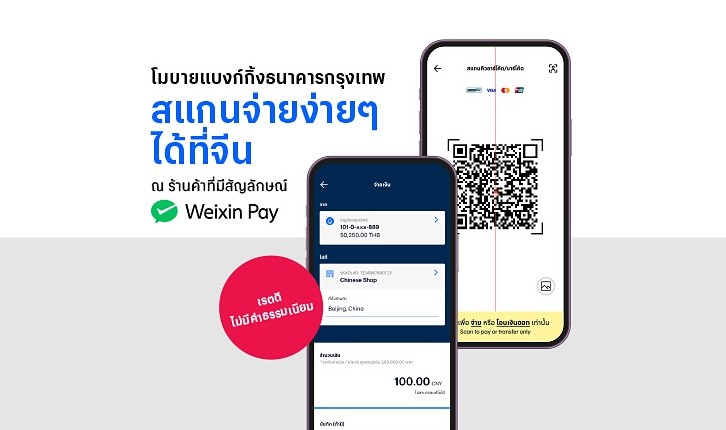

Easy Scan and Pay via QR Code Payment with Credit Card

on Bangkok Bank Mobile Banking

"Scan and Pay" with QR codes has made our lives much easier. The Scan and Pay service widely known and used today debits funds directly from our bank account. Today we are introducing "QR Code Payment with Credit Card" on

Bangkok Bank Mobile Banking for Bangkok Bank credit card holders, it's now even more convenient to receive cash back and collect points.

Things to Know About QR Code Payment with Credit Card:

- When scanning and paying via QR codes that support credit card and PromptPay payments, you can choose to pay by deducting from a savings account or credit card.

- Paying by scanning and choosing to deduct from a credit card is equivalent to swiping a credit card, not getting a cash advance. Paying back in full by the due date, you will not incur the 16% interest charge

How to Know if the QR Code Support Payment with Credit Card:

- Look for signages related to credit cards e.g. Visa or Mastercard on the QR code.

- Ask the store directly.

Benefits of QR Code Payment with Credit Card:

- Convenient: Easily scan and pay via mobile without needing to carry a card.

- Secure: No need to hand your card to store staff; you finalize your payment when you scan with your mobile phone.

- Enjoy benefits just like using a credit card.

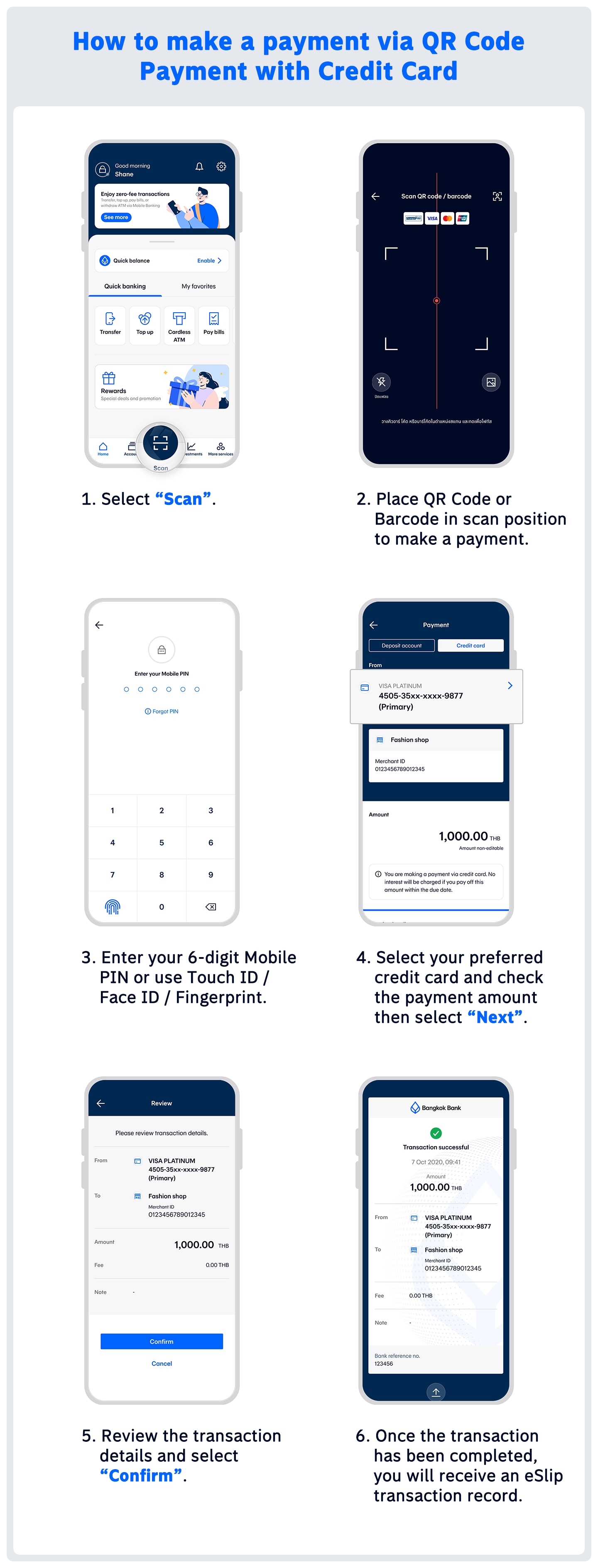

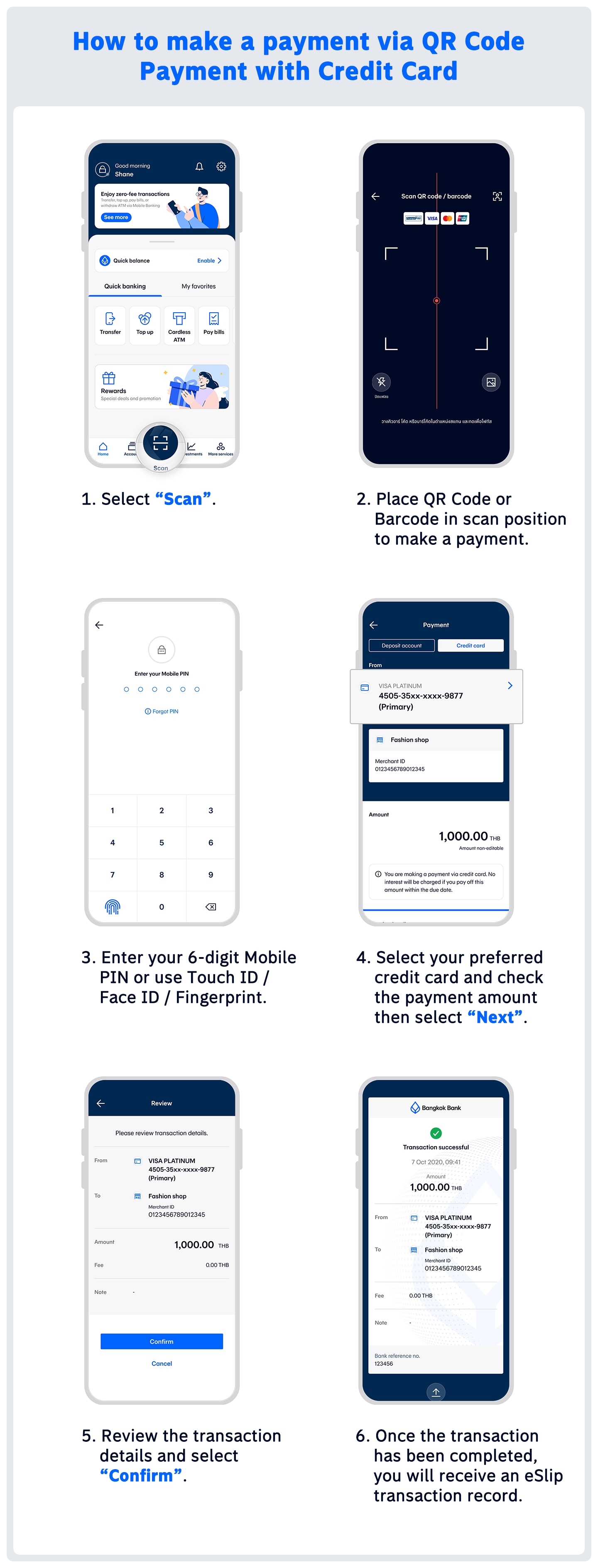

To use QR Code Payment with Credit Card service on Bangkok Bank Mobile Banking:

Terms and Conditions for QR Code Payment with Credit Card Service:

- The service can be used at stores that accept Visa and Mastercard payments both domestically and internationally but it is only available for foreign currencies supported by Bangkok Bank due to the Bank's exchange rates.

- Primary cardholders can only scan and pay with the primary card; supplementary cards cannot be chosen for scan and pay.

- Supplementary cardholders can only scan and pay with the supplementary card.