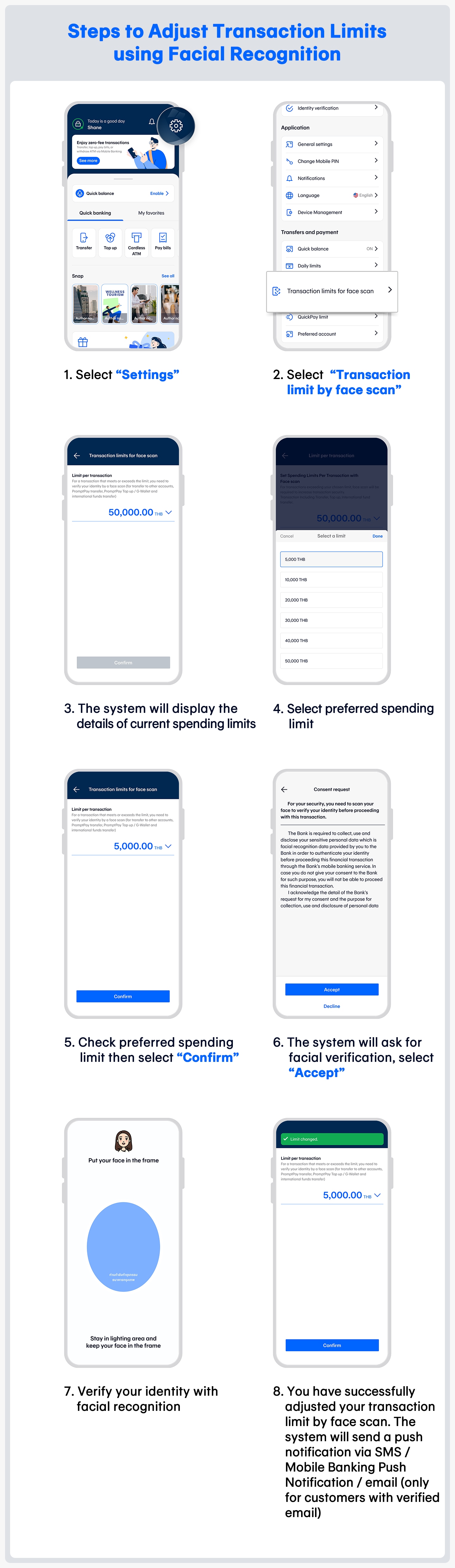

Adjust spending limit by facial recognition on Bangkok Bank Mobile Banking

Keep your money in your account with peace of mind. Your money won’t disappear from your account.Rest assured that every transfers, top-up, or payments exceeding the specified limit will require facial recognition before athe transaction is completed, Bangkok Bank has introduceds a “Transaction Limit by Face Scan” feature on

Bangkok Bank Mobile Banking app, helping users make transactions more securely than before. Previously, the

bank required facial recognition for transfers to others exceeding 50,000 baht per transaction and a daily cumulative total of 200,000 baht perday.

Benefits of adjusting transaction limits with facial recognition

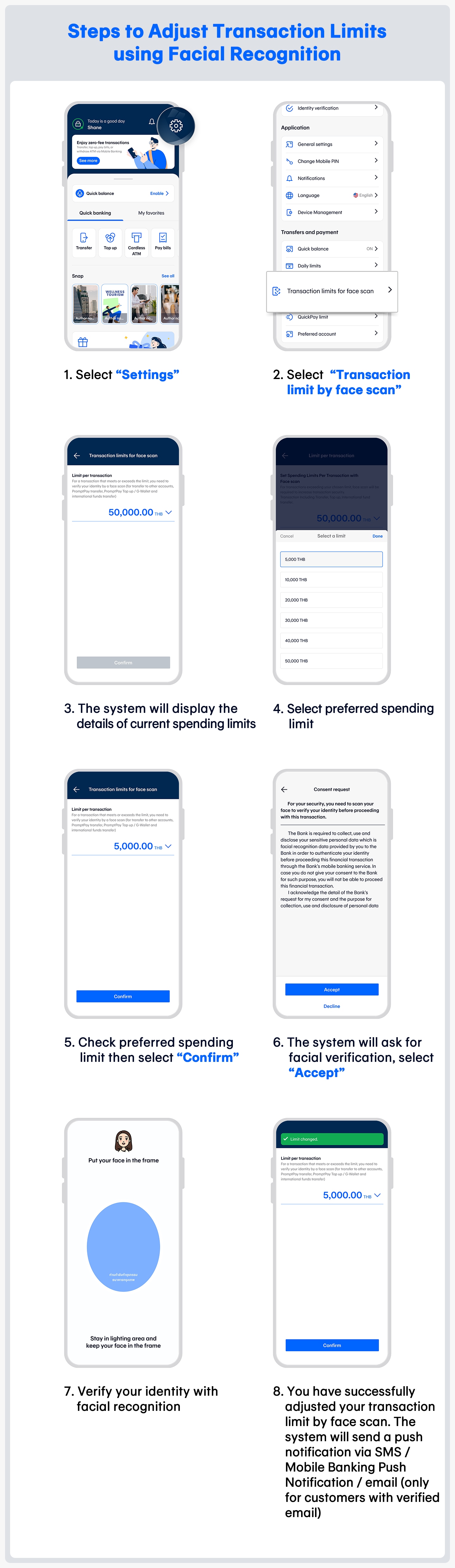

- Customize spending limits: Adjust your preferred spending limit to between 5,000 and 50,000 baht per transaction.

- Reduce potential damage: For transactions exceeding your specified limit, facial recognition is required to prevent unauthorized transfers, top-ups, and payments.

To enable customers to fully verify their identity using facial recognition , please bring the following identification documents to update your information and take a photo of your face for identity verification at any Bangkok Bank branch nationwide from today onwards. The required documents are as follows:

Thai citizens

Foreigners

- Passbook and identification documents such as Passport / Non Thai Identification Card / Unregistered Person Card / Resident Certificate and House Registration, etc.

In addition, to further secure your account and prevent any leakage of funds, customers can lock their savings and other accounts to prevent fraudsters from transferring, topping up, or paying money out of their accounts using the “Lock & Unlock” feature from Bangkok Bank Mobile Banking app.