Manage credit card usage by yourself

with Bangkok Bank Mobile Banking

“Lock and limit credit card usage” on

Bangkok Bank Mobile Banking will help you using

Bangkok Bank credit card more convenient. You can lock lost cards promptly or managing and controlling the usage of credit card through

Bangkok Bank Mobile Banking.

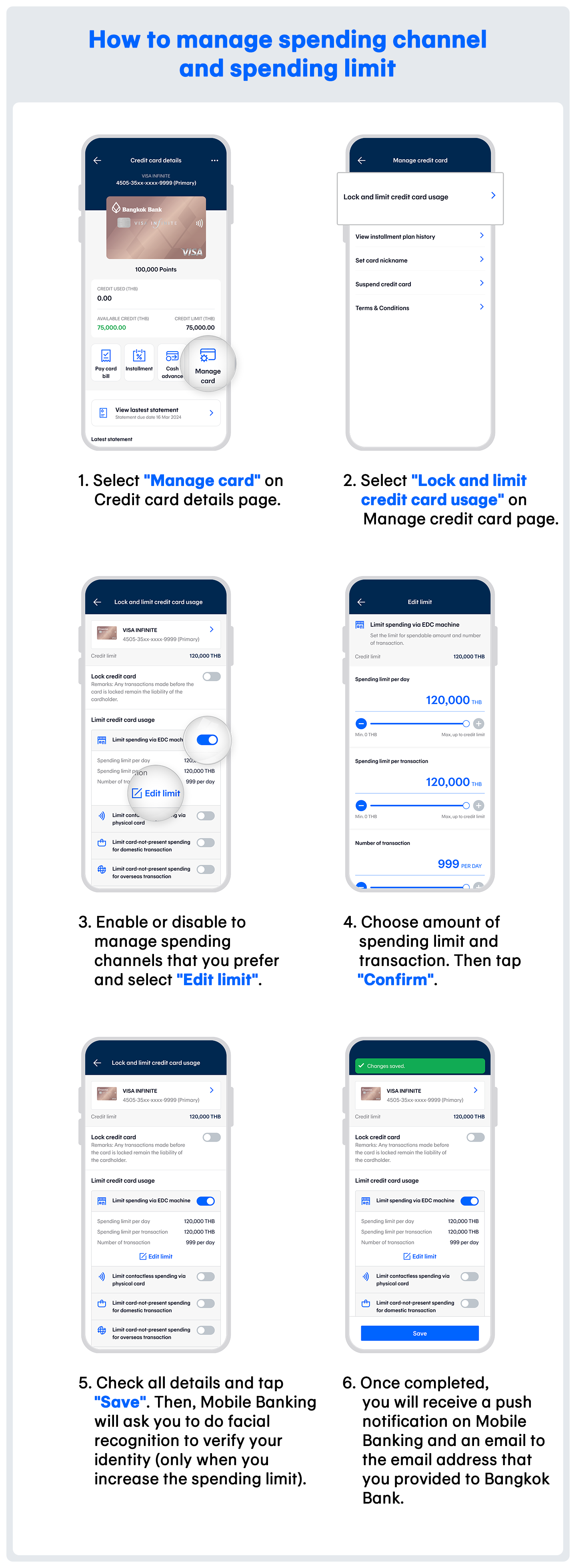

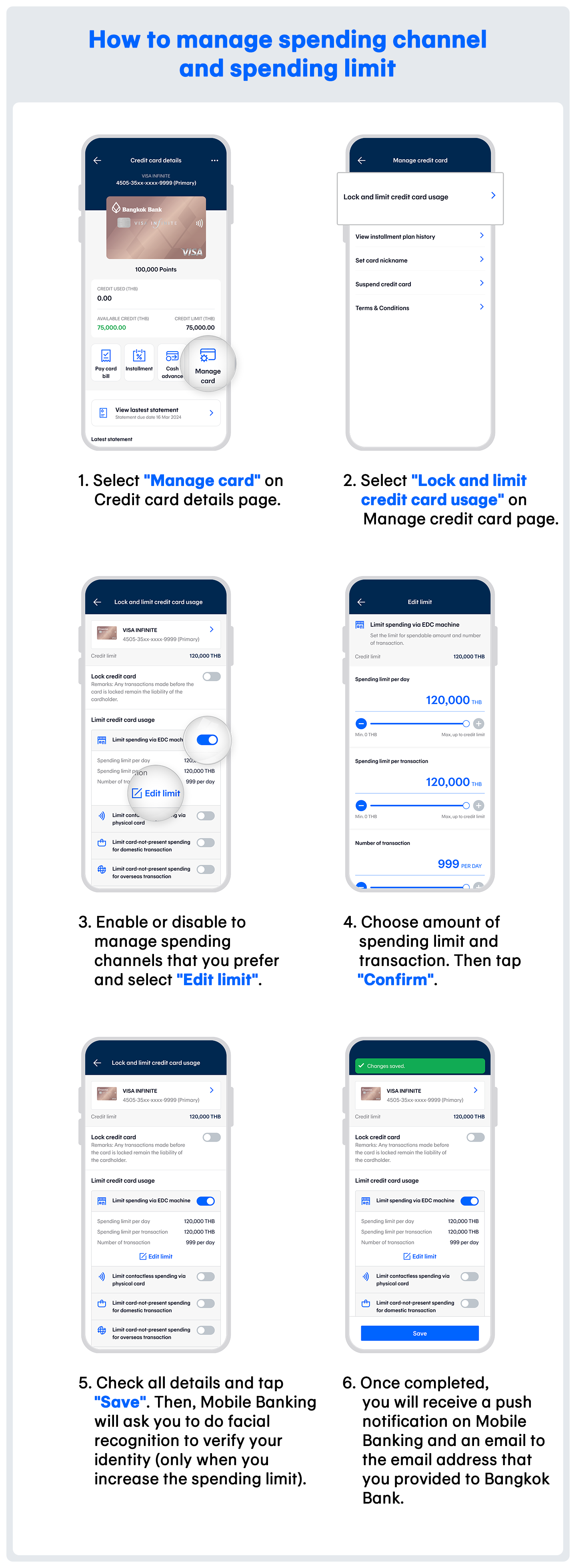

You can use “Lock and limit credit card usage” easily through Bangkok Bank Mobile Banking for the following transactions:

- Lock / unlock credit card usage

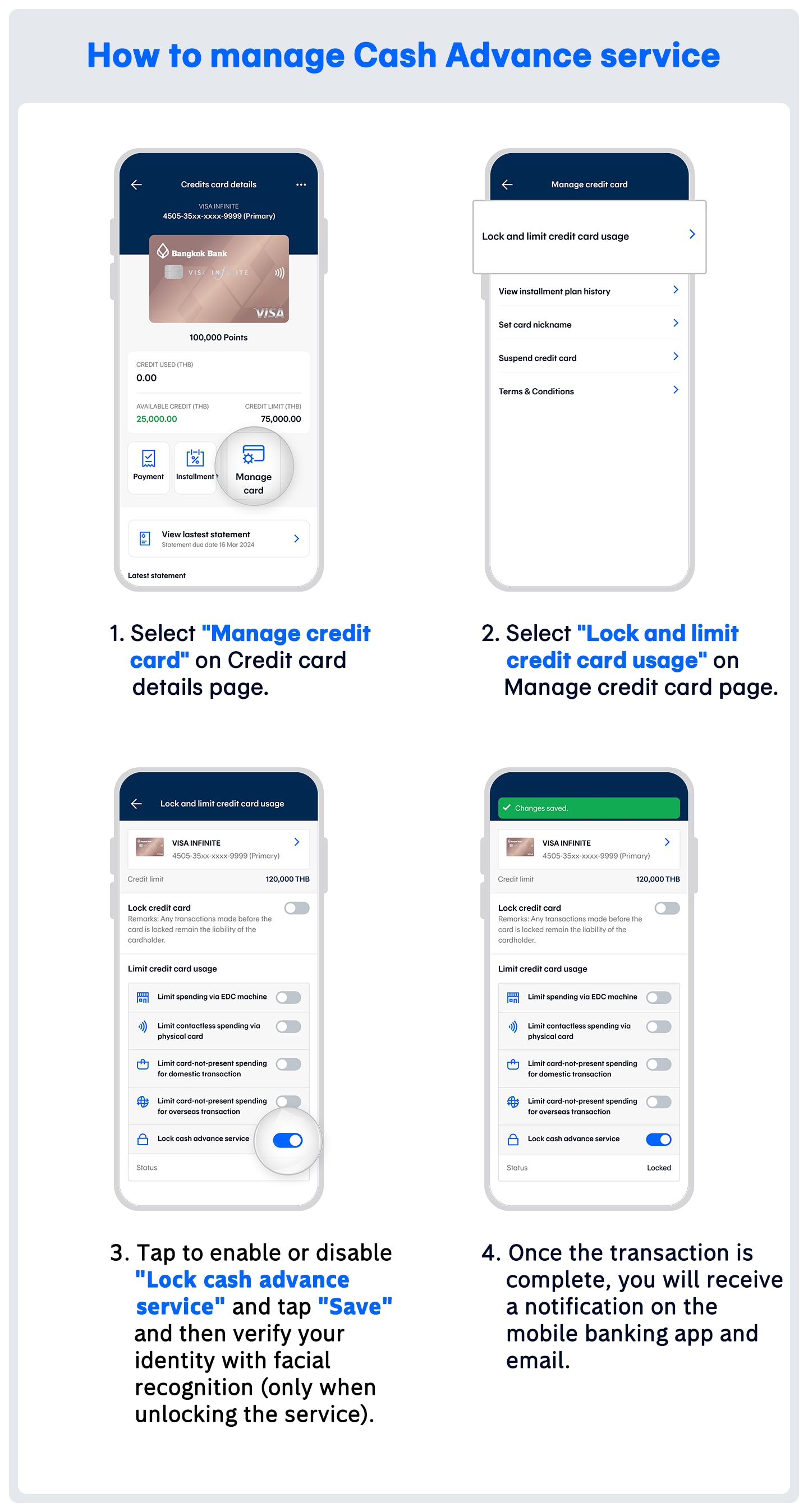

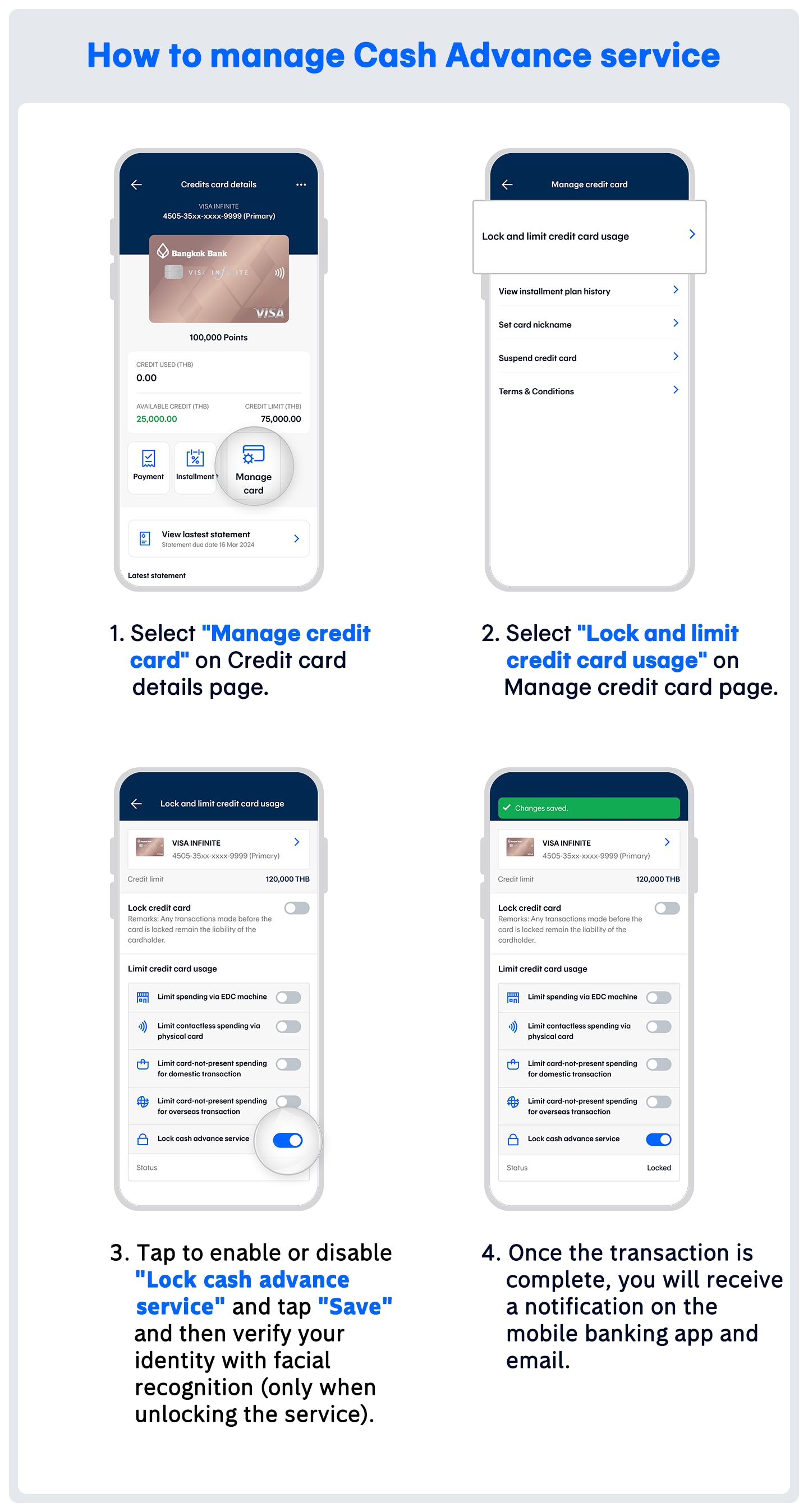

- Lock / unlock Cash Advance service

- Increase / decrease daily spending limit amount per day

- Increase / decrease spending limit amount per transaction

- Increase / decrease number of transactions per day

Benefits of using “Lock and limit credit card usage”:

- Use a credit card more convenient and secure

- Be prepared for unexpected events; for example, when a credit card is lost or there is a credit card transaction you did not proceed, you can lock credit card usage on Bangkok Bank Mobile Banking promptly before proceeding the credit card cancellation.

Conditions that apply to “Lock and limit credit card usage”:

- “Lock and limit credit card usage” only applies to Bangkok Bank credit cards that are added for using the service through Bangkok Bank Mobile Banking.

- “Lock and limit credit card usage” does not support commercial cards such as Corporate cards, Government cards, Purchasing Credit cards, Fleet cards.

- Primary cardholders can control the usage of both primary and supplementary cards that are added to Bangkok Bank Mobile Banking

- Supplementary cardholders can only control the usage of supplementary cards that are added to Bangkok Bank Mobile Banking