Online Banking

Personal

- Bualuang iBanking

- Bualuang iBanking

- Bualuang iBanking

- Mobile Banking

- Mobile Banking

- Mobile Banking

- Bualuang iFunds

The rewards must be redeemed by April 30, 2024, otherwise the investor will forfeit the rewards.

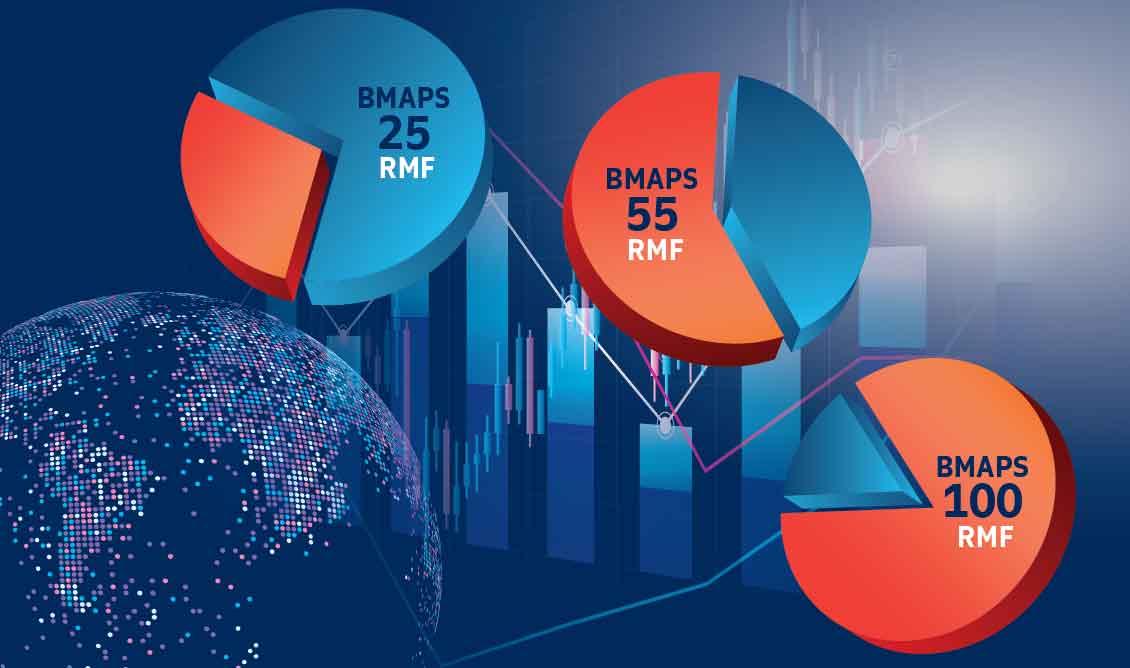

The Funds provide a long-term savings plan for your retirement and offer tax benefits in accordance with conditions of the Revenue Department.

The Funds provide a long-term savings plan and offer tax benefits in accordance with conditions of the Revenue Department.

Notes

For more information, or to request a prospectus, please contact

Bangkok Bank, call 1333 or visit www.bangkokbank.com

BBLAM, call 0 2674 6488 press 8 or visit www.bblam.co.th

BCAP Asset, call 0 2618 1599 or visit www.bcap.co.th