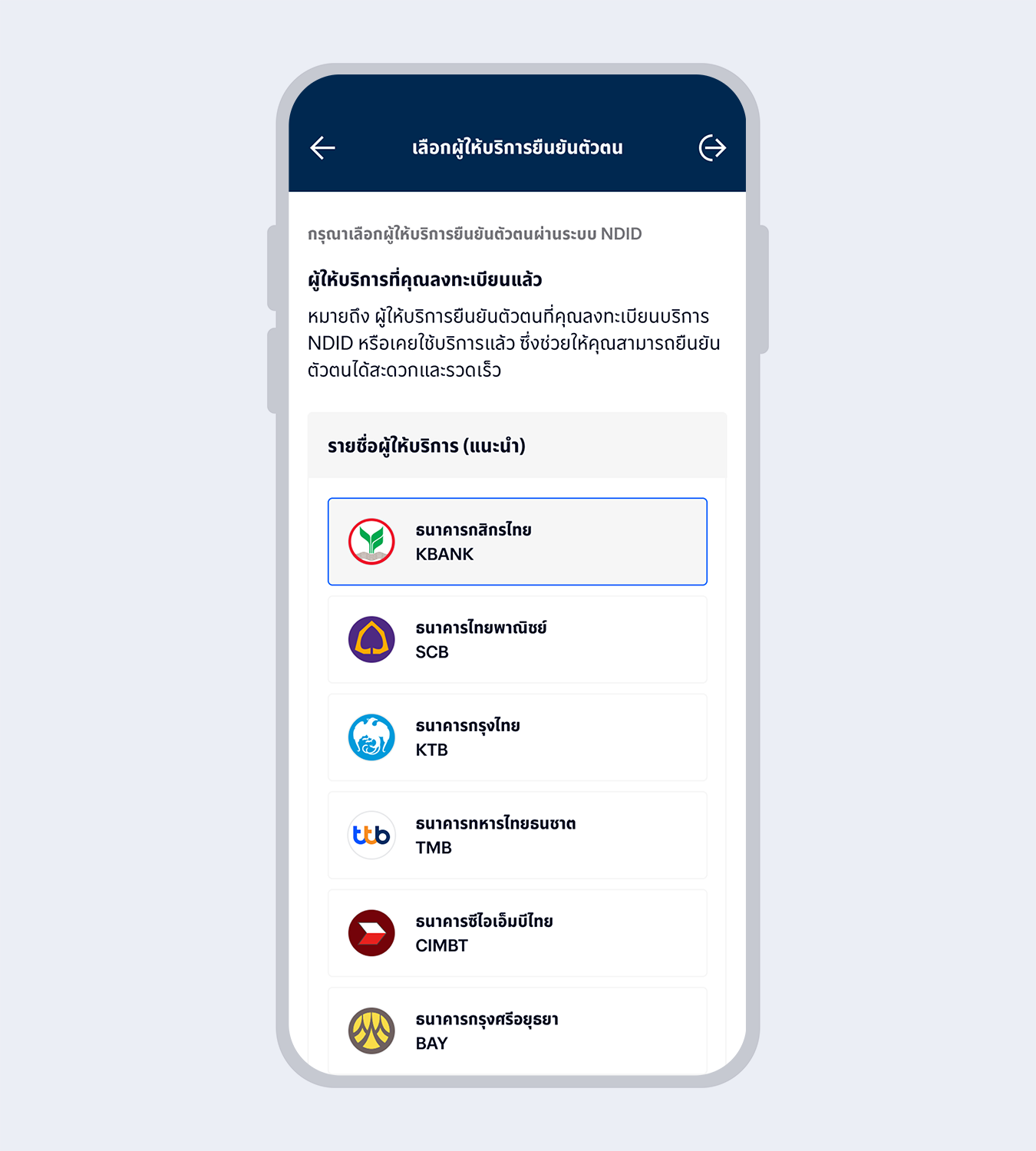

11.

Select the identity provider you have registered with

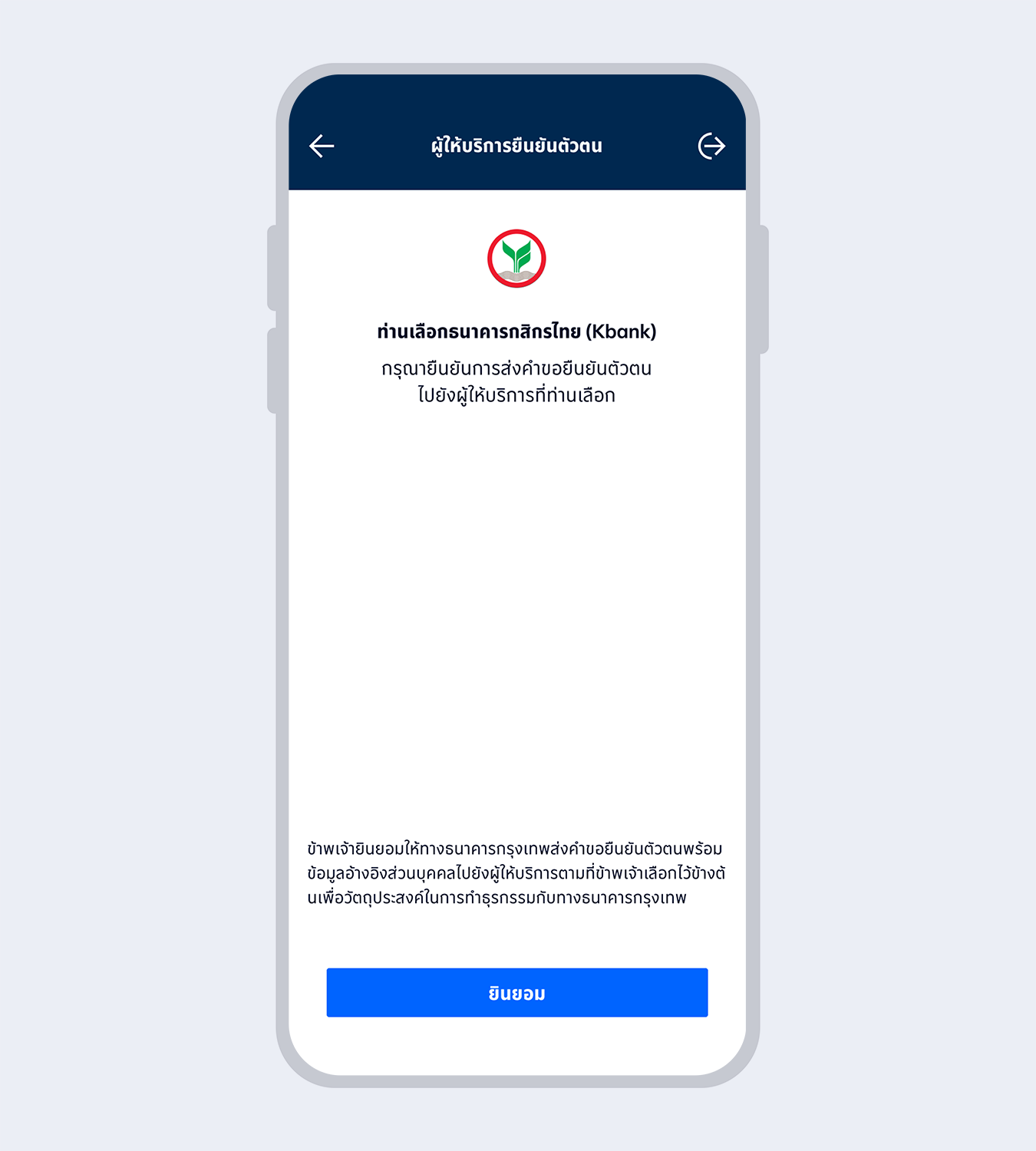

12.

Select “Accept”

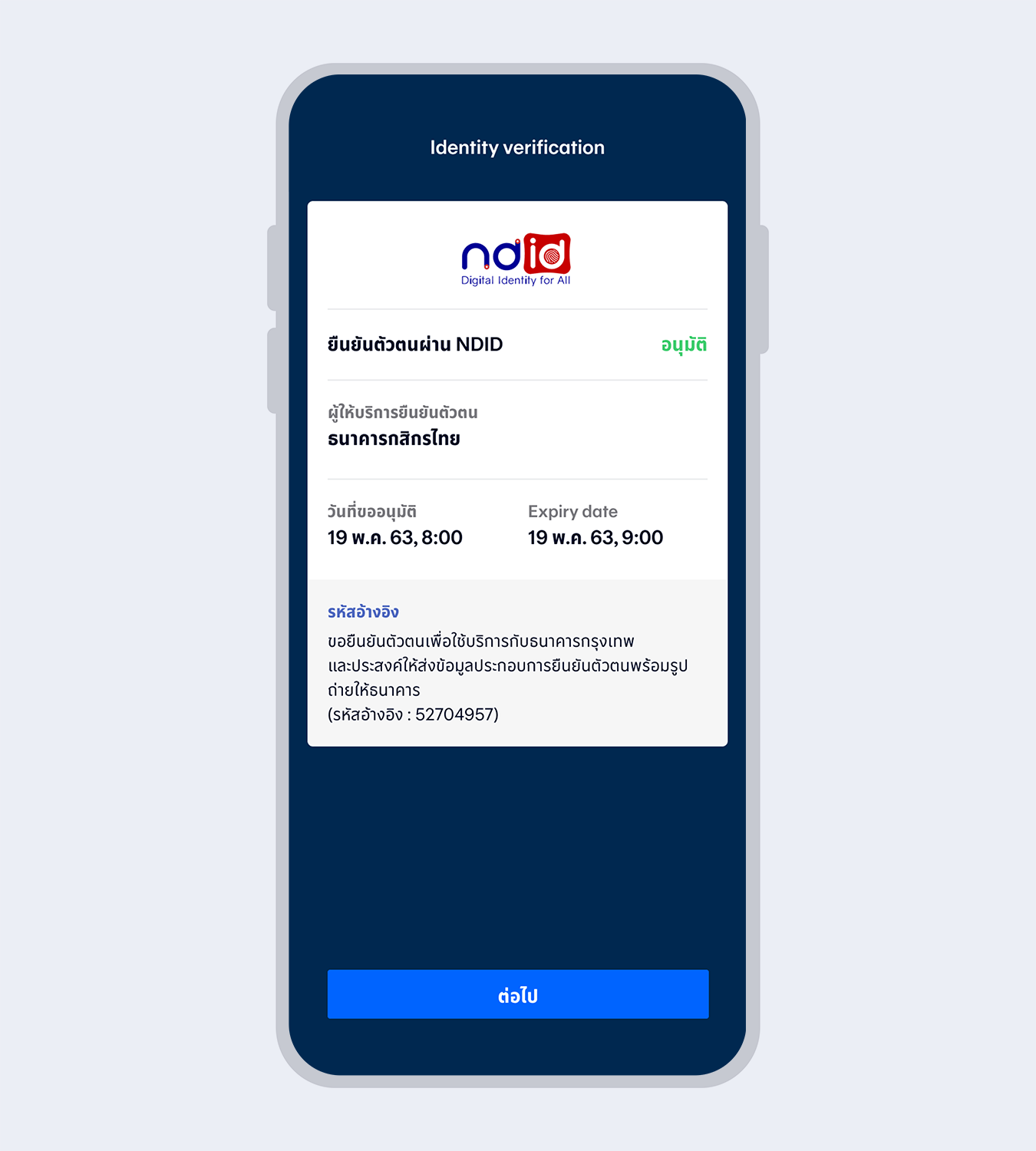

13.

When your authentication with the identity provider is completed, the request status will change to “Approved”. Select “Next”

14.

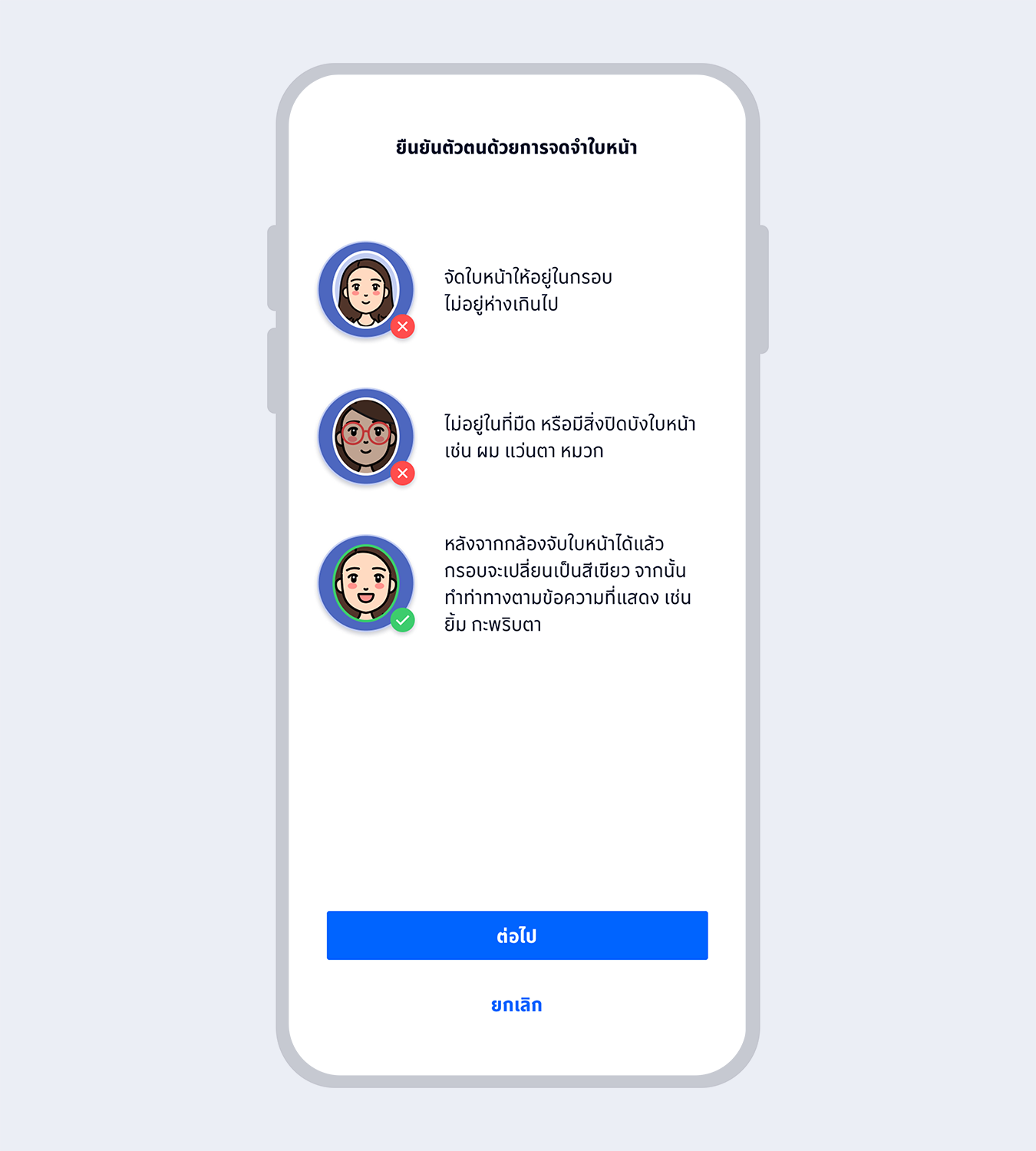

Prepare to take a selfie photo to verify your identity with facial recognition technology

15.

Fit your face in the frame and follow instructions for liveness detection

16.

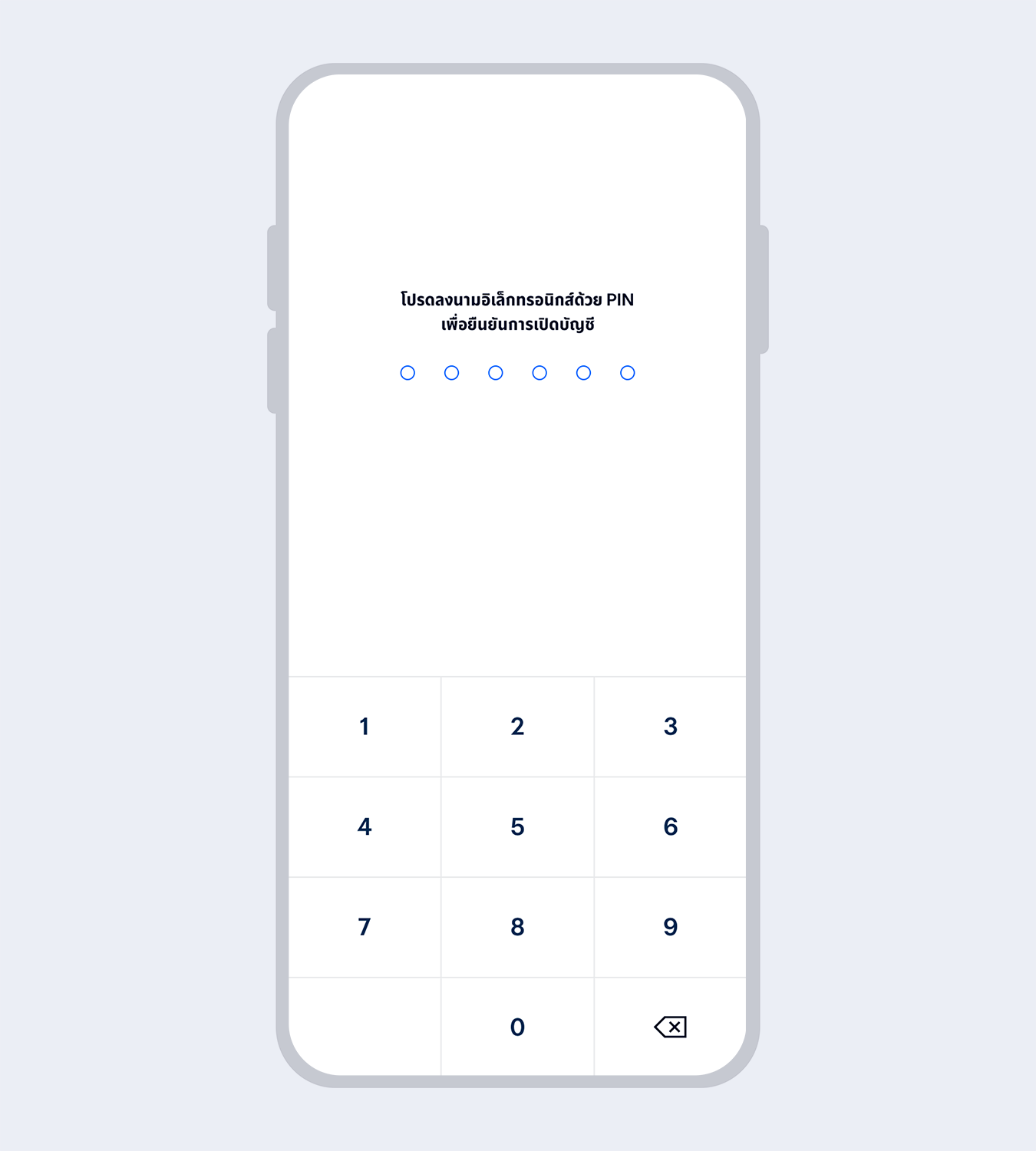

Enter your 6-digit Mobile PIN as an e-Signature to confirm account opening

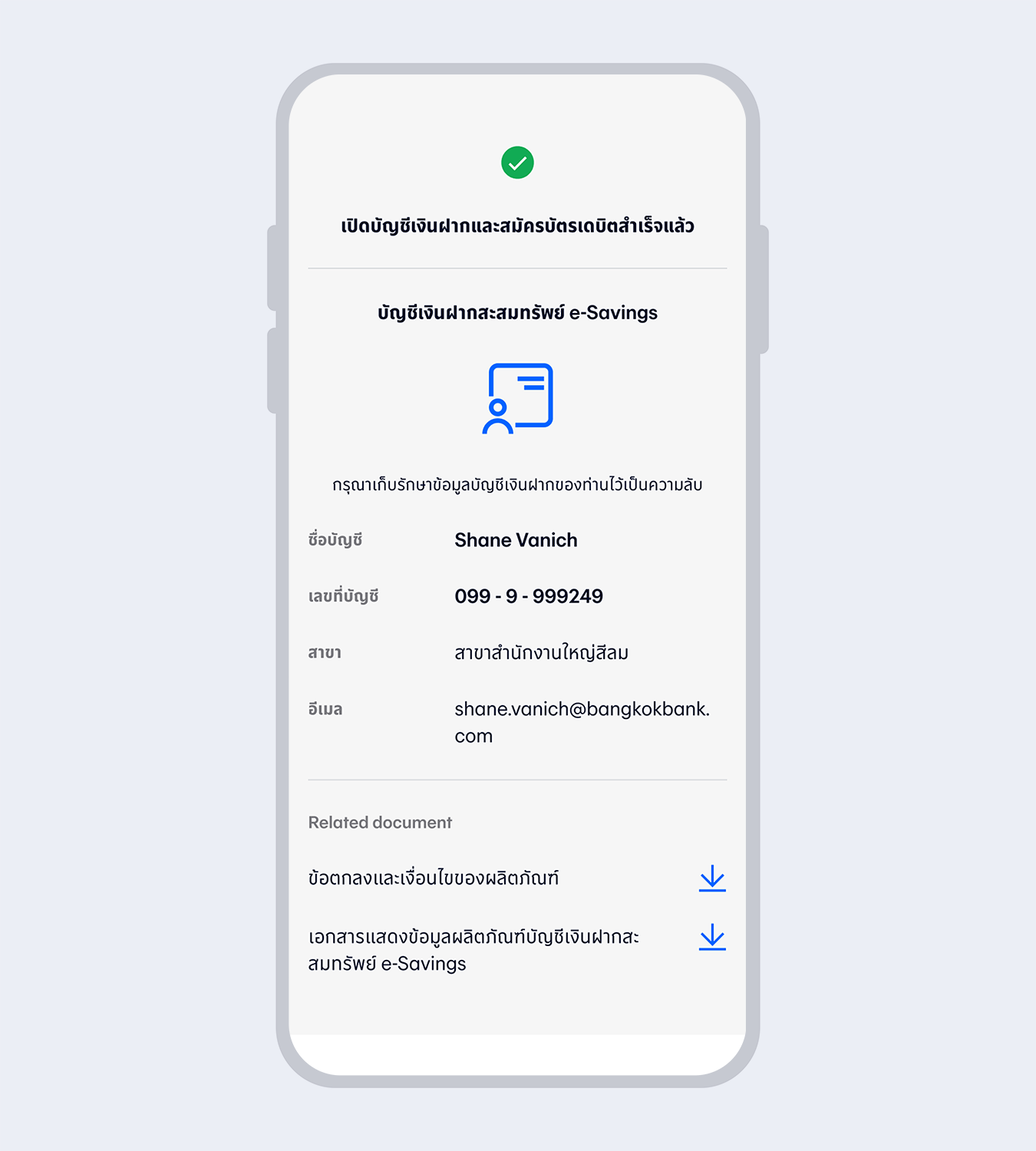

17.

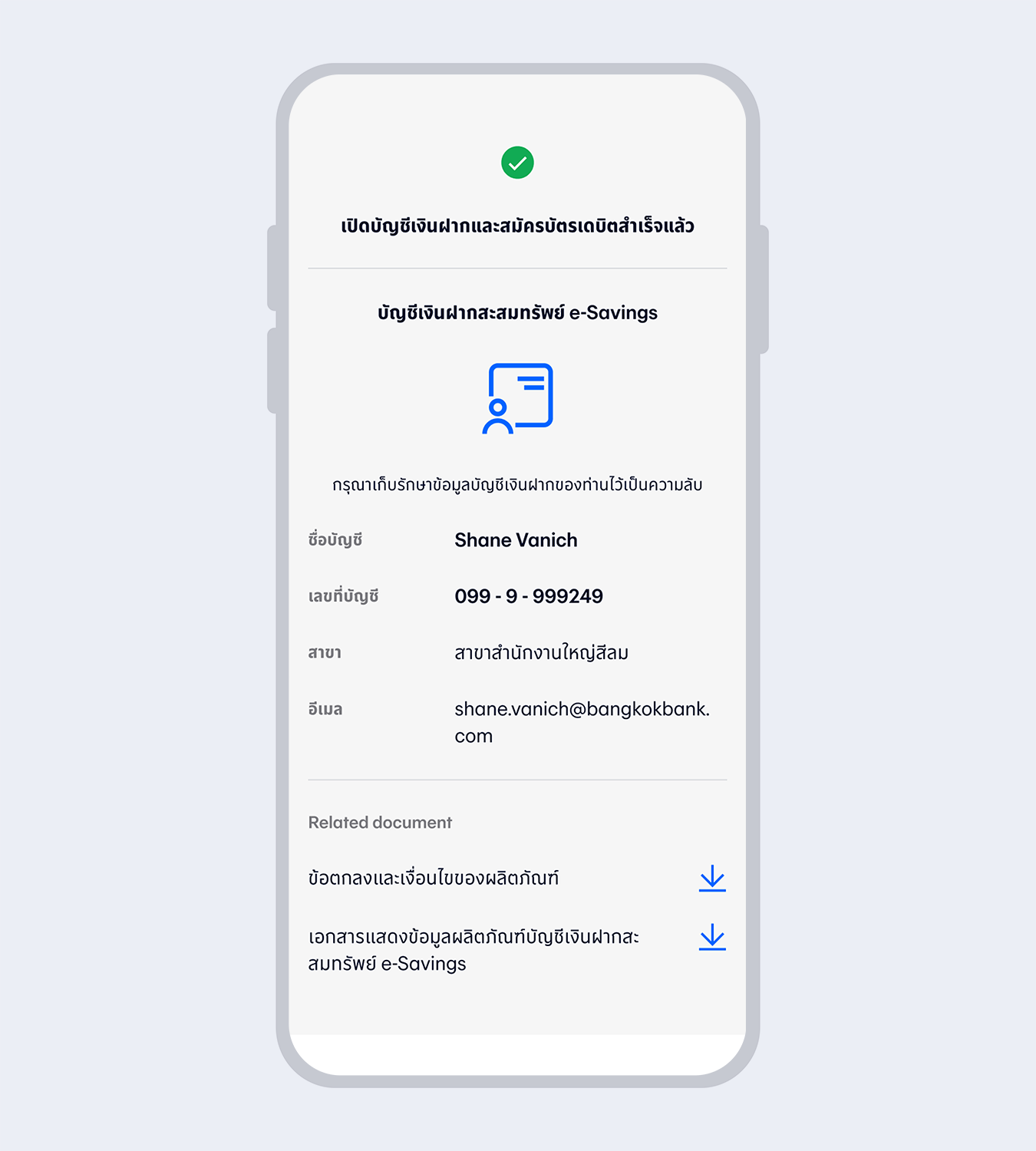

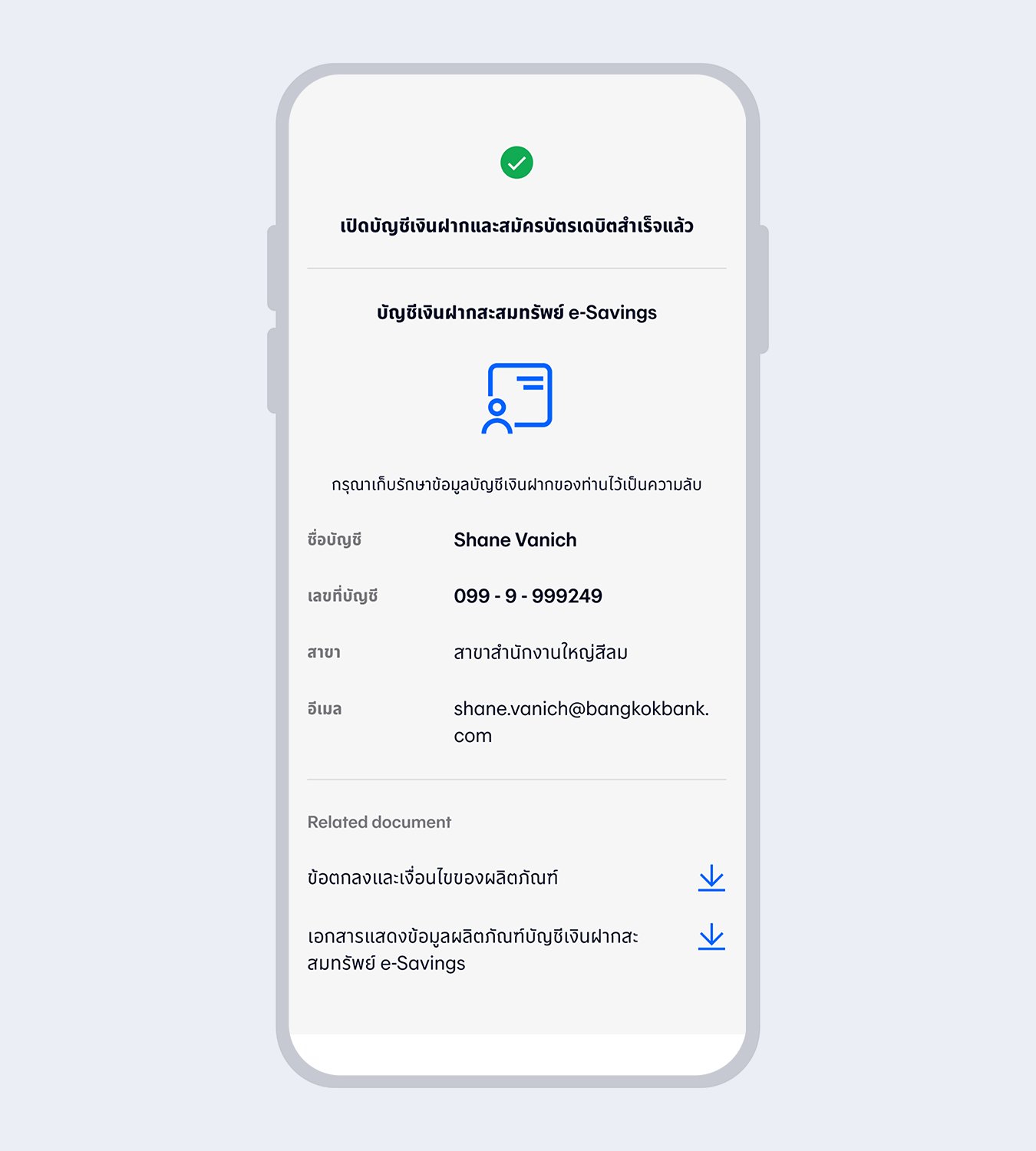

Account successfully opened

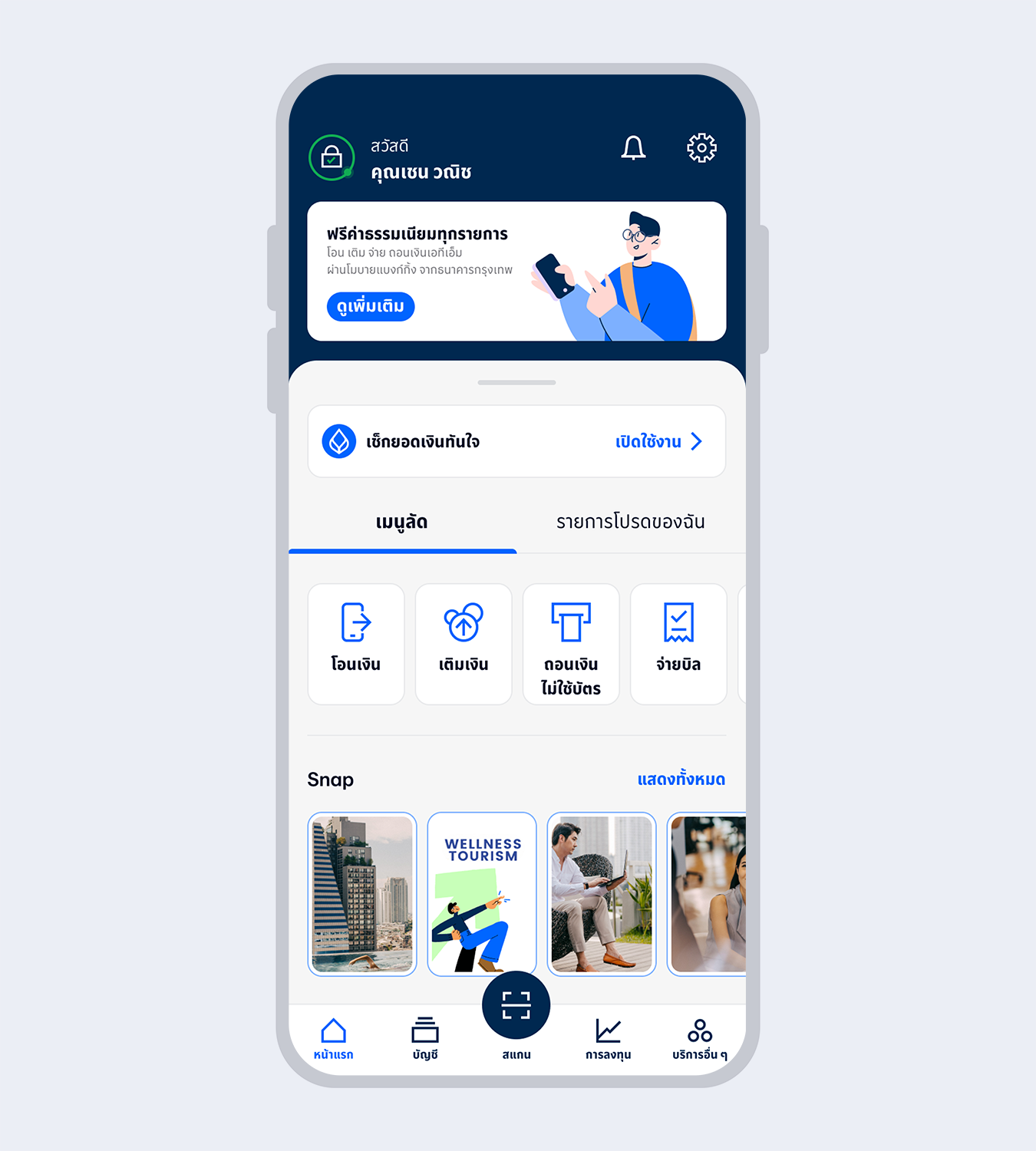

18.

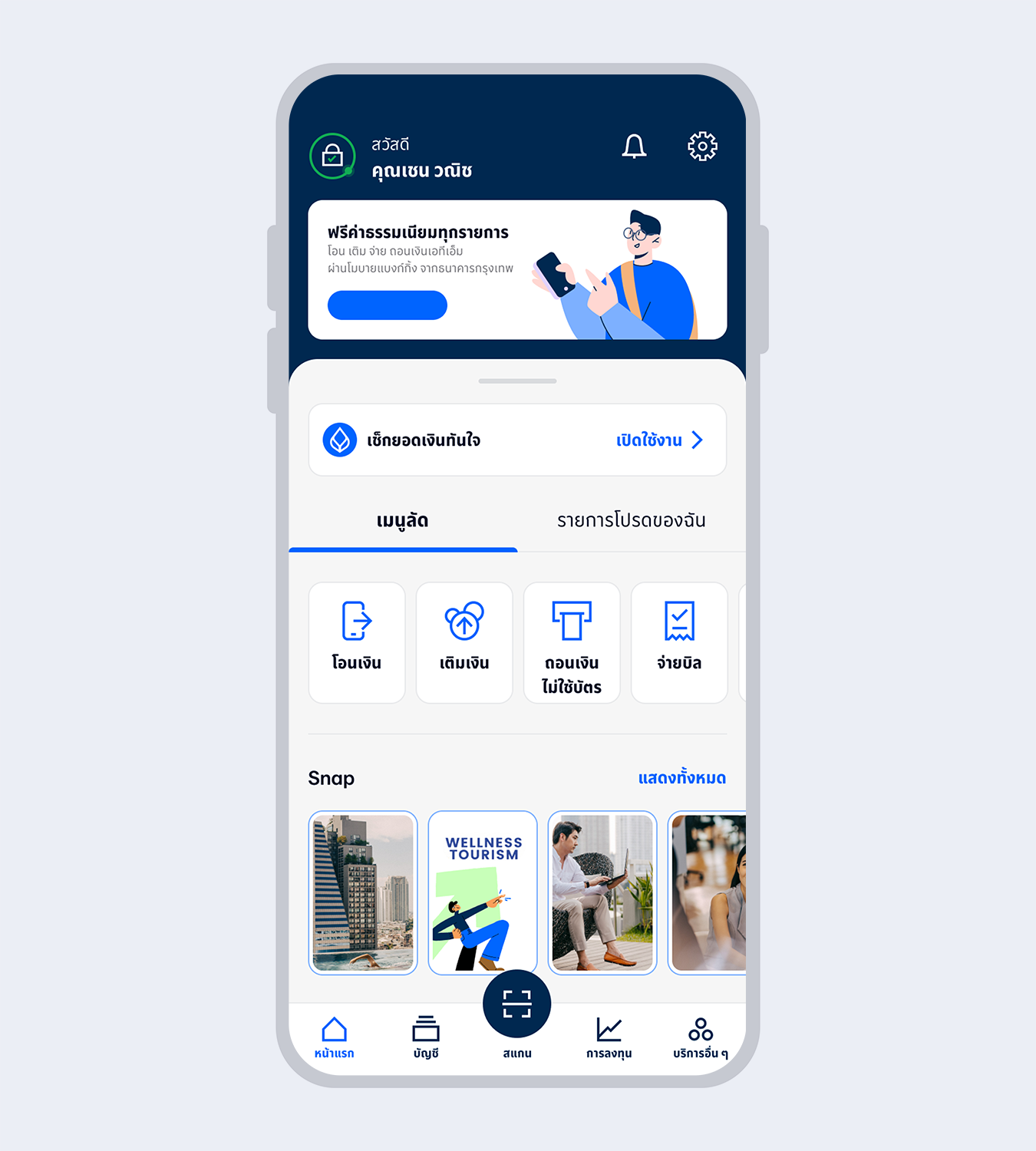

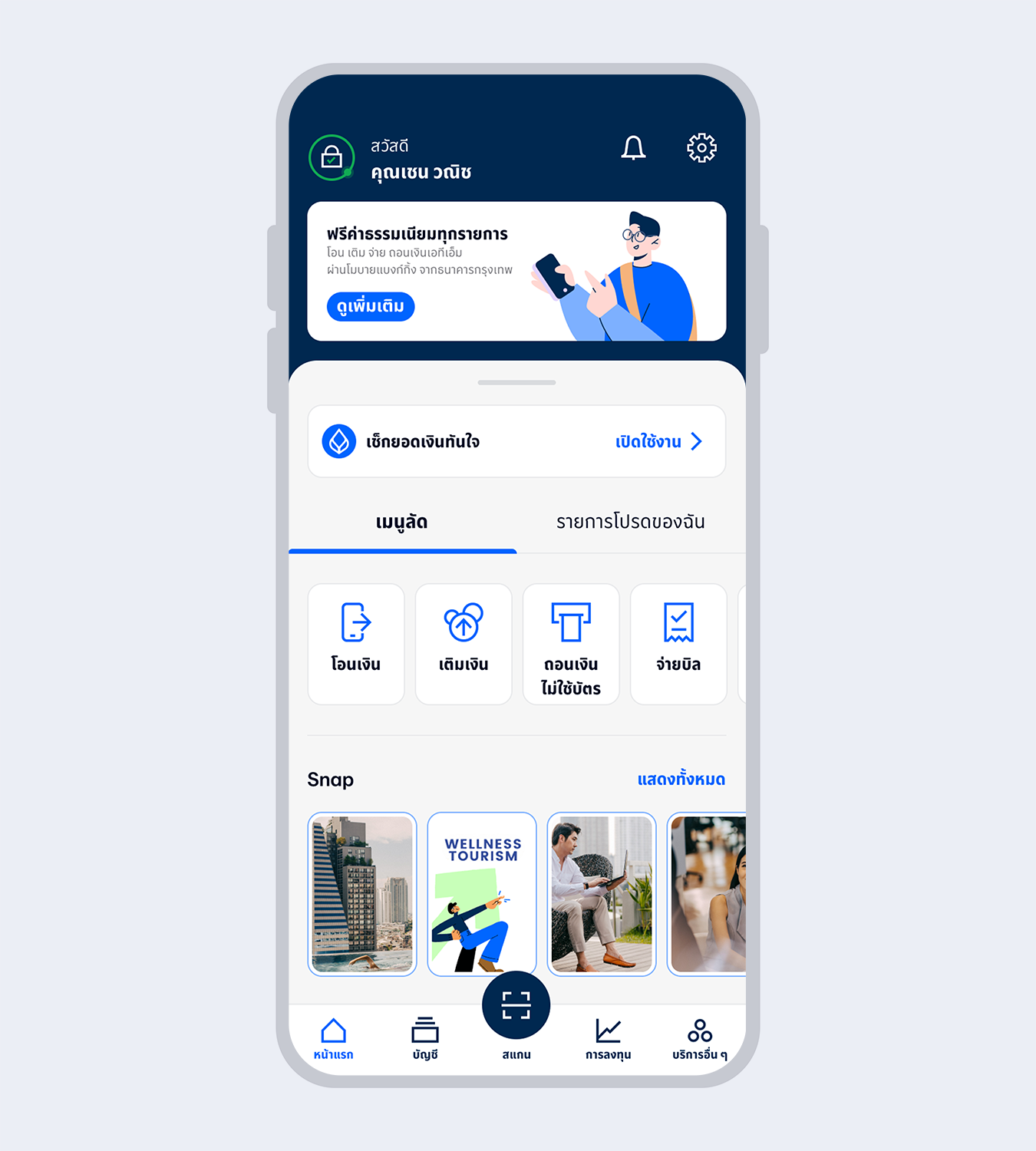

Welcome to Bangkok Bank Mobile Banking. Now you are ready for your financial transactions.

1.

Select “Open a Bangkok Bank account”

2.

Read the product details and select “Next”

3.

Take a photo of your Citizen ID card, review it and select “Next”

4.

Enter your Citizen ID card information and select “Next”

5.

Enter your mobile number and select “Confirm”

6.

Enter the One Time Password (OTP) received via SMS to verify your mobile number

7.

Set up your 6-digit Mobile PIN which you will use for subsequent log on to Mobile Banking

8.

Enter your personal information and select “Next”

9.

Enter the One Time Password (OTP) received via email to verify your email

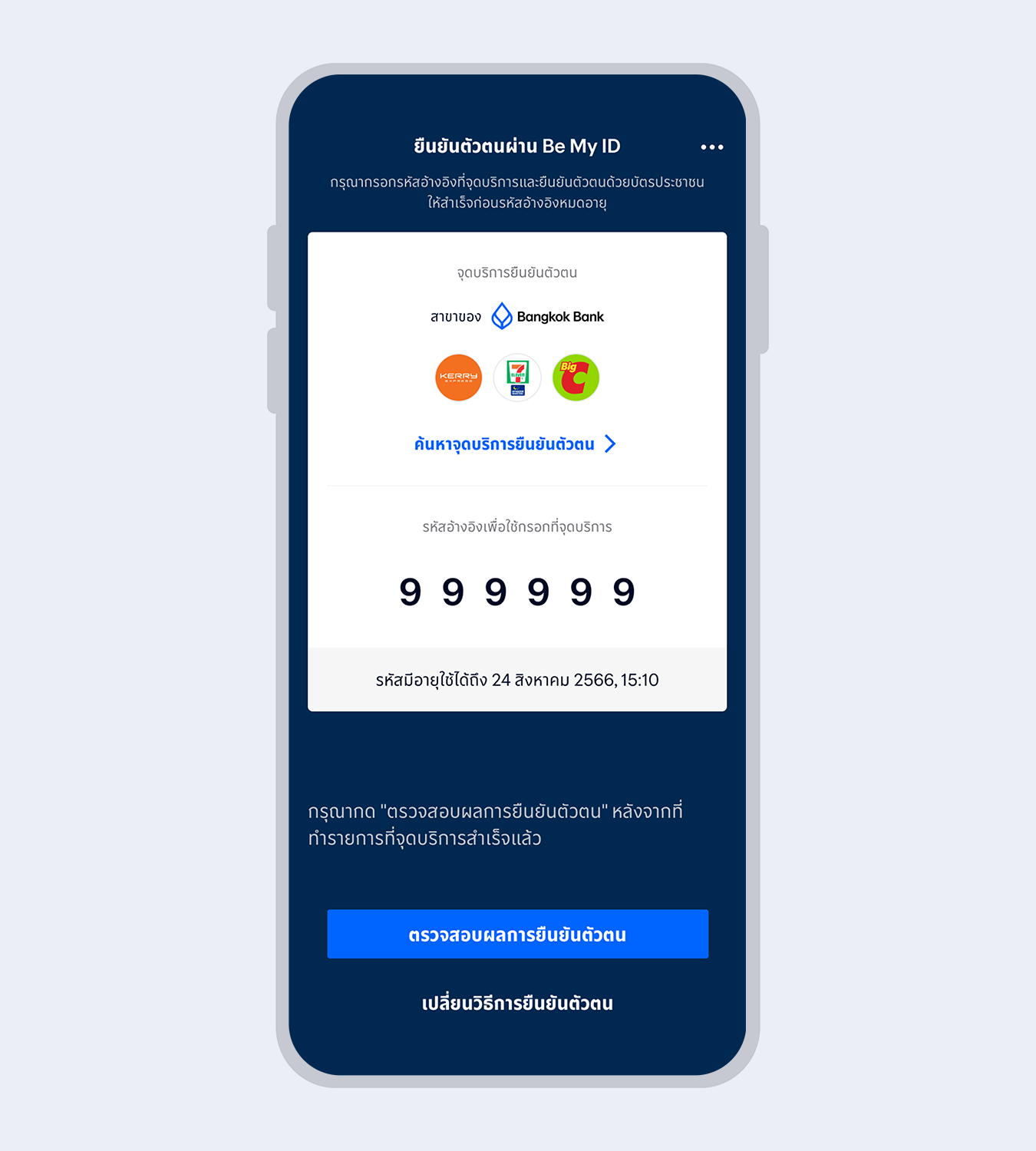

10.

Select “Authenticated by Be My ID”

11.

Use the reference code and your Citizen ID card to authenticate yourself at Be My ID service point

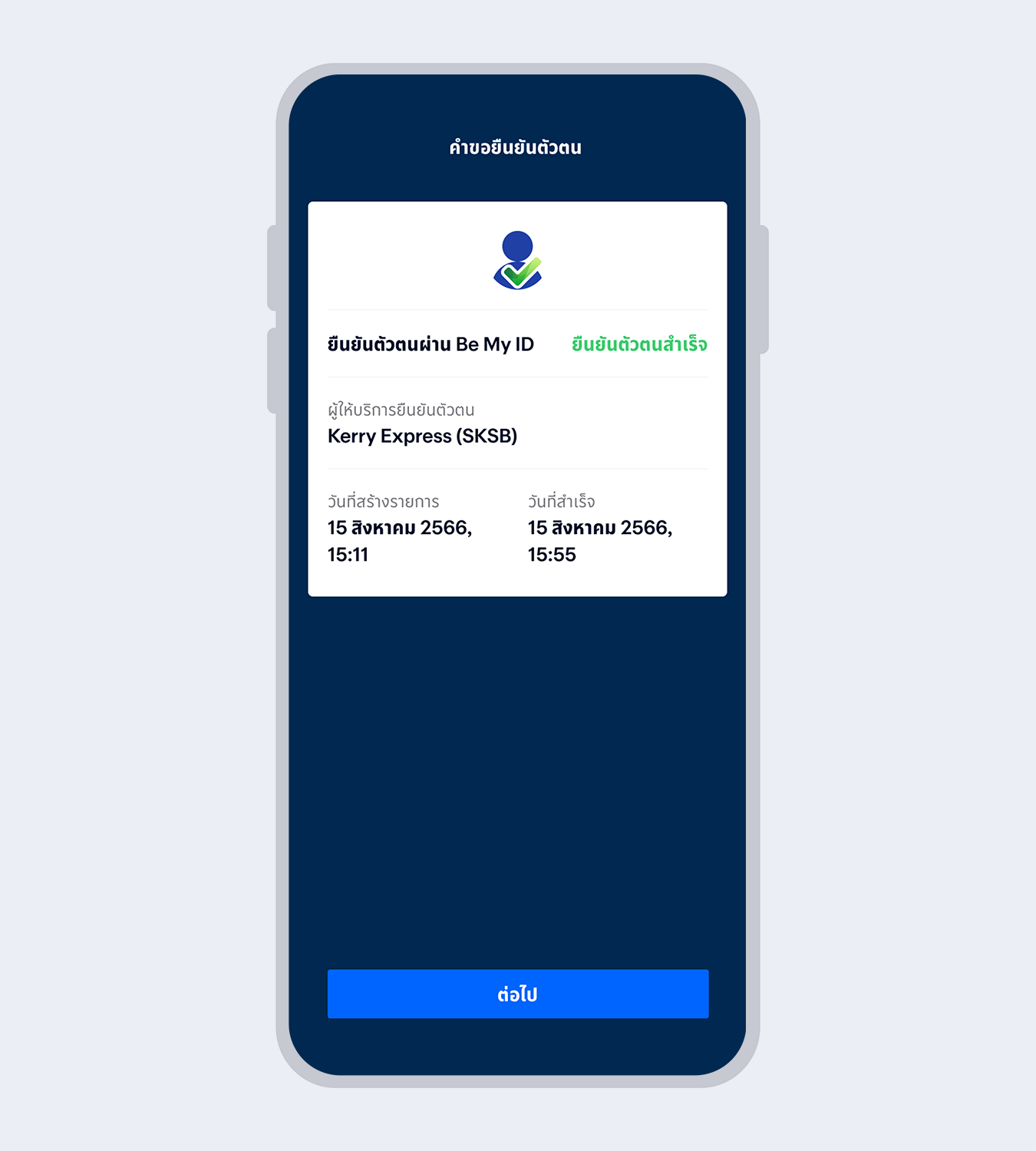

12.

When your authentication is completed, the request status will change to “Approved”. Select “Next”

13.

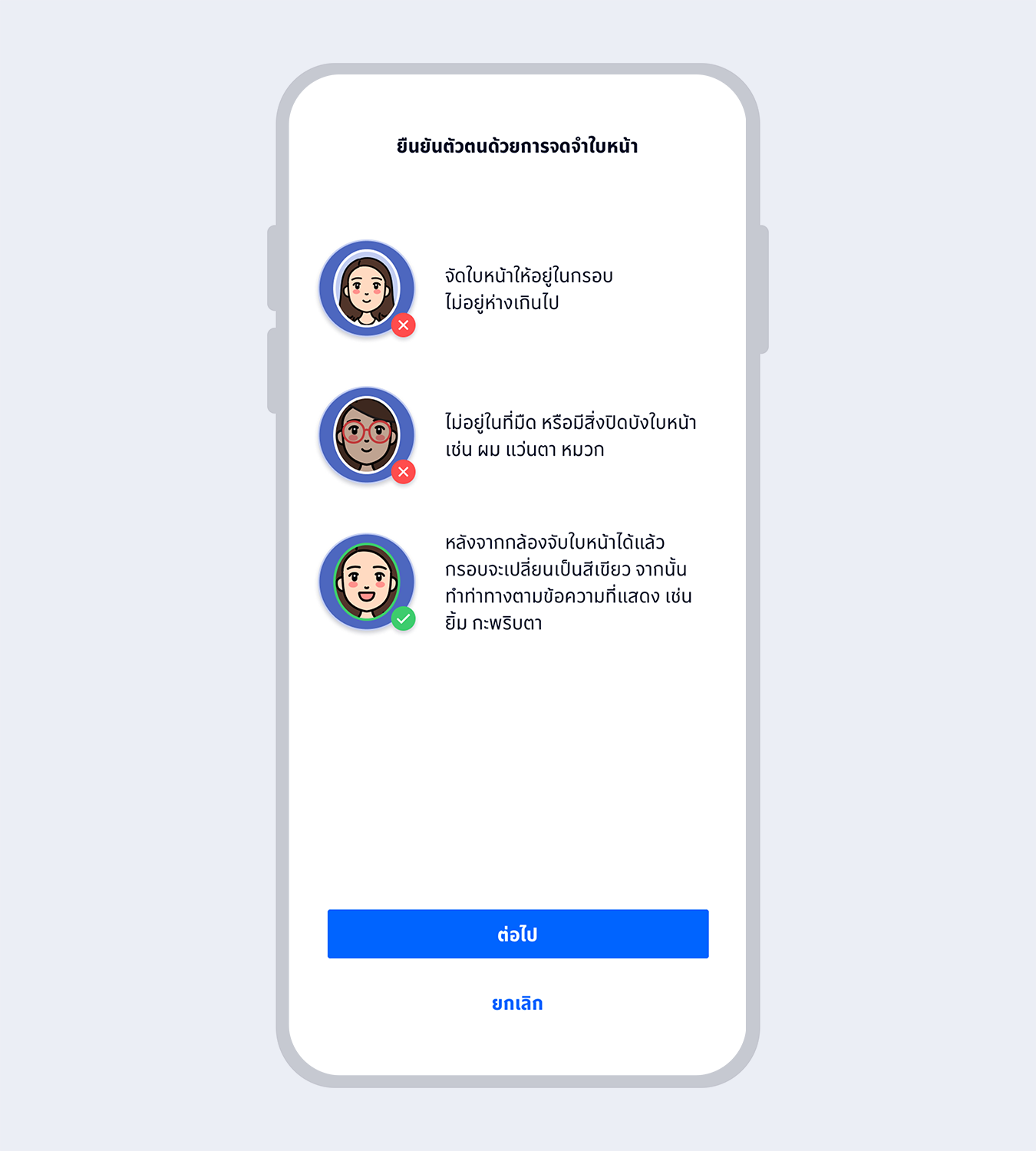

Prepare to take a selfie photo to verify your identity with facial recognition technology

14.

Fit your face in the frame and follow instructions for liveness detection

15.

Enter your 6-digit Mobile PIN as an e-Signature to confirm account opening

16.

Account successfully opened

17.

Welcome to Bangkok Bank Mobile Banking. Now you are ready for your financial transactions.

1.

Select “Open a Bangkok Bank account”

2.

Read the product details and select “Next”

3.

Take a photo of your Citizen ID card, review it and select “Next”

4.

Enter your Citizen ID card information and select “Next”

5.

Enter your mobile number and select “Confirm”

6.

Enter the One Time Password (OTP) received via SMS to verify your mobile number

7.

Set up your 6-digit Mobile PIN which you will use for subsequent log on to Mobile Banking

8.

Enter your personal information and select “Next”

9.

Enter the One Time Password (OTP) received via email to verify your email

10.

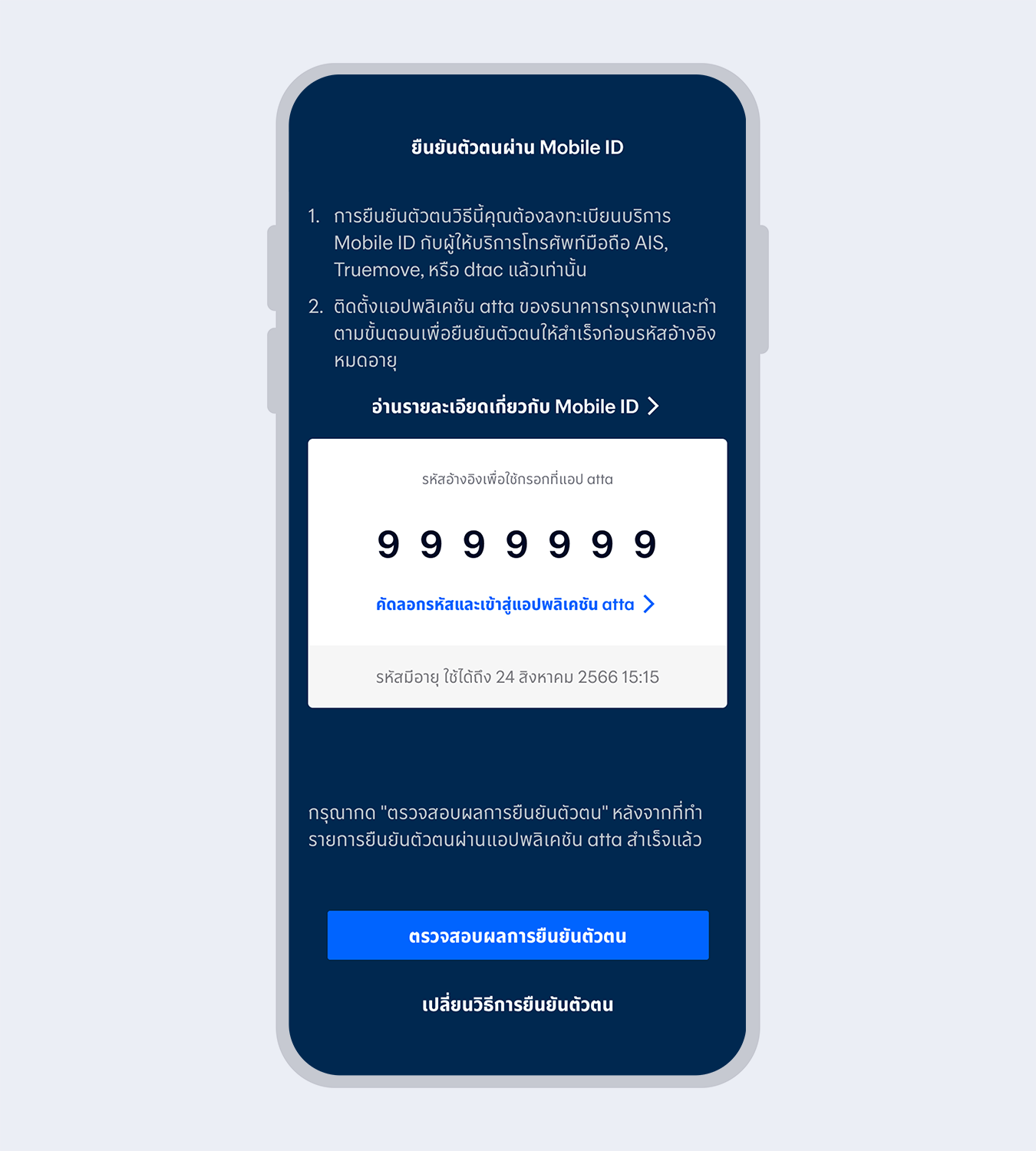

Select “Authenticated via atta app under the Mobile ID project”

11.

Copy the reference code and enter it on the atta app

12.

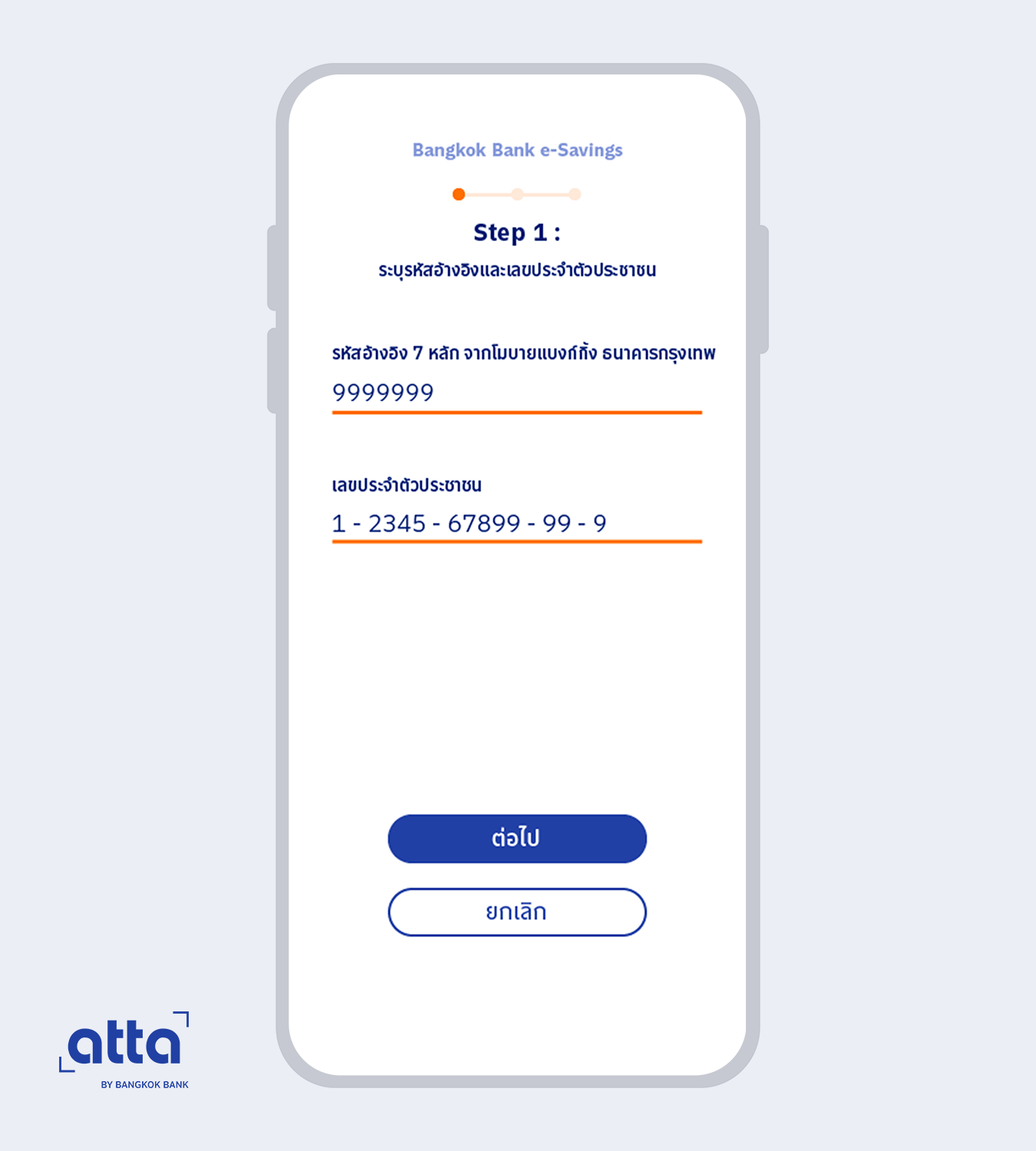

Open the atta app, and select “e-Savings Bangkok Bank”

13.

Enter the 7-digit reference code received from Mobile Banking app and your Citizen ID number

14.

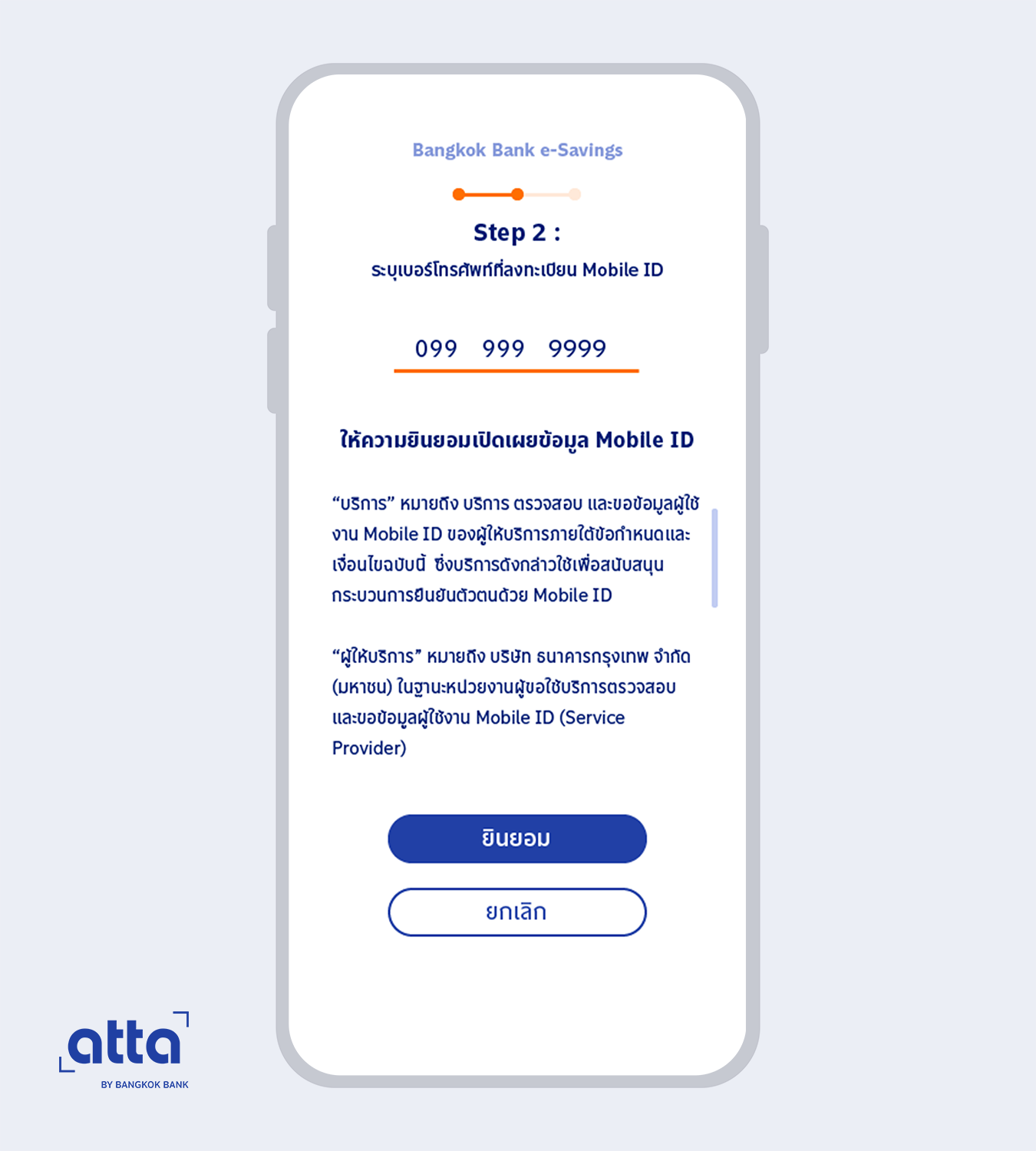

Enter your registered mobile number, read the terms and service conditions and select “Accept”

The system will direct you to authentication with the mobile operator app linked to your registered Mobile ID number. Please follow the instructions for authentication on the mobile operator app

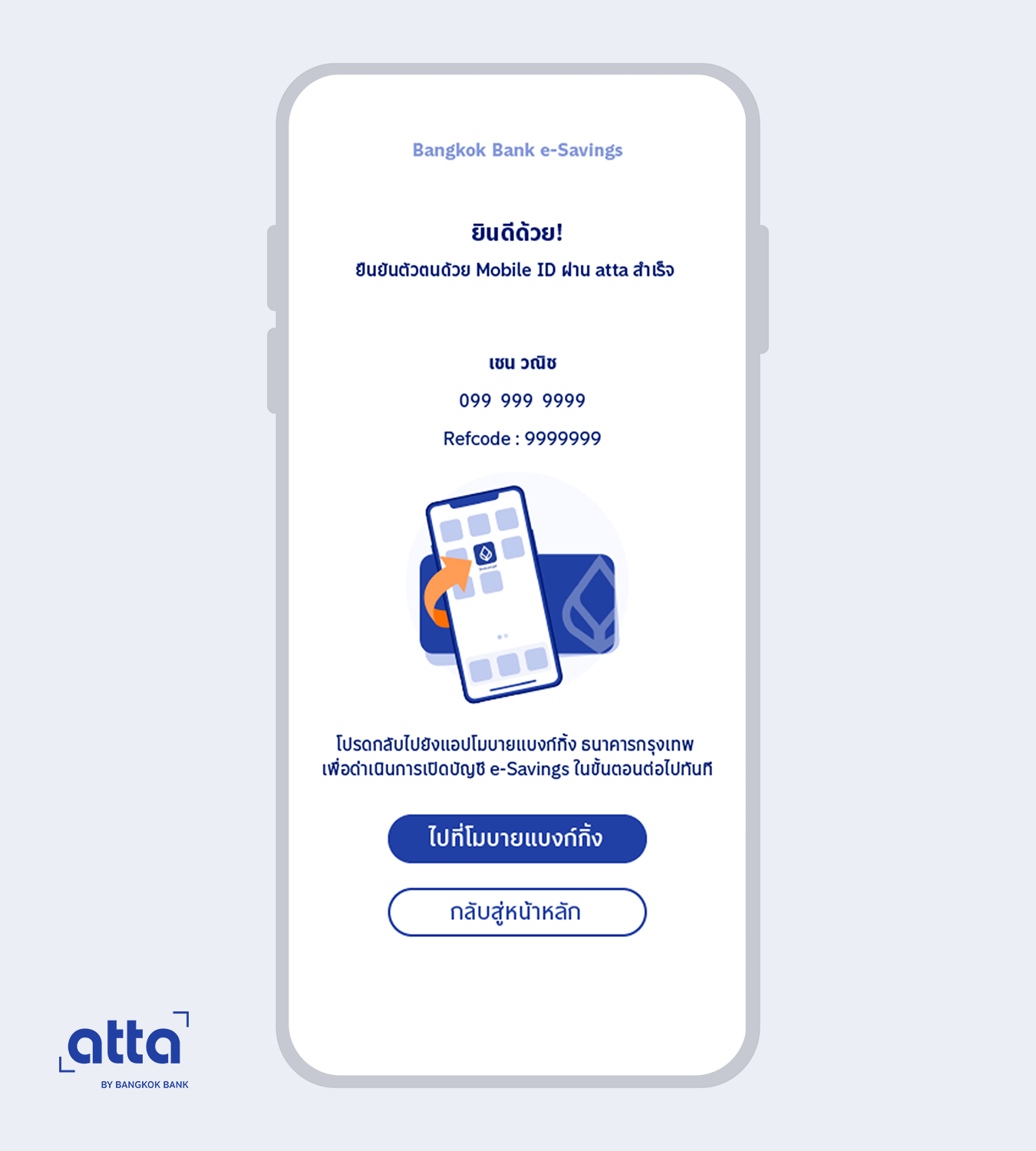

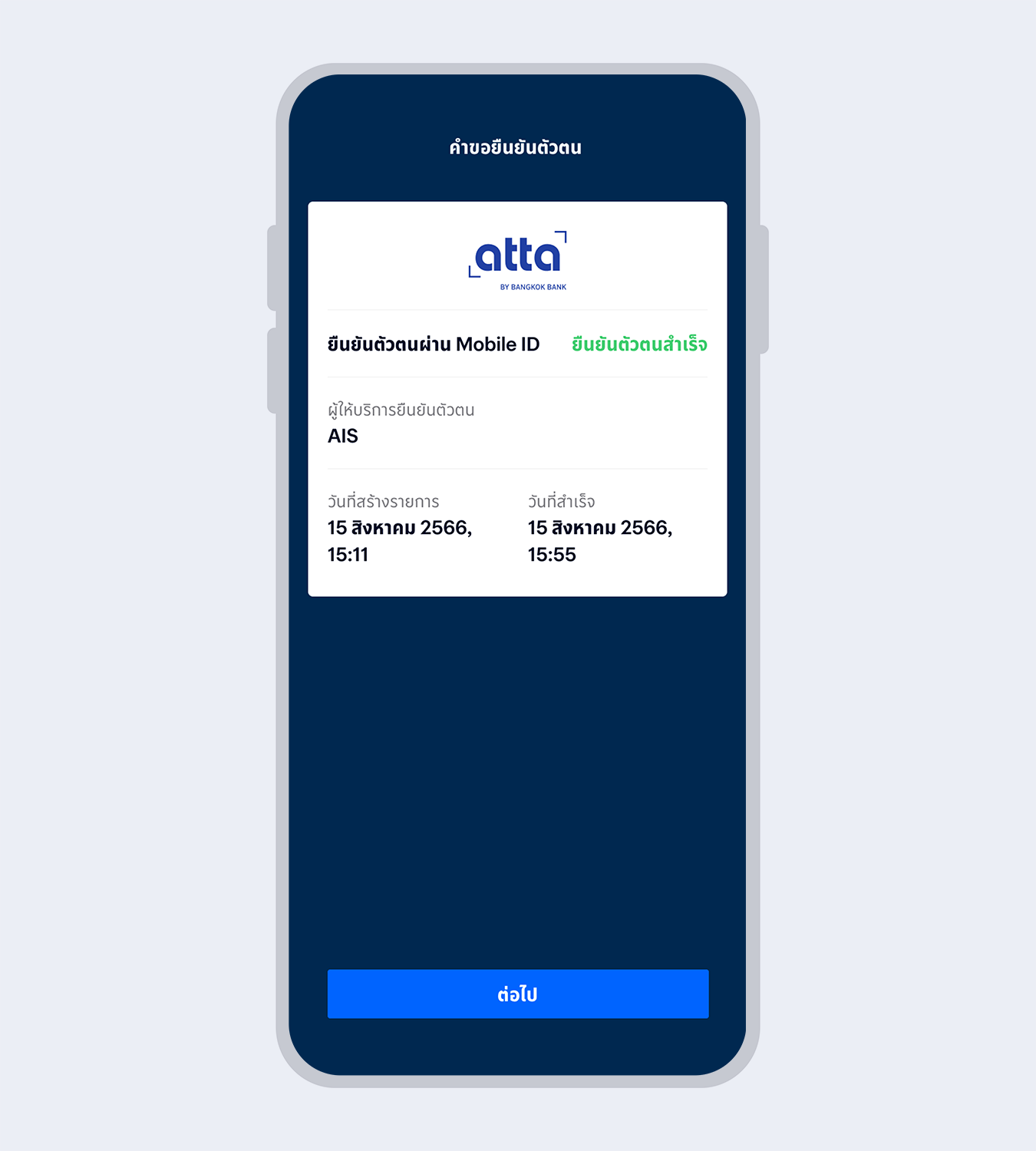

15.

The system will display your Mobile ID authentication results. Then, return to Mobile Banking app to proceed with the next step of account opening

16.

When your authentication is completed, the request status will change to “Approved”. Select “Next”

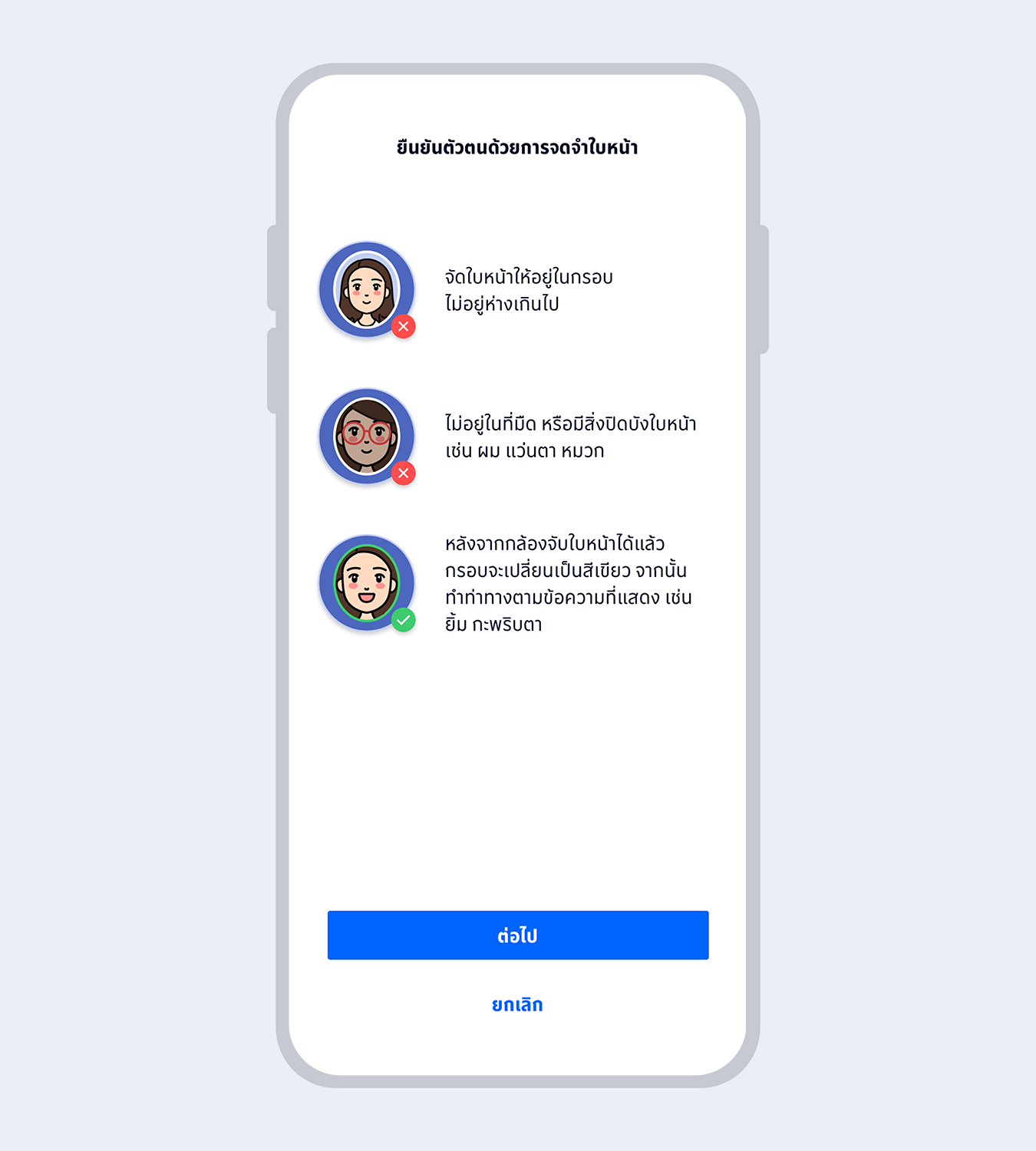

17.

Prepare to take a selfie photo to verify your identity with facial recognition technology

18.

Fit your face in the frame and follow instructions for liveness detection

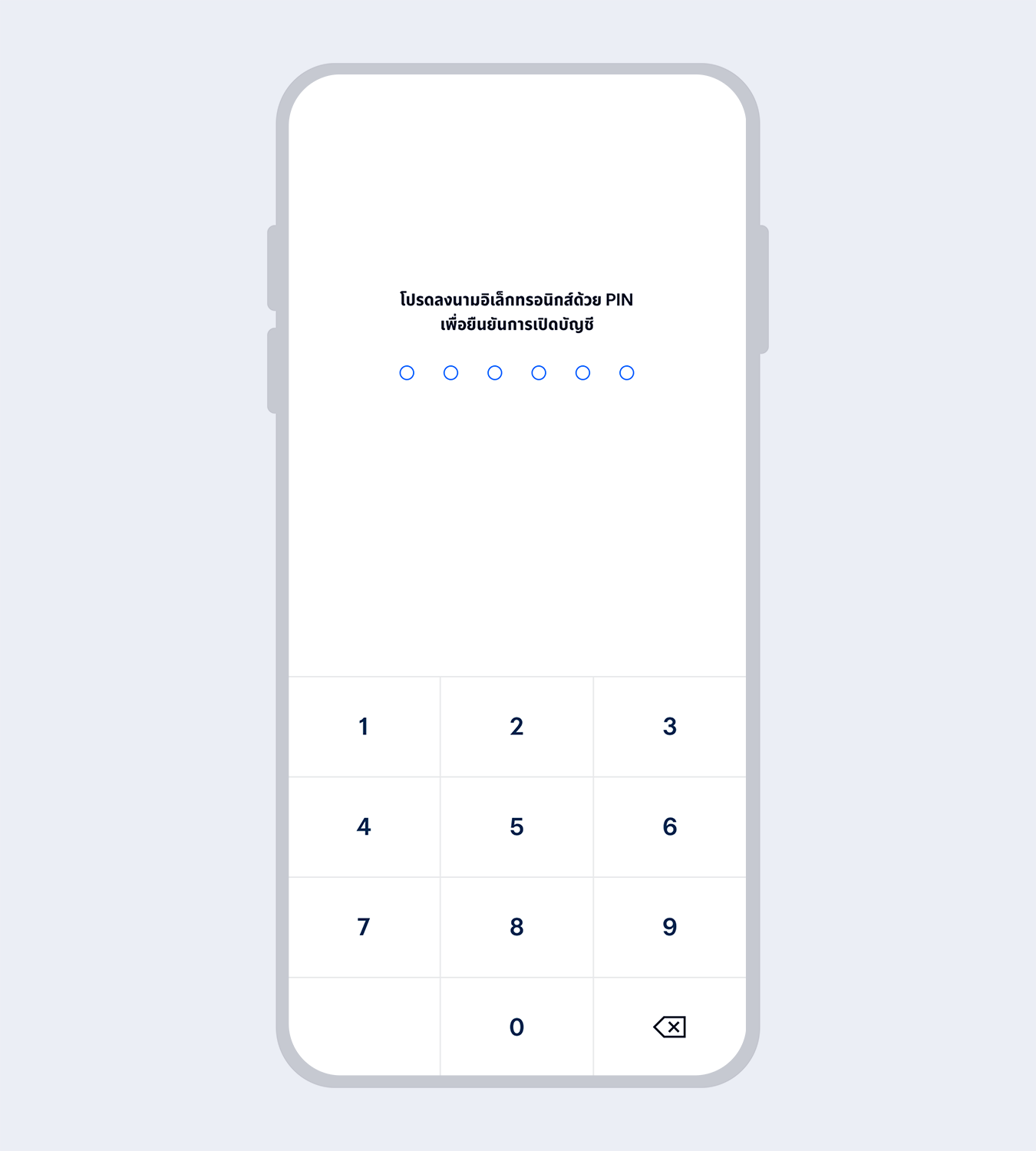

19.

Enter your 6-digit Mobile PIN as an e-Signature to confirm account opening

20.

Account successfully opened

21.

Welcome to Bangkok Bank Mobile Banking. Now you are ready for your financial transactions.