Get a cash advance from Bangkok Bank credit card

How to get a cash advance from Bangkok Bank credit card to your account, and are there any fees?

When facing an emergency and you urgently need cash – where can you get it? You may need money for maintaining business liquidity, buying necessities after being unexpectedly laid off, paying for children's tuition fees, or making an urgent payment for family medical expenses but what if you don’t have enough cash at the time? The solution might be right there in your pocket – you can get a loan through your credit card. However you will have to pay costs in exchange for the loan.

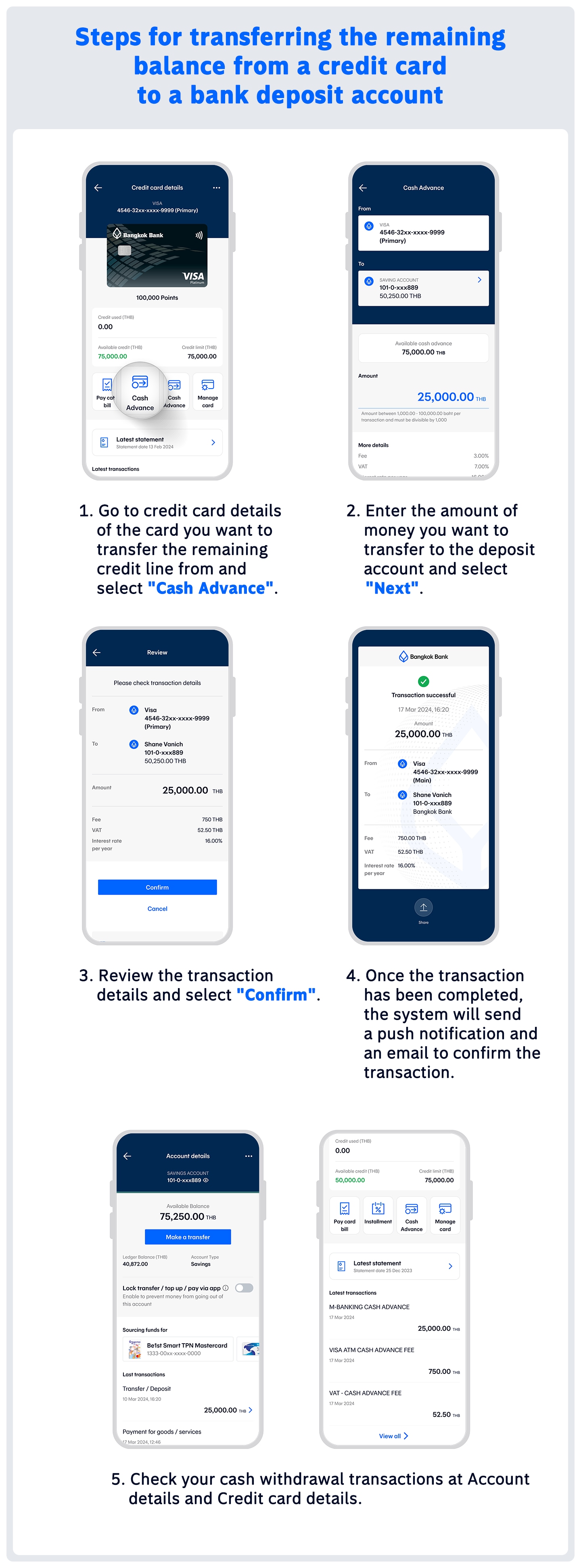

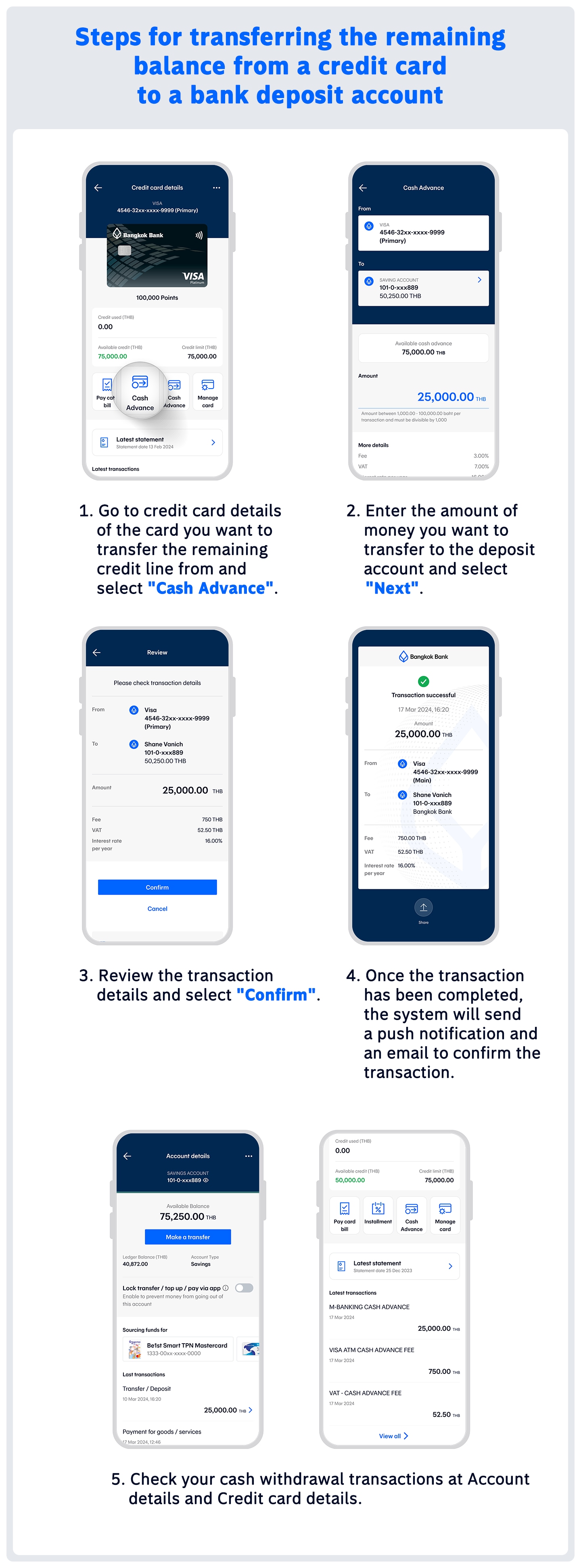

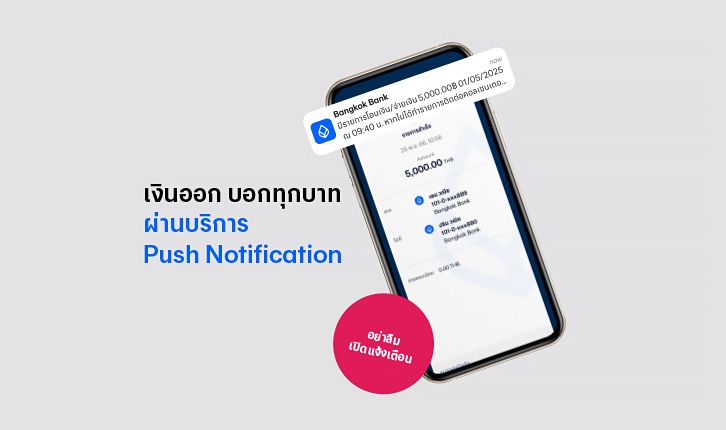

You can use your credit card to withdraw cash from ATMs, not just for buying things. However, there are fees charges for cash withdrawals from the ATM as well as value-added tax (VAT). Another way to get a cash advance is to transfer the remaining credit limit from your Bangkok Bank credit card to an account via Bangkok Bank Mobile Banking.

What you MUST know when you want to get a cash advance from a Bangkok Bank credit card to an account:

- Transferring money from a credit card is a form of borrowing. The credit card holder will have to pay the fees, interest and value-added tax (VAT) specified by the Bank. Only use it when necessary, such as in an emergency that requires urgent cash.

- The amount transferred from the credit card should be paid back to the Bank as soon as possible to avoid excess interest that can become unaffordable.

What are the expenses borne when transferring the remaining credit limit from a Bangkok Bank credit card to an account in one transaction?

- Cash advance fee (3% of Cash advance amount)

- Value-added tax (VAT) from the cash advance fee (7% of Cash advance fee per transaction)

- Interest rate per year 16% (The bank will charge interest on the day the bank pays to the merchant)

What is the minimum amount for transferring the remaining credit limit to an account?

The minimum amount is 1,000 baht, with increases in multiples of 1,000 baht (the transfer amount must be divisible by 1,000).

Which accounts can you transfer the remaining credit limit to?

You can only transfer a cash advance from a Bangkok Bank credit card to a savings account or current account on the Bangkok Bank Mobile Banking (excludes joint accounts).

How to make repayments:

You can make repayments in various ways, similar to credit card payments:

- Pay via Bangkok Bank Mobile Banking

- Pay with cash or cheque at a Bangkok Bank branch, or use the convenient automatic payment service

- Direct debit from your deposit account* to enable your credit card to withdraw from your deposit account at ATMs

- Pay via Bualuang Phone* tel: (66) 02645 5555 to enable your credit card to withdraw from your deposit account at ATMs

- Pay via Bualuang iBanking, internet banking service

*Please contact your home branch to enable your credit card to be used to withdraw cash from your deposit account at ATMs. Read more details about

Bangkok Bank credit cards.

What happens if you don't pay the outstanding balance?

You will have to pay interest and late payment penalties. In some cases, you might not be able to use the credit card until you make repayments.

Why can’t you transfer the full remaining credit limit?

Cash withdrawal limit according to the conditions set by the bank. Customers can make transactions according to the cash withdrawal limit displayed on mobile banking at that time.